TIDMPMG

RNS Number : 8386U

Parkmead Group (The) PLC

31 March 2023

31 March 2023

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Interim Results for the six-month period ended 31 December

2022

Parkmead, the independent energy group focused on growth through

gas, oil and renewable energy projects, is pleased to report its

interim results for the six-month period ended 31 December

2022.

HIGHLIGHTS

Strong operating cashflow, delivered through low-cost onshore

gas production

-- Revenue more than doubled to GBP11.1 million for the period

(2021: GBP4.6 million) as the Company benefited from robust

production through a sustained period of high gas prices

-- Net cash generated from operating activities rose strongly,

by over 400% to GBP8.6 million (2021: GBP1.7 million) equivalent to

8.0 pence per share

-- Gross profit increased to GBP9.8 million (2021: GBP3.8

million) generating a gross margin of 89%

-- Strong gross profits were nevertheless offset by a GBP4.8

million tax charge, principally arising from Netherlands

operations, and a GBP4.0 million windfall tax charge expensed

during the period but due for payment in May 2024

-- Average realised gas price throughout the period of EUR153.04/MWh

-- Average field operating cost in the period of just US$8.6 per

barrel of oil equivalent, generating strong operating cash

flows

-- Strong balance sheet with cash balances of GBP19.2 million

(2021: GBP24.1 million) as at 31 December 2022, equal to 17.6 pence

per share

-- An impairment of GBP12.7 million was recorded during the

period relating to licence P1293, following the decommissioning of

the Athena field

-- Net loss before impairment charge of GBP1.2 million (2021: GBP0.4 million)

-- Total assets of GBP70.3 million at 31 December 2022 (2021: GBP80.5 million)

Successful exploration drilling campaign and robust production

in the Netherlands

-- LDS-01 successfully encountered new commercial gas columns in the primary target horizons

-- Tie-in of LDS-01 is complete with first gas expected imminently

-- Both LDS-01 and LDS-02 were drilled safely, on time and under budget

-- LDS-02 did not encounter commercial volumes of hydrocarbons

in the targeted intervals however the well has been suspended and

is being assessed for reuse as a side-track into nearby targets

-- Average gross production for the period across the Group's

Netherlands assets was 18.0 MMscfd, approximately 3,205 barrels of

oil equivalent per day ("boepd")

-- Papekop field development has made significant progress in

recent months, as the joint venture aims to accelerate the

project

Well planning activities underway on the exciting Skerryvore

exploration targets

-- Well and site survey planning work has commenced with a rig

tendering process due to start in Q2 2023

-- An extensive tender process was completed in January 2023 for

the well management services and the contract was awarded to Exceed

Energy, an industry-leader in well management and performance

solutions

-- Parkmead increased its equity in Skerryvore to 50%, and

progressed the project to Phase C as Licence Exploration Operator

with strong industry partners

-- Skerryvore consists of stacked light oil prospects at Mey and Tor intervals

UKCS 33(rd) Offshore Oil & Gas Licensing Round

-- Parkmead, as one of the leading UK independents, remains

committed to the UKCS oil and gas industry and made selective

applications in the UKCS 33(rd) Offshore Oil and Gas Licensing

Round, the outcome of which will be known later in 2023

Record revenue delivered from Kempstone Hill Wind Farm

-- Revenue of GBP343,000 in the six months to 31 December 2022

-- 245% increase in average exported power price realised

-- Over 95% uptime achieved during the period

-- Greencat Renewables have been appointed to review methods of

increasing electricity generation and utilising spare generation

capacity at the Kempstone Hill

-- Kempstone Hill Wind Farm provides power for up to 1,000 homes

and has an attractive inflation-linked, Feed-in Tariff through

until 2036

-- Electricity is sold through a power purchase agreement which

provides valuable upside through strong wholesale electricity

prices

Multiple new renewable energy projects under consideration

-- Environmental studies are ongoing at Pitreadie which are

expected to form part of a major wind farm planning application

-- Parkmead is also conducting a scoping study on a new site in

Scotland which has the potential for a solar farm

Substantial oil and gas reserves

-- 2P reserves of 45.5 MMBoe as at 1 March 2023 (45.6 MMBoe as at 1 March 2022)

Well positioned for further acquisitions and opportunities

-- Parkmead is actively evaluating further acquisition

opportunities in each of its areas of activity - renewables, gas

and oil

Parkmead's Executive Chairman, Tom Cross, commented:

"I am pleased to report that strong operating performance has

been achieved by Parkmead in the six-month period to 31 December

2022.

In line with our strategy, Parkmead now benefits from stable

revenue generated by clean, renewable sources, onshore Scotland.

This is in addition to our high-quality onshore gas assets across

the Netherlands.

The Group has achieved an increase in revenue of over 140% on

the prior year period, and outstanding growth in net cash generated

from operating activities of over 400%.

Parkmead's successful drilling campaign in the Netherlands has

resulted in the LDS-01 well encountering new commercial gas

volumes. This well has been swiftly tied into production

infrastructure, with first gas due imminently.

We continue to maintain strict financial discipline across all

our existing energy projects. This is in addition to the ongoing

evaluation of acquisition opportunities that will complement the

Group and maximise shareholder value."

Enquiries:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Ryan Stroulger (Finance Director)

Henry Steward (Group Commercial Manager)

finnCap Ltd +44 (0) 20 7220 0500

Marc Milmo / Seamus Fricker - Corporate

Finance

Andrew Burdis / Barney Hayward - ECM

Financial Performance

During the six-month period to 31 December 2022, the Group

increased its revenue by over 140% to GBP11.1 million (2021: GBP4.6

million) as Dutch TTF gas prices continued to remain above

historical averages. The Group's high-quality onshore asset base in

the Netherlands, as well as the addition of renewable wind energy

production in Scotland, has provided a strong underlying operating

profit margin.

Net cash generated from operating activities rose strongly by

over 400% to GBP8.6 million (2021: GBP1.7 million). Parkmead

delivered an operating profit before non-cash impairments of GBP7.6

million for the half year (2021: GBP1.8 million), or 7.0p on a per

share basis. An impairment of GBP12.7 million was recorded during

the period relating to licence P1293, following the decommissioning

of the Athena field. Administrative expenses amounted to GBP2.0

million (2021: GBP1.5 million) which included a non-cash expense of

GBP0.8 million in respect of a revaluation of share appreciation

rights. The Group realised a loss before tax of GBP5.2 million

(2021: GBP1.3 million profit before tax). Taxation for the period,

excluding windfall tax, was GBP4.8 million (2021: GBP1.7 million)

due to high average gas prices achieved and the low-cost nature of

our onshore assets. The loss after taxation, excluding the Athena

impairment charge, was GBP1.2 million (2021: GBP0.4 million).

Due to a windfall tax imposed by the Dutch Government, levied

retrospectively on Parkmead's 2022 gas production, the Group

suffered a non-current tax liability of GBP4.0m which relates to

the whole of the calendar year 2022. This tax is not payable until

May 2024. Whilst frustrating, we understand that this windfall tax

will aid the Netherlands population in accessing lower-cost,

low-carbon energy - an ultimate goal for Parkmead, and why we aim

to increase our domestic natural gas output in the region.

Parkmead continues to maintain a strong balance sheet with total

assets at 31 December 2022 of GBP70.3 million (2021: GBP80.5

million). There was a GBP12.7 million cash spend on decommissioning

activities in the six month period to 31 December 2022. After this

spend, cash and cash equivalents at 31 December 2022 were GBP19.2

million (2021: GBP24.1 million), equivalent to 17.6 pence per

share. Short term decommissioning provisions were GBP4.6 million

(2021: GBP13.5 million). Interest bearing loans receivable were

GBP2.9 million (2021: GBP2.9 million). Debt was strictly maintained

at the low level of just GBP0.9 million (2021: GBP0.5 million).

This debt was inherited as a result of the acquisition of Kempstone

Hill Wind Energy Limited.

Review of Activities

Onshore Netherlands

Our Netherlands production remains some of the most efficient

and profitable in Europe, on a per-barrel basis. Production across

the fields continues to decline at slower rates than expected.

Across the six months to 31 December 2022 gross production averaged

18.0 MMscfd, approximately 3,205 barrels of oil equivalent per day

("boepd").

In December, Parkmead announced the spudding of the 'LDS'

two-well drilling campaign in the Netherlands. The LDS wells were

drilled from the existing Diever well site, reducing cost and

expediting the tie-in process in a success case. We are pleased to

report that both wells were drilled safely, on time and under

budget. LDS-01 successfully encountered commercial gas columns in

the primary target horizons. The well was completed and has been

tied in, with first gas expected imminently. LDS-02 was

unfortunately unsuccessful in encountering commercial volumes of

gas however it has greatly helped the joint venture's understanding

of the regional geology for follow-on prospects. LDS-02 has

therefore been suspended and is currently being assessed for

potential re-entry and sidetrack to other nearby prospects.

The operating cost of the combined fields is very low at just

$8.6 per barrel of oil equivalent. These high-quality assets

underpin our Group's outstanding gross profit margin of 89% and

allows for the company to reinvest in further opportunities.

Onshore gas production is considered to play an important role in a

just transition, and we continue to progress further projects on

our licences, in line with government strategy.

Furthermore, excellent progress continues to be made on the

Papekop development. The permitting process is underway, with

commercial discussions progressing around transportation and

offtake. A potential development of the Papekop field would target

35.6 Bcf of gross gas reserves, with potential for upside through

oil production.

UK Oil and Gas

Greater Perth Area ("GPA")

During the period, Parkmead has completed phase one of a Net

Zero feasibility study with the Scott Area partners, and leading

engineering consultancy, Worley. We are pleased to report that the

tie back of the GPA through Scott provides several viable options

for reinjection of the associated Perth gas, post-processing on

Scott. This represents a significant step forward that aligns with

the NSTA strategy for reduced flaring and Net Zero developments.

The Scott platform lies just 10km southeast of the GPA project and

a tie-back would yield a number of mutually beneficial advantages

for both the Scott partnership and Parkmead. Significant efforts

continue into aligning suitable partners for the possible

development of GPA and the potential life extension of neighbouring

infrastructure through which GPA could be developed.

The GPA forms part of a portfolio of opportunities.

Transportation studies for our base case development concept were

previously completed. These have confirmed there are no technical

hurdles associated with the transportation and processing of fluids

from the Perth producing wells all the way through the offshore

infrastructure to the onshore facilities.

The GPA project has the potential to deliver 100 million barrels

recoverable on a P50 basis. Projects like GPA play an important

role in underpinning the security of energy supply that the UK

requires in its transition to net zero. As a fuel that is primarily

used for transportation, manufacturing and petrochemicals, oil will

continue to feature as a vital commodity in the UK over the coming

years. Therefore, it is very important that the UK continues to

develop such projects in order to reduce reliance on

less-regulated, more carbon-intensive imports. Parkmead believes

that production of hydrocarbons from GPA can be done in a

sustainable fashion in alignment with the UK government's most

recent targets on carbon emissions.

Skerryvore

During the period, Parkmead increased its stake in the

high-impact Skerryvore project from 30% to 50% and gained

regulatory approval to progress into the next phase of the licence.

Parkmead will continue as operator in this current phase, which is

testament to the efforts and capability of the project team.

Skerryvore will be Parkmead's first operated exploration well.

Parkmead's joint venture partners on the licence are Serica Energy

(UK) Limited (20%) and CalEnergy (Gas) Limited (30%).

The Company's detailed technical work programme has confirmed

the considerable multi-interval potential of Skerryvore. The

planned well will target the main stacked exploration prospects, at

Mey and Chalk intervals, which studies indicate could contain

significant volumes of light oil. The licence also contains

additional prospectivity at the Ekofisk and Jurassic levels. A

successful discovery will result in a tie back to nearby

infrastructure in line with the NSTA's MER and Hub Strategy for new

developments.

The area around Skerryvore is currently seeing important

activity on several fronts, with Harbour Energy now in the execute

phase of the adjacent Talbot development project, and NEO Energy

proceeding with the redevelopment of Affleck. Activity is also

ongoing on the Isabella discovery by TotalEnergies. Further

development activity is also taking place in the Norwegian sector

in close proximity to Skerryvore at Tommeliten A, a licence

operated by ConocoPhillips.

Fynn

Parkmead (50% and operator) continues to progress the technical

work on the two undeveloped discoveries at Fynn Beauly and Fynn

Andrew ("Fynn") situated in the Central North Sea, plus additional

prospectivity in the Piper formation.

Fynn Beauly is a very large heavy oil discovery with an

estimated in-place volume of up to 1,343 million barrels across

several blocks. Fynn Andrew, is wholly contained on the offered

blocks and holds 49.5 million barrels of oil-in-place on a P50

basis. Parkmead's partner on the offered blocks is Orcadian Energy

(50% working interest).

UKCS 33(rd) Offshore Oil and Gas Licensing Round

Despite industry concerns over the imposition of the Energy

Profits Levy, Parkmead remains committed to the UKCS oil and gas

industry. Parkmead has therefore made selective applications in the

UKCS 33(rd) Offshore Oil and Gas Licensing Round, the outcome of

which will be known later in 2023.

UK Renewable Energy Portfolio

The acquisition of producing renewable energy assets in February

2022 was a complementary addition to our organic renewable energy

projects at Pitreadie. Since the integration of Kempstone Hill, we

have achieved outstanding uptime of 98%, as well as benefiting from

a large increase in wholesale electricity export prices. This has

resulted in record revenue from the wind farm of GBP343,000 in the

six months to 31 December 2022.

Kempstone Hill is a 1.5MW onshore wind farm in Scotland which

benefits from an attractive inflation-linked, Feed-in Tariff

through to 2036. Electricity is sold through a power purchase

agreement which provides exposure to strong wholesale electricity

prices. We anticipate that a tendering process for a new PPA,

effective Q3 2023, will provide another year of strong revenues

from the asset.

At Pitreadie, commercial discussions continue to progress with

potential joint venture partners. Following positive results of

initial studies, further environmental surveys and planning work

are ongoing in support of a major wind farm planning

application.

Parkmead will continue to add to its renewable energy portfolio

through further acquisitions of producing assets as well as

progressing existing organic projects.

Decommissioning

As mentioned in our FY2022 results, Parkmead decided to progress

legacy decommissioning activities on the UKCS in order to

capitalise on lower supply chain costs, agreed before the

significant inflation in the offshore market. The Company is

pleased to report wells across P218 and P1293 have successfully

been decommissioned safely, on time and on budget. P&A

activities across the P1242 licence are ongoing and a number of

techniques have been successfully implemented, reducing time and

cost across this abandonment programme. The completion of this work

on the UKCS will leave Parkmead with no major abandonment

liabilities going forward.

Outlook

Parkmead has delivered significant results at operating level

from its diversified energy portfolio in the six-month period to 31

December 2022, and through the three months post period end. There

are obvious concerns in the upstream industry about the high and

increasing levels of taxation on primary energy production across

Europe, and how that may impact future investment. Despite this

higher taxation, Parkmead has the benefit of having built multiple

opportunities to create additional value, such as those across the

Netherlands, as well as the progression of our Skerryvore project

in the UK Central North Sea. This is in addition to actively

reviewing acquisition opportunities internationally, which would

complement our existing portfolio of assets. The Board is confident

that the Parkmead team is well positioned to drive the business

forward and to build upon the achievements already made to

date.

Tom Cross

Executive Chairman

31 March 2023

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014. Upon the publication of this

announcement, the information contained herein is now considered to

be in the public domain.

Notes:

1. Tim Coxe, Parkmead Group's Managing Director, North Sea, who

holds a First-Class Master's Degree in Engineering and over 30

years of experience in the oil and gas industry, has overseen the

review and approval of the technical information contained in this

announcement. Tim is accountable for the company's HSE, Subsurface,

Drilling, Production Operations and Development Project functions.

Reserves and contingent resource estimates have been produced by

Parkmead's subsurface team and are stated as of 1 March 2023.

Parkmead's evaluation of reserves and resources was prepared in

accordance with the 2007 Petroleum Resources Management System

prepared by the Oil and Gas Reserves Committee of the Society of

Petroleum Engineers and reviewed and jointly sponsored by the World

Petroleum Council, the American Association of Petroleum Geologists

and the Society of Petroleum Evaluation Engineers.

A glossary of key terms can be found at

https://www.nstauthority.co.uk/site-tools/glossary-of-terms/

Condensed Consolidated statement of profit and loss and other

comprehensive income

for the six months ended 31 December 2022

Six months Six months Twelve months

to 31 December to 31 December to 30 June

2022 2021 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Continuous operations

Revenue 11,124 4,633 12,129

Cost of sales (1,331) (837) (1,370)

------------------------------------- ------ ---------------- ----------------- ---------------

Gross profit 9,793 3,796 10,759

Exploration and evaluation expenses 2 (153) (465) (1,116)

Impairment of goodwill - - (2,174)

Impairment of property, plant (12,733) - -

and equipment: development &

production

Gain / (loss) on sale of assets 10 - (31)

Administrative expenses 3 (2,049) (1,457) (2,231)

------------------------------------- ------ ---------------- ----------------- ---------------

Operating profit (5,132) 1,874 5,207

Finance income 81 37 73

Finance costs (113) (625) (1,317)

------------------------------------- ------ ---------------- ----------------- ---------------

(Loss) / profit before taxation (5,164) 1,286 3,963

Taxation (4,770) (1,697) (4,777)

Windfall taxation (4,044) - -

------------------------------------- ------ ----------------- ---------------

Loss for the period attributable

to the equity holders of the

Parent (13,978) (411) (814)

------------------------------------- ------ ---------------- ----------------- ---------------

Loss Per share (pence)

Basic 5 (12.79) (0.38) (0.75)

Diluted (12.79) (0.38) (0.75)

Condensed Consolidated statement of financial position

as at 31 December 2022

31 December 31 December 30 June 2022

2022 2021

Notes (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment:

development & production 4,370 14,613 15,843

Property, plant and equipment:

other 6,200 4,391 6,636

Goodwill 1,084 2,174 1,084

Exploration and evaluation assets 34,369 30,685 34,346

Interest bearing loans 4 - 2,900 2,900

Deferred tax assets 187 - 187

----------------------------------- ------

Total non-current assets 46,210 54,763 60,996

----------------------------------- ------ -------------------- -------------------- -------------------

Current assets

Trade and other receivables 1,973 1,597 2,018

Interest bearing loans 4 2,937 - -

Inventory 17 46 42

Cash and cash equivalents 19,179 24,128 23,263

----------------------------------- ------

Total current assets 24,106 25,771 25,323

----------------------------------- ------ -------------------- -------------------- -------------------

Total assets 70,316 80,534 86,319

----------------------------------- ------ -------------------- -------------------- -------------------

Current liabilities

Trade and other payables (10,666) (2,975) (3,545)

Decommissioning provisions (4,562) (13,498) (19,228)

Current tax liabilities (2,848) (1,219) (1,432)

----------------------------------- ------

Total current liabilities (18,076) (17,692) (24,205)

----------------------------------- ------ -------------------- -------------------- -------------------

Non-current liabilities

Other liabilities (1,242) (903) (1,181)

Loan (905) (500) (948)

Deferred tax liabilities (1,925) (1,339) (1,925)

Windfall taxes (4,044) - -

Decommissioning provisions (1,108) (2,739) (1,066)

----------------------------------- ------ -------------------- -------------------- -------------------

Total non-current liabilities (9,224) (5,481) (5,120)

----------------------------------- ------ -------------------- -------------------- -------------------

Total liabilities (27,300) (23,173) (29,325)

----------------------------------- ------ -------------------- -------------------- -------------------

Net assets 43,016 57,361 56,994

----------------------------------- ------ -------------------- -------------------- -------------------

Equity attributable to equity

holders

Called up share capital 19,688 19,688 19,688

Share premium 88,017 88,017 88,017

Merger reserve 3,376 3,376 3,376

Retained deficit (68,065) (53,720) (54,087)

----------------------------------- ------ -------------------- -------------------- -------------------

Total equity 43,016 57,361 56,994

----------------------------------- ------ -------------------- -------------------- -------------------

Condensed Consolidated statement of changes in equity

for the six months ended 31 December 2022

Share Share Merger Retained Total

capital premium reserve deficit

------------------------------ ------------- ------------- ------------- ------------- -------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------- ------------- ------------- ------------- -------------

At 30 June 2021 19,688 88,017 3,376 (53,360) 57,721

------------------------------ ------------- ------------- ------------- ------------- -------------

Loss for the period - - - (411) (411)

------------------------------ ------------- ------------- ------------- ------------- -------------

Total comprehensive loss for

the year - - - (411) (411)

------------------------------ ------------- ------------- ------------- ------------- -------------

Share-based payments - - - 51 51

------------------------------ ------------- ------------- ------------- ------------- -------------

At 31 December 2021 19,688 88,017 3,376 (53,720) 57,361

------------------------------ ------------- ------------- ------------- ------------- -------------

Loss for the period - - - (403) (403)

------------------------------ ------------- ------------- ------------- ------------- -------------

Total comprehensive loss for

the year - - - (403) (403)

------------------------------ ------------- ------------- ------------- ------------- -------------

Share-based payments - - - 36 36

------------------------------ ------------- ------------- ------------- ------------- -------------

At 30 June 2022 19,688 88,017 3,376 (54,087) 56,994

------------------------------ ------------- ------------- ------------- ------------- -------------

Loss for the period - - - (13,978) (13,978)

------------------------------ ------------- ------------- ------------- ------------- -------------

Total comprehensive loss for

the year - - - (13,978) (13,978)

------------------------------ ------------- ------------- ------------- ------------- -------------

At 31 December 2022 19,688 88,017 3,376 (68,065) 43,016

------------------------------ ------------- ------------- ------------- ------------- -------------

Condensed Consolidated statement of cashflows

for the six months ended 31 December 2022

Six months Six months Twelve months

to 31 December to 31 December to 30 June

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cashflows from operating activities

Cashflows from operations 11,779 2,474 8,038

Taxation paid (3,203) (770) (3,508)

--------------------------------------------- ------------------- ------------------- -------------------

Net cash generated from operating

activities 8,576 1,704 4,530

--------------------------------------------- ------------------- ------------------- -------------------

Cash flow from investing activities

Interest received 81 37 73

Acquisition of exploration and evaluation

assets (253) (360) (548)

Proceeds from sale of property, plant

and equipment 163 - 874

Acquisition of property, plant and

equipment: development and production (275) (46) (123)

Acquisition of property, plant and

equipment: other - (1) (3,114)

Decommissioning expenditure (12,754) (233) (1,667)

Net cash on acquisition of Kempstone

Hill - - 360

--------------------------------------------- ------------------- ------------------- -------------------

Net cash used in investing activities (13,038) (603) (4,145)

--------------------------------------------- ------------------- ------------------- -------------------

Cash flow from financing activities

Lease payments (168) (162) (375)

Interest paid (31) (24) (45)

Repayment of loans and borrowings (43) - (542)

--------------------------------------------- ------------------- ------------------- -------------------

Net cash used in financing activities (242) (186) (962)

--------------------------------------------- ------------------- ------------------- -------------------

Net increase / (decrease) in cash

and cash equivalents (4,704) 915 (577)

Cash and cash equivalents at beginning

of period 23,263 23,378 23,378

Effect of foreign exchange rate differences 620 (165) 462

--------------------------------------------- ------------------- ------------------- -------------------

Cash and cash equivalents at end

of period 19,179 24,128 23,263

--------------------------------------------- ------------------- ------------------- -------------------

Notes to the Interim financial statements

1. Accounting policies

General Information

These condensed consolidated interim financial statements of The

Parkmead Group plc and its subsidiaries (the "Group") were approved

by the Board of Directors on 30 March 2023. The Parkmead Group plc

is the parent company of the Group. Its shares are quoted on AIM,

part of the London Stock Exchange. The registered office is located

at 20 Farringdon Street, 8th Floor, London, England, EC4A 4AB.

The condensed consolidated interim financial statements for the

period 1 July 2022 to 31 December 2022 are unaudited. In the

opinion of the Directors, the condensed consolidated interim

financial statements for the period presents fairly the financial

position, and results from operations and cash flows for the period

in conformity with the generally accepted accounting principles

consistently applied. The condensed consolidated interim financial

statements incorporate unaudited comparative figures for the

interim period 1 July 2021 to 31 December 2021 and the audited

financial year ended 30 June 2022.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory accounts for the year

ended 30 June 2022 which were prepared under International

Financial Reporting Standards ("IFRS") as adopted for use in the UK

were filed with the Registrar of Companies. The auditors reported

on those accounts and their report was unqualified and did not

contain a statement under either Section 498 (2) or Section 498 (3)

of the Companies Act 2006 and did not include references to any

matters to which the auditor drew attention by way of emphasis.

Basis of preparation

The interim financial information in this report has been

prepared under the historical cost convention using accounting

policies consistent with International Financial Reporting

Standards (IFRS) as adopted by the UK and IFRS Interpretations

Committee (IFRIC) interpretations. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and IFRIC and there is an ongoing process of review and

endorsement by the UK. The financial information has been prepared

on the basis of UK-adopted international accounting standards that

the Directors expect to be adopted and applicable as at 30 June

2022.

The Group has chosen not to adopt IAS 34 - Interim Financial

Statements, in preparing these financial statements.

The accounting policies applied in this report are the same as

those applied in the consolidated financial statements for the year

ended 30 June 2022.

Going concern

The Directors have made an assessment of the Group's ability to

continue as a going concern. As at 31 December 2022 the Group had

GBP43.0 million of net assets of which GBP19.2 million is held in

cash, of which GBP4.7 million is held as restricted cash.

The Group's production in the Netherlands has been uninterrupted

by COVID-19 and the Group and Company employees have utilised

technology to work remotely where required. The Group's current

cash reserves are the principal source of funding and are expected

to more than exceed its estimated liabilities. Based on these

circumstances, the Directors have considered it appropriate to

adopt the going concern basis of accounting in preparing these

interim results.

2. Exploration and evaluation expenses

Exploration and evaluation expenses includes impairment charges

of GBP18,000 recorded in respect of exploration licences

relinquished in the period (Six months to 31 December 2021:

GBP318,000, Twelve months to 30 June 2022: GBP860,000).

3. Administrative expenses

Administrative expenses include an expense in respect of a

non-cash revaluation of share appreciation rights (SARs) totalling

GBP800,000 (Six months to 31 December 2021: GBP238,000 charge, 12

months to 30 June 2022: GBP418,000 charge). The SARs may be settled

by cash or shares and are therefore revalued with the movement in

share price.

Administrative expenses also includes a non-cash share based

payment charge of GBPNil due to options which have been granted,

lapsed or forfeited (Six months to 31 December 2021: GBP51,000, 12

months to 30 June 2022: GBP87,000 credit).

Administrative expenses also include a foreign exchange gain of

GBP620,000 (Six months to 31 December 2021: GBP165,000 expense, 12

months to 30 June 2022: GBP462,000 gain).

4. Interest bearing loans

On 27 July 2017, The Parkmead Group plc entered into a credit

facility with Energy Management Associates Limited, whereby

Parkmead agreed to lend up to GBP2,900,000 to Energy Management

Associates Limited.

The loan has a period of two years, with a fixed interest rate

of 2.5 per cent. Interest charged by Parkmead during the period

amounted to GBP37,000 (Six months to 31 December 2021: GBP37,000,

Twelve months to 30 June 2022: GBP73,000).

On 26 July 2021, The Parkmead Group plc entered into a 24-month

extension of the loan.

5. Loss per share

Loss per share attributable to equity holders of the Company

arise as follows:

Six months Six months Twelve months

to 31 December to 31 December to 30 June

2022 2021 2022

(unaudited) (unaudited) (audited)

Loss per 1.5p ordinary share (pence)

Basic (12.79) (0.38) (0.75)

Diluted (12,79) (0.38) (0.75)

-------------------------------------- ---------------- ---------------- --------------

The calculations were based on the following information:

Six months Six months Twelve months

to 31 December to 31 December to 30 June

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Loss attributable to ordinary shareholders (13,978) (411) (814)

-------------------------------------------- ---------------- ---------------- --------------

Weighted average number of shares

in issue

Basic weighted average number of shares 109,266,931 109,266,931 109,266,931

-------------------------------------------- ---------------- ---------------- --------------

Dilutive potential ordinary shares

Share options 10,778,154 10,778,154 10,778,154

-------------------------------------------- ---------------- ---------------- --------------

Basic loss per share is calculated by dividing the loss for the

period by the weighted average number of ordinary shares

outstanding during the period.

Diluted earnings per share is calculated by dividing the loss

for the period by the weighted average number of ordinary shares

outstanding during the period plus the weighted average number of

ordinary shares that would be issued on conversion of all the

dilutive potential ordinary shares into ordinary shares.

Diluted loss per share

Loss per share requires presentation of diluted loss per share

when a company could be called upon to issue shares that would

decrease net profit or net loss per share. When the Group makes a

loss the outstanding share options are anti-dilutive and so are not

included in dilutive potential ordinary shares.

6. Notes to the statement of cashflows

Reconciliation of operating (loss) / profit to net cash flow

from operations

Six months Six months Twelve months

to 31 December to 31 December to 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

Operating (loss) / profit (5,132) 1,874 5,207

Depreciation 326 341 726

Amortisation and exploration write-off 18 318 860

(Gain) / loss on sale of property,

plant and equipment (10) - 31

Provision for share based payments - 51 87

Currency translation adjustments (620) 165 (462)

Impairment of Goodwill - - 2,174

Impairment of property, plant and 12,733 - -

equipment: development & production

Decreases / (increase) in receivables 45 (359) (667)

Decrease in stock 25 20 24

Increase in payables 4,394 64 58

---------------------------------------- ---------------- ---------------- --------------

Net cash flow from operations 11,779 2,474 8,038

---------------------------------------- ---------------- ---------------- --------------

7. Post balance sheet events

In January 2023 Parkmead E&P and joint venture partners

completed a six-well decommissioning campaign across the P1293

licence (former Athena wells). The final remaining subsea

infrastructure will be removed, and recycled where possible,

throughout Q2 2023.

Decommissioning activities on the P1242 licence (former Platypus

wells) commenced in March 2023.

The two-well LDS drilling campaign in the Netherlands was

completed safely, on time and under budget between November 2022

and February 2023. LDS-01 will be used as a gas-producing well and

has already been successfully tied in to surrounding

infrastructure. The LDS-02 well did not encounter a sufficient

hydrocarbon column and has been suspended for potential

re-entry.

A former subsidiary, Deo Petroleum Limited, has been restored to

the Register of Companies. This is in relation to ongoing work

across the Greater Perth Area licences.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR WPUBUWUPWGQU

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

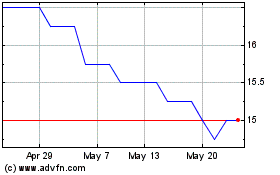

The Parkmead (AQSE:PMG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

The Parkmead (AQSE:PMG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024