MARKET MOVEMENTS:

-- Brent crude oil is down 0.1% at $87.08 a barrel.

-- European benchmark gas is up 0.1% to EUR49.34 a

megawatt-hour.

-- Gold futures are down 0.1% at $1,984.60 a troy ounce.

-- LME three-month copper futures are down 0.7% at $8,024.50 a

metric ton.

-- Wheat futures are up 0.4% to $5.83 a bushel.

TOP STORY:

Why the Shine Has Come Off Clean-Energy Stocks

Clean-energy stocks have fallen out of favor, with pressures

created by rising interest rates outweighing supportive government

policies.

The iShares Global Clean Energy ETF reached its lowest level

since July 2020 this week. The exchange-traded fund invests in

renewable-energy companies and utilities in line with a benchmark

compiled by S&P Dow Jones Indices, including First Solar and

Plug Power. It has plunged 33% this year.

Some stocks have fallen even harder. U.S.-listed Enphase Energy

has shed 64% in 2023, while competitor SolarEdge Technologies has

sunk more than 70%. Excluding stocks that have been ejected from

the S&P 500, SolarEdge ranks as the index's worst performer

this year.

Supply-chain problems and waning demand have added to the

challenges created by higher borrowing costs. The result: a

stock-market selloff despite commitments by the U.S. and other

large economies to foster sustainable power generation.

OTHER STORIES:

Exxon, Chevron Look to the West in an Increasingly Uncertain

World

As the world becomes more dangerous, the two largest Western

crude producers are focusing their investments closer to home.

Chevron on Monday announced that it was acquiring Hess in a $53

billion deal that gives it access to one of this century's biggest

oil finds in the South American country of Guyana and allows it to

double down on shale by expanding its presence to North Dakota.

Both regions are established oil producers with limited

geopolitical tensions, affording Chevron new reserves with fewer

risks.

The deal follows a megadeal in the U.S. shale patch by Exxon

Mobil, which this month acquired Pioneer Natural Resources in a $60

billion merger that anchors its future to the prolific Permian

Basin of West Texas and New Mexico.

The back-to-back acquisitions signal that the oil majors are

increasingly turning their attention to the Western Hemisphere as

international investments are complicated by the threat of

expanding regional conflicts, from Ukraine to the Middle East.

--

Sibanye-Stillwater Says More Than 4,000 Workers Could Be

Affected by Restructuring

Sibanye-Stillwater said that more than 4,000 employees and

contractors could potentially be affected by the proposed

restructuring of four shafts at its South Africa platinum group

metal operations, and that it will consult with unions and

non-unionized employees.

The Johannesburg-listed precious metals miner said one of the

shafts ceased production in 2022 and that one other was at the end

of its operating life, adding that the remaining two required

restructuring so as to achieve sustainable production.

As an alternative to closure, it is proposing reducing the

workforce at two of the shafts, the company said.

--

Global Fossil-Fuel Demand to Hit New Record in 2024, Report

Says

Global demand for fossil fuels is likely to hit a new record

next year, amid surging demand from Asia, according to a new

report.

The Economist Intelligence Unit report said global demand for

coal, oil and gas is set to reach new heights in 2024, with high

commodity prices likely to spur investment into the sector.

Global energy consumption is likely to rise by 1.8% on year in

2024, with oil demand alone rising 1.7%. Much of this will be

spurred by demand from Asia, Latin America and the Middle East,

despite surging prices for energy, the EIU said Wednesday.

MARKET TALKS:

Fresnillo Drops After 3Q Output Falls, Costs Weigh

1017 GMT - Fresnillo shares drop nearly 2% after the Mexican

precious-metal miner reported lower third-quarter silver and gold

production, but stuck to its full-year guidance. Lower mining

grades in the quarter across the company's flagship silver mines

drove most of the production downturn, Citigroup says. Given the

run rate for the first nine months of 2023, full-year production is

most likely to be at the lower end of Fresnillo's guidance for both

silver and gold, Citi says. "The company has also flagged that cost

headwinds from inflation and currency headwinds are likely to

impact earnings in 2H23, implying limited room for softening in the

rate of cost increase," Citi analysts say in a note.

(philip.waller@wsj.com)

--

Palm Oil Rises in Possible Technical Rebound

1015 GMT - Palm oil ended higher, reversing earlier losses in a

possible technical rebound after prices fell to their lowest in

more than a week earlier in the session. Prices seem to have been

supported near MYR3,650/ton after retreating from the MYR3,700/ton

level, based on technical analysis, Lim Tai An, an analyst at

Phillip Nova, says in a commentary. The Bursa Malaysia Derivatives

contract for January delivery closed MYR15 higher at MYR3,682 a

ton. (ronnie.harui@wsj.com)

--

SSAB's Solid Earnings Should be Well Received

0854 GMT - SSAB's solid earnings and cash flow delivery with

in-line guidance should be well received by the market, and could

be a catalyst for small positive revisions to full-year 2023

consensus estimates, Citi analyst Krishan Agarwal says in a note.

SSAB delivered a solid set of 3Q results with reported Ebitda 13%

ahead of Visible Alpha consensus, driven by steel pricing, and a

large beat on free cash flow, he says. SSAB also announced a SEK2.5

billion share buy back program, highlighting the continued strength

in its earnings and cash flow while 4Q guidance is largely in line

with current market expectations. "We expect shares to respond

positively to the strong print." SSAB B shares are last up 7.4%.

(dominic.chopping@wsj.com)

--

Metals Mixed as China Demand Remains Soft

0753 GMT - Metal prices are mixed in early trading in London,

with worries over demand keeping prices range-bound. Three-month

copper is down 0.4% at $8,045 a metric ton while aluminum is up

0.1% at $2,208 a ton. Gold, meanwhile, is down 0.2% at $1,982.90 a

troy ounce. Sucden Financial notes that Chinese support for the

economy has stepped up, after the government issued additional

sovereign debt and raised the budget deficit ratio. "We expect that

while these announcements are not game changers for the market, the

cumulative impact of policy support, especially in the form of

housing market aid, will help stabilize the demand for steel in Q4

2023 before a slight recovery next year," Sucden says.

(yusuf.khan@wsj.com)

--

Oil Continues Slide as Investors Eye Middle East Conflict

0736 GMT - Oil prices are continuing to slide, amid worries that

the wider Middle Eastern region could become embroiled in the

current conflict in Israel. Brent crude is down 0.5% to $86.74 a

barrel while WTI is 0.6% lower at $83.24 a barrel. "Although there

was no further escalation in the Israel-Hamas conflict yesterday,

the market remains on edge and the focus continues to be on any

further developments within the region," ING says in a note, adding

that markets should remain volatile due to the conflict.

(yusuf.khan@wsj.com)

--

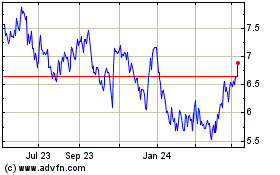

Lynas's Extended License Smooths Pathway for Growth

0332 GMT - An extension to Lynas's Malaysian license takes the

pressure off the ramp-up of its new Kalgoorlie rare-earths plant in

Australia and opens the door to new growth opportunities, Macquarie

analysts say in a note. Lynas could upgrade the remaining two

trains at solvent extraction and product finishing, and lift the

processing capacity to 12,500 metric tons, or it could unlock

capacity at its Mt. Weld operation by changing its mining schedule,

the analysts say. "The excess cracking and leaching capacity could

also open opportunities to process concentrates from other

rare-earths miners in Australia," they add. They lift their target

on the stock by 3% to A$7.70 and keep an outperform rating. Lynas

is up 4.6% at A$7.13. (rhiannon.hoyle@wsj.com; @RhiannonHoyle)

--

Lynas License Extension Seen Giving Production Boost

2344 GMT - The extension of Lynas's Malaysian license to 2026

should result in higher output of neodymium-praseodymium, or NdPr,

in FY 2025-26 than was anticipated before, Citi analyst Paul

McTaggart says in a note. "We've increased our NdPr production

forecasts 16%/8% in FY25/26 as we incorporate importing/processing

lanthanide concentrate in Malaysia until March 2026," McTaggart

says. Higher expected rare-earths production results in a 14% and

6% increase in earnings estimates for fiscal years 2025 and 2026

respectively, and a slight lift in Citi's target on Lynas to A$7.20

from A$7.15, he says. Lynas is up 3.7% at

A$7.07.(rhiannon.hoyle@wsj.com; @RhiannonHoyle)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

October 25, 2023 07:38 ET (11:38 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Jan 2025 to Feb 2025

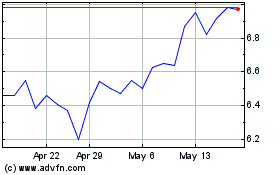

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Feb 2024 to Feb 2025