TIDMBUR

RNS Number : 9668S

Burford Capital Limited

09 November 2023

November 9, 2023

BURFORD CAPITAL REPORTS NINE-MONTH AND THIRD QUARTER 2023 FINANCIAL

RESULTS;

NINE-MONTH CONSOLIDATED TOTAL REVENUES INCREASED FIVEFOLD TO

$794 MILLION

Burford Capital Limited ("Burford"), the leading global finance

and asset management firm focused on law, today announces its

unaudited financial results at and for the three and nine months

ended September 30, 2023 .(1) Burford's report on Form 6-K at

and for the three and nine months ended September 30, 2023,

including unaudited condensed consolidated financial statements

(the "3Q23 Quarterly Report"), is available at http://www.rns-pdf.londonstockexchange.com/rns/9668S_1-2023-11-9.pdf

and on the Burford Capital website at http://investors.burfordcapital.com

.

Christopher Bogart, Chief Executive Officer of Burford Capital,

commented:

"Consolidated total revenues increased fivefold to $794 million

in the first nine months of 2023 compared to the prior-year

period, driven by significant growth in capital provision income

with and without our YPF-related assets. Positive realizations'

momentum has continued, with Burford-only capital provision-direct

realizations up 42% in the first nine months of 2023 from the

prior-year period as portfolio activity has continued. Group-wide

total portfolio grew 16% in the first nine months of 2023 to

$7.1 billion, benefiting from significant fair value gains and

growth in deployments and undrawn commitments. In the first

nine months of 2023, we have grown book value 27% to $10.10

per ordinary share, the first time in our history we have surpassed

$10 per ordinary share."

Consolidated financial results

Summary statements of operations

============================================================================================

Nine months ended Three months ended

September 30, September 30,

Consolidated (US GAAP)

($ in thousands, except

per share data) 2023 2022 +/-% 2023 2022 +/-%

--------------------------------- ---------- --------- ----- -------- ---------- -----

Capital provision income 1,016,113 153,166 563% 504,513 (22,579) NM

--------------------------------- ---------- --------- ----- -------- ---------- -----

Asset management income 5,767 7,091 -19% 1,876 1,583 19%

--------------------------------- ---------- --------- ----- -------- ---------- -----

Total revenues 794,329 157,891 403% 368,873 (12,701) NM

--------------------------------- ---------- --------- ----- -------- ---------- -----

Net income/(loss) attributable

to Burford Capital Limited

shareholders 510,427 (51,408) NM 272,542 (58,336) NM

Per diluted ordinary

share 2.33 (0.23) NM 1.24 (0.27) NM

Note: "NM" denotes non meaningful.

Summary statements of financial position

============================================================================================

Consolidated (US GAAP) September December 31, $ change +/-%

($ in thousands, except 30, 2023 2022

per share data)

--------------------------------- --------------------- --------------- ---------- -----

Capital provision assets 4,894,648 3,735,556 1,159,092 31%

--------------------------------- --------------------- --------------- ---------- -----

Total Burford Capital

Limited equity 2,208,235 1,742,584 465,651 27%

Book value per ordinary

share 10.10 7.97 2.13 27%

-------------------------------- --------------------- --------------- ---------- -----

Non-controlling interests 828,877 644,486 184,391 29%

--------------------------------- --------------------- --------------- ---------- -----

Total shareholders'

equity 3,037,112 2,387,070 650,042 27%

--------------------------------- --------------------- --------------- ---------- -----

Total liabilities and

shareholders' equity 5,526,335 4,288,359 1,237,976 29%

(1) In this announcement, references to (1) "3Q23" and "3Q22"

are to Burford's unaudited financial results for the three months

ended September 30, 2023 and 2022, respectively, and (2) "9M23"and

"9M22" are to Burford's unaudited financial results for the

nine months ended September 30, 2023 and 2022, respectively.

All figures in this announcement are unaudited and presented

on a consolidated basis in accordance with the generally accepted

accounting principles in the United States ("US GAAP"), unless

otherwise stated. Definitions, reconciliations and information

additional to those set forth in this announcement are available

on the Burford Capital website and in the 3Q23 Quarterly Report

(as defined above). In addition, Burford applied its revised

valuation methodology for capital provision assets to its unaudited

condensed consolidated financial statements at September 30,

2023 and for the three and nine months ended September 30, 2023

and 2022 included in this announcement. However, because Burford

has not previously issued quarterly financial statements, the

unaudited condensed consolidated financial statements for the

three and nine months ended September 30, 2022 contained in

this announcement have not historically been presented and therefore

are not a restatement of previously issued unaudited condensed

consolidated financial statements.

Burford-only operational and financial review (non-GAAP)

Selected metrics(1)

=============================================================================================

Nine months ended Three months ended

September 30, September 30,

Burford-only (non-GAAP) 2023 2022 +/-% 2023 2022 +/-%

($ in thousands)

---------------------------- ---------- -------- ------ --- -------- ---------- ------

Realized gains relative

to cost 123,539 62,870 96% 29,145 36,269 -20%

---------------------------- ---------- -------- ------ --- -------- ---------- ------

Realizations 274,101 192,480 42% 79,158 122,278 -35%

---------------------------- ---------- -------- ------ --- -------- ---------- ------

Cash receipts(2) 379,732 229,472 65% 132,794 130,018 2%

---------------------------- ---------- -------- ------ --- -------- ---------- ------

Deployments 304,432 275,419 11% 55,986 153,289 -63%

---------------------------- ---------- -------- ------ --- -------- ---------- ------

New commitments 448,682 400,568 12% 17,648 105,342 -83%

---------------------------- ---------- -------- ------ --- -------- ---------- ------

(1) Represents Burford-only capital provision-direct, unless

noted otherwise.

---------------------------------------------------------------------------------------------

(2) Represents Burford-only proceeds from capital provision-direct,

capital provision-indirect and asset management and other services.

---------------------------------------------------------------------------------------------

Group-wide (non-GAAP) September 30, December 31, $ change +/-%

2023 2022

($ in thousands)

---------------------------- -------------------- --------------------- ---------- ------

Total portfolio 7,103,559 6,146,871 956,688 16%

-- Realized gains of $124 million in 9M23 nearly doubled from

the prior-year period (9M22: $63 million), with no contribution

from YPF-related assets

o Realized gains in 9M23 included a $37 million gain from

the resolution of an asset recovery matter

-- Realizations in 9M23 up 42% to $274 million (9M22: $192 million)

o Continued strength in realizations in 9M23 reflects increased

portfolio velocity, as the case backlog in the courts

continues to clear

-- Cash receipts in 9M23 up 65% to $380 million (9M22: $229 million)

o Cash receipts in 9M23 m eaningfully exceeded total operating

expenses and finance costs

-- Deployments in 9M23 up 11% to $304 million (9M22: $275 million)

o 50% of total Burford-only capital provision-direct deployments

in 9M23 related to the 2023 vintage year

-- New commitments in 9M23 up 12% to $449 million (9M22: $401

million)

-- Group-wide total portfolio increased 16% to $7.1 billion at

September 30, 2023 (December 31, 2022: $6.1 billion), due

to significant fair value gains and growth in deployments

and undrawn commitments

Selected financial metrics

===================================================================================

Nine months ended Three months ended

September 30, September 30,

Burford-only (non-GAAP)

($ in thousands, except

per share data) 2023 2022 +/-% 2023 2022 +/-%

--------------------------- -------- --------- ----- -------- --------- -----

Total revenues 725,927 107,432 576% 344,013 (14,223) NM

--------------------------- -------- --------- ----- -------- --------- -----

Operating income/(loss) 575,550 26,487 NM 291,212 (39,339) NM

--------------------------- -------- --------- ----- -------- --------- -----

Net income/(loss) 510,427 (51,408) NM 272,542 (58,336) NM

--------------------------- -------- --------- ----- -------- --------- -----

Burford-only (non-GAAP) September 30, December 31, $ change +/-%

($ in thousands, except 2023 2022

per share data)

--------------------------- ------------------- --------------- --------- -----

Tangible book value

attributable to Burford

Capital Limited 2,074,311 1,608,672 456,639 29%

Tangible book value

attributable to

Burford Capital

Limited per ordinary

share 9.48 7.36 2.12 29%

-- Total revenues in 9M23 of $726 million (9M22: $107 million),

a driver of significant earnings improvement

o Growth in realized and unrealized gains, excluding YPF-related

assets, from increased case resolutions and milestone developments

o Realized gains on total capital provision assets of $125

million in 9M23 nearly doubled compared to 9M22, with no

contribution from YPF-related assets

o Unrealized gains, excluding YPF-related assets, on total

capital provision assets increased 78% in 9M23 compared

to 9M22, showing portfolio activity

o Favorable summary judgment in 1Q23 and favorable final

judgment in 3Q23 in YPF-related assets generated $460 million

in unrealized gains in 9M23

-- Operating income in 9M23 of $576 million (9M22: $26 million),

reflecting growth in total revenues

o Operating expenses in 9M23 of $150 million (9M22: $81 million)

reflect strong portfolio performance and certain idiosyncratic

events-increase driven primarily by non-cash increase in

long-term incentive compensation including accruals from

unrealized gains on YPF-related assets and legacy asset

recovery incentive compensation including accruals

- Long-term incentive compensation is only paid once cash

recoveries are received

- Only one eligible asset recovery asset remains

o Salaries and benefits and general, administrative and other

expenses only slightly higher after certain noted items

in 9M23 compared to 9M22

o Legacy asset recovery incentive compensation including

accruals and case-related expenditures ineligible for inclusion

in asset cost continue to be idiosyncratic

-- Net income in 9M23 of $510 million (9M22: Net loss of $51

million)

o Net income per diluted share in 9M23 of $2.33 (9M22: Net

loss of $0.23 per diluted share)

-- Tangible book value attributable to Burford Capital Limited

of $2,074 million at September 30, 2023 (December 31, 2022:

$1,609 million)

o Tangible book value attributable to Burford Capital Limited

per ordinary share increased 29% (38% annualized) to $9.48

at September 30, 2023 (December 31, 2022: $7.36), primarily

reflecting strong earnings

-- Annualized Burford-only ROTE for 9M23 of 37%

Selected portfolio metrics

=================================================================================

Burford-only September December 31, $ change +/-%

($ in thousands) 30, 2023 2022

--------------------------------- ------------- ------------- --------- -----

Deployed cost 1,644,661 1,486,150 158,511 11%

--------------------------------- ------------- ------------- --------- -----

Plus: Fair value

adjustments 1,661,153 1,117,855 543,298 49%

================================= ============= ============= ========= =====

Fair value 3,305,814 2,604,005 701,809 27%

--------------------------------- ------------- ------------- --------- -----

Undrawn commitments 1,372,555 1,299,048 73,507 6%

================================= ============= ============= ========= =====

Total capital provision-direct

portfolio 4,678,369 3,903,053 775,316 20%

--------------------------------- ------------- ------------- --------- -----

Total capital provision

portfolio(1) 4,721,926(2) 3,942,700(3) 779,226 20%

--------------------------------- ------------- ------------- --------- -----

(1) Represents capital provision-direct and capital provision-indirect.

(2) The fair value of Burford-only capital provision-indirect

assets does not include $0.4 million of our interests in the

Strategic Value Fund. All assets held at the Strategic Value

Fund have concluded at September 30, 2023.

(3) The fair value of $31.4 million for the Burford-only capital

provision-indirect assets did not include an additional $1.0

million for the Burford-only portion of the receivable from

due from settlement of capital provision assets on concluded

assets in the Strategic Value Fund for a total fair value of

$32.4 million for Burford-only capital provision-indirect assets.

-- Fair value of Burford-only capital provision-direct assets

increased $702 million to $3.3 billion at September 30, 2023

(December 31, 2022: $2.6 billion)

-- Of the $702 million increase in capital provision-direct asset

fair value in 9M23, $463 million attributable to the YPF-related

assets

-- Cumulative ROIC since inception from Burford-only capital

provision-direct assets of 87% (December 31, 2022: 88%) and

IRR of 27% (December 31, 2022: 29%)

Liquidity and capital

=============================================================================

Burford-only (non-GAAP) September December 31, $ change +/-%

30, 2023 2022

($ in thousands)

---------------------------- ----------- -------------- ---------- ------

Liquidity

Cash and cash equivalents 240,028 73,679 166,349 226%

--------------------------- ----------- -------------- ---------- ------

Marketable securities 107,006 136,358 (29,352) -22%

=========================== =========== ============== ========== ======

Total liquidity 347,034 210,037 136,997 65%

--------------------------- ----------- -------------- ---------- ------

Due from settlement of

capital provision assets 69,530 114,650 45,120 -39%

-- Burford-only cash and cash equivalents and marketable securities

of $347 million at September 30, 2023 (December 31, 2022:

$210 million)

o Strong liquidity position at September 30, 2023 primarily

reflects continued solid Burford-only cash receipts and

issuance of $400 million in senior notes in June 2023,

partially offset by the redemption in full of the 6.125%

bonds due 2024 in July 2023

o Liquidity levels enable us to take advantage of new opportunities,

while recognizing the variability of cash inflows

-- Burford-only due from settlement of capital provision assets

of $70 million at September 30, 2023 (December 31, 2022: $115

million)

-- Total debt outstanding of $1.6 billion at September 30, 2023

(December 31, 2022: $1.3 billion)

o Leverage decreased in 9M23, primarily driven by asset

and equity growth and remains well below covenant ceiling

levels

o In June 2023, Moody's revised its outlook on its Ba2 rating

to positive from stable

o In October 2023, S&P revised its outlook on its BB- rating

to positive from stable

Investor and Analyst Conference Call

Burford will hold a conference call for investors and analysts

at 10.00am EST / 3.00pm GMT on Thursday, November 9, 2023. The

dial-in number for the conference call is +1 646 664-1960 (USA)

/ +44 (0)20 4587 0498 (UK) / +44 (0)20 3936 2999 (all other

locations) and the access code is 151405. To minimize the risk

of delayed access, participants are urged to dial into the conference

call by 9.40am EST / 2.40pm GMT .

A live webcast of the call will also be available at

https://www.investis-live.com/burfordcapital/65044c3f673c270c008a5d08/3q23-results

, and pre-registration at that link is encouraged.

An accompanying 3Q23 and 9M23 results presentation for investors

and analysts will also be made available on the Burford Capital

website prior to the conference call at http://investors.burfordcapital.com

.

Following the conference call, a replay facility for this event

will be available until Thursday, November 23, 2023 by dialing

+1 845 709-8569 (USA) / +44 (0)20 3936 3001 (UK) / +44 (0)20

3936 3001 (all other locations) and using the replay access

code 241638. A replay facility will also be accessible through

the webcast at https://www.investis-live.com/burfordcapital/65044c3f673c270c008a5d08/3q23-results

.

For further information, please contact:

Burford Capital Limited

For investor and analyst inquiries:

Robert Bailhache, Head of Investor Relations, +44 (0)20 3530

EMEA and Asia - email 2023

Jim Ballan, Head of Investor Relations, Americas

- email +1 (646) 793 9176

For press inquiries:

David Helfenbein, Vice President, Public Relations

- email +1 (212) 235 6824

+44 (0)20 7260

Deutsche Numis - NOMAD and Joint Broker 1000

Giles Rolls

Charlie Farquhar

+44 (0)20 7029

Jefferies International Limited - Joint Broker 8000

Graham Davidson

J ames Umbers

+44 (0)20 3207

Berenberg - Joint Broker 7800

Toby Flaux

James Thompson

Yasmina Benchekroun

About Burford Capital

Burford Capital is the leading global finance and asset management

firm focused on law. Its businesses include litigation finance

and risk management , asset recovery and a wide range of legal

finance and advisory activities. Burford is publicly traded

on the New York Stock Exchange (NYSE: BUR) and the London Stock

Exchange (LSE: BUR), and it works with companies and law firms

around the world from its offices in New York, London, Chicago,

Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

For more information, please visit www.burfordcapital.com.

Summary Financial Statements and Reconciliations

The tables below set forth summaries of the condensed consolidated

and Burford-only statements of operations for the three and

nine months ended September 30, 2023 and 2022, the condensed

consolidated and Burford-only statements of financial position

at September 30, 2023 and December 31, 2022 and corresponding

reconciliations from consolidated to Burford-only financial

results . Furthermore, the tables below set forth certain additional

reconciliations for financial information contained in this

announcement.

Summary condensed consolidated statements of operations

Three months ended Nine months ended

September 30, September 30,

($ in thousands) 2023 2022 2023 2022

=================================== =========== ========== =========== ==========

Revenues

Capital provision income/(loss) 504,513 (22,579) 1,016,113 153,166

(Less)/Plus: Third-party

interests in capital

provision assets (140,412) 11,910 (235,944) 12,128

Asset management income 1,876 1,583 5,767 7,091

Services and other income/(loss) 2,896 (3,615) 8,393 (14,494)

Total revenues 368,873 (12,701) 794,329 157,891

Total operating expenses 53,068 25,319 150,999 82,146

Operating income/(loss) 315,805 (38,020) 643,330 75,745

Finance costs and loss

on debt extinguishment 29,013 20,335 70,690 57,812

Foreign currency transactions

(gains)/losses (9,811) 6,328 (21,149) 9,386

Income/(loss) before income

taxes 296,603 (64,683) 593,789 8,547

Benefit from/(provision

for) income taxes 531 7,562 (15,550) (10,804)

Net income/(loss) 297,134 (57,121) 578,239 (2,257)

=========== ========== =========== ==========

Net income/(loss) attributable

to Burford Capital Limited

shareholders 272,542 (58,336) 510,427 (51,408)

=========== ========== =========== ==========

Net income/(loss) attributable

to Burford Capital Limited

shareholders per ordinary

share

Basic $1.24 $(0.27) $2.33 $(0.23)

Diluted $1.22 $(0.27) $2.29 $(0.23)

Summary Burford-only statement of operations

Three months ended Nine months ended

September 30, September 30,

($ in thousands) 2023 2022 2023 2022

============================ ========= ========== ========= =========

Revenues

Capital provision income 324,995 (15,335) 676,402 80,442

Asset management income 16,141 4,559 41,182 41,322

Services and other income 2,877 (3,447) 8,343 (14,332)

Total revenues 344,013 (14,223) 725,927 107,432

Operating income 291,212 (39,339) 575,550 26,487

Net income 272,542 (58,336) 510,427 (51,408)

Net income per share:

Basic $1.24 $(0.27) $2.33 $(0.23)

Diluted $1.22 $(0.27) $2.29 $(0.23)

Reconciliation of summary condensed consolidated statement of

operations to summary Burford-only statement of operations

Three months ended September 30, 2023

----------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------------------------------------------------------------

Elimination of third-party interests

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

====================== ============= ========== ========== =========== ========== ======= ===============

Capital provision

income 504,513 (845) (36,193) (140,690) (8,368) 6,578 324,995

(Less): Third-party

interests in

capital provision

assets (140,412) - - 140,699 - (287) -

Asset management

income 1,876 16 14,249 - - - 16,141

Services and

other income/(loss) 2,896 (1) (3) - - (15) 2,877

Total revenues 368,873 (830) (21,947) 9 (8,368) 6,276 344,013

Operating income 315,804 (193) (22,020) - (8,292) 5,912 291,212

Net income/(loss) 297,133 (193) (22,020) - (8,292) 5,913 272,542

Three months ended September 30, 2022

----------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

---------------------- ------------- ---------- ---------- ----------- ---------- ------- -------------

Capital provision

income (22,579) 6,138 (11,090) 12,070 95 31 (15,335)

Plus: Third-party

interests in

capital provision

assets 11,910 - - (12,060) - 150 -

Asset management

income 1,583 48 2,928 - - - 4,559

Services and

other (loss)/income (3,615) 183 - - - (15) (3,447)

Total revenues (12,701) 6,369 (8,162) 10 95 166 (14,223)

Operating income (38,020) 6,479 (8,209) - 207 204 (39,339)

Net income/(loss) (57,121) 6,479 (8,208) - 207 307 (58,336)

Nine months ended September 30, 2023

-------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

----------------------------------------------------------------------

Elimination of third-party interests

-------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

--------------------- ------------- ---------- --------- ----------- ---------- ------- -------------

Capital provision

income 1,016,113 (1,052) (84,429) (235,731) (20,373) 1,874 676,402

(Less): Third-party

interests in

capital provision

assets (235,944) - - 235,710 - 234 -

Asset management

income 5,767 108 35,307 - - - 41,182

Services and

other income 8,393 (1) (5) - - (44) 8,343

Total revenues 794,329 (945) (49,127) (21) (20,373) 2,064 725,927

Operating income 643,329 (12) (49,417) - (20,094) 1,743 575,550

Net income/(loss) 578,238 (12) (49,417) - (20,094) 1,711 510,427

Nine months ended September 30, 2022

--------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-----------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

-------------------- ------------- ---------- --------- ---------- ---------- --------- -------------

Capital provision

income 153,166 3,861 (85,265) 12,568 (223) (3,665) 80,442

Plus: Third-party

interests in

capital provision

assets 12,128 - - (12,570) - 442 -

Asset management

income 7,091 266 33,965 - - - 41,322

Services and

other income (14,494) 183 - - - (21) (14,332)

Total revenues 157,891 4,310 (51,300) (2) (223) (3,244) 107,432

Operating income 75,745 5,122 (51,409) - 130 (3,101) 26,487

Net income/(loss) (2,257) 5,122 (51,408) - 130 (2,995) (51,408)

Reconciliation of capital provision income excluding YPF-related

assets

($ in thousands) Three months ended Nine months ended

September 30, 2023 September 30, 2023

------------------------------------------------------- ------------------- -------------------

Capital provision income 504,513 1,016,113

Less: Capital provision income from YPF-related assets (417,920) (695,238)

-------------------------------------------------------- ------------------- -------------------

Capital provision income excluding YPF-related assets 86,593 320,875

======================================================== =================== ===================

Summary condensed consolidated statement of financial

position

At

($ in thousands) September 30, 2023 December 31, 2022

======================================================================== =================== ==================

Total assets 5,526,335 4,288,359

Total liabilities 2,489,223 1,901,289

Total Burford Capital Limited equity 2,208,235 1,742,584

Non-controlling interests 828,877 644,486

Total shareholders' equity 3,037,112 2,387,070

Basic ordinary shares outstanding 218,698,930 218,581,877

Total shareholders' equity attributable to Burford Capital Limited per

basic ordinary share $10.10 $7.97

Total shareholders' equity per basic ordinary share $13.89 $10.92

Reconciliation of summary condensed consolidated statement

of financial position to summary Burford-only statement of

financial position

At September 30, 2023

--------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-----------------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------------------

Strategic Advantage

($ in thousands) Consolidated Value Fund BOF-C Colorado Fund Other Burford-only

------------------ ------------- -------------- ----------- ----------- -------------- ---------- -------------

Total assets 5,526,335 (260) (581,980) (644,955) (189,490) (73,984) 4,035,666

Total liabilities 2,489,223 (199) - (644,955) (60) (16,578) 1,827,431

Total

shareholders'

equity 3,037,112 (61) (581,980) - (189,430) (57,406) 2,208,235

At December 31, 2022

--------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-----------------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------------------

Strategic Value

($ in thousands) Consolidated Fund BOF-C Colorado Advantage Fund Other Burford-only

------------------ ------------- ---------------- ---------- ---------- --------------- --------- -------------

Total assets 4,288,359 (2,779) (477,590) (409,249) (103,523) (76,792) 3,218,426

Total liabilities 1,901,289 (228) (4,234) (409,249) (120) (11,616) 1,475,842

Total

shareholders'

equity 2,387,070 (2,551) (473,356) - (103,403) (65,176) 1,742,584

Reconciliation of components of realizations from a consolidated

basis to a Group-wide basis

Three months ended September 30, 2023

---------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- ------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- -------- -------- -----------

Capital provision-direct 89,162 (10,004) 79,158 16,539 12,243 107,940

Capital provision-indirect 19,575 (6,228) 13,347 6,228 - 19,575

Post-settlement - - - 20,050 - 20,050

Total realizations 108,737 (16,232) 92,505 42,817 12,243 147,565

============= ================= ============== ======== ======== ===========

Three months ended September 30, 2022

---------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- ------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- -------- -------- -----------

Capital provision-direct 160,224 (37,946) 122,278 78,455 37,224 237,957

Capital provision-indirect 8,345 (4,758) 3,587 7,847 - 11,434

Post-settlement - - - 12,146 - 12,146

Total realizations 168,569 (42,704) 125,865 98,448 37,224 261,537

============= ================= ============== ======== ======== ===========

Nine months ended September 30, 2023

----------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- -------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- --------- -------- -----------

Capital provision-direct 335,414 (61,313) 274,101 89,915 64,994 429,010

Capital provision-indirect 59,219 (39,317) 19,902 39,002 - 58,904

Post-settlement - - - 118,307 - 118,307

Total realizations 394,633 (100,630) 294,003 247,224 64,994 606,221

============= ================= ============== ========= ======== ===========

Nine months ended September 30, 2022

----------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- -------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- --------- -------- -----------

Capital provision-direct 236,204 (43,724) 192,480 102,836 49,543 344,859

Capital provision-indirect 20,811 (11,125) 9,686 25,749 - 35,435

Post-settlement - - - 50,449 - 50,449

Total realizations 257,015 (54,849) 202,166 179,034 49,543 430,743

============= ================= ============== ========= ======== ===========

Reconciliation of components of deployments from a consolidated

basis to a Group-wide basis

Three months ended September 30, 2023

---------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- ------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- -------- -------- -----------

Capital provision-direct 69,690 (13,704) 55,986 4,379 21,819 82,184

Capital provision-indirect 32,257 (26,881) 5,376 26,881 - 32,257

Post-settlement - - - 7,466 - 7,466

Total deployments 101,947 (40,585) 61,362 38,726 21,819 121,907

============= ================= ============== ======== ======== ===========

Three months ended September 30, 2022

---------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- ------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- -------- -------- -----------

Capital provision-direct 197,916 (44,627) 153,289 6,277 45,155 204,721

Capital provision-indirect 9,653 (7,923) 1,730 8,422 - 10,152

Post-settlement - - - 7,419 - 7,419

Total deployments 207,569 (52,550) 155,019 22,118 45,155 222,292

============= ================= ============== ======== ======== ===========

Nine months ended September 30, 2023

----------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- -------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- --------- -------- -----------

Capital provision-direct 401,215 (96,783) 304,432 17,362 97,775 419,569

Capital provision-indirect 145,051 (120,876) 24,175 120,876 - 145,051

Post-settlement - - - 43,272 - 43,272

Total deployments 546,266 (217,659) 328,607 181,510 97,775 607,892

============= ================= ============== ========= ======== ===========

Nine months ended September 30, 2022

----------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

------------- -------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

---------------------------- ------------- ----------------- -------------- -------- --------- -----------

Capital provision-direct 381,482 (106,063) 275,419 20,944 105,459 401,822

Capital provision-indirect 29,829 (24,699) 5,130 25,198 - 30,328

Post-settlement - - - 50,571 - 50,571

Total deployments 411,311 (130,762) 280,549 96,713 105,459 482,721

============= ================= ============== ======== ========= ===========

Reconciliation of consolidated proceeds from capital provision

assets to Burford-only cash receipts

Nine months Nine months

ended September ended September

($ in thousands) 30, 2023 30, 2022

---------------------------------------- ----------------- -----------------

Consolidated proceeds from capital

provision assets 440,154 282,322

Less: Elimination of third-party

interests (94,587) (70,137)

Burford-only total proceeds from

capital provision assets 345,567 212,185

----------------------------------------- ----------------- -----------------

Burford-only proceeds from capital

provision-direct assets 319,236 202,499

Burford-only proceeds from capital

provision-indirect assets 26,331 9,686

Burford-only total proceeds from

capital provision assets 345,567 212,185

----------------------------------------- ----------------- -----------------

Consolidated asset management

income 5,767 7,091

Plus: Eliminated income from funds 35,415 34,231

Burford-only asset management

income 41,182 41,322

Less: Non-cash adjustments(1) (12,137) (29,527)

Burford-only proceeds from asset

management income 29,045 11,795

Burford-only proceeds from marketable

security interest and dividends 3,625 1,845

Burford-only proceeds from asset

recovery fee for services (38) 629

Burford-only proceeds from insurance

receipts 1,533 3,018

Burford-only proceeds from asset

management and other services 34,165 17,287

----------------------------------------- ----------------- -----------------

Cash receipts 379,732 229,472

========================================= ================= =================

(1) Adjustments for the change in asset management receivables

accrued during the applicable period but not yet received at the

end of such period.

Reconciliation of consolidated portfolio to Group-wide

portfolio

($ in thousands) At September 30, 2023 At December 31, 2022

============================================== ===================== ==============================

Consolidated fair value 4,894,648 3,735,556

Consolidated undrawn commitments 1,811,824 1,720,727

---------------------------------------------- --------------------- ------------------------------

Eliminations of third-party interests:

Less: Attributable to fair value (1,550,901) (1,100,137)

Less: Attributable to undrawn commitments (433,645) (413,446)

Burford-only fair value 3,343,747 2,635,419

Burford-only undrawn commitments 1,378,179 1,307,281

---------------------------------------------- --------------------- ------------------------------

Burford-only portfolio 4,721,926 3,942,700

---------------------------------------------- --------------------- ------------------------------

Other funds fair value 1,135,257 1,076,320

Other funds undrawn commitments 203,004 239,145

---------------------------------------------- --------------------- ------------------------------

Other funds portfolio 1,338,261 1,315,465

---------------------------------------------- --------------------- ------------------------------

BOF-C fair value 638,432 516,982

BOF-C undrawn commitments 404,940 371,724

---------------------------------------------- --------------------- ------------------------------

BOF-C portfolio 1,043,372 888,706

---------------------------------------------- --------------------- ------------------------------

Total group-wide portfolio 7,103,559 6,146,871

============================================== ===================== ==============================

Reconciliation of consolidated to Burford-only cash and cash

equivalents and marketable securities

At September 30, 2023 At December 31, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Elimination of Elimination of

third-party third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Cash and cash

equivalents 255,568 (15,540) 240,028 107,658 (33,979) 73,679

Marketable

securities 107,006 - 107,006 136,358 - 136,358

Total cash and

cash equivalents

and marketable

securities 362,574 (15,540) 347,034 244,016 (33,979) 210,037

Reconciliation of consolidated to Burford-only capital provision

assets

At September 30, 2023 At December 31, 2022

---------------------------------------------- ----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

------------------------------- -------------------------------

Elimination Elimination

of third-party of third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------- ------------- ---------------- ------------- ------------- ---------------- -------------

YPF-related

assets 1,931,013 (645,245) 1,285,768 1,232,549 (409,514) 823,035

Other assets 2,963,635 (905,225) 2,058,410 2,503,007 (689,602) 1,813,405

Capital provision

assets 4,894,648 (1,550,470) 3,344,178 3,735,556 (1,099,116) 2,636,440

Reconciliation of consolidated to Burford-only due from

settlement of capital provision assets

At September 30, 2023 At December 31, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Elimination of Elimination of

third-party third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Due from

settlement of

capital

provision assets 71,284 (1,754) 69,530 116,582 (1,932) 114,650

Reconciliation of consolidated to Burford-only realized gains on

capital provision-direct assets

Three months ended September 30, 2023 Three months ended September 30, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Eliminations and Eliminations and

($ in thousands) Consolidated adjustments Burford-only Consolidated adjustments Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Realized gains

relative to cost 37,566 (7,440) 30,126 51,769 (15,288) 36,481

Nine months ended September Nine months ended September

30, 2023 30, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Eliminations Eliminations

($ in thousands) Consolidated and adjustments Burford-only Consolidated and adjustments Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Realized gains

relative to

cost 171,331 (46,811) 124,520 85,809 (21,853) 63,956

Reconciliation of shareholders' equity attributable to Burford

Capital Limited per ordinary share

($ in thousands, except share data) At September 30, 2023 At December 31, 2022

==================================================================== ===================== ====================

Total shareholders' equity 3,037,112 2,387,070

Less: Non-controlling interests (828,877) (644,486)

--------------------------------------------------------------------- --------------------- --------------------

Total Burford Capital Limited equity 2,208,235 1,742,584

--------------------------------------------------------------------- --------------------- --------------------

Basic ordinary shares outstanding 218,698,930 218,581,877

--------------------------------------------------------------------- --------------------- --------------------

Shareholders' equity attributable to Burford Capital Limited per

ordinary share $10.10 $7.97

--------------------------------------------------------------------- --------------------- --------------------

Reconciliation of tangible book value attributable to Burford

Capital Limited per ordinary share

($ in thousands, except share data) At September 30, 2023 At December 31, 2022

==================================================================== ===================== ====================

Total Burford Capital Limited equity 2,208,235 1,742,584

Less: Goodwill ( 133 ,924) (133,912)

--------------------------------------------------------------------- --------------------- --------------------

Tangible book value attributable to Burford Capital Limited 2,074,311 1,608,672

--------------------------------------------------------------------- --------------------- --------------------

Basic ordinary shares outstanding 218,698,930 218,581,877

--------------------------------------------------------------------- --------------------- --------------------

Tangible book value attributable to Burford Capital Limited per

ordinary share $9.48 $7.36

--------------------------------------------------------------------- --------------------- --------------------

Definitions and Use of Non-GAAP Financial Measures and Alternative

Performance Measures

Burford reports its financial results in accordance with US

GAAP. US GAAP requires us to present financial statements that

consolidate some of the limited partner interests in private

funds we manage as well as assets held on our balance sheet

where we have a partner or minority investor. We therefore refer

to various presentations of our financial results as follows:

-- Consolidated refers to assets, liabilities and activities

that include those third-party interests, partially owned

subsidiaries and special purpose vehicles that we are required

to consolidate under US GAAP. At the date of this announcement,

the major entities where there is also a third-party partner

in, or owner of, those entities include BCIM Strategic Value

Master Fund, LP, Burford Opportunity Fund C LP, Burford

Advantage Master Fund LP, Colorado Investments Limited ("Colorado")

and several other entities in which Burford holds investments

where there is also a third-party partner in, or owner of,

those entities.

-- Burford-only refers to assets, liabilities and activities

that pertain only to Burford on a proprietary basis, excluding

any third-party interests and the portions of jointly owned

entities owned by others.

-- Group-wide refers to the totality of assets managed by

Burford, including those portions of the private funds owned

by third parties and including private funds that are not

consolidated within Burford's consolidated financial statements.

Group-wide is therefore the sum of Burford-only and non-controlling

interests in consolidated and non-consolidated private funds.

Group-wide does not include third-party interests in capital

provision assets, the economics of which have been sold

to those third parties, that do not meet the criteria to

be recognized as a sale under US GAAP. This includes the

third-party interests in Colorado and other capital provision

asset subparticipations.

We subdivide our capital provision assets into two

categories:

-- Direct , which includes all of our capital provision assets

that we have originated directly (i.e., not through participation

in a private fund) from our balance sheet. We also include

direct (i.e., not through participation in a private fund)

complex strategies assets in this category.

-- Indirect , which includes our balance sheet's participations

in two of our private funds (i.e., BCIM Strategic Value

Master Fund, LP and Burford Advantage Master Fund LP) .

We also use certain unaudited alternative performance measures,

including:

-- Internal rate of return ("IRR") is a discount rate that

makes the net present value of a series of cash flows equal

to zero and is expressed as a percentage figure. We compute

IRR on concluded (including partially concluded) legal finance

assets by treating that entire portfolio (or, when noted,

a subset thereof) as one undifferentiated pool of capital

and measuring actual and, if necessary, estimated inflows

and outflows from that pool, allocating costs appropriately.

IRRs do not include unrealized gains or losses.

-- Return on invested capital ("ROIC") from a concluded asset

is the absolute amount of realizations from such asset in

excess of the amount of expenditure incurred in funding

such asset divided by the amount of expenditure incurred,

expressed as a percentage figure. ROIC is a measure of our

ability to generate absolute returns on our assets. Some

industry participants express returns on a multiple of invested

capital ("MOIC") instead of a ROIC basis. MOIC includes

the return of capital and, therefore, is 1x higher than

ROIC. In other words, 70% ROIC is the same as 1.70x MOIC.

Other unaudited alternative performance measures and terms we

use include:

-- Commitment is the amount of financing we agree to provide

for a legal finance asset. Commitments can be definitive

(requiring us to provide funding on a schedule or, more

often, when certain expenses are incurred) or discretionary

(allowing us to provide funding after reviewing and approving

a future matter). Unless otherwise indicated, commitments

include deployed cost and undrawn commitments.

-- Deployment refers to the funding provided for an asset,

which adds to our deployed cost in such asset.

-- Deployed cost is the amount of funding we have provided

for an asset at the applicable point in time.

-- Fair value adjustment is the amount of unrealized gain

or loss recognized in our consolidated statements of operations

in the relevant period and added to or subtracted from,

as applicable, the asset or liability value in our consolidated

statements of financial position.

-- Portfolio includes deployed cost, net unrealized gains

or losses and undrawn commitments.

-- Realization: A legal finance asset is realized when the

asset is concluded (i.e., when litigation risk has been

resolved). A realization will result in us receiving cash

or, occasionally, non-cash assets or recognizing a due from

settlement receivable, reflecting what we are owed on the

asset.

-- Realized gain / loss reflects the total amount of gain

or loss generated by a legal finance asset when it is realized,

calculated as realized proceeds less deployed cost, without

regard for any previously recognized fair value adjustment.

-- Unrealized gain / loss represents the fair value of our

legal finance assets over or under their funded cost, as

determined in accordance with the requirements of the applicable

US GAAP standards, for the relevant financial reporting

period (consolidated statement of operations) or cumulatively

(consolidated statement of financial position).

-- YPF-related assets refers to our Petersen and Eton Park

legal finance assets, which are two claims relating to Republic

of Argentina's nationalization of YPF S.A., the Argentine

energy company.

We also use certain non-GAAP financial measures, including:

-- Book value per ordinary share is calculated by dividing

total Burford Capital Limited equity by the number of ordinary

shares issued and outstanding.

-- Cash receipts provide a measure of the cash that our capital

provision and other assets generate during a given period

as well as cash from certain other fees and income. In particular,

cash receipts represent the cash generated from capital

provision and other assets, including cash proceeds from

realized or concluded assets and any related hedging assets,

and cash received from asset management income, services

and/or other income, before any deployments into funding

existing or new assets. Cash receipts are a non-GAAP financial

measure and should not be considered in isolation from,

as a substitute for, or superior to, financial measures

calculated in accordance with US GAAP. The most directly

comparable measure calculated in accordance with US GAAP

is proceeds from capital provision assets as set forth in

our consolidated statements of cash flows. We believe that

cash receipts are an important measure of our operating

and financial performance and are useful to management and

investors when assessing the performance of our Burford-only

capital provision assets.

-- Return on tangible equity ("ROTE") is Burford-only net

income/(loss) divided by the average of tangible equity

at the beginning and end of the relevant period, with tangible

equity calculated as total Burford Capital Limited equity

less goodwill. ROTE is a non-GAAP financial measure and

should not be considered in isolation from, as a substitute

for, or superior to, financial measures calculated in accordance

with US GAAP. The most directly comparable measure calculated

in accordance with US GAAP is net income/(loss) attributable

to Burford Capital Limited shareholders as set forth in

our consolidated statements of operations. We believe ROTE

is an important measure of our operating and financial performance

and is useful to management and investors when assessing

the performance of our Burford-only capital provision assets.

-- Tangible book value attributable to Burford Capital Limited

is calculated by subtracting intangible assets (such as

goodwill) from total Burford Capital Limited equity . T

angible book value attributable to Burford Capital Limited

per ordinary share is calculated by dividing tangible book

value attributable to Burford Capital Limited by the total

number of outstanding ordinary shares . Each of tangible

book value attributable to Burford Capital Limited and tangible

book value attributable to Burford Capital Limited per ordinary

share is a non-GAAP financial measure and should not be

considered in isolation from, as a substitute for, or superior

to, financial measures calculated in accordance with US

GAAP. The most directly comparable measure calculated in

accordance with US GAAP is total Burford Capital Limited

equity as set forth in our consolidated statements of financial

position. We believe that tangible book value attributable

to Burford Capital Limited per ordinary share is an important

measure of our financial condition and is useful to management

and investors when assessing capital adequacy and our ability

to generate earnings on tangible equity invested by our

shareholders.

For additional information, including reconciliations of our

non-GAAP financial measures to the most directly comparable

US GAAP measures and reconciliations of our alternative performance

measures additional to those set forth in this announcement,

see the 3Q23 Quarterly Report furnished to the US Securities

and Exchange Commission on November 9, 2023 and made available

on our website at http://investors.burfordcapital.com . Non-GAAP

financial measures should not be considered in isolation from,

as substitutes for, or superior to, financial measures calculated

in accordance with US GAAP.

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy any ordinary shares or other

securities of Burford.

This announcement does not constitute an offer of any Burford

private fund. Burford Capital Investment Management LLC, which

acts as the fund manager of all Burford private funds, is registered

as an investment adviser with the US Securities and Exchange

Commission. The information provided in this announcement is

for informational purposes only. Past performance is not indicative

of future results. The information contained in this announcement

is not, and should not be construed as, an offer to sell or

the solicitation of an offer to buy any securities (including,

without limitation, interests or shares in any of Burford private

funds). Any such offer or solicitation may be made only by means

of a final confidential private placement memorandum and other

offering documents.

Forward-looking statements

This announcement contains "forward-looking statements" within

the meaning of Section 21E of the US Securities Exchange Act

of 1934, as amended, regarding assumptions, expectations, projections,

intentions and beliefs about future events. These statements

are intended as "forward-looking statements". In some cases,

predictive, future-tense or forward-looking words such as "aim",

"anticipate", "believe", "continue", "could", "estimate", "expect",

"forecast", "guidance", "intend", "may", "plan", "potential",

"predict", "projected", "should" or "will" or the negative of

such terms or other comparable terminology are intended to identify

forward-looking statements, but are not the exclusive means

of identifying such statements. In addition, Burford and its

representatives may from time to time make other oral or written

statements that are forward-looking, including in its periodic

reports that Burford files with, or furnishes to, the US Securities

and Exchange Commission, other information made available to

Burford's security holders and other written materials. By their

nature, forward-looking statements involve known and unknown

risks, uncertainties and other factors because they relate to

events and depend on circumstances that may or may not occur

in the future. Burford cautions that forward-looking statements

are not guarantees of future performance and are based on numerous

assumptions, expectations, projections, intentions and beliefs

and that Burford's actual results of operations, including its

financial position and liquidity, and the development of the

industry in which it operates, may differ materially from (and

be more negative than) those made in, or suggested by, the forward-looking

statements contained in this announcement. Significant factors

that may cause actual results to differ from those Burford expects

include, among others, those discussed under "Risk Factors"

in Burford's annual report on Form 20-F for the year ended December

31, 2022 filed with the US Securities and Exchange Commission

on May 16, 2023 and other reports or documents that Burford

files with, or furnishes to, the US Securities and Exchange

Commission from time to time. In addition, even if Burford's

results of operations, including its financial position and

liquidity, and the development of the industry in which it operates

are consistent with the forward-looking statements contained

in this announcement, those results of operations or developments

may not be indicative of results of operations or developments

in subsequent periods.

Except as required by law, Burford undertakes no obligation

to update or revise the forward-looking statements contained

in this announcement, whether as a result of new information,

future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTBLBMTMTIMBLJ

(END) Dow Jones Newswires

November 09, 2023 07:00 ET (12:00 GMT)

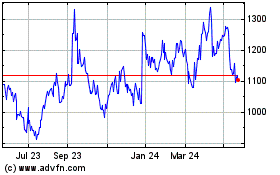

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

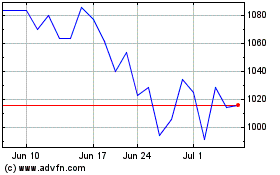

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024