TIDMBUR

RNS Number : 9319L

Burford Capital Limited

11 September 2023

8 September 2023

Released out of hours on September 8, 2023, and queued for

release via RNS upon its reopening on September 11, 2023.

BURFORD CAPITAL STATEMENT ON YPF DAMAGES RULING

Court's Ruling suggests a final judgment of approximately $16

billion against Argentina

Burford Capital Limited, the leading global finance and asset

management firm focused on law, today releases the following

statement in connection with the September 8, 2023 Findings of Fact

and Conclusions of Law (the "Ruling") issued by the United States

District Court for the Southern District of New York (the "Court")

in connection with the Petersen and Eton Park cases against the

Republic of Argentina and YPF (the "Case" or the "YPF

Litigation").

The Ruling follows a prior decision on March 31, 2023 by the

Court granting summary judgment on liability against Argentina and

setting for an evidentiary hearing questions around the date on

which Argentina should have made a tender offer for YPF's shares

and the appropriate rate of pre-judgment interest to be applied.

That evidentiary hearing was held on July 26-28, 2023 and the

Ruling is the Court's decision on the issues raised for

hearing.

The Court decided the issues raised at the hearing in Petersen's

and Eton Park's (collectively, "Plaintiffs'") favor, holding that

the appropriate date for the tender offer was April 16, 2012 and

that pre-judgment interest should run from May 3, 2012 at a simple

interest rate of 8%.

The Court has asked the parties to memorialize the Ruling in a

proposed judgment and submit it to the Court, which Petersen and

Eton Park will endeavor to do forthwith. We discuss below the

computation of potential damages but in round numbers the Court's

Ruling implies a judgment against Argentina of approximately $16

billion.

In other words, the Ruling results in a complete win against

Argentina at the high end of the possible range of damages.

Jonathan Molot, Burford's Chief Investment Officer who leads

Burford's work on the Case, commented:

"We have been pursuing this case since 2015 and it has involved

substantial Burford management time along with the dedicated

engagement of a team of some of the best lawyers on the planet from

multiple law firms and world-class experts (going up against very

good lawyers, and winning). Burford is uniquely positioned to

pursue these kinds of cases and secure wins for clients and

substantial returns for shareholders - not only because of the size

and scale of these kinds of cases, but because of the internal and

external resources we can uniquely bring to bear. There is no

aspect of this case, from strategy to minutiae, that did not

involve an experienced Burford team spending many thousands of

hours getting to this point. This case represents what Burford is

all about and exemplifies the contribution we make to the civil

justice system - without us, there would be no justice in this

complicated and long-running case for Petersen and Eton Park."

Christopher Bogart, Burford's Chief Executive Officer,

commented:

"In our recent shareholder letter, we referred to the

YPF-related assets as one of Burford's four pillars of value and

I'm pleased to see this extraordinary win and the value it could

create for our shareholders once we complete the litigation process

and collect from Argentina. The Ruling is a major milestone for

Burford and we continue to see momentum in our overall portfolio

and continued demand for our capital and services."

Introductory matters

As is customary in US litigation, the Ruling was released

without prior notice to Burford or the parties by its posting on

PACER, the publicly available official US federal court site, at

10:45am EDT on September 8, 2023, and was thus public immediately

upon release. The Ruling is also available in its entirety on

Burford's IR website at http://investors.burfordcapital.com for the

convenience of investors who did not wish to register for a PACER

account.

While Burford offers in this release its views and

interpretation of the Ruling, those are qualified in their entirety

by the actual text of the Ruling and we caution that investors

cannot rely on Burford's statements in preference to the actual

Ruling. In the event of any inconsistency between this release and

the text of the actual Ruling, the text of the actual Ruling will

prevail and be dispositive. Burford disclaims, to the fullest

extent permitted by law, any obligation to update its views and

interpretation as the litigation proceeds. Moreover, the Case

remains in active litigation and Argentina has declared its

intention to appeal any decision; all litigation carries

significant risks of uncertainty and unpredictability until final

resolution, including the risk of total loss. Finally, Burford is

and will continue to be constrained by legal privilege and client

confidences in terms of the scope of its ability to speak publicly

about the Case or the Ruling.

Burford also cautions that there are meaningful remaining risks

in the Case, including further proceedings before the Court,

appeals, enforcement and collateral litigation in other

jurisdictions. Moreover, litigation matters often resolve for

considerably less than the amount of any judgment rendered by the

courts and to the extent that any settlement or resolution

discussions occur in this Case no public communication about those

discussions will be possible until their conclusion.

The Ruling

The Court previously held that (i) the bylaws "on their face,

required that the Republic make a tender offer" for Petersen's and

YPF's shares; (ii) "the Republic failed to make the tender offer";

and (iii) the failure "harmed Plaintiffs because they never

received the compensated exit" that the bylaws promised. Indeed,

the Court held that "once the Court decides the legal issues, the

relatively simple facts in this case will demand a particular

outcome" and held that "there is no question of fact as to whether

the Republic breached".

Thus, the Court held that "Plaintiffs were damaged by the

Republic because Plaintiffs were entitled to receive a tender offer

that would have provided them with a compensated exit but did

not".

The Court previously held that the damages to be awarded will

consist of the tender offer price under Formula D of the bylaws

calculated in US dollars as of a constructive notice date that is

40 days prior to Argentina taking control and triggering the tender

offer obligation. The Court said it must decide as a factual matter

whether the operative notice date for the calculation is 40 days

before April 16, 2012, when the Presidential intervention decree

was implemented, or 40 days before May 7, 2012, when the Argentine

legislature took follow-up action. In the Ruling, the Court

concluded that April 16, 2012 was the appropriate date.

The calculation of damages using a notice date that is 40 days

before the April 16, 2012 takeover was included in Plaintiffs'

publicly filed summary judgment brief and would imply tender offer

consideration of approximately $7.5 billion for Petersen and $900

million for Eton Park, before interest.

The Court also previously reserved for determination the

prejudgment interest rate that would run from the date of the

breach in 2012 through the issuance of a final judgment in 2023.

The Court accepted that "the commercial rate applied by the

Argentine courts is the appropriate measure" and noted that

Plaintiffs had pleaded that that rate was "between 6% and 8%", but

"the Court reserves judgment on the precise rate it will utilize".

After the hearing, the Court ultimately applied an 8% rate from May

3, 2012 until the date of the judgment, and thereafter interest

will accrue at the applicable US federal rate until payment.

Subject to final computations by the parties' experts, that

finding implies interest of approximately $6.8 billion for Petersen

and $815 million for Eton Park, yielding a total judgment of

approximately $14.3 billion for Petersen and $1.7 billion for Eton

Park, or $16 billion in total.

Investors may find notable the Court's commentary on Burford's

role in the case:

The Court also rejects the Republic's effort to inject Burford

Capital into these proceedings. This remains a case brought by

plaintiffs against a defendant for its wrongful conduct towards

them, and the relevant question is what the Republic owes

Plaintiffs to compensate them for the loss of the use of their

money, not what Plaintiffs have done or will do with what they are

owed. The Republic owes no more or less because of Burford

Capital's involvement. Furthermore, the Republic pulled the

considerable levers available to it as a sovereign to attempt to

take what it should have paid for and has since spared no expense

in its defense. If Plaintiffs were required to trade a substantial

part of their potential recovery to secure the financing necessary

to bring their claims, in Petersen's case because it was driven to

bankruptcy, and litigate their claims to conclusion against a

powerful sovereign defendant that has behaved in this manner, this

is all the more reason to award Plaintiffs the full measure of

their damages.

Next steps

The Court has asked the parties to submit a proposed judgment

reflecting the Ruling, which Plaintiffs will endeavor to do

promptly. Once that judgment issues, Argentina has indicated its

intention to appeal.

There is also a process for seeking reconsideration from the

District Court of its own ruling, although such motions rarely

prevail as they are being made to the same judge who decided the

matter originally.

Once the Court issues its final judgment, that judgment will be

appealable as of right to the Second Circuit Court of Appeals.

The Second Circuit presently is taking around a year to resolve

appeals once filed, although there is meaningful deviation from

that mean. The District Court's judgment would be enforceable while

the appeal is pending unless Argentina posts a bond to secure its

performance, which we consider unlikely, or unless a court grants a

relatively unusual stay.

Following the Second Circuit's decision, either party can seek

review from the Supreme Court of the United States. The Supreme

Court accepts cases only on a discretionary basis and we believe

the likelihood of it accepting a commercial case of this nature

that does not present a contested issue of law is quite low,

particularly given that Argentina has already once in this Case

unsuccessfully sought Supreme Court review.

With an enforceable judgment in hand, Plaintiffs will either

need to negotiate a resolution of the matter with Argentina, which

would certainly result in what would likely be a substantial

discount to the judgment amount in exchange for agreed payment, or

engage in an enforcement campaign against Argentina which would

likely be of extended duration relying on Burford's and its

advisors' judgment enforcement expertise. Burford will not provide

publicly any information about its enforcement or settlement

strategies.

Burford's position

Burford has different economic arrangements in each of the

Petersen and Eton Park cases.

At bottom, on a net basis, we expect that the Burford balance

sheet will be entitled to around 35% of any proceeds generated in

the Petersen case and around 73% of any proceeds generated in the

Eton Park case.

In the Petersen case, Burford is entitled by virtue of a

financing agreement entered into with the Spanish insolvency

receiver of the Petersen bankruptcy estate to 70% of any recovery

obtained in the Petersen case. That 70% entitlement is not affected

by Burford's spending on the cases, which is for Burford's account;

it is a simple division of any proceeds. From that 70%, certain

entitlements to the law firms involved in the case and other case

expenses will need to be paid, reducing that number to around

58%.

Burford has, however, sold 38.75% of its entitlement in the

Petersen case to third party investors, reducing Burford's net

share of proceeds to around 35% (58% x 61.25%).

In the Eton Park case, there is both a funding agreement and a

monetization transaction. The net combined impact of those

transactions is that Burford would expect to receive around 73% of

any proceeds. Burford has not sold any of its Eton Park

entitlement.

In both Petersen and Eton Park, the numbers above are

approximations and will vary somewhat depending on the ultimate

level of case costs by the end of the Case, as we expect continued

significant spending on the Case.

For further information, please contact:

Burford Capital Limited

For investor and analyst inquiries:

Robert Bailhache, Head of Investor Relations, +44 (0)20 3530

EMEA and Asia - email 2023

Jim Ballan, Head of Investor Relations, Americas

- email +1 (646) 793 9176

For press inquiries:

David Helfenbein, Vice President, Public Relations

- email +1 (212) 235 6824

Numis Securities Limited - NOMAD and Joint +44 (0)20 7260

Broker 1000

Giles Rolls

Charlie Farquhar

+44 (0)20 7029

Jefferies International Limited - Joint Broker 8000

Graham Davidson

Tony White

+44 (0)20 3207

Berenberg - Joint Broker 7800

Toby Flaux

James Thompson

Arnav Kapoor

About Burford Capital

Burford Capital is the leading global finance and asset

management firm focused on law. Its businesses include litigation

finance and risk management, asset recovery and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the New York Stock Exchange (NYSE: BUR) and the London Stock

Exchange (LSE: BUR), and it works with companies and law firms

around the world from its offices in New York, London, Chicago,

Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

For more information, please visit www.burfordcapital.com .

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy any ordinary shares or other

securities of Burford.

This announcement does not constitute an offer of any Burford

private fund. Burford Capital Investment Management LLC, which acts

as the fund manager of all Burford private funds, is registered as

an investment adviser with the US Securities and Exchange

Commission. The information provided in this announcement is for

informational purposes only. Past performance is not indicative of

future results. The information contained in this announcement is

not, and should not be construed as, an offer to sell or the

solicitation of an offer to buy any securities (including, without

limitation, interests or shares in any of Burford private funds).

Any such offer or solicitation may be made only by means of a final

confidential private placement memorandum and other offering

documents.

Forward-looking statements

This announcement contains "forward-looking statements" within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, regarding assumptions, expectations, projections,

intentions and beliefs about future events. These statements are

intended as "forward-looking statements". In some cases,

predictive, future-tense or forward-looking words such as "aim",

"anticipate", "believe", "continue", "could", "estimate", "expect",

"forecast", "guidance", "intend", "may", "plan", "potential",

"predict", "projected", "should" or "will" or the negative of such

terms or other comparable terminology are intended to identify

forward-looking statements, but are not the exclusive means of

identifying such statements. In addition, Burford and its

representatives may from time to time make other oral or written

statements which are forward-looking statements, including in its

periodic reports that Burford files with, or furnishes to, the US

Securities and Exchange Commission, other information made

available to Burford's security holders and other written

materials. By their nature, forward-looking statements involve

known and unknown risks, uncertainties and other factors because

they relate to events and depend on circumstances that may or may

not occur in the future. Burford cautions you that forward-looking

statements are not guarantees of future performance and are based

on numerous assumptions , expectations, projections, intentions and

beliefs and that Burford's actual results of operations, including

its financial position and liquidity, and the development of the

industry in which it operates, may differ materially from (and be

more negative than) those made in, or suggested by, the

forward-looking statements contained in this announcement.

Significant factors that may cause actual results to differ from

those Burford expects include, among others, (i) uncertainty

relating to adverse litigation outcomes and the timing of

resolution of litigation matters and (ii) those discussed under

"Risk Factors" in Burford's annual report on Form 20-F for the year

ended December 31, 2022 filed with the US Securities and Exchange

Commission on May 16, 2023 and other reports or documents that

Burford files with, or furnishes to, the US Securities and Exchange

Commission from time to time. In addition, even if Burford's

results of operations, including its financial position and

liquidity, and the development of the industry in which it operates

are consistent with the forward-looking statements contained in

this announcement, those results of operations or developments may

not be indicative of results of operations or developments in

subsequent periods.

Except as required by law, Burford undertakes no obligation to

update or revise the forward-looking statements contained in this

announcement, whether as a result of new information, future events

or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRLMMFTMTMBMAJ

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

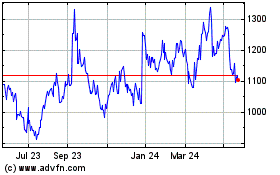

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

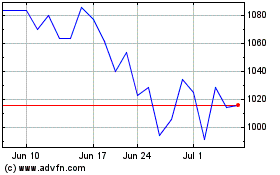

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025