UPDATE: Malaysia Stalls Lynas Rare-Earth Plant

01 July 2011 - 3:00AM

Dow Jones News

A plan to break China's dominance over rare-earth metals

suffered a setback as Malaysia's government put restrictions on a

plant due to start producing thousands of tons of the materials

within months.

The 700 million ringgit, or roughly $230 million, processing

plant under construction by Australia's Lynas Corp. (LYC.AU, LYSDY)

is intended to produce about a sixth of the world's supply of

rare-earth elements when it hits full production, which is expected

for as early as next year.

Rare-earth metals are used in a range of industrial and

technology applications. China has 90% of global production and has

been limiting its exports, which has raised global concerns about

potential shortfalls in supply and over reliance on a single

source.

The potential setback comes as rivals of Lynas are rushing to

market new rare-earth products. The 17 elements are favored for a

host of niche applications because of their unusual

characteristics. Magnets made with the rare-earth minerals

neodymium and praseodymium are uniquely strong, making them

valuable components in wind turbines and computer hard drives.

Rare-earth phosphors such as europium and yttrium are in demand to

tweak the color of compact fluorescent light bulbs and LED

displays.

But Malaysia's government forbid Lynas from importing raw

materials and starting operations at the plant's Gebeng industrial

site until the company complies with recommendations in a report

commissioned by the International Atomic Energy Agency. The IAEA

review, conducted by an international team of experts and concluded

in June, identified 10 issues to be addressed before the plant

could start up.

Many Malaysian residents are concerned that the operation could

cause lasting environmental damage, although the IAEA mostly

supported Lynas's contention that the plant will be safe. Gebeng is

on the fringes of Kuantan, a port city of around 500,000 on the

steamy east coast of the Malaysian peninsula.

"The government reiterates its position that public safety

remains its highest priority and [the government] will do whatever

is necessary to ensure this is not compromised," Rebecca Fatima Sta

Maria, secretary-general of the Ministry of International Trade and

Industry, said in a prepared statement.

Lynas said Thursday it still will be able to meet targets to

start operations at the site as soon as September, although

analysts expressed doubt about that timetable.

"The start-up was always pretty ambitious and I'd be very

surprised if this news doesn't delay that. You would have to think

it's going to be a minimum of six months' delay and probably 12

months," said Michael Evans, an analyst at CLSA in Sydney.

Lynas Chief Executive Nicholas Curtis said the plant remains on

track to start deliveries of rare earths next year. "We expect to

deliver some product in the first half of 2012 and we'll be fully

operational by the second half," he said at a Kuala Lumpur news

conference.

Among its recommendations, the IAEA said Lynas should be

required to submit a plan for managing waste from the plant once it

closes, and to establish a fund for decommissioning the site and

bringing it back to normal use.

Lynas has said it expects its main deposit at Mount Weld in

Western Australia, which has started producing materials to feed

the Gebeng plant, will be in production for at least 20 years.

Curtis said a "considerable body of work" must be completed to

fulfill the IAEA's requirements but that it can be done well in

advance of the company's timetable.

At the heart of the dispute is iron phosphogypsum, a crumbly,

off-white waste product. When Gebeng hits full capacity it will

produce 20,000 tons of rare-earth materials and 64,000 tons of

phosphogypsum every year--enough to cover a one-hectare site to a

depth of five stories. Around 106 tons of thorium, a radioactive

element formerly used in gaslight mantles and currently being

investigated as a fuel for certain nuclear reactors incapable of

producing plutonium, would be distributed throughout the waste.

Lynas has outlined tentative plans to recycle the waste as a

building material or for building artificial reefs. The IAEA report

found that the thorium waste would be at "relatively low

concentrations," with radioactivity at a low enough level that the

agency wouldn't consider it a radioactive material when being

transported.

But Fuziah Salleh, the representation for Kuantan in Malaysia's

Parliament and an opponent of the project, said the waste still

would be too risky for use in the country and suggested it be kept

in a nuclear-style storage facility. "The waste must not be

recycled. It could be sold back to Malaysians by irresponsible

vendors," she said.

China has been tightening controls on exports from its mines

since last year by raising the threshold for entry, imposing

stricter environmental standards and slashing export quotas. That

has driven the price of the elements up: The basket price for

rare-earth materials in Australia's Mount Weld deposit hit $204.85

a ton on Monday, up from $10.32 a ton in 2009.

Denver-based Molycorp Inc. (MCP) has said it expects to start

producing 19,050 tons a year of rare-earth materials from its

Mountain Pass mine in California next year. And the arrival of

other new producers seeking to profit from price increases has led

some analysts to predict that the world will have an oversupply of

the most common rare-earth materials by 2015. Total global

production last year was 114,800 metric tons.

-David Fickling, Dow Jones Newswires;

david.fickling@dowjones.com

-Ankur Relia, Dow Jones Newswires; ankur.relia@dowjones.com

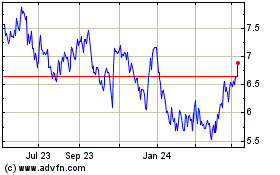

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Dec 2024 to Jan 2025

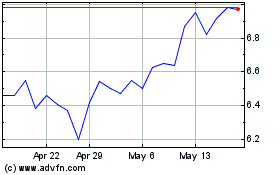

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Jan 2024 to Jan 2025