MARKET COMMENT: S&P/ASX 200 Faces Drag from FOMC Minutes

21 February 2013 - 10:30AM

Dow Jones News

2259 GMT [Dow Jones] Australia's S&P/ASX 200 faces a drag

from bearish FOMC minutes which pushed the S&P 500 down 1.2%,

its biggest fall in 3 months. IG strategist Evan Lucas tips a 0.6%

fall to 5069, with BHP (BHP.AU) expected to do most of the damage

after its ADRs fell to A$37.59, down 2.9% vs Wednesday's domestic

close. Weaker commodity prices could also be a negative factor for

the Australian market, with LME copper down 1.1% and Nymex crude

falling 2.3% overnight, although spot iron ore rose 0.6% to

US$158.90. The expiry of February S&P/ASX 200 index options

could cause additional volatility, and potentially some resilience

in the market at the open, given its recent bullish trend. However,

after the October expiry debacle, traders say a lot of options

positions will have already been rolled to the next contract month.

That might partly explain Wednesday's strength in the market.

February equity options are also expiring at the close of trading.

The market will otherwise be focused on results from the likes of

AMP (AMP.AU), Origin (ORG.AU), IAG (IAG.AU), Iluka (ILU.AU), Qantas

(QAN.AU), Brambles (BXB.AU) and Goodman Group (GMG.AU). The

S&P/ASX 200 closed up 0.3% at 5098.7 Wednesday.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

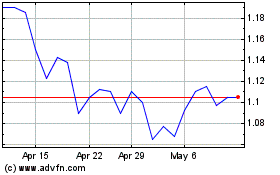

AMP (ASX:AMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

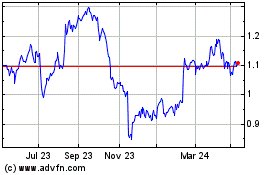

AMP (ASX:AMP)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about AMP Limited (Australian Stock Exchange): 0 recent articles

More Amp News Articles