Empire Metals Limited Saudi Strategic Investor Led Placing to Raise GBP3m (3719A)

22 January 2024 - 6:00PM

UK Regulatory

TIDMEEE

RNS Number : 3719A

Empire Metals Limited

22 January 2024

Empire Metals Limited / LON : EEE / Sector: Natural

Resources

22 January 2024

Empire Metals Limited

('Empire ' or the 'Company')

Saudi Strategic Investor Led Placing to Raise GBP3 million to

Advance Development of Pitfield Titanium Project

E mpire Metals Limited (LON: EEE), the AIM-quoted resource

exploration and development company, is pleased to announce that is

has raised GBP3 million before expenses by way of a placing of

27,272,728 new ordinary shares of no par value in the capital of

the Company at 11p (the 'Placing Shares') to a strategic investor

in Saudi Arabia and existing shareholders (the 'Placing').

Shaun Bunn, Managing Director, said: "We are extremely pleased

to welcome TransOceanic Minerals, a group focused on investments in

the natural resource sector as a shareholder of the Company. The

principal, Mr Fahad Al-Tamimi has also led some of the largest

engineering and construction projects in the natural resource

sector in Saudi Arabia. This is an important milestone for the

Company as this strategic partnership not only recognises the

global significance of our Pitfield project but with the on-going

support of TransOceanic Minerals and potential future partnerships

in Saudi Arabia, the Company will have the capacity to expand

project development and accelerate value creation for all

shareholders. We also thank our existing shareholders for their

continued support as we now add to our on-going exploration efforts

a significant work stream of mineralogical studies and

metallurgical test work and design which will move the project the

next critical step towards mine development."

The net proceeds of the Placing will be primarily used to allow

the Company to continue to expand the Reverse Circulation ('RC')

drilling and to undertake additional Diamond Core drilling for

petrology, mineralogical and metallurgical studies. These

programmes will be in addition to the current RC drill programme,

the final results from the first phase being announced shortly with

the second, already funded, phase expected to commence in February.

The new funds will also be used to expand mineralogical and

metallurgical studies and process design work that will focus on

the beneficiation and recovery of a high-value TiO(2) product with

a view to moving to the design phase for a test plant in 2025.

Application for Admission and Total Voting Rights

The Placing Shares will rank pari passu in all respects with the

existing ordinary shares of no par value in the capital of the

Company. Application has been made to the London Stock Exchange for

the Placing Shares to be admitted to trading on AIM ('Admission').

It is expected that Admission will become effective on or around 26

January 2024. As a result of the issue of the Placing Shares as

described above, the issued share capital of the Company now

consists of 598,850,524 ordinary shares of no-par value.

Warrants

The Company has agreed to issue warrants over a total of 224,886

ordinary shares in the Company exercisable at 11p per share for a

period of two years from date of grant in relation to the

Placing.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, as incorporated into UK law by the

European Union (Withdrawal) Act 2018, until the release of this

announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

Empire Metals Ltd

Shaun Bunn / Greg Kuenzel Tel: 020 4583 1440

S. P. Angel Corporate Finance LLP Tel: 020 3470 0470

(Nomad & Broker)

Ewan Leggat / Adam Cowl / Kasia

Brzozowska

---------------------

Shard Capital Partners LLP (Joint Tel: 020 7186 9950

Broker)

Damon Heath

---------------------

St Brides Partners Ltd (Financial Tel: 020 7236 1177

PR)

Susie Geliher / Ana Ribeiro

---------------------

About Empire Metals Limited

Empire Metals is an AIM-listed (LON: EEE) exploration and

resource development company with a project portfolio comprising

copper, titanium and gold interests in Australia and Austria.

The Company's strategy is to develop a pipeline of projects at

different stages in the development curve. Its current focus is on

the Pitfield Project in Western Australia, which has demonstrated

to contain a newly recognised giant mineral system that hosts a

globally significant titanium discovery. The Company is also

advancing the Eclipse-Gindalbie Project in Western Australia, which

is prospective for high-grade gold and also kaolin used to produce

high-purity alumina, an essential component in lithium-ion

batteries.

Company also has two further exploration projects in Australia;

the Walton Project in Western Australia, and the Stavely Project in

the Stavely Arc region of Victoria, in addition to three precious

metals projects located in a historically high-grade gold producing

region of Austria.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBIGDBGGDDGSB

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

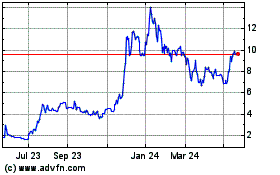

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

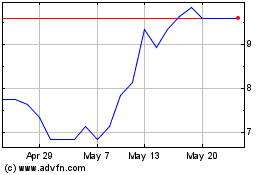

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025