AMP Taps Shareholders to Fund Company Reset After Big 1st Half Loss -- Update

08 August 2019 - 11:34AM

Dow Jones News

By Robb M. Stewart and David Winning

SYDNEY--AMP Ltd. (AMP.AU), Australia's biggest wealth manager,

is turning to investors for cash and will accept less for unwanted

assets as it seeks the money to reinvent itself after a surge in

fund outflows.

The financial-services provider has been struggling with the

loss of funds after a government-ordered probe in 2018 of

misconduct in the country's financial industry heard it was among

companies that had charged fees for customer advice it didn't

provide and that it had sought to mislead regulators. Early last

year, the company's chief executive, chairman and several board

members resigned.

On Thursday, the company said it planned to invest heavily in a

three-year plan to rebuild its wealth-management business, tackle

legacy issues and position AMP Capital and its banking arm for

growth.

It has booked impairment charges of 2.35 billion Australian

dollars (US$1.59 billion), pitching it to a A$2.3 billion net loss

in the six months through June from a A$115 million profit in the

first half of the prior financial year.

The loss reflected the challenges facing AMP and the actions

taken to address them, said Francesco De Ferrari, the former head

of Credit Suisse's Asia-Pacific private banking business who joined

AMP as CEO in December. He added the impairment didn't materially

impact financial stability and shouldn't overshadow a resilient

underlying performance, particularly from AMP Capital and AMP Bank

during the first half.

AMP recorded net cash outflows of A$3.1 billion in the six

months through June, compared with A$873 million outflows in the

same period last year, which it said was a reflection of reputation

damage and a focus on client retention. There were signs of

improvement emerging toward the end of the first half, it said.

AMP said it would invest between A$1 billion and A$1.3 billion

in order to return to growth and deliver A$300 million in running

annual cost savings by 2022.

AMP would seek to raise A$650 million selling shares at a

discount to institutional shareholders in an underwritten placement

and offer shares to small shareholders, to bolster its balance

sheet.

It would also work on a revised deal to sell AMP Life, a basket

of mature businesses and its Australian and New Zealand

wealth-protection insurance unit. An earlier agreement to sell AMP

Life to Resolution Life Group Holdings LP for A$3.3 billion was

derailed this year by the concerns of New Zealand's central

bank.

AMP said it had also cut the price of a deal with Resolution

Life, and would now accept A$2.5 billion in cash and a 20% equity

interest worth about A$500 million in a new Australian company

controlled by Resolution Life that would become the owner of AMP

Life. The pair were working with regulators in Australia and New

Zealand to address requirements for a change in control of the

assets, it said.

AMP has suspended dividend payments and said it was on track to

complete a customer compensation and remediation program during

2021.

It also said Chief Financial officer-designate John Moorhead had

decided to leave to pursue other opportunities, and Deputy CFO

James Georgeson would step in on an acting basis as retiring

finance chief Gordon Lefevre prepares to hand over the role.

Write to Robb M. Stewart and robb.stewart@wsj.com and David

Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 07, 2019 21:19 ET (01:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

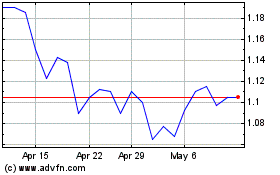

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

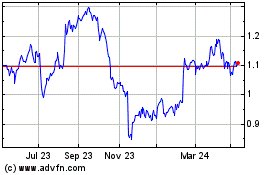

AMP (ASX:AMP)

Historical Stock Chart

From Mar 2024 to Mar 2025