false

0001823587

0001823587

2023-11-29

2023-11-29

0001823587

skyh:ClassACommonStockParValue00001PerShareCustomMember

2023-11-29

2023-11-29

0001823587

skyh:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareCustomMember

2023-11-29

2023-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 29, 2023

Sky Harbour Group Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39648

|

|

85-2732947

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

136 Tower Road, Suite 205

Westchester County Airport

White Plains, NY

|

|

10604

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212) 554-5990

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

SKYH

|

|

NYSE American LLC

|

|

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

|

SKYH WS

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities

As previously disclosed, on November 1, 2023, Sky Harbour Group Corporation (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain investors (collectively, the “Investors”). On November 29, 2023 (the “Second Closing Date”), pursuant to the terms of the Purchase Agreement, the Company sold and issued to the Investors an aggregate of 2,307,692 PIPE Shares (the “Additional PIPE Shares”) of the Company's Class A common stock, par value $0.0001 per share (“Class A Common Stock”) and accompanying PIPE Warrants to purchase an aggregate of 400,000 shares of Class A Common Stock (the “Additional PIPE Warrants” and, together with the Additional PIPE Shares, the “Additional PIPE Securities”) for an aggregate purchase price of $15,000,000 (the “Additional Financing”). Together with the first closing on November 2, 2023 (the “Initial Closing Date”), the aggregate PIPE financing through the Purchase Agreement totaled $57,810,000.

The Additional PIPE Warrants are similar in form and substance to the Company’s public warrants to purchase Class A Common Stock. The Additional PIPE Warrants are exercisable at an exercise price of $11.50 per share, subject to adjustment as set forth therein. The Additional PIPE Warrants are fully exercisable and expire on January 25, 2027. For further information regarding the terms of the Additional PIPE Warrants, see the section entitled “Warrants” in Exhibit 4.4 (Description of Securities) to our Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 24, 2023.

The Purchase Agreement includes certain covenants, including a limitation on the Company’s use of the net proceeds from the Additional Financing, certain customary standstill restrictions for a period of 90 days following the Second Closing Date and a restriction on paying any extraordinary dividend to the extent it would result in the issuance of a number of shares of Class A Common Stock upon exercise of the Additional PIPE Warrants (without regard to any limitations on exercise of the Additional PIPE Warrants) in excess of the number of shares of Class A Common Stock permissible by the NYSE American LLC to be issued without stockholder approval. In addition, pursuant to the Purchase Agreement, the Company granted to Altai Capital Falcon LP (the “Lead Investor”) certain participation rights with respect to certain future equity and debt offerings by the Company until the eighteen-month anniversary of Initial Closing Date. In addition, the Investors entered in to a six month customary lock-up agreement beginning on the Initial Closing Date.

The Additional PIPE Securities were offered and sold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. Each of the Investors represented that it was an “accredited investor,” as defined in Regulation D, and is acquiring the Additional PIPE Securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof in violation of applicable securities laws. The Additional PIPE Securities have not been registered under the Securities Act and such Additional PIPE Securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

Neither this Current Report on Form 8-K nor any of the exhibits attached hereto is an offer to sell or the solicitation of an offer to buy the Additional PIPE Securities, shares of Class A Common Stock or any other securities of the Company.

Item 7.01. Regulation FD Disclosure.

On November 29, 2023, the Company issued a press release announcing the closing of the Additional Financing. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed to be incorporated by reference in the filings of the Company under the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

EXHIBIT INDEX

|

Exhibit Number

|

Exhibit Title

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 29, 2023

| |

SKY HARBOUR GROUP CORPORATION

|

|

| |

|

|

|

| |

By:

|

/s/ Tal Keinan

|

|

| |

Name:

|

Tal Keinan

|

|

| |

Title:

|

Chief Executive Officer

|

|

Exhibit 99.1

Sky Harbour Group Announces the Second Closing of its Private Equity Placement with an Altai Capital Investment Vehicle for an Additional Aggregate Consideration of $15,000,000

West Harrison, New York – November 29th, 2023 – Sky Harbour Group Corporation (NYSE American: SKYH, SKYH WS) (“SHG” or the “Company”), an aviation infrastructure company building the first nationwide network of Home-Basing campuses for business aircraft, today announced the successful second closing of a private equity placement (the “Second Closing Financing”) with an investment vehicle managed by Altai Capital pursuant to the Securities Purchase Agreement executed on November 1, 2023 (the “Purchase Agreement”). The Second Closing Financing consisted of 2,307,692 shares of Class A Common Stock (the “Additional PIPE Shares”) and warrants[1] to purchase up to 400,000 shares of Class Common Stock (the “Additional PIPE Warrants” and, together with the Additional PIPE Shares, the “Additional PIPE Securities”) for an aggregate purchase price of $15,000,000. On a per share basis, the purchase price is equivalent to approximately $6.50 per share of Class A Common Stock and associated warrant coverage. Together with the first closing which occurred on November 2, 2023 (the "Initial Closing Date") the aggregate PIPE Financing totaled $57,810,000.

The additional investment by Altai Capital Falcon LP (“Altai Falcon”) includes participations from accredited investors that included a fund managed by Altai Capital itself; Bess Ventures & Advisory, the family office of Lane Bess (former CEO of Palo Alto Networks, former COO of Zscaler and current CEO of Deep Instinct); Raga Partners, a New York-based private investment firm and the founding partners of investment firm 8VC. The closing of the Second Closing Financing occurred today in New York, NY.

Lane Bess commented: “I came to know Sky Harbour as a resident. There is simply no offering like it in business aviation - period. I have never gotten more utility out of my aircraft. Great product. Outstanding team. I am very happy to be boarding this rocket ship and excited to help the company reach new heights.”

Tal Keinan, Sky Harbour CEO, commented: “We are gratified at the growing recognition of Sky Harbour’s unique model among sophisticated aircraft operators, and eager to get to work with our new partners as we steepen Sky Harbour’s climb.”

Altai Capital’s founder, Rishi Bajaj commented: “We expect that the completion of this equity financing will give Sky Harbour access to over $200 million of additional debt capital, enabling the Company to fully build out twelve total airfields totaling over 2.4 million square feet of rentable hangar space. Altai Capital and our partners look forward to supporting Sky Harbour as it completes a nationwide network of home-basing solutions for the domestic private aviation industry.”

The Purchase Agreement includes certain covenants, including a limitation on the Company’s use of the net proceeds from the Financing and certain customary standstill restrictions for a period of 90 days. In addition, the Investors entered into a six-month customary lock-up agreement beginning on the Initial Closing Date. The composition of the board of directors and corporate governance of the Company will remain unchanged.

The Additional PIPE Securities were offered and sold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. Each of the investors represented that it was an “accredited investor,” as defined in Regulation D, and acquired the Additional PIPE Securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The Additional PIPE Securities have not been registered under the Securities Act and such Additional PIPE Securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

Morrison & Foerster acted as legal advisor to the Company and Schulte Roth + Zabel LLP to Altai Capital.

1 The PIPE Warrants are governed by the Warrant Agreement, dated as of October 21, 2020, by and between the Company and Continental Stock Transfer and Trust Company, and, following Securities Act registration and Lock-up Agreement expiration, are expected to trade under the ticker SKYH WS with the Company’s existing warrants. The PIPE Warrants are exercisable at an exercise price of $11.50 per share, subject to adjustment as set forth therein, and will expire on January 25, 2027. For further information regarding the terms of the PIPE Warrants, see the section entitled “Warrants” in Exhibit 4.4 (Description of Securities) to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 24, 2023.

About Sky Harbour Group Corporation

Sky Harbour Group Corporation is an aviation infrastructure company developing the first nationwide network of Home-Basing campuses for business aircraft. The company develops, leases and manages general aviation hangars across the United States. Sky Harbour’s Home-Basing offering aims to provide private and corporate customers with the best physical infrastructure in business aviation, coupled with dedicated service tailored to based aircraft, offering the shortest time to wheels-up in business aviation. To learn more, visit www.skyharbour.group.

About Altai Capital

Altai Capital is a technology-focused investment firm founded in 2009 by Rishi Bajaj. Altai Capital makes long-term investments across a diverse range of financial instruments, including debt, private equity, venture capital, and publicly traded securities. To learn more, visit www.altai.com.

Forward Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements about the financial condition, results of operations, earnings outlook and prospects of SHG may include statements for the period following the consummation of the business combination. When used in this press release, the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of SHG as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in the public filings made or to be made with the SEC by SHG, including the filings described above, regarding the following: expectations regarding SHG’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and SHG’s ability to invest in growth initiatives; SHG’s ability to scale and build the hangars currently under development or planned in a timely and cost-effective manner; the implementation, market acceptance and success of SHG’s business model and growth strategy; the success or profitability of SHG’s hangar facilities; SHG’s future capital requirements and sources and uses of cash; SHG’s ability to obtain funding for its operations and future growth; developments and projections relating to SHG’s competitors and industry; the ability to recognize the anticipated benefits of the business combination; geopolitical risk and changes in applicable laws or regulations; the possibility that SHG may be adversely affected by other economic, business, and/or competitive factors; operational risk; risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on SHG’s business operations, as well as SHG’s financial condition and results of operations. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of SHG prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. SHG undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

SKYH Investor Relations:

investors@skyharbour.group

Attn: Francisco X. Gonzalez, CFO

v3.23.3

Document And Entity Information

|

Nov. 29, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Sky Harbour Group Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 29, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39648

|

| Entity, Tax Identification Number |

85-2732947

|

| Entity, Address, Address Line One |

136 Tower Road, Suite 205

|

| Entity, Address, Address Line Two |

Westchester County Airport

|

| Entity, Address, City or Town |

White Plains

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

10604

|

| City Area Code |

212

|

| Local Phone Number |

554-5990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001823587

|

| ClassACommonStockParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

SKYH

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

SKYH WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=skyh_ClassACommonStockParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=skyh_WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

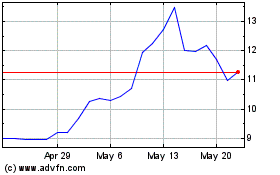

Sky Harbour (AMEX:SKYH)

Historical Stock Chart

From Apr 2024 to May 2024

Sky Harbour (AMEX:SKYH)

Historical Stock Chart

From May 2023 to May 2024