AMP Moves to Slim Down With Exit From Wealth Protection, Mature Operations

25 October 2018 - 9:54AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Under-pressure Australian

financial-services heavyweight AMP Ltd. (AMP.AU) has moved to exit

a number of operations in deals it expects will net at least 2.17

billion Australian dollars (US$1.53 billion) and release capital to

bolster its balance sheet.

In a statement Thursday, AMP said it had agreed to sell a

portfolio of wealth-protection insurance and mature businesses,

reached a reinsurance deal in New Zealand and decided to sell its

New Zealand wealth-management and advice businesses via an initial

public offering.

The company had been reviewing its portfolio of assets since

February, but stepped up its efforts in the wake of damaging

revelations that emerged during an ongoing probe into misconduct in

Australia's financial industry that sparked the departure of AMP's

chief executive and chairman and saw several board members step

down.

AMP said it had agreed to sell its Australian and New Zealand

wealth-protection and mature AMP Life businesses to Resolution Life

Group Holdings LP in deal it valued at A$3.3 billion, including

A$1.9 billion in cash. It also signed a binding reinsurance

agreement with Swiss Re AG for its New Zealand retail

wealth-protection operation that will release up to A$150 million

in regulatory capital.

The company also said it aimed to launch an IPO for its New

Zealand wealth and advice arm in 2019, which would strip out a

business with operating earnings of about A$40 million but would

release further capital for AMP.

Excluding the planned IPO, AMP said it expected net cash and

preference shares in AMP Life of A$1.06 billion after costs, plus a

further almost A$1.12 billion in income-generating equity

investments in the operations it is offloading.

The deals mark a major step toward reshaping AMP as a simpler,

more focused company, acting Chief Executive Mike Wilkins said. He

said incoming CEO Francesco De Ferrari had a mandate to transform

the company and the changes announced on Thursday would give him

greater flexibility to set a new strategy.

AMP was forced to apologize in April for misconduct and failings

in its regulatory disclosures revealed in a royal-commission

inquiry into the wider financial industry, including allegation the

company misled a regulator over fees charged to customers for

advice it failed to deliver. In the wake of that, AMP's CEO,

chairman and several board members stepped down.

In testimony that month, the corporate regulator said eight

financial-services firms have since 2013 reported breaches where

they charged customers a fee without providing regular advice. AMP

and the country's biggest banks have been ordered to review

financial advice to customers going back a decade, and have stepped

up a process of compensation and remediation that for many

companies is expected to continue into next year.

Mr. De Ferrari, a 17-year veteran of Credit Suisse Group AG

(CS), which includes time as CEO of South East Asia, will take the

helm in December. In June, David Murray, a former CEO of

Commonwealth Bank of Australia and head of a government review of

the financial system that concluded in 2014, took over as

chairman.

Mr. Wilkins said 2019 would be a year of transition for AMP,

with the planned IPO and the exit from the wealth-protection and

other assets set to complete during the second half of the year.

With those moves, he said the company would be focused on

higher-growth operations and would have a strengthened balance

sheet.

In the third quarter of this year, AMP's Australian

wealth-management business logged net cash outflows of A$1.5

billion but a A$579 million increase in assets under management to

A$132.6 billion. The challenges for the wealth business were

partially offset by resilience in its AMP Capital and AMP Bank

units, with the Capital arm recording net cash inflows of A$521

million and the retail banking business's total loan book steady at

about A$20 billion, AMP said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 24, 2018 18:39 ET (22:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

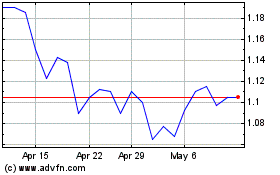

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

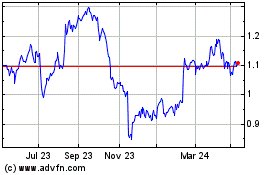

AMP (ASX:AMP)

Historical Stock Chart

From Mar 2024 to Mar 2025