UPDATE: Emerald Energy Up Following Sinochem Takeover Move

12 August 2009 - 7:47PM

Dow Jones News

Shares in U.K. oil and gas explorer Emerald Energy PLC (EEN.LN)

rose sharply Wednesday after its board recommended shareholders

approve a takeover proposal from China's state-owned Sinochem

Corp., which values it at GBP532.1 million.

Emerald said in a statement the tie-up offers Sinochem the

opportunity to expand its exploration and production in the Middle

East and Latin America by enhancing its reserve base in Syria and

Colombia.

Sinochem's interest in Emerald is just one of a string of moves

this year by Chinese companies to build up foreign energy and

minerals holdings, the largest of which was Aluminum Corp. of

China, or Chinalco, in February paying $14 billion for a 9% stake

in Anglo-Australian mining-giant Rio Tinto PLC (RTP).

More recent was news Monday that China National Petroleum Corp.

and Cnooc Ltd. (CEO) have proposed paying at least US$17 billion

for all of Repsol YPF SA's (REP) stake in its Argentine unit YPF

SA.

Under the terms of the offer Wednesday, shareholders of Isle of

Man-based Emerald Energy will be entitled to 750 pence in cash for

each share, representing a 33.81 pence premium to the closing price

on July 10, the last business day prior to an announcement from

Emerald that it had received an approach.

Emerald didn't reveal at that time that the proposal was from

Beijing-based Sinochem, China's fourth biggest oil firm by

assets.

The Emerald board said it considered the terms of the proposal

from Sinochem "to be fair and reasonable" and unanimously

recommended shareholders vote in favor.

At 0825 GMT, shares in Emerald were trading up 62 pence, or

9.2%, at 737 pence, more than double the previous 12-month low of

around 300 pence seen in October and November.

Emerald's chairman, Alastair Beardsall, said the offer

represents fair value for shareholders, realistically reflecting

its business and assets.

Sinochem's president, Han Gensheng, said the acquisition is

another step in building a global energy company. The company's

spokesman in Beijing was unavailable.

Sinochem is also involved in another potential takeover, of

Australia's Nufarm Ltd. (NUF.AU), which has a market capitalization

of A$2.51 billion.

On July 24, Australian crop protection company Nufarm said it

had been approached about a potential takeover by Sinochem.

Sinochem characterized its contacts with Nufarm as being at a

preliminary stage.

"This is one of a range of potential growth opportunities that

Sinochem is currently exploring," the Chinese company said at the

time.

An energy analyst at a U.S. bank said there is consensus between

Chinese companies, the government in Beijing and regulators that

now is the time for them to go out and buy foreign assets.

"For a lot of China companies, if they are not doing their bit

and acquiring foreign resources, it makes them look bad, so I think

everybody wants to get on the bandwagon," the analyst said.

Other deals by Chinese companies in recent months include China

Petrochemical Corp., which is also known as Sinopec, acquiring

Swiss-based oil explorer Addax Petroleum Corp. (AXC.T) for US$7.2

billion.

In April, CNPC purchased Kazakh oil producer MangistauMunaiGas

jointly with Kazakhstan's state-owned KazMunaiGas for US$3.3

billion.

Company Web site: www.emeraldenergy.com

-By Elizabeth Adams, Dow Jones Newswires; +44 (0) 20 7842 9386;

elizabeth.adams@dowjones.com

Simon Hall in Beijing and Aries Poon in Hong Kong contributed to

this story.

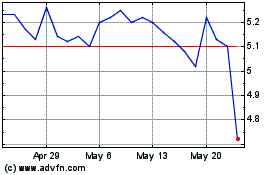

Nufarm (ASX:NUF)

Historical Stock Chart

From Apr 2024 to May 2024

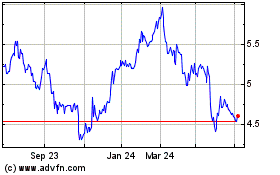

Nufarm (ASX:NUF)

Historical Stock Chart

From May 2023 to May 2024