TIDMSAA TIDMNFC

RNS Number : 7659E

M&C Saatchi PLC

31 October 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO ANY RESTRICTED JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION.

FOR IMMEDIATE RELEASE

31 October 2022

M&C Saatchi plc

("M&C Saatchi" or the "Company")

Results of Court Meeting and General Meeting on 31 October

2022

Further to the announcement on 21 October 2022 (the "Notice of

Reconvened Meetings"), which set out the reasons why ADV and Vin

Murria, who together hold approximately 22.3% of the issued share

capital of M&C Saatchi, were required by virtue of their

previous statement to vote against the Scheme, the M&C Saatchi

Directors announce the results of the Court Meeting held today in

connection with the Next 15 Offer. As set out in the Notice of

Reconvened Meetings, based solely on the implied value of the Next

15 Offer at that time, the M&C Saatchi Directors were unable to

recommend that M&C Saatchi Shareholders vote in favour of the

Scheme at the Reconvened M&C Saatchi Court Meeting.

At the Court Meeting, as more particularly described below, the

requisite majority of Scheme Shareholders did not vote in favour of

the resolution to approve the Scheme.

Due to the result of the Court Meeting, the Company did not

proceed to convene the General Meeting.

Full details of the resolution that was proposed at the Court

Meeting is set out in the notice of the Court Meeting contained in

the Scheme Document.

Lapse of the Next 15 Offer

As a result of votes cast at the Court Meeting, the M&C

Saatchi Directors note that the Next 15 Offer has not satisfied the

conditions as outlined in the Scheme Document and as such, the Next

15 Offer has now lapsed. As both the Next 15 Offer and ADV Offer

have lapsed, M&C Saatchi is no longer in an offer period for

the purposes of the Takeover Code.

The M&C Saatchi Directors believe in the strong, standalone

future prospects of M&C Saatchi. Following the lapse of both

the Next 15 Offer and the ADV Offer, the M&C Saatchi Directors

look forward to continuing the implementation of M&C Saatchi's

strategy as an independent business including to: invest in high

margin businesses, enhance margins, further simplify the group,

implement technology platforms, and scale data and analytics

capabilities, and reduce costs.

Voting results of the Court Meeting

The results of the poll at the Court Meeting are set out in the

table below. Each Scheme Shareholder present in person or by proxy

was entitled to one vote for each Scheme Share held at the Voting

Record Time.

Results of FOR AGAINST TOTAL

Court Meeting

Number of

Scheme Shares

voted 8,443,468 69,069,738 77,513,206

---------- ----------- -----------

Percentage

of Scheme

Shares voted

(1) 10.89 89.11 100.00

---------- ----------- -----------

(1) Rounded to two decimal places.

Further Information

Capitalised terms used but not defined in this announcement

shall have the meanings given to them in the Scheme document

related to the Next 15 Offer posted to M&C Saatchi Shareholders

on 17 June 2022 (the "M&C Saatchi

Scheme Document"), a copy of which is available on M&C Saatchi's website at https://mcsaatchiplc.com/application/files/2716/6308/5670/Scheme_Document_17_June_2022.pdf

For further information please call: M&C Saatchi plc +44 (0)20-7543-4500

Gareth Davis, Chairman

Numis Securities +44 (0)20-7260-1000

Nick Westlake, Stuart Ord, Iqra

Amin

Liberum +44 (0)20-3100-2000

Neil Patel, Benjamin Cryer, Will

King, NOMAD

Tim Medak, Mark Harrison, M&A

Brunswick +44 (0)207-404-5959

Sumeet Desai, Stuart Donnelly,

Kate Pope

Important Notices

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise, or the solicitation of any vote in

favour or approval of any offer in any jurisdiction where to do so

would constitute a violation of the laws of such jurisdiction and

any such offer (or solicitation) may not be extended in any such

jurisdiction.

Any securities referred to herein have not been and will not be

registered under the US Securities Act of 1933, as amended, or with

any securities regulatory authority of any state of the United

States and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

thereunder.

This announcement has been prepared in accordance with English

law and the City Code of Takeovers and Mergers (the "Code"), and

information disclosed may not be the same as that which would have

been prepared in accordance with laws outside of the United

Kingdom. The distribution of this announcement in jurisdictions

outside the United Kingdom may be restricted by law and therefore

persons into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

Disclaimer

Numis Securities Limited ("Numis"), which is authorised and

regulated by the Financial Conduct Authority in the United Kingdom,

is acting exclusively for M&C Saatchi as joint financial

adviser and joint broker and for Next 15 as nominated adviser and

broker and no one else in connection with the ADV Offer and the

Next 15 Offer and will not be responsible to anyone other than

M&C Saatchi or Next 15 for providing the protections afforded

to clients of Numis nor for providing advice in relation to the ADV

Offer and the Next 15 Offer or any other matters referred to in

this Announcement. Neither Numis nor any of its affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Numis in connection

with this Announcement, any statement contained herein or

otherwise.

Liberum Capital Limited, which is authorised and regulated by

the Financial Conduct Authority in the United Kingdom, is acting

exclusively for M&C Saatchi as nominated adviser and broker and

no one else in connection with the ADV Offer and the Next 15 Offer

and will not be responsible to anyone other than M&C Saatchi

for providing the protections afforded to clients of Liberum

Capital Limited nor for providing advice in relation to the ADV

Offer and the Next 15 Offer or any other matters referred to in

this Announcement. Neither Liberum Capital Limited nor any of its

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Liberum Capital Limited in connection with this Announcement,

any statement contained herein or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMMBBTTMTMJBRT

(END) Dow Jones Newswires

October 31, 2022 08:16 ET (12:16 GMT)

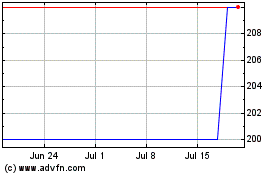

M&C Saatchi (AQSE:SAA.GB)

Historical Stock Chart

From Dec 2024 to Dec 2024

M&C Saatchi (AQSE:SAA.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024