TIDMABDP

RNS Number : 0589A

AB Dynamics PLC

21 September 2022

21 September 2022

AB Dynamics plc

("AB Dynamics", the "Company" or the "Group")

Pre-Close Trading Update

Acquisition of Ansible Motion Limited

AB Dynamics (AIM: ABDP), the designer, manufacturer and supplier

of advanced testing, simulation and measurement products to the

global transport market, is pleased to issue the following trading

update and the announcement of an acquisition in advance of the

publication of its preliminary results for the year ended 31 August

2022 ("FY22").

Trading Update

The Group performed strongly during the second half of the year,

managing continued supply chain disruption effectively to deliver

strong organic growth and another record half year period for

sales. As a result, the Board expects to report revenue for FY22 of

approximately GBP80m, representing year on year growth of

approximately 22%. With robust margin performance through the

second half, full year adjusted operating profit is also

anticipated to be ahead of current market expectations.

The track testing sector delivered particularly strong growth

throughout FY22, with good growth across all primary product lines.

The laboratory testing and simulation sector showed more modest

sales growth, predominantly due to timing on larger contracts.

The Group maintained its track record of strong operating cash

conversion, with net cash at 31 August 2022 of GBP29.0m (2021:

GBP22.3m), after capex investment of GBP4m.

Despite the significant sales growth throughout the year, order

intake continued to be strong and resulted in another period of

positive book to bill ratio. Whilst mindful of continued

uncertainty in the wider economic backdrop, this provides good

momentum as the business enters FY23.

Acquisition of Ansible Motion Limited

The Group has completed the acquisition of Ansible Motion

Limited ("Ansible Motion") for an initial consideration of GBP19.2m

(the "Acquisition").

Ansible Motion is a leading provider of advanced simulators to

the global automotive market. Ansible Motion's products are used

for a wide range of applications including evaluation of Advanced

Driver Assistance Systems ("ADAS"), autonomy, vehicle dynamics,

powertrain development and motorsport.

Founded in 2009 and headquartered in Norfolk, Ansible Motion has

been a long-standing partner of rFpro, which was acquired by AB

Dynamics in 2019. The Ansible Motion product range complements the

existing AB Dynamics range of driving simulation products, building

out the family of products to enable access to a wider range of

customers and applications.

The Acquisition supports a number of the Group's stated

strategic priorities including:

-- Expanding the Group's product range in the simulation market

and achieving critical mass in the simulation business unit;

-- Enhancing the Group's capabilities in the field of simulation

R&D through a talented team of engineers and increasing the

capacity of the business through an additional product development

and manufacturing facility in the UK; and

-- Synergistic benefits of shared services and access to the

existing AB Dynamics channels to market

Financial Considerations

The maximum consideration payable for Ansible is GBP31.2m,

comprising an initial cash consideration of GBP16.0m and GBP3.2m of

new ordinary shares in AB Dynamics issued to the vendors. The

Acquisition has been completed on a cash free, debt free basis with

the initial cash consideration funded from the Group's existing

cash resources and short-term utilisation of part of the Group's

revolving credit facility. Conditional consideration of up to

GBP12.0m will be payable in cash subject to meeting certain

performance criteria for the year ending 31 August 2023.

Ansible Motion has a strong record of profitable, and cash

generative growth. Based on unaudited accounts, in the year ended

31 March 2022 Ansible Motion generated revenue of GBP8.0m (2021:

GBP5.4m), earnings before interest, tax, depreciation and

amortisation ('EBITDA') of GBP1.9m (2021: GBP0.8m) and operating

profit of GBP1.8m (2021: GBP0.7m). Net assets at 31 March 2022 were

GBP4.1m.

The Board expects that the Acquisition will be earnings

enhancing in FY23 with revenues forecast to be approximately

GBP12.0m, based on the existing orderbook and strong order

pipeline, and adjusted operating profit of approximately GBP2.2m.

Should this forecast be achieved, the conditional cash payment

would be estimated at GBP1.3m.

Ansible Motion is being acquired from its three shareholders, Mr

Kia Cammaerts, Mr Jonathan Walker and Mr Robert Stevens, with Mr

Cammaerts and Mr Stevens remaining in the business as Managing

Director and Chief Engineer respectively.

Dr James Routh, Chief Executive Officer, said:

"I am very pleased to be able to provide a positive trading

update ahead of the publication of our full year results. The

business has performed strongly against a backdrop of continued

challenging market conditions and demonstrates the resilience of

our business model.

The acquisition of Ansible Motion is another important milestone

in our ongoing strategic development and supports the Group's

strategic initiatives by broadening the scope of the Group's

product offering, strengthens our position in the strategically

important global simulation market, and enhances our capabilities

in R&D and manufacturing.

Ansible Motion is a business we have known for a long time, and

has an outstanding reputation for providing customer focussed

driving simulation solutions and, coupled with our existing

simulator business and our world class simulation software rFpro,

this acquisition positions us as a market leader with genuine scale

to drive significant continued growth in the simulation sector.

The existing order book and strong market presence of Ansible

Motion, along with our established international sales channels

provides us with an outstanding platform for growth and we are very

pleased to welcome Kia, Robert and each of Ansible's 38 employees

to AB Dynamics."

More information on Ansible Motion can be found on its website

at www.ansiblemotion.com

Notice of results

The Group will announce its results for the year ended 31 August

2022 on Wednesday 23 November 2022. The management team will be

hosting a presentation for analysts on the day of the results.

Analysts who wish to attend the presentation should register their

interest with Tulchan Communications at abdynamics@tulchangroup.com

or 0207 353 4200.

Issue of Equity and Total Voting Rights

Pursuant to the acquisition of Ansible Motion, application has

been made to London Stock Exchange for 258,795 consideration shares

to be admitted to trading on AIM and it is expected that Admission

will become effective, and that trading will commence at 08.00 a.m.

on 26 September 2022 ("Admission").

Following Admission, and in accordance with the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules

("DTRs"), the Company's total issued share capital will consist of

22,885,261 ordinary shares of 1 penny each ("Ordinary Shares") with

one voting right per Ordinary Share. The Company does not hold any

Ordinary Shares in Treasury. Shareholders may therefore use this

figure as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in the Company, under the DTRs.

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of those Regulations.

The person responsible for arranging the release of this

information is David Forbes, Company Secretary.

Enquiries :

AB Dynamics plc 01225 860 200

Dr James Routh, Chief Executive Officer

Sarah Matthews-DeMers, Chief Financial Officer

Peel Hunt LLP 0207 894 7000

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Laura Marshall

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFVTAIIIFIF

(END) Dow Jones Newswires

September 21, 2022 02:02 ET (06:02 GMT)

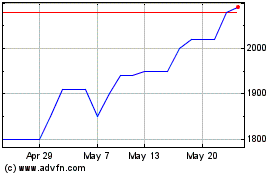

AB Dynamics (AQSE:ABDP.GB)

Historical Stock Chart

From Apr 2024 to May 2024

AB Dynamics (AQSE:ABDP.GB)

Historical Stock Chart

From May 2023 to May 2024