Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 July 2024 - 10:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

July 31, 2024

Commission File No. 0001-34184

SILVERCORP

METALS INC.

(Translation of registrant’s name into English)

Suite 1750 - 1066 West Hastings

Street

Vancouver, BC Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form

40-F [ X ]

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

| Dated:

July 31, 2024 |

SILVERCORP METALS INC. |

| |

|

| |

/s/

Jonathan Hoyles |

| |

Jonathan

Hoyles |

| |

General

Counsel and Corporate Secretary |

EXHIBIT INDEX

| |

|

| EXHIBIT |

DESCRIPTION OF EXHIBIT |

Exhibit 99.1

SILVERCORP UPDATE ON ACQUISITION OF ADVENTUS

Trading Symbols: TSX/NYSE AMERICAN:

SVM

VANCOUVER, BC, July 31, 2024 /CNW/ - Silvercorp

Metals Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) is pleased to announce that it

will proceed to close the acquisition of Adventus Mining Corporation ("Adventus") pursuant to the arrangement agreement (the

"Arrangement Agreement") under which the Company agreed to acquire all of the issued and outstanding common shares of Adventus

by way of a plan of arrangement (the "Transaction") as announced on April 26, 2024.

On July 5, 2024, Silvercorp announced it considered

the litigation referred to in the Adventus news release of June 17, 2024, which sought to void the environmental licence of the Curipamba-El

Domo project (the "Project"), a Material Adverse Effect, as defined in the Arrangement Agreement, in respect of Adventus.

The litigation was brought by a group of plaintiffs concerning the environmental consultation process for the Project.

A positive development has occurred with respect to

this litigation. Adventus announced on July 25, 2024, the local court in Las Naves Canton, Bolívar Province, Ecuador rejected the

litigation on July 24, 2024. The Court ruled that the Ecuadorean government correctly discharged its environmental consultation obligations

prior to issuing an environmental licence for the Project. The Court has not yet released written reasons for its judgement, and the plaintiffs

have given notice of their intention to appeal (the "Appeal") to the relevant provincial court.

With this local court ruling in favour of Adventus,

Silvercorp believes that all conditions to closing are satisfied and will proceed to close the Transaction on July 31, 2024.

For further information

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@Silvercorp.ca

Website: www.Silvercorp.ca

CAUTIONARY DISCLAIMER - FORWARD LOOKING STATEMENTS

This news release includes "forward-looking

statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information"

within the meaning of applicable securities laws relating to, among other things, the anticipated benefits of the Transaction, the strategic

rationale for the Transaction, the anticipated use of the proceeds of the Placement, the timing and anticipated receipt of required shareholder,

regulatory court, stock exchange or other approvals, the ability of the parties to satisfy the other conditions to the closing of the

Transaction and the anticipated timing for closing of the transaction. Forward-looking information may in some cases be identified by

words such as "will", "anticipates", "expects", "intends" and similar expressions suggesting future

events or future performance.

We caution that all forward-looking information

is inherently subject to change and uncertainty and that actual results may differ materially from those expressed or implied by the forward-looking

information. A number of risks, uncertainties and other factors, including the Appeal or subsequent developments in the litigation and

potential impacts of the Appeal or such subsequent litigation developments on the Project, could cause actual results and events to differ

materially from those expressed or implied in the forward-looking information or could cause our current objectives, strategies and intentions

to change. Accordingly, we warn investors to exercise caution when considering statements containing forward-looking information and that

it would be unreasonable to rely on such statements as creating legal rights regarding our future results or plans. We cannot guarantee

that any forward-looking information will materialize and you are cautioned not to place undue reliance on this forward-looking information.

Any forward-looking information contained in this news release represent expectations as of the date of this news release and are subject

to change after such date. However, we are under no obligation (and we expressly disclaim any such obligation) to update or alter any

statements containing forward-looking information, the factors or assumptions underlying them, whether as a result of new information,

future events or otherwise, except as required by law. All of the forward-looking information in this news release is qualified by the

cautionary statements herein.

Forward-looking information is provided herein

for the purpose of giving information about the Transaction referred and its expected impact. Readers are cautioned that such information

may not be appropriate for other purposes. Completion of the Transaction is subject to customary closing conditions, termination rights

and other risks and uncertainties including court and shareholder approval. Accordingly, there can be no assurance that the Transaction

will occur, or that it will occur on the terms and conditions contemplated in this news release. The Transaction could be modified, restructured

or terminated. There can also be no assurance that the strategic benefits expected to result from the Transaction will be fully realized.

In addition, if the transaction is not completed, and each of the parties continues as an independent entity, there are risks that the

announcement of the Transaction and the dedication of substantial resources of each party to the completion of the Transaction could have

an impact on such party's current business relationships (including with future and prospective employees, customers, distributors, suppliers

and partners) and could have a material adverse effect on the current and future operations, financial condition and prospects of such

party.

A comprehensive discussion of other risks that

impact Silvercorp can also be found in their public reports and filings which are available under its profile at www.sedarplus.ca.

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-update-on-acquisition-of-adventus-302210693.html

SOURCE Silvercorp Metals Inc

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/31/c4793.html

%CIK: 0001340677

CO: Silvercorp Metals Inc

CNW 08:00e 31-JUL-24

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Oct 2024 to Nov 2024

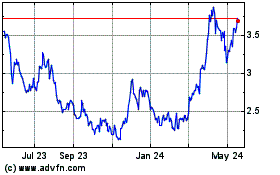

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Nov 2023 to Nov 2024