TIDMPET

RNS Number : 5071M

Petrel Resources PLC

22 September 2021

22(nd) September 2021

Petrel Resources plc

("Petrel" or "the Company")

Interim Statement for the six months ended 30 June 2021

Petrel Resources plc (AIM: PET) today announces financial

results for the six months ended 30(th) June 2021.

Petrel is a hydrocarbon explorer with interests in Iraq, and

Ghana.

Highlights

-- Petrel's Iraqi business is being painstakingly re-built -

reversing emigration.

-- Iraqi human and physical infrastructure has been degraded

since 1990.

-- An updated oil field development proposal has been

submitted.

-- Ratification plan agreed-in-principle with Ghanaian

authorities.

-- Shareholder base broadened, to prepare for expansion.

Despite much-publicised challenges, Iraq remains the biggest

commercial opportunity in petroleum today. The geology is

unsurpassed. The oil market is sharply recovering. But contracts

must be updated for effective exploration and development.

2021 was a moment of truth for companies prepared to invest in

Iraq. Some western majors, ignorant of prevailing circumstances,

had bid over-optimistically on service contracts from 2009, and

then found it hard to operate effectively.

Others, including TotalEnergies and Chinese NOCs, have

re-committed themselves given the large opportunity. Iraq is not

for the faint of heart, but there is considerable upside to be

realised provided the elected government implements necessary

reforms.

For several years after the 2003 Iraqi invasion, there was a

perception that contractors close to western governments, and later

super-majors, would dominate Iraqi oil exploration and development.

Iraqis had other ideas, however: they want partners, rather than

bosses.

Iraq is sovereign, but so is finance. The investment dollar is

an orphan. It seeks out return, and works to minimise risk - though

resolute investors will carry risk if fairly compensated.

Any investment is worth the discounted Present Value of all cash

flows (in and out). Calculations are sensitive to timing and the

discount rate. Foreigners always see higher risks than locals

do.

The more uncertainty (political, tax, operational) the higher

the discount rate, & the lower the Present Value.

For capitalism to work, it must reward all the key players,

whose interests should be aligned - rather than in conflict.

The biggest challenge facing Petrel in this new era is not

operating conditions, access to technology or community relations.

The biggest challenge facing agile industry players is outdated

contracts and fiscal terms that were designed during boom

years.

The post-2014 and especially post-C-19 world is more challenging

for petroleum projects: there is investor prejudice despite

petroleum improving lives.

The worst outcome would be for Iraqi output to stagnate at 4

million barrels daily, for gas to continue to be flared, for Iraqi

youth to remain unemployed.

Operations:

Petrel Resources plc Interests (as of September 2021):

Iraqi Western Desert Block 6: 100% Petrel Working Interest.

Awaiting ratification. 30 year term, or until early pay-out.

Prior TCA studies (with Itochu) on the Merjan oil-field.

At the invitation of Iraqi Government officials in 2020, Petrel

submitted a proposal to develop the Merjan oil field, in accordance

with applicable laws and the Iraqi Model Contract. This builds on

the Technical Cooperation Agreement (TCA), conducted by Petrel in

50% cooperation with partner Itochu, from 2004. Merjan's 800 metres

of oil-bearing sands were intercepted in a 1982 wild-cat by Mobil

(now ExxonMobil) designed to test the deep sections.

Ghana

Tano 2A Petroleum Agreement: 30% Petrel Working Interest.

Awaiting ratification, then exploration periods of 3 years initial

term + 2 extension periods of 3.5 years.

Restructuring the Iraqi oil & gas industry:

The Iraqi Government's stated desire is to boost oil & gas

development, and the applicable law is under review. This has

proven a tortuous process since 2005, and the current ad-hoc legal

framework is acknowledged to be sub-optimal. However the C-19

pandemic, triggering an oil price war in early 2020, together with

anti-fossil fuel agitation internationally, has refocused players

on the need to develop natural resources, rather than forgo

prosperity by leaving national resources undeveloped.

Petrel has also been asked, by an Iraqi group, to evaluate

minerals opportunities that may become economically and legally

viable following the expected passage of legislation.

Petrel maintains relationships with Ministry of Oil officials,

despite Covid-19 constraints. Director, Riadh Ani, is Iraqi: his

father Mahmoud Ahmed is an Iraqi oil legend, encountering oil &

gas in over 1,000 wells he drilled as DG of the Iraqi Drilling

Company, and North Oil Company. Despite difficult politics since

1980, Iraq has the best petroleum geology worldwide: onshore,

generally shallow structures in flat terrain, easily accessible

with infrastructure. Permeability and porosity are generally good

to excellent.

In discussions shortly before the Covid-19 pandemic, the

authorities suggested that Petrel initially target "exploration of

blocks in the western desert of Iraq, and present past studies done

on the Merjan-Kifl-West Kifl discoveries, and Petrel's work on the

Mesozoic and Paleozoic plays in the Western Desert".

Where skills are available, Petrel favours local workers and

suppliers. Petrel has also invested heavily in training and

development of its Iraqi staff and Ministry officials we have

partnered with. Despite periodic issues with politicians, Iraqis

value longstanding relationships and independence from foreign

players. They want partners, not bosses.

What should Iraq's oil policy be now?

Unfortunately, the combination of suspicion of foreign oil

companies, sanctions, and wars (including internal sectarian

conflict and resistance since 2003) have held back Iraq's

development, including the building of necessary oil and other

infrastructure. Iraq's government earnings and economy remains

dependent on oil.

Have Service Contracts achieved their objectives for companies

and Iraq? No: even at its pre-C-19 peak of c.4.7 million barrels of

oil daily (mmbod) output, Iraq fell short of its 6 to 9 mmbod 1989

plan, and the high hopes of rivalling Saudi Arabia. There is

insufficient incentive for contractors to boost production, and

recoveries - while the Ministry of Oil has been hollowed out by

sanctions and wars, and now unable to fill the gap.

Should the Federal Ministry of Oil negotiate Production Sharing

Agreements?

Yes: this would better align the interests of the parties, and

create more wealth, value-added in downstream industries like

refined products and petrochemicals, infrastructure and employment

for Iraq.

The success of Qatar in LNG - or even the Emirates and Oman show

what can be done with more pragmatism.

Iraq's misfortune was that the necessary reform of oil laws and

policy came during the most turbulent year in the industry's

history.

Oil & Gas are cyclical, and exploration even more so.

Explorers do best when they acquire choice acreage at a modest cost

in bad times, add value prudently, and then fund or attract

partners on carried terms. This is an approach our group has used

successfully over 30 years, with circa 20 partnerships. The junior

profits from agility, low cost base and a rising market. The major

farming in gains time by short-circuiting the often - for them -

difficult environmental permitting and community relations - at

which Clontarf's experienced team excels.

Where does the market stand in this cycle as of 3(rd) quarter

2021?

Oil demand peaked at 101 million barrels of oil daily during the

4(th) quarter of 2019. It crashed by 10% in mid-2020 - half of

which was due to de-stocking. But - helped by pump-priming and C-19

vaccines - a sharp recovery occurred in 2021.

Demand should be fully restored by 2022 - Chinese consumption is

already at record levels of 14.3mmbod.

Assuming continued vaccine success, relaxing lock-downs and no

major breakthrough C-19 variants, 2022 should exhibit strong demand

growth.

What of supply? The fracking revolution was halted by the 2014

oil price fall, and gone into reverse - though we should never

write US entrepreneurs off.

OPEC plans to open the spigots in a controlled fashion: already

there is some relaxation of Emirates exports. But there is no

production surge: on the contrary, sanctions-hit Venezuelan output

collapsed to 0.55mmbod, Iran's is down to 2.5, while Iraq

languishes at 4, Nigeria at 1.44. Only Libya has recovered, and

only partially to 1.17 (only 70% of the pre-2011 level).

Given recovering demand and supply constraints, one would expect

oil companies to explore for and develop new sources of competitive

oil and gas for the future. Instead, the combination of C-19,

market hostility and low prices and lower 2020 demand was a perfect

storm storing up future supply problems, as demand surges.

Longer-term China, other Far East, and India will grow

strongly.

A supply crunch - probably triggered by a political crisis in

some exporting country - is likely within 2 years - subject to

effective C-19 vaccines and no new pandemic.

Yet, though oil demand rebounded strongly during 2021, following

the record demand fall caused by the C-19 pandemic, exploration and

development expenditure remain depressed. At least $5 trillion of

necessary investment has been deferred. Despite much debate about

modernising tax rates and contract conditions, governments have

been slow to update contractual so as to deliver development.

Despite a cyclical freezing of the farm-out market, and reduced

investor interest, some governments remain stuck in the contract

and fiscal terms expectations of the pre-2014 boom years. Most

frustrating for innovative juniors are the frequent requests for

bonds and bonuses. These may suit incumbent politicians and

slow-moving majors with fat balance sheets, but they are not well

suited to advance development in challenging times. Partly

balancing the revenue fall is the collapse in service costs,

especially seismic and rig rates. Partners and investors can be

persuaded to fund operating and capex costs at currently low rates

- on the cyclical argument - but they are reluctant to pay money to

host governments.

If we can resolve the outstanding issues (especially the request

for an up-front sign-on bonus, technology and training grants,

etc.), we hope to proceed quickly with our work programmes in both

Iraq and Ghana. It makes no sense to pay money up-front for a

contract in which we would be paying 100% of the cost and taking

100% of the risk. The anomalous nature of such bonuses is confirmed

by the fact that they are generally not included in the "cost

oil".

As of September 2021, testing, quarantine, and documentation

requirements remain onerous.

Nonetheless, Petrel Resources plc directors and contractors were

able to conduct business travel to Africa, and the Middle East.

Ghana - developments delayed

Petrel Resources plc, and its partners, are ready to advance the

Ghana Tano 2A work programme, subject to securing the necessary

funding in an environment complicated by prevailing circumstances,

as soon as the signed Petroleum Agreement is ratified.

Despite volatile oil prices, the carefully calibrated Ghanaian

fiscal terms help make the Tano Basin oil play feasible, given the

demonstrated source rock and Cretaceous sands reservoirs which

remain an industry favourite. Indeed, the industry's exploration

contraction may assist Clontarf's focused strategy on bigger

potential stratigraphic traps.

Ghana achieved much after 2007, ramping oil production up to 215

kbpd by 2020. The Jubilee oil-field started producing in 2010, just

3 years after discovery. Non-associated Sankofa gas (operated by

the ENI, with World Bank finance) generates electricity cleanly and

competitively. A further discovery well (Afina-1, at 4,085 meters

depth) was announced by independent Springfield in 2019.

Unfortunately, a slow ratification process, exacerbated by

conflicting policies, stymied efficient development: progress

stagnated after 2018, and output slipped below 200kbod. Jubilee's

topside issues constrained water

injection, and gas output stalled, when Ghana Gas prioritised Sankofa gas over Jubilee gas.

High-level official meetings immediately prior to and during the

pandemic were productive. We understand that new shareholders

helped the Tano 2A Operating Company (Pan Andean Resources (Ghana)

Ltd.) overcome financial capacity concerns following volatile oil

prices and market capitalisation. Everyone should remember,

however, that Ghanaian ratification can be a slow and tortuous

process.

Tamraz Group

The acquisition of a 29% stake by the Tamraz group in July 2019

was widely welcomed by shareholders followed by approval to go to

51%.

The new investors were unable to complete the purchase of the

additional shares while the ownership of most of the 29% became

uncertain. High Court proceedings stopped any dealings in shares

held by the Tamraz Group. This position persists though there is

ongoing contact.

Future

Our Iraqi Director, Riadh Ani has maintained strong

relationships with Ministry of Oil officials. Petrel has monitored

the evolving contracts, and opportunities, even during the darkest

hours of sanctions, invasion, conflict, and Covid-19.

Riadh Ani, is highly regarded as the son of one of the most

successful drillers in history: his father Mahmoud Ahmed had run

Iraq's North Oil Company, and also the State Iraqi Drilling

Company, and in a decades' long drilling career encountered oil

& gas in over 1,000 wells. Only about 12 wells were duds - a

record of exploration and appraisal drilling that is unlikely to be

bettered. This stellar career highlights Iraq's unique petroleum

geology - even compared to neighbouring oil exporters.

Petrel is funded for ongoing activities. The focus is once again

Iraq.

David Horgan

Chairman

21(st) September 2021

For further information please visit http://www.petrelresources.com/ or contact:

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

In addition, market soundings (as defined in MAR) were taken in

respect of the matters contained in this announcement, with the

result that certain persons became aware of inside information (as

defined in MAR), as permitted by MAR. This inside information is

set out in this announcement. Therefore, those persons that

received inside information in a market sounding are no longer in

possession of such inside information relating to the company and

its securities.

S

For further information please visit http://www.petrelresources.com/ or contact:

Petrel Resources

David Horgan, Chairman +353 (0) 1 833 2833

John Teeling, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Madeleine Gordon-Foxwell +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ciara Wylie +353 (0) 1 661 4055

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (162) (243) (399)

Impairment of deferred development costs - - (52)

----------------------- ---------------------- ----------------------

OPERATING LOSS (162) (243) (451)

LOSS BEFORE TAXATION (162) (243) (451)

Income tax expense - - -

----------------------- ---------------------- ----------------------

LOSS FOR THE PERIOD (162) (243) (451)

Items that are or may be reclassified subsequently to profit or

loss

Exchange differences - (9) -

TOTAL COMPREHENSIVE PROFIT FOR THE

PERIOD (162) (252) (451)

======================= ====================== ======================

LOSS PER SHARE - basic and diluted (0.10c) (0.16c) (0.29c)

======================= ====================== ======================

CONDENSED STATEMENT OF FINANCIAL

POSITION 30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

ASSETS: EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Intangible assets 932 985 932

----------------------- ---------------------- ----------------------

932 985 932

----------------------- ---------------------- ----------------------

CURRENT ASSETS

Trade and other receivables 18 49 35

Cash and cash equivalents 255 409 334

----------------------- ---------------------- ----------------------

273 458 369

TOTAL ASSETS 1,205 1,443 1,301

----------------------- ---------------------- ----------------------

CURRENT LIABILITIES

Trade and other payables (777) (654) (711)

----------------------- ---------------------- ----------------------

(777) (654) (711)

----------------------- ---------------------- ----------------------

NET CURRENT LIABILITIES (504) (196) (342)

NET ASSETS 428 789 590

======================= ====================== ======================

EQUITY

Share capital 1,963 1,963 1,963

Capital conversion reserve fund 8 8 8

Capital redemption reserve 209 209 209

Share premium 21,786 21,786 21,786

Share based payment reserve 27 27 27

Translation reserve - 367 -

Retained deficit (23,565) (23,571) (23,403)

----------------------- ---------------------- ----------------------

TOTAL EQUITY 428 789 590

======================= ====================== ======================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Capital Share based

Share Share Redemption Conversion Payment Translation Retained Total

Capital Premium Reserves Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January

2020 1,867 21,601 209 8 27 376 (23,328) 760

Shares issued 96 185 281

Total

comprehensive

income - (9) (243) (252)

-------- -------- ----------- ----------- ------------------ ------------ --------- --------

As at 30 June

2020 1,963 21,786 209 8 27 367 (23,571) 789

Transfer of

reserves - - - - - (367) 367 -

Total

comprehensive

income - - - - - - (199) (199)

-------- -------- ----------- ----------- ------------------ ------------ --------- --------

As at 31

December 2020 1,963 21,786 209 8 27 - (23,403) 590

Total

comprehensive

income - - - - - - (162) (162)

----------- ----------- ------------------ ------------

As at 30 June

2021 1,963 21,786 209 8 27 - (23,565) 428

======== ======== =========== =========== ================== ============ ========= ========

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period (162) (243) (451)

Impairment charge - - 52

Foreign exchange (8) - 4

----------- ----------- -----------

(170) (243) (395)

Movements in Working Capital 83 13 84

----------- ----------- -----------

CASH USED IN OPERATIONS (87) (230) (311)

NET CASH USED IN OPERATING ACTIVITIES (87) (230) (311)

----------- ----------- -----------

INVESTING ACTIVITIES

Payments for exploration and evaluation assets - (2) -

----------- ----------- -----------

NET CASH USED IN INVESTING ACTIVITIES - (2) -

----------- ----------- -----------

FINANCING ACTIVITIES

Shares issued - 281 281

----------- ----------- -----------

NET CASH GENERATED FROM FINANCING ACTIVITIES - 281 281

----------- ----------- -----------

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (87) 49 (30)

Cash and cash equivalents at beginning of the period 334 368 368

Effect of exchange rate changes on cash held in foreign currencies 8 (8) (4)

CASH AND CASH EQUIVALENT AT THE OF THE PERIOD 255 409 334

=========== =========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2021

and the comparative amounts for the six months ended 30 June 2020

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2020.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2020, which are available on the Company's website

www.petrelresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. LOSS PER SHARE

30 June 21 30 June 20 31 Dec 20

EUR EUR EUR

Loss per share - Basic and Diluted (0.10c) (0.16c) (0.29c)

Basic and diluted loss per share

The earnings and weighted average number of ordinary shares used in the calculation of basic

loss per share are as follows:

EUR'000 EUR'000 EUR'000

Loss for the period attributable to equity holders (162) (243) (451)

Weighted average number of ordinary shares for the purpose of basic

earnings per share 157,038,467 150,821,396 153,961,544

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 21 30 June 20 31 Dec 20

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Opening balance 932 984 984

Additions - 2 -

Impairment - - (52)

Exchange translation adjustment - (1) -

________ ________ ________

Closing balance 932 985 932

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ireland and Ghana. The directors are aware that

by its nature there is an inherent uncertainty in Exploration and

evaluation assets and therefore inherent uncertainty in relation to

the carrying value of capitalized exploration and evaluation

assets.

Due to legislative uncertainty since 2017, exacerbated by the

Taoiseach's public statements in September 2019 against the issue

of new Atlantic oil exploration licenses, Petrel has discontinued

farm-out discussions with a gas super-major. Also, the board

reluctantly dropped our 100% owned and operated Frontier

Exploration License (FEL) 3/14, despite multiple identified

targets. Similarly, the board decided not to apply to convert our

prospective Licensing Option (LO) 16/24 into a Frontier Exploration

License. Accordingly, the directors have impaired in full all

expenditure relating to the above mentioned licenses.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanaian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit

sharing and taxation;

-- Exchange rate risk;

-- Financial risk management;

-- Geological and development risks;

Regional Analysis 30 Jun 21 30 Jun 20 31 Dec 20

EUR'000 EUR'000 EUR'000

Ghana 932 932 932

Ireland - 53 -

_______ _______ _______

932 985 932

5. SHARE CAPITAL

2021 2020

EUR'000 EUR'000

Authorised:

800,000,000 ordinary shares of EUR0.0125 10,000 10,000

Allotted, called-up and fully paid:

Number Share Capital Premium

EUR'000 EUR'000

At 1 January 2020 149,346,159 1,867 21,601

Issued during the period 7,692,308 96 185

At 30 June 2020 157,038,467 1,963 21,786

Issued during the period - - -

At 31 December 2020 157,038,467 1,963 21,786

Issued during the period - - -

At 30 June 2021 157,038,467 1,963 21,786

Movements in issued share capital

On 26 May 2020 a total of 7,692,308 shares were placed at a

price of 3.25 pence per share. Proceeds were used to provide

additional working capital and fund development costs.

6. POST BALANCE SHEET EVENTS

There are no material post balance sheets events affecting the

Group.

7. The Interim Report for the six months to 30(th) June 2021 was

approved by the Directors on 21(st) September 2021.

8. The Interim Report will be available on the Company's website at www.petrelresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGZLKMNGMZM

(END) Dow Jones Newswires

September 22, 2021 01:59 ET (05:59 GMT)

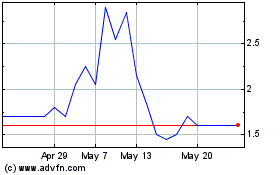

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From May 2024 to Jun 2024

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024