false

0001047335

0001047335

2024-08-09

2024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2024 (August 9, 2024)

NATIONAL HEALTHCARE CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation)

|

001-13489

(Commission File Number)

|

52-2057472

(I.R.S. Employer Identification

No.)

|

|

100 E. Vine Street

Murfreesboro, Tennessee

(Address of Principal Executive

Offices)

|

|

37130

(Zip Code)

|

Registrant’s telephone number, including area code: (615) 890-2020

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

NHC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1988 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial standards pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 2.02.

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

National HealthCare Corporation (“NHC”) issued a press release on August 9, 2024, announcing its June 30, 2024 earnings. The entire press release is attached as Exhibit 99.1 and is incorporated by reference herein.

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

Exhibit No.

|

Description of Exhibit

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 9, 2024

| |

NATIONAL HEALTHCARE CORPORATION

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/

|

Brian F. Kidd

|

|

| |

Name: |

Brian F. Kidd |

|

| |

Title: |

Senior VP/Chief Financial Officer |

|

Exhibit 99.1

For release: August 9, 2024

Contact: Brian F. Kidd, SVP/CFO

Phone: (615) 890-2020

NHC Reports Second Quarter 2024 Earnings

MURFREESBORO, Tenn. -- National HealthCare Corporation (NYSE American: NHC), the nation's oldest publicly traded senior health care company, announced today net operating revenues and grant income for the quarter ended June 30, 2024 totaled $300,658,000 compared to $282,582,000 for the quarter ended June 30, 2023, an increase of 6.4%. Excluding the governmental stimulus income and supplemental Medicaid payments from various states, as well as the three skilled nursing facilities in Missouri in which we exited operations in February 2024, same-facility net operating revenues increased 8.0% during the second quarter of 2024 compared to the same period a year ago.

For the quarter ended June 30, 2024, the reported GAAP net income attributable to NHC was $26,844,000 compared to $16,281,000 for the same period in 2023. Excluding the unrealized gains in our marketable equity securities portfolio and other non-GAAP adjustments, adjusted net income for the quarter ended June 30, 2024 was $15,612,000 compared to $13,658,000 for the same period in 2023 (*). The GAAP diluted earnings per share were $1.73 for the quarter ended June 30, 2024 compared to $1.06 for the quarter ended June 30, 2023. Adjusted diluted earnings per share were $1.00 and $0.89 for the quarters ended June 30, 2024 and 2023, respectively (*).

(*) - See the tables below that provide a reconciliation of GAAP to non-GAAP items.

About NHC

As of August 1, 2024, NHC affiliates operate for themselves and third parties 80 skilled nursing facilities with 10,349 beds. NHC affiliates also operate 26 assisted living communities with 1,413 units, nine independent living communities with 778 units, three behavioral health hospitals, 34 homecare agencies, and 30 hospice agencies. NHC’s other services include Alzheimer’s and memory care units, pharmacy services, a rehabilitation services company, and providing management and accounting services to third party post-acute operators. Other information about the company can be found on our web site at www.nhccare.com.

Non-GAAP Financial Presentation

The Company is providing certain non-GAAP financial measures as the Company believes that these figures are helpful in allowing investors to more accurately assess the ongoing nature of the Company’s operations and measure the Company’s performance more consistently across periods. Therefore, the Company believes this information is meaningful in addition to the information contained in the GAAP presentation of financial information. The presentation of this additional non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

Forward-Looking Statements

Statements in this press release that are not historical facts are forward-looking statements. NHC cautions investors that any forward-looking statements made involve risks and uncertainties and are not guarantees of future performance. The risks and uncertainties are detailed from time to time in reports filed by NHC with the S.E.C., including Forms 8-K, 10-Q, and 10-K. All forward-looking statements represent NHC’s best judgment as of the date of this release.

-more-

Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30

|

|

|

June 30

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Revenues and grant income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net patient revenues

|

|

$ |

279,918 |

|

|

$ |

269,605 |

|

|

$ |

565,741 |

|

|

$ |

527,612 |

|

|

Other revenues

|

|

|

11,295 |

|

|

|

12,977 |

|

|

|

22,648 |

|

|

|

24,533 |

|

|

Government stimulus income

|

|

|

9,445 |

|

|

|

- |

|

|

|

9,445 |

|

|

|

- |

|

|

Net operating revenues

|

|

|

300,658 |

|

|

|

282,582 |

|

|

|

597,834 |

|

|

|

552,145 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, wages and benefits

|

|

|

180,076 |

|

|

|

175,294 |

|

|

|

363,214 |

|

|

|

343,118 |

|

|

Other operating

|

|

|

78,154 |

|

|

|

73,234 |

|

|

|

155,583 |

|

|

|

144,723 |

|

|

Facility rent

|

|

|

10,570 |

|

|

|

9,901 |

|

|

|

20,918 |

|

|

|

19,993 |

|

|

Depreciation and amortization

|

|

|

9,338 |

|

|

|

10,083 |

|

|

|

19,924 |

|

|

|

20,131 |

|

|

Interest

|

|

|

- |

|

|

|

93 |

|

|

|

46 |

|

|

|

191 |

|

|

Total costs and expenses

|

|

|

278,138 |

|

|

|

268,605 |

|

|

|

559,685 |

|

|

|

528,156 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

22,520 |

|

|

|

13,977 |

|

|

|

38,149 |

|

|

|

23,989 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income

|

|

|

4,956 |

|

|

|

3,696 |

|

|

|

10,641 |

|

|

|

8,019 |

|

|

Unrealized gains on marketable equity securities

|

|

|

9,124 |

|

|

|

4,650 |

|

|

|

23,523 |

|

|

|

6,036 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

36,600 |

|

|

|

22,323 |

|

|

|

72,313 |

|

|

|

38,044 |

|

|

Income tax provision

|

|

|

(9,494 |

) |

|

|

(6,406 |

) |

|

|

(18,956 |

) |

|

|

(10,842 |

) |

|

Net income

|

|

|

27,106 |

|

|

|

15,917 |

|

|

|

53,357 |

|

|

|

27,202 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (income)/loss attributable to noncontrolling interest

|

|

|

(262 |

) |

|

|

364 |

|

|

|

(300 |

) |

|

|

802 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to National HealthCare Corporation

|

|

$ |

26,844 |

|

|

$ |

16,281 |

|

|

$ |

53,057 |

|

|

$ |

28,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

1.74 |

|

|

$ |

1.06 |

|

|

$ |

3.45 |

|

|

$ |

1.83 |

|

|

Diluted

|

|

$ |

1.73 |

|

|

$ |

1.06 |

|

|

$ |

3.42 |

|

|

$ |

1.83 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

15,391,535 |

|

|

|

15,297,435 |

|

|

|

15,371,150 |

|

|

|

15,317,319 |

|

|

Diluted

|

|

|

15,555,612 |

|

|

|

15,322,344 |

|

|

|

15,530,624 |

|

|

|

15,339,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share

|

|

$ |

0.61 |

|

|

$ |

0.59 |

|

|

$ |

1.20 |

|

|

$ |

1.16 |

|

|

Balance Sheet Data

|

|

June 30

|

|

|

December 31

|

|

|

(in thousands)

|

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities

|

|

$ |

270,019 |

|

|

$ |

223,620 |

|

|

Restricted cash, cash equivalents and marketable securities

|

|

|

170,264 |

|

|

|

167,971 |

|

|

Current assets

|

|

|

447,871 |

|

|

|

406,235 |

|

|

Property and equipment, net

|

|

|

487,193 |

|

|

|

493,329 |

|

|

Total assets

|

|

|

1,339,699 |

|

|

|

1,310,796 |

|

|

Current liabilities

|

|

|

216,935 |

|

|

|

214,476 |

|

|

Stockholders' equity

|

|

|

945,817 |

|

|

|

908,752 |

|

-more-

Selected Operating Statistics

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30

|

|

|

June 30

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Skilled Nursing Per Diems:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare

|

|

$ |

577.71 |

|

|

$ |

548.74 |

|

|

$ |

579.81 |

|

|

$ |

552.38 |

|

|

Managed Care

|

|

|

447.96 |

|

|

|

445.00 |

|

|

|

459.48 |

|

|

|

444.97 |

|

|

Medicaid

|

|

|

264.49 |

|

|

|

253.22 |

|

|

|

264.88 |

|

|

|

245.12 |

|

|

Private Pay and Other

|

|

|

312.91 |

|

|

|

275.11 |

|

|

|

310.31 |

|

|

|

276.79 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Skilled Nursing Per Diem

|

|

$ |

338.86 |

|

|

$ |

318.92 |

(1) |

|

$ |

341.21 |

(1) |

|

$ |

317.38 |

(1) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skilled Nursing Patient Days:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare

|

|

|

74,602 |

|

|

|

79,981 |

|

|

|

155,758 |

|

|

|

164,013 |

|

|

Managed Care

|

|

|

62,957 |

|

|

|

59,567 |

|

|

|

128,388 |

|

|

|

118,013 |

|

|

Medicaid

|

|

|

279,504 |

|

|

|

284,681 |

|

|

|

561,325 |

|

|

|

561,187 |

|

|

Private Pay and Other

|

|

|

150,234 |

|

|

|

164,000 |

|

|

|

307,677 |

|

|

|

321,422 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Skilled Nursing Patient Days

|

|

|

567,297 |

|

|

|

588,229 |

(1) |

|

|

1,153,148 |

(1) |

|

|

1,164,635 |

(1) |

(1) NHC exited three skilled nursing facilities in Missouri on March 1, 2024. For the first quarter of 2024, the exited Missouri skilled nursing facilities had an average skilled nursing per diem of $259.56 and 20,267 patient days. For the three months ended June 30, 2023, the exited Missouri skilled nursing facilities had an average skilled nursing per diem of $259.43 and 31,945 patient days. For the six months ended June 30, 2023, the exited Missouri skilled nursing facilities had an average skilled nursing per diem of $250.72 and 62,889 patient days.

The tables below provide reconciliations of GAAP to non-GAAP items (in thousands, except per share amounts):

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30

|

|

|

June 30

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to National Healthcare Corporation

|

|

$ |

26,844 |

|

|

$ |

16,281 |

|

|

$ |

53,057 |

|

|

$ |

28,004 |

|

|

Non-GAAP adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains on marketable equity securities

|

|

|

(9,124 |

) |

|

|

(4,650 |

) |

|

|

(23,523 |

) |

|

|

(6,036 |

) |

|

Operating results for newly opened operations not at full capacity (2)

|

|

|

20 |

|

|

|

333 |

|

|

|

20 |

|

|

|

1,550 |

|

|

Stock-based compensation expense

|

|

|

1,176 |

|

|

|

772 |

|

|

|

1,969 |

|

|

|

1,411 |

|

|

Gain on sale of unconsolidated company

|

|

|

- |

|

|

|

- |

|

|

|

(1,024 |

) |

|

|

- |

|

|

Acquisition-related expenses (3)

|

|

|

2,194 |

|

|

|

- |

|

|

|

2,194 |

|

|

|

- |

|

|

Employee retention credit

|

|

|

(9,445 |

) |

|

|

- |

|

|

|

(9,445 |

) |

|

|

- |

|

|

Income tax provision on non-GAAP adjustments

|

|

|

3,947 |

|

|

|

922 |

|

|

|

7,750 |

|

|

|

800 |

|

|

Non-GAAP Net income

|

|

$ |

15,612 |

|

|

$ |

13,658 |

|

|

$ |

30,998 |

|

|

$ |

25,729 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted earnings per share

|

|

$ |

1.73 |

|

|

$ |

1.06 |

|

|

$ |

3.42 |

|

|

$ |

1.83 |

|

|

Non-GAAP adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains on marketable equity securities

|

|

|

(0.43 |

) |

|

|

(0.23 |

) |

|

|

(1.12 |

) |

|

|

(0.29 |

) |

|

Operating results for newly opened operations not at full capacity (2)

|

|

|

- |

|

|

|

0.02 |

|

|

|

- |

|

|

|

0.07 |

|

|

Stock-based compensation expense

|

|

|

0.05 |

|

|

|

0.04 |

|

|

|

0.10 |

|

|

|

0.07 |

|

|

Gain on sale of unconsolidated company

|

|

|

- |

|

|

|

- |

|

|

|

(0.05 |

) |

|

|

- |

|

|

Acquisition-related expenses (3)

|

|

|

0.10 |

|

|

|

- |

|

|

|

0.10 |

|

|

|

- |

|

|

Employee retention credit

|

|

|

(0.45 |

) |

|

|

- |

|

|

|

(0.45 |

) |

|

|

- |

|

|

Non-GAAP diluted earnings per share

|

|

$ |

1.00 |

|

|

$ |

0.89 |

|

|

$ |

2.00 |

|

|

$ |

1.68 |

|

(2) The operating results for newly opened facilities or agencies not at full capacity include newly constructed healthcare facilities or agencies that are still considered in the start-up phase, which are two hospice agencies for the three and six months ended June 30, 3024. For the three and six months ended June 30, 2023, included are two behavioral health hospitals, two homecare agencies, and two hospice agencies.

(3) Represents expenses incurred to acquire the White Oak operations that are not capitalizable.

###

v3.24.2.u1

Document And Entity Information

|

Aug. 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATIONAL HEALTHCARE CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 09, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-13489

|

| Entity, Tax Identification Number |

52-2057472

|

| Entity, Address, Address Line One |

100 E. Vine Street

|

| Entity, Address, City or Town |

Murfreesboro

|

| Entity, Address, State or Province |

TN

|

| Entity, Address, Postal Zip Code |

37130

|

| City Area Code |

615

|

| Local Phone Number |

890-2020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NHC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001047335

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

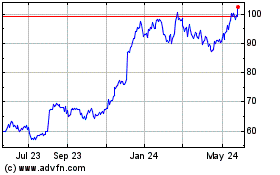

National HealthCare (AMEX:NHC)

Historical Stock Chart

From Dec 2024 to Jan 2025

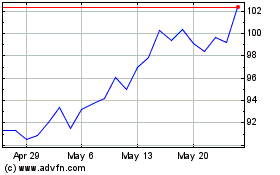

National HealthCare (AMEX:NHC)

Historical Stock Chart

From Jan 2024 to Jan 2025