TIDMHEV

Helium Ventures plc

("Helium Ventures" or the "Company")

Final Results for the year ended 30 April 2023

Helium Ventures (AQSE: HEV), a London based investment company, announces its

audited final results for the year ended 30 April 2023.

CHAIRMAN'S STATEMENT

I am pleased to present the Chairman's statement for the Company, covering the

twelve months to 30 April 2023. The Company was incorporated in 2021 as a

Special Purpose Acquisition Company with the aim of investing in low carbon,

pure play, helium projects internationally. Following admission on the AQSE

Growth Market, a secondary listing on the US OTC market was achieved in order to

make the Company's shares more accessible to a wider audience.

Whilst the Board reviewed a wide range of helium projects globally, we were

unable to secure a project which met our investment criteria and which we could

complete within our target timeframe. An opportunity arose to acquire Vestigo

Technologies Ltd ("Trackimo"), which owns and distributes its advanced tracking

software product, Trackimo and associated hardware and intellectual property,

providing utilisation of our capital at a premium to our share price and

exposure to a high growth business with significant existing revenues and strong

partnerships with tier one global technology businesses. On 7 October 2022, the

Company announced the conditional acquisition of Trackimo, to be satisfied by

the issue of Helium Ventures shares.

On 21 September 2023, the Company raised net proceeds of £250,000 through the

issue of 6,250,000 new ordinary shares of 1 pence each at price of 4 pence per

share to support the ongoing transaction and provide additional working capital.

On 9 October 2023, the proposed acquisition of Trackimo was terminated and the

Company instead entered into an agreement to subscribe for £250,000 new ordinary

shares in Trackimo with the proceeds of the recent placing. The Company will

receive a total value of £1.55 million in Trackimo shares at the Trackimo IPO

subscription price, or at a price to be determined by an independent valuation

of Trackimo, if the Trackimo IPO does not proceed. Furthermore, for the

Company's continued support and assistance throughout the transaction, Trackimo

has also agreed to issue the Company an additional £100,000 new ordinary shares

on completion of the Trackimo IPO.

The Company has agreed with Trackimo that any remaining proceeds received from

the potential exercise of warrants in the Company, once the Company's general

working capital and operating costs have been deducted, will be invested into

Trackimo, with the Company receiving shares (calculated on the above agreed

valuation).

At the date of this report, the total consideration due to the Company is

£1,900,000 in the form of Trackimo equity which will be issued to the Company at

either the Trackimo IPO or at the long stop date of 31 March 2024. The issuance

of Trackimo equity to the Company will be capped at 9.99% of the enlarged issued

share capital of Trackimo.

The Company continues to hold 7,142,858 ordinary shares in Blue Star Helium

Limited ("Blue Star"), an ASX listed company with a portfolio of helium acreage

in the USA. Blue Star has made excellent progress during recent months and has

recently completed a US$7m equity raise alongside a gas processing agreement

with IACX Energy LLC which will enable maiden production at their Voyager Helium

discovery during Q4, 2023. The global helium market dynamics remain strong and

it is hoped that the Blue Star equity valuation will fully reflect that once

production is established.

We believe that the recent re-structuring of the transaction with Trackimo will

enable the Company to secure value for its shareholders in a potentially AIM

listed company. Once the Trackimo shares are issued the Company will re-assess

the best method to ensure that shareholders can receive value for the underlying

shareholdings held within Helium Ventures.

I would like to thank our shareholders, my fellow directors, and our

professional advisers for their ongoing support.

Neil Ritson, Non-Executive Chairman

30 October 2023

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

The Auditors have drawn attention to note 2.2 in the financial statements, which

indicates that the Company incurred a net loss of £429,657 and incurred

operating cash outflows of £279,621 during the year ended 30 April 2023. As

stated in note 2.2, these events or conditions, along with the other matters as

set forth in note 2.2, indicate that a material uncertainty exists that may cast

significant doubt on the Company's ability to continue as a going concern. The

Auditors opinion is not modified in respect of this matter.

STATEMENT OF COMPREHENSIVE INCOME FOR THE PERIODED 30 APRIL 2023

Year Period

ended ended

30 April

30 April 2022

2023

Note £ £

Continuing Operations

Administrative expenses 4 (389,404) (452,160)

Fair value loss on financial asset at fair 12 (39,830) (63,510)

value through profit and loss

Operating loss (429,234) (515,670)

Foreign exchanges losses (423) (504)

Loss before taxation (429,657) (516,174)

Taxation on loss of ordinary activities 7 - -

Loss for the year from continuing operations (429,657) (516,174)

Other comprehensive income

Other comprehensive income - -

Total comprehensive loss for the year (429,657) (516,174)

attributable to shareholders from continuing

operations

Basic & dilutive earnings per share - pence 8 (2.55) (3.54)

The statement of comprehensive income has been prepared on the basis that all

operations are continuing operations. The accompanying notes form part of these

financial statements.

STATEMENT OF FINANCIAL POSITION AS AT 30 APRIL 2023

Note As at 30 As at 30

April April

2023 2022

£ £

CURRENT ASSETS

Cash and cash equivalents 9 64,691 344,312

Trade and other 10 3,002 16,380

receivables

Investments held at fair 12 116,609 156,439

value through profit or

loss

TOTAL CURRENT ASSETS 184,302 517,131

TOTAL ASSETS 184,302 517,131

EQUITY

Share capital 13 168,400 168,400

Share premium account 13 810,005 810,005

Share based payment 14 18,615 18,615

reserve

Retained deficit (945,831) (516,174)

TOTAL EQUITY 51,189 480,846

CURRENT LIABILITIES

Trade and other payables 11 133,113 36,285

TOTAL CURRENT LIABILITIES 133,113 36,285

TOTAL LIABILITIES 133,113 36,285

TOTAL EQUITY AND 184,302 517,131

LIABILITIES

The accompanying notes form part of these financial statements.

The financial statements were approved by the board on 30 October 2023 by:

Neil Ritson, Non-Executive Chairman

STATEMENT OF CHANGES IN EQUITYAS AT 30 APRIL 2023

Ordinary Share Share Based Retained Total

Share Premium Payment deficit equity

capital Reserves

£ £ £ £ £

Comprehensive

income for the

period

Loss for the period - - - (516,174) (516,174)

Other comprehensive - - - - -

income

Total comprehensive - - - (516,174) (516,174)

loss for the period

Transactions with

owners

Ordinary Shares 168,400 831,600 - - 1,000,000

issued

Warrants issued - (10,095) 18,615 - 8,520

Share Issue Costs - (11,500) - - (11,500)

Total transactions 168,400 810,005 18,615 - 997,020

with owners

As at 30 April 2022 168,400 810,005 18,615 (516,174) 480,846

Ordinary Share Share Based Retained Total

Share Premium Payment deficit equity

capital Reserves

£ £ £ £ £

Comprehensive

income for the

year

Loss for the year - - - (429,657) (429,657)

Other - - - - -

comprehensive

income

Total - - - (429,657) (429,657)

comprehensive loss

for the year

Transactions with

owners

Ordinary Shares - - - - -

issued

Warrants issued - - - - -

Share Issue Costs - - - - -

Total transactions - - - - -

with owners

As at 30 April 168,400 810,005 18,615 (945,831) 51,189

2023

The accompanying notes form part of these financial statements.

STATEMENT OF CASH FLOW FOR THE YEARED 30 APRIL 2023

Year ended Period ended

30 April 2023 30 April 2022

Note £ £

Cash flow from operating

activities

Loss for the year (429,657) (516,174)

Adjustments for:

Share based payments 14 - 8,520

Fair value losses 12 39,830 63,510

Changes in working capital:

Decrease/(increase) in 13,377 (16,380)

trade and other

receivables

Increase in trade and other 96,829 36,285

payables

Net cash outflow from (279,621) (424,239)

operating activities

Cash flows from investing

activities

Investment in Blue Star 12 - (219,949)

Helium

Net cash flow from - (219,949)

investing activities

Cash flows from financing

activities

Proceeds from issue of 13 - 988,500

shares net of share issue

costs

Net cash flow from - 988,500

financing activities

Net increase in cash and (279,621) 344,312

cash equivalents

Cash and cash equivalents 344,312 -

at beginning of the year

Cash and cash equivalents 9 64,691 344,312

at end of year

The accompanying notes form part of these financial statements.

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 30 APRIL 2023

1. General Information

Helium Ventures plc was incorporated on 23 April 2021 in England and Wales and

remains domiciled there with Registered Number 13355240 under the Companies Act

2006.

The address of its registered office is Eccleston Yards, 25 Eccleston Place,

London SW1W 9NF, United Kingdom.

The principal activity of the Company is to seek suitable investment

opportunities primarily in potential companies, businesses or asset/(s) that

have operations in the natural gas exploration or technology sectors.

The Company listed on the Aquis Stock Exchange ("AQSE") on 8 July 2021. The

Company began dual trading on the US OTCQB Market on 4 January 2022.

2. Accounting policies

The principal accounting policies applied in preparation of these financial

statements are set out below. These policies have been consistently applied

unless otherwise stated.

2.1. Basis of preparation

The financial statements for the year ended 30 April 2023 have been prepared by

Helium Ventures plc in accordance with the requirements of the AQSE Rules, UK

adopted international accounting standards (`IFRS') and requirements of the

Companies Act 2006. The financial statements have been prepared under the

historical cost convention, as modified by financial assets and financial

liabilities (including derivative instruments) at fair value.

The preparation of financial statements requires the use of certain critical

accounting estimates. It also requires management to exercise its judgement in

the process of applying the Company's accounting policies. The areas involving

a higher degree of judgement or complexity, or areas where assumptions and

estimates are significant in the financial statements, are disclosed in note

2.9.

2.2. Going concern

The Company's business activities, together with facts likely to affect its

future operations and financial and liquidity positions are set out in the

Chairman's Statement and the Strategic Report. In addition, note 15 to the

financial statements disclose the Company's financial risk management policy.

The Company's financial statements have been prepared on the going concern

basis, which contemplates that the Company will be able to realize its assets

and discharge liabilities in the normal course of business. Despite this, there

can be no assurance that the Company will either achieve or maintain

profitability in the future and financial returns arising therefrom, may be

adversely affected by factors outside the control of the Company.

The Company has had recurring losses in the current year and prior period, and

its continuation as a going concern is dependent on the Company's ability to

successfully fund its operations by obtaining additional financing from equity

injections or other funding.

This indicates that a material uncertainty exists that may cast significant

doubt over the Company's ability to continue as a going concern.

Whilst acknowledging this material uncertainty, the directors consider it

appropriate to prepare the consolidated financial statements on a going concern

basis for the following reasons:

· The Company may reasonably expect to maintain continued support from

shareholders and other financiers that have supported the Company's previous

capital raising to assist with meeting future funding needs; and

· All outgoing and expenditure can be suspended until the sufficient

completion of a capital raise.

The financial statements do not include the adjustments that would result if the

Company were unable to continue as a going concern. The auditors have made

reference to going concern by way of a material uncertainty within their report.

2.3. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand, and demand deposits

with banks and other financial institutions.

2.4. Equity

Share capital is determined using the nominal value of shares that have been

issued.

The Share premium account includes any premiums received on the initial issuing

of the share capital. Any transaction costs associated with the issuing of

shares are deducted from the Share premium account, net of any related income

tax benefits.

Equity-settled share-based payments are credited to a share-based payment

reserve as a component of equity until related options or warrants are exercised

or lapse. See note 2.7.

Retained losses includes all current and prior period results as disclosed in

the income statement.

2.5. Foreign currency translation

The financial statements are presented in Sterling which is the Company's

functional and presentational currency.

Transactions in currencies other than the functional currency are recognised at

the rates of exchange on the dates of the transactions. At each balance sheet

date, monetary assets and liabilities are retranslated at the rates prevailing

at the balance sheet date with differences recognised in the Statement of

comprehensive income in the year in which they arise.

2.6. Financial instruments

IFRS 9 requires an entity to address the classification, measurement and

recognition of financial assets and liabilities.

a) Classification

The Company classifies its financial assets in the following measurement

categories:

· those to be measured subsequently at fair value (either through OCI

or through profit or loss);

· those to be measured at amortised cost; and

· those to be measured subsequently at fair value through profit or

loss.

The classification depends on the Company's business model for managing the

financial assets and the contractual terms of the cash flows.

For assets measured at fair value, gains and losses will be recorded either in

profit or loss or in OCI. For investments in equity instruments that are not

held for trading, this will depend on whether the Company has made an

irrevocable election at the time of initial recognition to account for the

equity investment at fair value through other comprehensive income (FVOCI).

b) Recognition

Purchases and sales of financial assets are recognised on trade date (that is,

the date on which the Company commits to purchase or sell the asset). Financial

assets are derecognised when the rights to receive cash flows from the financial

assets have expired or have been transferred and the Company has transferred

substantially all the risks and rewards of ownership.

During the year the Company acquired an investment in Blue Star Helium Limited.

This is an equity investment which is held for trading, and as such it has been

classified as a current financial asset at fair value through profit or loss.

c) Measurement

At initial recognition, the Company measures a financial asset at its fair value

plus, in the case of a financial asset not at fair value through profit or loss

(FVPL), transaction costs that are directly attributable to the acquisition of

the financial asset.

Transaction costs of financial assets carried at FVPL are expensed in profit or

loss.

For Blue Star Helium Limited the initial investment was recognised at the fair

value of the consideration paid in AUD$400,000 translated into GBP£219,949 at

the date of acquisition. See note 12.

Debt instruments

Amortised cost: Assets that are held for collection of contractual cash flows,

where those cash flows represent solely payments of principal and interest, are

measured at amortised cost. Interest income from these financial assets is

included in finance income using the effective interest rate method. Any gain or

loss arising on derecognition is recognised directly in profit or loss and

presented in other gains/(losses) together with foreign exchange gains and

losses. Impairment losses are presented as a separate line item in the statement

of profit or loss.

Equity instruments

The Company subsequently measures all equity investments at fair value. Where

the Company's management has elected to present fair value gains and losses on

equity investments in OCI, there is no subsequent reclassification of fair value

gains and losses to profit or loss following the derecognition of the

investment. Dividends from such investments continue to be recognised in profit

or loss as other income when the Company's right to receive payments is

established. Changes in the fair value of financial assets at FVPL are

recognised in other gains/(losses) in the statement of profit or loss as

applicable. Impairment losses (and reversal of impairment losses) on equity

investments measured at FVOCI are not reported separately from other changes in

fair value.

At the year end the Company has recognised a fair value loss in the investment

in Blue Star Helium Limited. This loss has been determined by reference to the

closing share price of Blue Helium Limited at 30 April 2023. See note 12.

d) Impairment

The Company assesses, on a forward-looking basis, the expected credit losses

associated with any debt instruments carried at amortised cost. The impairment

methodology applied depends on whether there has been a significant increase in

credit risk. For trade receivables, the Company applies the simplified approach

permitted by IFRS 9, which requires expected lifetime losses to be recognised

from initial recognition of the receivables.

2.7. Equity instruments

Share capital is determined using the nominal value of shares that have been

issued.

The Share premium account includes any premiums received on the initial issuing

of the share capital. Any transaction costs associated with the issuing of

shares are deducted from the Share premium account.

Share based payments reserves represent the value of equity settled share-based

payments provided to employees, including key management personnel, and third

parties for services provided.

In accordance with IFRS 2, for equity-settled share-based payment transactions,

the entity shall measure the goods or services received, and the corresponding

increase in equity, directly, at the fair value of the goods or services

received, unless that fair value cannot be estimated reliably. The fair value of

the service received in exchange for the grant of options and warrants is

recognised as an expense, other than those warrants that were issued in relation

to the listing which have been recorded against share premium in equity. If the

entity cannot estimate reliably the fair value of the goods or services

received, the entity shall measure their value, and the corresponding increase

in equity, indirectly, by reference to the fair value of the equity instruments

granted.

Retained deficit represents the cumulative retained losses of the Company at the

reporting date.

2.8. Taxation

Tax currently payable is based on taxable profit for the year. Taxable profit

differs from profit as reported in the income statement because it excludes

items of income and expense that are taxable or deductible in other years and it

further excludes items that are never taxable or deductible. The liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted by the balance sheet date.

Deferred tax is recognised on differences between the carrying amounts of assets

and liabilities in the financial information and the corresponding tax bases

used in the computation of taxable profit and is accounted for using the balance

sheet liability method. Deferred tax liabilities are generally recognised for

all taxable temporary differences and deferred tax assets are recognised to the

extent that it is probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and liabilities

are not recognised if the temporary difference arises from initial recognition

of goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that affects

neither the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary differences

arising on investments in subsidiaries and associates, and interests in joint

ventures, except where the Company is able to control the reversal of the

temporary difference and it is probable that the temporary difference will not

reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each balance sheet

date and reduced to the extent that it is no longer probable that sufficient

taxable profits will be available to allow all or part of the asset to be

recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the

year when the liability is settled, or the asset realised. Deferred tax is

charged or credited to profit or loss, except when it relates to items charged

or credited directly to equity, in which case the deferred tax is also dealt

with in equity.

Deferred tax assets and liabilities are offset when there is a legally

enforceable right to set off current tax assets against current tax liabilities

and when they relate to income taxes levied by the same taxation authority and

the Company intends to settle its current tax assets and liabilities on a net

basis.

2.9. Critical accounting judgements and key sources of estimation uncertainty

The preparation of the financial statements in conformity with IFRSs requires

management to make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of assets,

liabilities, income and expense. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions

to accounting estimates are recognised in the year in which the estimates are

revised and in any future years affected. There was no significant accounting

judgements in the current year.

· Share Based Payments: warrants valued using Black Scholes method

In prior periods, the Company has made awards of warrants on its unissued share

capital to certain parties in return for services provided to the Company. The

valuation of these warrants involved making a number of critical estimates

relating to price volatility, future dividend yields, expected life of the

options and interest rates. These assumptions have been integrated into the

Black Scholes Option Pricing model in this instance to derive a value for any

share-based payments. These judgements and assumptions are described in more

detail in note 14.

The expense charged to the Statement of Comprehensive Income during the year in

relation to share based payments was £Nil (2022: £8,520). In the prior period

£10,095 was also offset from the share premium account.

2.10 New standards and interpretations not yet adopted

New standards, amendments and interpretations adopted by the Company

The adoption of the following mentioned amendments, which were all effective for

the years beginning after 1 May 2022, have not had a material impact on the

Company's financial statements:

Standard Impact on initial application Effective date

IFRS 3 Reference to conceptual framework 1 January 2022

IAS 16 Property, plant and equipment: 1 January 2022

Proceeds before intended use

IAS 37 Provisions, contingent liabilities 1 January 2022

and contingent assets

IAS 1 Presentation of Financial statements: 1 January 2022

Classification of Liabilities as

Current or Non-Current- Deferral or

Effective date

IAS 1 Presentation of financial statements: 1 January 2022

Disclosure of accounting policies

IAS 8 Changes to accounting estimates and 1 January 2022

errors - Definition of accounting

errors

IAS 12 Income taxes - Deferred tax related 1 January 2022

to assets and liabilities arising

from a single transaction

Annual improvements to Amendments to IFRS 1, IFRS 9, IFRS 16 1 January 2022

IFRS standards 2018 and IAS 41

-2022

New standards, amendments and interpretations not yet adopted by the Company:

Standard Impact on initial application Effective date

Amendments Presentation of Financial Statements and IFRS 1 January 2023

to IAS 1 Practice Statement 2: Disclosure of Accounting

Policies

Amendments Accounting policies, Changes in Accounting 1 January 2023

to IAS 8 Estimates and Errors - Definition of Accounting

Estimates

Amendments Income Taxes - Deferred Tax related to Assets and 1 January 2023

to IAS 12 Liabilities arising from a Single Transaction

Amendments Amendments to IFRS 16 Leases: Lease Liability in a 1 January 2024

to IFRS 16 Sale and Leaseback

IAS 1 Presentation of Financial statements: 1 January 2024

Classification of Liabilities as Current or Non

-Current

IFRS 9 Financial instruments 1 January 2024

IAS 1 Presentation of financial statements - Disclosure 1 January 2024

of accounting policies

The Directors have evaluated the impact of transition to the above standards and

do not consider that there will be a material impact of transition on the

financial statements.

3. Segmental analysis

The Company manages its operations in one segment, being seeking a suitable

investment target. The results of this segment are regularly reviewed by the

board as a basis for the allocation of resources, in conjunction with individual

investment appraisals, and to assess its performance.

4. Operating Loss

Operating loss for the Company is stated after charging:

Year ended Period ended

30 April 2023 30 April 2022

£ £

Directors' fees (note 5) 78,088 57,976

Professional fees 165,475 220,167

Listing expenses 109,484 99,222

Other administrative expenses 36,357 66,275

Share based payments - 8,520

389,404 452,160

5. Employees

The average number of persons employed by the Company (including executive

directors) during the year was:

No. of employees

Year ended Period ended

30 April 2023 30 April 2022

Management 3 3

3 3

The aggregate payroll costs of these persons were as follows:

Year ended Period ended

30 April 2023 30 April 2022

£ £

Directors' fees 77,366 57,600

Employers NI 722 376

78,088 57,976

6. Auditor's Remuneration

Year ended Period ended

30 April 2023 30 April 2022

£ £

Fees payable to the Company's 37,000 27,500

auditor for the audit of the

Company

Fees payable to the Company's

auditor for other services:

Audit related assurance services - 1,500

Reporting accountant services 45,000 15,000

82,000 44,000

7. Taxation

Year ended Period ended

30 April 2023 30 April 2022

£ £

Current tax - -

Deferred tax - -

Income tax expense - -

Income tax can be reconciled to the loss in the statement of comprehensive

income as follows:

Year ended Period ended

30 April 2023 30 April 2022

£ £

Loss before taxation (429,657) (516,174)

Tax at the UK Corporation rate (81,634) (98,073)

of 19%

Tax effect of amounts which 7,567 13,686

are not deductible

Tax losses on which no 74,067 84,387

deferred tax asset has been

recognised

Total tax (charge)/credit - -

UK - -

Overseas - -

Total tax (charge)/credit) - -

The Company has accumulated tax losses of approximately £158,067 (2022: £84,000)

that are available, under current legislation, to be carried forward

indefinitely against future profits.

A deferred tax asset has not been recognised in respect of these losses due to

the uncertainty of future profits. The amount of the deferred tax asset not

recognised is approximately £158,067 (2022: £84,000).

8. Earnings per share

The calculation of the basic and diluted earnings per share is calculated by

dividing the profit or loss for the year by the weighted average number of

ordinary shares in issue during the year.

Year ended Period ended

30 April 2023 30 April 2022

£ £

Loss attributable to shareholders (429,657) (516,174)

of Helium Ventures plc

Weighted number of ordinary shares 16,480,000 14,587,882

in issue

Basic & dilutive earnings per share (2.55) (3.54)

from continuing operations - pence

There is no difference between the diluted loss per share and the basic loss per

share presented. Share options and warrants could potentially dilute basic

earnings per share in the future but were not included in the calculation of

diluted earnings per share as they are anti-dilutive for the year presented. See

note 14 for further details.

9. Cash and cash equivalents

Year ended Period ended

30 April 2023 30 April 2022

£ £

Cash at bank 64,691 344,312

64,691 344,312

10. Trade and other receivables

Year ended Period ended

30 April 2023 30 April 2022

£ £

Prepayments 3,002 16,380

3,002 16,380

11. Trade and other payables

Year ended Period ended

30 April 2023 30 April 2022

£ £

Trade creditors 45,785 4,506

Accruals 30,000 31,779

Payroll liabilities 57,328 -

133,113 36,285

12. Investments held at fair value through profit or loss

£

Cost at 23 April 2021 -

Addition - Blue Star Helium Limited 219,949

Cost at 30 April 2022 219,949

Cost at 30 April 2023 219,949

-

Fair value loss at 30 April 2022 (63,510)

Fair value loss at 30 April 2023 (39,830)

Fair value of Investment at 30 April 2022 156,439

Fair value of Investment at 30 April 2023 116,609

On3 November 2021, the Company acquired an investment in Blue Star Helium

Limited. The investment totalled AUD$400,000 at AUD5.6 centsper share and was

part of a AUD$15 million fundraise. The Company holds 7,142,858 shares in Blue

Star Helium Limited representing 0.45% of the total issued shares in that

company.

The investment was recognised as a financial asset held at fair value through

profit and loss. It is classified as a current asset as the Company views this

as an asset which is likely to be held for the short term only.

During the year a fair value loss was recognised in the income statement

reflecting the fall in value from the last revaluation date of AUD 3.9 cents per

share at acquisition to AUD 3.1 cents per share at the date of these accounts.

The shares were initially purchased for AUD 5.6 cents per share.

Accounting standards, including IFRS 13, prescribe a three-level hierarchy for

fair valuing financial instruments. The investment in Blue Star Helium Limited

has been measured and recognised in the financial statements at Level 1 as the

entity is publicly quoted. The three levels are described below:

Level 1: The fair value of financial instruments traded in active markets (such

as publicly traded derivatives, and equity securities) is based on quoted market

prices at the end of the reporting year. The quoted market price used for

financial assets held by the Company is the current bid price. These instruments

are included in level 1.

Level 2: The fair value of financial instruments that are not traded in an

active market (e.g. over-the- counter derivatives) is determined using valuation

techniques that maximise the use of observable market data and rely as little as

possible on entity-specific estimates. If all significant inputs required to

fair value an instrument are observable, the instrument is included in level 2.

Level 3: If one or more of the significant inputs is not based on observable

market data, the instrument is included in level 3. This is the case for

unlisted equity securities.

13. Share capital and share premium

Ordinary Shares ShareCapital Share Premium Total

# £ £ £

Issue of ordinary 5,000,000 50,000 - 50,000

shares on

incorporation1

Issue of ordinary 2,600,000 26,000 - 26,000

shares 2

Issue of ordinary 9,240,000 92,400 831,600 924,000

shares 3

Share issue costs - - (21,595) (21,595)

At 30 April 2022 16,840,000 168,400 810,005 978,405

At 30 April 2023 16,840,000 168,400 810,005 978,405

1 On incorporation on 23 April 2021 the Company issued 5,000,000 ordinary shares

of £0.01 at their nominal value of £0.01.

2 On 15 June 2021, the Company issued 2,600,000 ordinary shares at their nominal

value of £0.01.

3 On admission to the Aquis Stock Exchange Growth Market on 8 July 2021,

9,240,000 shares were issued at a placing price of £0.10.

14. Share based payment reserves

Total

£

Opening balance on incorporation

Advisor warrants Issued 1 8,520

Broker warrants issued 2 10,095

At 30 April 2022 18,615

Movement in the year -

At 30 April 2023 18,615

1 On 1 May 2021, the board of directors entered into an agreement to issue

200,000 Advisor Warrants to Cairn subject to and conditional on Admission. The

Advisor Warrants are exercisable at the price of £0.10 per Ordinary Share and

are exercisable either in whole or part for a period of five years from the date

of admission.

2 On 8 June 2021, the board of directors entered into an agreement to issue

300,000 Broker Warrants to Pello subject to and conditional on Admission. The

Broker Warrants are exercisable at the price of £0.10 per Ordinary Share and are

exercisable either in whole or part for a period of three years from the date of

admission.

On 16 June 2021, 7.6 million founder warrants were issued linked to existing

shares. Each warrant entitles the holder to subscribe for one share at a price

of £0.05 for a period of three years from grant.

The estimated fair values of warrants which fall under IFRS 2, and the inputs

used in the Black-Scholes model to calculate those fair values are as follows:

Date Number of Share Exercise Expected Expected Risk Expected

of warrants Price Price volatility life free dividends

grant rate

8 July 200,000 £0.10 £0.10 50.00% 5 15.00% 0.00%

2021

8 July 300,000 £0.10 £0.10 50.00% 3 15.00% 0.00%

2021

The total number of warrants issued during the year:

Number of Warrants Exercise Price Expiry date

On incorporation

Issued on 1 May 2021 200,000 £0.10 8 July 2026

Issued on 8 June 2021 300,000 £0.10 8 July 2024

Issued on 16 June 2021 7,600,000 £0.05 16 June 2024

At 30 April 2022 8,100,000 £0.05

Issued during the year: - - -

At 30 April 2023 8,100,000 £0.05

The weighted average exercise price of the warrants exercisable at 30 April 2023

is £0.05 (2022: £0.05)

The weighted average time to expiry of the warrants as at 30 April is 1.14 years

(2022: 2.14 years)

The 7,600,000 warrants issued on 16 June 2021 were issued alongside the placing

of ordinary shares and as such are not fair valued separately, as they fall

outside of the scope of IFRS 2.

15. Financial Instruments and Risk Management

Principal financial instruments

The principal financial instruments used by the Company from which the financial

risk arises are as follows:

Financial Assets

Year ended Period ended

30 April 30 April

2023 2022

£ £

Investment held at fair value 116,609 156,439

through profit or loss (note

12)

Cash at bank and in hand 64,691 344,312

181,300 500,751

Financial Liabilities

Year ended Period ended

30 April 2023 30 April

£ 2022

£

Trade and other payables 133,113 36,285

133,113 36,285

The financial liabilities are payable within one year.

General objectives and policies

As alluded to in the Directors report the overall objective of the Board is to

set policies that seek to reduce risk as far as practical without unduly

affecting the Company's competitiveness and flexibility. Further details

regarding these policies are:

Policy on financial risk management

The Company's principal financial instruments comprise cash and cash

equivalents, other receivables, trade and other payables. The Company's

accounting policies and methods adopted, including the criteria for recognition,

the basis on which income and expenses are recognised in respect of each class

of financial asset, financial liability and equity instrument are set out in

note 2 - "Accounting Policies".

The Company does not use financial instruments for speculative purposes. The

carrying value of all financial assets and liabilities approximates to their

fair value.

Derivatives, financial instruments and risk management

The Company does not use derivative instruments or other financial instruments

to manage its exposure to fluctuations in foreign currency exchange rates,

interest rates and commodity prices.

Foreign currency risk management

The Company operates in a global market with income and costs possibly arising

in a number of currencies and is exposed to foreign currency risk arising from

commercial transactions, translation of assets and liabilities and net

investment in foreign subsidiaries. Exposure to commercial transactions arise

from sales or purchases by operating companies in currencies other than the

Company's functional currency. Currency exposures are reviewed regularly.

Due to the minimal amount of transactions in AUD, the Company does not consider

hedging its investment in Blue Star Helium Limited beneficial because the cash

flow risk created from such hedging techniques would outweigh the risk of

foreign currency exposure.

The Company has a limited level of exposure to foreign exchange risk through

their foreign currency denominated cash balances.

Accordingly, movements in the Sterling exchange rate against these currencies

could have a detrimental effect on the Company's results and financial

condition.

The table below shows the currency profiles of cash and cash equivalents:

Year ended Period ended

30 April 2023 30 April 2022

£ £

Cash and cash equivalents GBP 64,691 344,312

64,691 344,312

Credit risk

Credit risk refers to the risk that a counterparty will default on its

contractual obligations resulting in financial loss to the Company. The Company

has adopted a policy of only dealing with creditworthy counterparties. The

Company's exposure and the credit ratings of its counterparties are monitored by

the Board of Directors to ensure that the aggregate value of transactions is

spread amongst approved counterparties.

The Company applies IFRS 9 to measure expected credit losses for receivables,

these are regularly monitored and assessed. Receivables are subject to an

expected credit loss provision when it is probable that amounts outstanding are

not recoverable as set out in the accounting policy. The impact of expected

credit losses was immaterial.

The Company's principal financial assets are cash and cash equivalents. Cash

equivalents include amounts held on deposit with financial institutions.

The credit risk on liquid funds held in current accounts and available on demand

is limited because the Company's counterparties are banks with high credit

-ratings assigned by international credit-rating agencies.

No financial assets have indicators of impairment.

The Company's maximum exposure to credit risk is limited to the carrying amount

of financial assets recorded in the financial statements.

Borrowings and interest rate risk

The Company currently has no borrowings. The Company's principal financial

assets are cash and cash equivalents. Cash equivalents include amounts held on

deposit with financial institutions. The effect of variable interest rates is

not significant.

Liquidity risk

During the year ended 30 April 2023, the Company was financed by cash raised

through equity funding. Funds raised surplus to immediate requirements are held

as cash deposits in Sterling.

In managing liquidity risk, the main objective of the Company is to ensure that

it has the ability to pay all of its liabilities as they fall due. The Company

monitors its levels of working capital to ensure that it can meet its

liabilities as they fall due.

The table below shows the undiscounted cash flows on the Company's financial

liabilities as at 30 April 2023 on the basis of their earliest possible

contractual maturity.

Total Within 2 months Within

£ £ 2-6 months

£

At 30 April 2023

Trade payables 45,785 45,785 -

Accruals 30,000 30,000 -

Payroll liabilities 57,328 57,328 -

133,113 133,113 -

Total Within 2 months Within

£ £ 2-6 months

£

At 30 April 2022

Trade payables 4,506 4,026 480

Accruals 31,779 4,279 27,500

36,285 8,305 27,980

Capital management

The Company considers its capital to be equal to the sum of its total equity.

The Company monitors its capital using a number of key performance indicators

including cash flow projections, working capital ratios, the cost to achieve

development milestones and potential revenue from partnerships and ongoing

licensing activities.

The Company's objective when managing its capital is to ensure it obtains

sufficient funding for continuing as a going concern. The Company funds its

capital requirements through the issue of new shares to investors.

16. Related Party Transactions

Provision of services

Orana Corporate LLP has a service agreement with the Company for the provision

of accounting, company secretarial and corporate finance services. In the year

to 30 April 2023, Orana Corporate LLP received £41,366 (2022: £50,000) for these

services from the Company.

Directors' remuneration

For details of the directors' remuneration paid in the year, see note 5.

Other than these there were no other related party transactions.

17. Ultimate Controlling Party

As at 30 April 2023 there was no ultimate controlling party of the Company.

18. Contingent liabilities

As at 30 April 2023 (2022: £0) there were no contingent liabilities for the

Company.

19. Capital Commitments

As at 30 April 2023 (2022: £0) there were no capital commitments for the

Company.

20. Events Subsequent to year end

On 21 September 2023, the Company announced that it had raised net proceeds of

£250,000 through the issue of 6,250,000 new ordinary shares of 1 pence each at

price of 4 pence per share and has issued an additional 812,500 new ordinary

shares of 1 pence each at price of 4 pence per share in relation to a placing

and a broking fee retainer.

On 9 October 2023, the proposed acquisition of Trackimo was terminated and the

Company instead entered into an agreement to subscribe for £250,000 new ordinary

shares in Trackimo with the proceeds of the recent placing. The Company will

receive a total value of £1.55 million in Trackimo shares at the Trackimo IPO

subscription price, or at price to be determined by an independent valuation of

Trackimo, if the Trackimo IPO does not proceed. Furthermore, for the Company's

continued support and assistance throughout the transaction, Trackimo has also

agreed to issue the Company an additional £100,000 new ordinary shares on

completion of the Trackimo IPO.

On 10 October 2023, the temporary suspension in the Company's shares was lifted

and trading resumed.

There are no other events of significance subsequent to the year end.

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company accept responsibility for the

contents of this announcement.

ENDS

Enquiries:

Helium Ventures plc +44 (0) 20 3475 6834

Neil Ritson

Cairn Financial Advisers LLP (AQSE Corporate Adviser) +44 (0) 20 72130 880

Liam Murray / Ludovico Lazzaretti

Note:

Certain statements made in this announcement are forward-looking statements.

These forward-looking statements are not historical facts but rather are based

on the Company's current expectations, estimates, and projections about its

industry; its beliefs; and assumptions. Words such as 'anticipates,' 'expects,'

'intends,' 'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These statements are not a

guarantee of future performance and are subject to known and unknown risks,

uncertainties, and other factors, some of which are beyond the Company's

control, are difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security holders not to

place undue reliance on these forward-looking statements, which reflect the view

of the Company only as of the date of this announcement. The forward-looking

statements made in this announcement relate only to events as of the date on

which the statements are made. The Company will not undertake any obligation to

release publicly any revisions or updates to these forward-looking statements to

reflect events, circumstances, or unanticipated events occurring after the date

of this announcement except as required by law or by any appropriate regulatory

authority.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

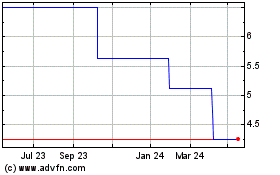

Helium Ventures (AQSE:HEV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Helium Ventures (AQSE:HEV)

Historical Stock Chart

From Nov 2023 to Nov 2024