3rd UPDATE: China Cuts 1st Half 2011 Rare-Earth Export Quotas

29 December 2010 - 6:28AM

Dow Jones News

China cut its quotas on first-half exports of rare-earth metals

around 35%, a move likely to exacerbate concerns among global

buyers of the minerals after an even deeper cut late this year.

China supplies around 95% of the global market for rare earths,

metals that are used in high-tech batteries, televisions, mobile

phones and defense products. Its decision to cut export quotas by

72% for the second half of 2010 met with worldwide criticism that

it was taking undue advantage of its market-dominant position to

engineer a rise in rare-earth prices. That would leave high-tech

industries little choice but to locate to China.

A supply crunch would have its deepest impact on Japanese

technology manufacturers such as Hitachi Ltd. (HIT). But it's not

uniquely a Japanese problem, notes Hallgarten & Co. strategist

Christopher Ecclestone. Japanese manufacturers use some of what

they receive from China, but Sumitomo Corp. (8053.TO, SSUMY) and

others convert and re-export the minerals, he said. U.K.-based

Dyson's vacuum motors contain magnets made of neodymium, a

rare-earth element, while aerospace companies like Boeing (BA) and

Lockheed Martin (LMT) use these materials for guidance systems.

China's decision to cut export quotas is stoking trade tensions

with the U.S. less than a month before President Hu Jintao arrives

for a visit with President Barack Obama.

"We are very concerned about Chian's export restraints on

rare-earth materials," said a spokeswoman from the U.S. Trade

Representative's office, adding "we have raised our concerns with

China and we are continuing to work closely on the issue with

stakeholders."

For its part, China has maintained that the cuts are in line

with sustainable development, citing concerns over environmental

degradation associated with mining the metals.

First-half 2011 quotas total 14,508 metric tons, down about 35%

compared with the same period this year, according to data from the

Ministry of Commerce Tuesday.

The cuts depart from comments by Commerce Minister Chen Deming,

who said earlier this month that China will largely leave quotas

for the rare minerals unchanged in 2011. China could still raise

its second-half 2011 quotas, leaving next year's exports roughly

equivalent to 2010.

Rare earths burst into the limelight in September, when Japanese

importers claimed China had suspended shipments of the metals after

Japan detained a Chinese fishing boat captain whose trawler

collided with Japanese patrol vessels near islands both countries

claim.

In response to China's increasingly strict regulation of its

domestic rare-earth industry and soaring prices, major importers

like Japan and the U.S. are seeking out alternative suppliers,

including Australia, Mongolia and Thailand.

Two big producers are already ramping up: Lynas Corp. (LYSDY) in

Australia and Molycorp Inc. (MCP) in the U.S., which just this week

began blasting in an open-pit mine in the California desert that

had been a major rare-earths producer before mining stopped in

2002.

Chinese officials have welcomed the trend, saying it is

irrational for China to supply the whole world's rare-earth needs

with just 30% of global reserves.

"Every country that has reserves should start to exploit their

resources instead of relying on China," the country's Chamber of

Minerals, Metals and Chemicals Importers & Exporters President

Xu Xu said Tuesday at a rare-earth conference in Beijing.

Xu also predicted that rare-earth prices will inevitably

increase, in line with most commodity prices, including copper, oil

and iron ore.

But China's dominance won't be easily eroded, said Wang Caifeng,

a former senior official with Ministry of Industry &

Information Technology's raw material department.

"I am confident that China will hold its bellwether position in

the global rare-earth industry in the long term," he said.

Meanwhile, annual demand for rare earths will keep rising--to

around 200,000-250,000 tons by 2015, Wang said without providing a

comparative figure for 2010.

-Yajun Zhang contributed to this article, Dow Jones Newswires;

(86 10) 8400-7712; yajun.zhang@dowjones.com

--James Areddy, Chuin-Wei Yap, Caitlin Nish, Tatyana Shumsky and

Tom Barkley contributed to this article

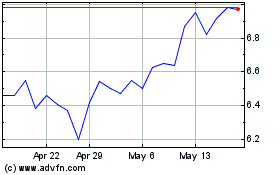

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Oct 2024 to Nov 2024

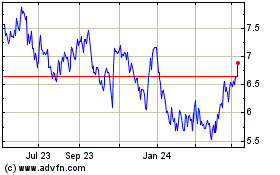

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Nov 2023 to Nov 2024