Anglesey Mining PLC Anglesey acquires a further 29.8% of Grängesberg Iron AB

12 January 2023 - 6:00PM

UK Regulatory

TIDMAYM

Trading Symbol

AIM: AYM

12th January 2023

Anglesey Mining plc

("Anglesey" or "the Company")

Anglesey acquires a further 29.8% of Grängesberg Iron AB

Anglesey Mining plc (AIM:AYM), the UK minerals development company, is pleased

to announce it has entered into an agreement to acquire an additional 29.8% of

Grängesberg Iron AB ("GIAB"), the entity that owns the Grängesberg Iron Ore

Project in Sweden, taking Anglesey's stake to 49.75%.

* Anglesey Mining plc has agreed with Roslagen Resources AB ("Roslagen") to

purchase Roslagen's 29.8% stake in GIAB, taking Anglesey's ownership level

to 49.75%, and the assignment to Anglesey of 40% of outstanding

subordinated debt owed to Roslagen by GIAB with a nominal value of £

335,000, for a total consideration of £525,000, to be satisfied as follows:

+ A cash payment on completion of SEK 1,090,000 (c.£87,000), funded from

the Company's existing resources; and,

+ The issue to Roslagen of 14,544,827 new ordinary shares of Anglesey

Mining at a price of 3.0 pence per share (the "Consideration Shares"),

to be held in escrow for twelve months from the date of issue. A

further announcement will be made upon the issue of the Consideration

Shares.

* At the closing of the transaction, Roslagen will hold 4.9% of the expanded

capital of Anglesey and will also continue to hold approximately SEK

6,280,000 (£500,000) in subordinated debt due from GIAB

* Anglesey has a Right of First Refusal on the remaining 50.25% of GIAB

* Andreas Simoncic, a director and shareholder of Roslagen will remain on the

Board of GIAB

* The Updated PFS for Grängesberg completed in July 2022 highlighted the

robust economics of the asset with a post-tax NPV8 of US$688m, at an iron

ore price of US$120/tonne, 62% Fe, CFR China benchmark, and FOB costs of

US$53/t to the ice-free port of Oxelösund, Sweden

* Previously, revenue was also generated from the sale of apatite

concentrates (17-19% P) produced from the tailings stream. While the PFS

indicates potential apatite production of 210ktpa, no sales have yet been

included in the financial evaluation. This product also contains elevated

rare earth content

* The Swedish Mining Inspectorate granted Grängesberg Iron AB a 25-year

mining concession for the iron ore mine in 2013

Jo Battershill, Chief Executive of Anglesey Mining, commented: "We are very

excited to agree this transaction with Roslagen, increasing Anglesey's holding

in Grängesberg. We are also very pleased to retain the services of Andreas

Simoncic on the Board of GIAB and welcome Roslagen's ongoing involvement as an

Anglesey shareholder. Andreas' long history with the project will be an

important component in moving Grängesberg forward."

"We continue to believe the Grängesberg project has the potential to be

restarted as one of Europe's largest individual producers of iron ore

concentrates. When combined with the high-grade nature of the concentrate and

proximity to European steel mills, the asset clearly demonstrates highly

strategic positioning."

"As we have previously communicated, the opportunity for Anglesey Mining is now

to advance the project through to a Financial Investment Decision. This could

be completed along with securing a strategic investor, offtake partner,

separate listing, or a combination of these options. However, we recognise that

there is still a lot of work to complete at Grängesberg, including updating

both the resource and reserve models and undertaking environmental assessment

studies as preliminary steps to preparing a Feasibility Study."

Additional Information on GIAB

As at 31 December 2021, GIAB had gross assets of SEK 90,091,613 (£7.2m). GIAB

reported a loss before tax of SEK (6,001,706) (£0.48m) for the year ended 31

December 2021.

Background on Grängesberg Iron AB

Grängesberg Iron AB ("GIAB") is a private Swedish company that was founded in

2007 by Roslagen with the target of re-opening the historic iron ore mine in

Grängesberg.

In May 2014, as part of a financial and capital restructuring process in GIAB,

Anglesey Mining entered into agreements giving it the right to acquire a

controlling interest in the Grängesberg Iron Ore Project. The agreements

included a payment of US$145,000 for a direct 6% interest in GIAB.

At the same time, Eurang Limited, a UK private company, agreed to invest $1.75

million, of which $1.25 million was invested in GIAB, for new shares

representing a 51% shareholding interest in GIAB. The additional $500,000 was

used to cover transaction costs, expenses and certain outstanding liabilities.

Roslagen held the remaining shares. Anglesey also entered into shareholder and

cooperation agreements such that Anglesey holds management control and

operatorship of GIAB with three out of five directors to the board of GIAB

including the Chair. Through this structure, Anglesey Mining retains a Right of

First Refusal over the GIAB stake held by Eurang.

Anglesey Mining's stake in GIAB was subsequently increased to the current 19.9%

through working capital injections in the company since 2014, while Roslagen's

shareholding was diluted.

GIAB Balance Sheet

As part of the 2014 agreements and reorganisation, an outstanding loan in GIAB

in the principal amount of US$3.5 million due to KII Holdings Limited, a

Cypriot subsidiary company to a substantial Greek shipping group, was also

renegotiated. At the end of December 2022, the liabilities on the GIAB balance

sheet included outstanding debt of SEK 93,023,816 (£7.4m), which included SEK

79,675,695 (£6.3m) payable to KII and SEK 10,448,605 (£0.8m) to Roslagen, prior

to the assignment of SEK 4,200,000 to Anglesey as part of the proposed

transaction.

The debt is non-recourse to Anglesey Mining and all creditors have the right at

maturity, or in connection with an IPO, to convert all or part of the loan into

shares in GIAB at:

(i) valuation of GIAB in IPO; or,

(ii) valuation to be agreed or determined by independent investment

bank

The term of this funding has been extended since the 2014 reorganisation and

discussions are currently ongoing with respect to a further extension beyond

the current expiry at the end of January, 2023.

Grängesberg Iron Ore Project

The Grängesberg Iron ore project, owned by GIAB, is located 10 km to the

southwest of Ludvika in Dalarna County, central Sweden, within the Bergslagen

mining district. The project is situated approximately 200 km northwest from

Stockholm, the capital of Sweden.

The Grängesberg Mine produced iron ore from the late sixteenth century until

1990 when the mine closed due to the prevailing iron ore price. Grängesberg was

one of Sweden's most important iron ore mines, next only to Kiruna and

Malmberget and was producing approximately 4.0Mtpa in the latter years of

operations.

At the time of closure significant amounts of iron ore were reported to still

remain in the mine, which have been estimated by GIAB to NI43-101 standards.

GIAB intend to re-open the iron ore mine for future production in line with the

Pre-Feasibility Study Update completed in July 2022.

Resources and Reserves

The resource and reserve estimates for Grängesberg are provided below.

Resource Tonnes Fe P Contained Fe

Category (Mt) (%) (%) (Mt)

Grängesberg Indicated 115.2 40.2 0.78 46.3

Inferred 33.1 45.1 0.91 15.0

Total 148.3 41.3 0.81 61.3

Resources were last estimated in 2014 to a cut-off grade of 20% Fe and with a

minimum mining width of 10m applied.

Reserve Tonnes Fe Contained Fe

Category (Mt) (%) (Mt)

Grängesberg Probable 82.4 37.2 30.7

Total 82.4 37.2 30.7

Reserves were calculated to a cut-off grade 25% Fe and with a minimum mining

width of 15m applied. The estimate also assumed 85% mining recovery and 15%

mining dilution with a long-term pellet price of 180 US¢/dmtu Fe.

Key Project Metrics

The key project metrics from the July 2022 Pre-Feasibility Study Update are

shown in the tables below.

Key Metric Unit 2022 PFS Update

Ore to Mill Mt 82.3

Life of Mine Years 16.0

Contained Fe Mt 30.6

Recovery % 85

Recovered Fe Mt 26.0

Outgoing Concentrate Mt 37.2

Concentrate Grade % Fe 70

Average annual Concentrate Output Mt 2.3

Cash cost* US$/t Conc 53.60

All-in Sustaining Cost** US$/t Conc 57.80

Pre-production capital US$m 399

Post-tax NPV8% % 688

Post-tax Internal Rate of Return % 26

Project payback Years 3.6

Average annual Post-tax Operating US$m 130

Cashflow ***

* Cash costs are inclusive of mining costs, processing costs, site G&A,

transportation charges to port and royalties

** All-in Sustaining Cost includes cash costs plus sustaining capital and

closure cost

*** Post-tax Operating Cashflow based on iron ore price forecast of US$120/t

China CFR 62% Fe benchmark

About Anglesey Mining plc

Anglesey Mining is traded on the AIM market of the London Stock Exchange and

currently has 280,675,721 ordinary shares on issue.

Anglesey is developing its 100% owned Parys Mountain Cu-Zn-Pb-Ag-Au deposit in

North Wales, UK with a 2020 reported resource of 5.2 million tonnes at 4.3%

combined base metals in the Indicated category and 11.7 million tonnes at 2.8%

combined base metals in the Inferred category.

Upon completion of the transaction Anglesey will hold an almost 50% interest in

the Grangesberg Iron project in Sweden, together with management rights and a

right of first refusal to increase its interest to 100%. Anglesey also holds

12% of Labrador Iron Mines Holdings Limited, which through its 52% owned

subsidiaries, is engaged in the exploration and development of direct shipping

iron ore deposits in Labrador and Quebec.

For further information, please contact:

Anglesey Mining plc

Jo Battershill, Chief Executive - Tel: +44 (0)7540 366000

John Kearney, Chairman - Tel: +1 416 362 6686

Davy

Nominated Adviser & Joint Corporate Broker

Brian Garrahy / Lauren O'Sullivan - Tel: +353 1 679 6363

WH Ireland

Joint Corporate Broker

Katy Mitchell / Harry Ansell - Tel: +44 (0) 207 220 1666

Scout Advisory Limited

Investor Relations Consultant

Sean Wade - Tel: +44 (0) 7464 609025

LEI: 213800X8BO8EK2B4HQ71

END

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

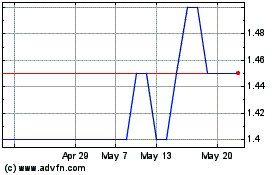

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024