Anglesey Mining PLC Chairman's Statement at AGM

28 October 2022 - 12:43AM

UK Regulatory

TIDMAYM

Trading Symbol

AIM: AYM

27th October 2022

Anglesey Mining plc

("Anglesey" or "the Company")

Chairman's AGM Statement

Anglesey Mining plc (AIM: AYM), the UK minerals development company, is pleased

to release the Chairman's Statement at the Annual General Meeting of

Shareholders held in London today, which highlights the significant progress

over the last year.

* Significant progress made across the Company's assets including the first

drilling programme at Parys Mountain since 2012 and the commencement of

permitting activities, while at Grängesberg the 2012 Prefeasibility Study

was updated generating very strong financial metrics.

* Difficulties within the global economy have clearly put metal prices under

pressure relative to the previous twelve months. However, our Board

continue to believe that future demand for Anglesey's suite of metals will

remain buoyant driven by ongoing decarbonisation efforts and the aggressive

Net Zero targets.

* The last year saw the appointment of Jo Battershill as CEO and a refresh of

the Board with the appointments of Namrata Verma and Andrew King as

Non-Executive Directors. Additionally, Anglesey transitioned from the Main

Board of the London Stock Exchange to the AIM market, being a more flexible

regulatory regime which we believe is better suited to the Company's

current stage of development and strategy.

* Over the next year, we expect to continue the current work programmes at

Parys Mountain that will ultimately advance the project through the

requisite production studies and permitting phases. We will also focus more

attention on the substantial opportunity presenting itself within the

Northern Copper Zone. At Grängesberg, we expect to commence the

recommendations from the PFS update, including baseline studies for the

environmental impact assessment and updating the mining reserve to include

some improvements to the proposed Grängesberg mine plan.

Jo Battershill, Chief Executive of Anglesey Mining, commented: "With today's

AGM statement, the Chairman of Anglesey Mining provided a summary of the

significant progress made by Anglesey Mining since the last AGM, including a

very clear message of how the Company's assets can play a significant role

within the UK to meet the 2050 Net Zero targets set by the Paris Agreement."

"The last 12-months at Parys Mountain have seen a significant amount of work,

commencing with the first drilling programme for over a decade followed by

geotechnical modelling for underground mine optimisation work and the

conceptual tailings design. Concurrently, we commenced the permitting and

environmental baseline work that has progressed very well. We believe the

significant gap between our internal valuation of Parys Mountain and Anglesey's

market capitalisation would be lessened with permits in hand, consequently the

permitting process remains a critical path activity."

"We have committed a significant amount of time on the Grängesberg Iron Ore

Project during the last year and expect to maintain this momentum over the

coming year. The results of the PFS Update were very impressive and clearly

highlighted just how big this opportunity could be for Anglesey shareholders."

"Anglesey remains focussed on the sustainable development of our resource

projects while applying appropriate environmentally friendly solutions. We look

forward to continuing the progress at our key projects over the next year."

Anglesey Mining plc is pleased to release the Statement of the Company's

Chairman, John Kearney, to Shareholders at the AGM held in London on Thursday

27 October 2022.

Significant progress made across Anglesey's projects

The past year since our last AGM has provided shareholders with some very

positive news generated from the significant progress at both our Parys

Mountain copper/zinc/lead project and our iron ore projects in Sweden and

Canada

A very active year at Parys Mountain saw the first drilling programme since

2012, the commencement of environmental studies, the appointment of Knight

Piésold to undertake both the design stage for the tailings management system

together with the geotechnical assessment of the underground development, and

engagement with local planning and regulatory authorities and local councils.

Meanwhile in Sweden, a Pre-Feasibility Study Update for the Grängesberg Iron

Ore Project was completed with very encouraging results, while in Canada

Labrador Iron Mines continued to advance its Houston direct shipping iron ore

project toward production.

Metal prices under pressure

The metals relevant to Anglesey's Parys Mountain project performed well during

the 2021 period, with average prices across the year higher than 2020. However,

since the second quarter of calendar 2022, metal prices have been very much

under pressure. The previous problems associated with the Covid-19 pandemic

have been replaced by a period of global uncertainty, both economic and

political, volatility, inflation and conflict including the invasion of

Ukraine.

Metals are critical for the climate transition and the clean energy

technologies needed to meet the world's climate action goals will require much

more metal. For example, every electric car requires up to four times more

copper than an ICE car and every megawatt of solar power generation capacity

requires 5 tonnes of copper.

In a recent paper published by the metals consulting company Wood Mackenzie

this month of October, they say:

"The road to zero carbon will see an extraordinary build-out of low-carbon

electric vehicles (EVs) and renewable power-generating capacity. And as the

world reduces its dependence on hydrocarbons, metals will be a linchpin of a

zero-carbon economy.

To meet zero-carbon targets, the mining industry would have to deliver new

projects at a frequency and consistent level of financing never previously

accomplished.

The implication is that more projects need to be progressed through the

pipeline and quickly, or there will simply not be enough primary copper to meet

demand.

A growing market deficit, exacerbated by the sharp increase in refined demand

growth will underpin a copper price rally to more than US$11,000/t (about

US$5.00/lb) within five years".

The independent Preliminary Economic Assessment (PEA) on Parys Mountain,

completed in January 2021, used the three-year trailing metal prices as of

September 2020 of US$2.81/lb Cu.

At the August 2022 metal prices ($3.70/lb Cu) copper production from a Parys

Mountain mine would represent 50% of the net smelter revenue under the expanded

case. The PEA indicates production of 75,000 tonnes of copper over the

project's 12-year mine life, when combined with the other metals produced this

equates to an average copper equivalent production rate of 14,000 tonnes per

year over the proposed life of the operation.

As a consequence, our Board remains very confident that the medium- and

long-term outlook for most minerals, particularly for copper at Parys Mountain,

is very encouraging.

We are also confident that the economics of Parys Mountain continue to remain

robust given the Preliminary Economic Assessment completed in 2021 utilised

very conservative pricing assumptions, including US$2.81/lb for copper and

US$1.20/lb for zinc, which compare to prices of US$3.59/lb and US$1.34/lb at

the date of this AGM.

On the iron ore front, the price has been under some pressure, primarily due to

the ongoing Zero Covid Policy in China that has reduced construction activities

and dampened demand for steel and therefore for iron ore. Nevertheless, we

believe Anglesey is very well positioned to benefit from the inevitable future

recovery in demand.

At Grängesberg, a very positive update of the PFS indicates production of 2.3 -

2.5Mtpa of iron ore concentrate grading 70% Fe that generates strong economic

returns, including a NPV8% of US$688 million post-tax, and confirming that the

Grängesberg iron ore mine has the potential to be restarted as one of Europe's

largest individual producers of high-grade iron ore concentrates.

The Ukraine conflict has highlighted the strategic positioning of Grängesberg.

Prior to the conflict, Russia and Ukraine supplied more than half of all iron

ore into the European steel market. With the future uncertainty around this

supply, a long-term source of iron ore could be highly sought after by European

and Middle Eastern steel producers. Grängesberg, with the high-grade nature of

its concentrate, existing infrastructure and favourable location in southern

Sweden in proximity to European steel mills, represents a highly strategic

opportunity.

Corporate developments

A number of changes were made on the corporate end during the year. These

included the appointment of Jo Battershill as CEO and refreshing the Board with

the appointment of two new Non-Executive Directors, Namrata Verma and Andrew

King who both join Anglesey with the highest of reputations in their own

particular sectors and their combined and extensive experience in the financing

sector of the worldwide minerals industry will be critical in the successful

funding of both projects.

Additionally, Anglesey moved its listing from the from the Main Market to the

AIM market of the London Stock Exchange. We believe the AIM listing will offer

greater flexibility, enabling the more rapid and cost-effective execution of

transactions and financings. AIM also provides improved visibility for Anglesey

and enhanced liquidity for investors.

Next steps

I firmly believe the outlook for Anglesey is very promising. At Parys Mountain,

the current work programmes will continue to advance the project through the

production studies and permitting phases. Additionally, the Anglesey team have

been reviewing the historical drilling and internal resource reports for the

extensive Northern Copper Zone. Initial examination suggests that the system

could be significantly larger than currently modelled but will require

additional drilling to test prospective areas.

At Grängesberg, planning will continue around commencing the recommendations

from the PFS update, including baseline studies for the environmental impact

assessment and updating the mining reserve to include some improvements to the

proposed Grängesberg mine plan.

In closing, on behalf of the Board of Directors, I would like to thank our

shareholders for the ongoing support, and I remain very confident that the

assets held by Anglesey will deliver significant value as they continue to be

progressed over the next year.

About Anglesey Mining plc

Anglesey Mining is traded on the AIM market of the London Stock Exchange and

currently has 280,675,721 ordinary shares on issue.

Anglesey is developing its 100% owned Parys Mountain Cu-Zn-Pb-Ag-Au deposit in

North Wales, UK with a 2020 reported resource of 5.2 million tonnes at 4.3%

combined base metals in the Indicated category and 11.7 million tonnes at 2.8%

combined base metals in the Inferred category.

Anglesey holds an almost 20% interest in the Grangesberg Iron project in

Sweden, together with management rights and a right of first refusal to

increase its interest to 70%. Anglesey also holds 12% of Labrador Iron Mines

Holdings Limited, which through its 52% owned subsidiaries, is engaged in the

exploration and development of direct shipping iron ore deposits in Labrador

and Quebec.

For further information, please contact:

Anglesey Mining plc

Jo Battershill, Chief Executive - Tel: +44 (0)7540 366000

John Kearney, Chairman - Tel: +1 416 362 6686

Davy

Nominated Adviser & Joint Corporate Broker

Brian Garrahy / Lauren O'Sullivan - Tel: +353 1 679 6363

WH Ireland

Joint Corporate Broker

Katy Mitchell / Harry Ansell - Tel: +44 (0) 207 220 1666

Canaccord Genuity Limited

Joint Corporate Broker

James Asensio / Harry Rees - Tel: +44 (0) 20 7523 8000

Scout Advisory Limited

Investor Relations Consultant

Sean Wade - Tel: +44 (0) 7464 609025

LEI: 213800X8BO8EK2B4HQ71

END

(END) Dow Jones Newswires

October 27, 2022 09:43 ET (13:43 GMT)

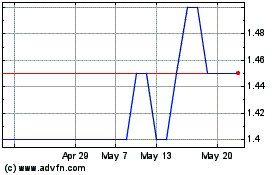

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Dec 2024 to Dec 2024

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024