WASHINGTON—The Obama administration is preparing to give Iran

limited access to U.S. dollars as part of looser sanctions on

Tehran, according to congressional staff members and a former

American official briefed on the plans.

The proposed move comes amid rising Iranian criticism that the

landmark nuclear agreement reached last year between global powers

and Tehran hasn't provided the country with sufficient economic

benefits.

Executives at European and Asian banks have said in recent

interviews that they remain reluctant to conduct any financial

transactions with Iran due to fears they might run afoul of the

U.S. Treasury and its regulations that ban dollar dealings with

Iranian firms. Most major international trade, particularly in oil

and gas, is conducted in U.S. dollars.

The Treasury is considering how to issue licenses to offshore

dollar clearing houses for specific Iranian financial institutions,

an approach that wouldn't require the involvement of American

banks, according to the congressional officials. The clearing

houses, likely involving select foreign banks, would conduct the

dollar transactions instead, shielding the U.S. financial system

from any direct contact with Iran, these officials said.

"They are looking at a couple mechanisms to allow for this

dollar trade, stopping short of normalizing banking transactions,"

said a congressional banking official briefed by the administration

on its plans, which haven't been finalized.

Treasury action on Iran's access to the dollar wouldn't require

congressional approval.

American law still prohibits U.S. and foreign banks from dealing

in dollars with Iran, despite the July nuclear agreement. The

Treasury Department designates Iran's entire financial system as a

"primary money laundering concern" due to Tehran's nuclear and

missile programs and support for international terrorist groups,

such as Hezbollah in Lebanon and Hamas in the Palestinian

territories.

The U.S. Treasury and State departments declined to comment

Thursday on preparations to allow Iran limited access to

dollars.

But Treasury Secretary Jacob Lew has stressed in recent weeks

the need for the U.S. to comply with the "letter and spirit" of the

nuclear agreement and help Iran gain economic relief. Congressional

officials following the deliberations said they expected a Treasury

action could come within weeks, though they acknowledged details of

the proposal were evolving.

Since 2006, the U.S. government has imposed an escalating

campaign to freeze Iran out of the global banking system in a bid

to persuade Tehran to roll back its nuclear program. The sanctions

crippled Iran's economy and cut by more than half its oil exports.

Under the nuclear agreement Iran consented to limit its nuclear

aspirations in exchange for the lifting of most international

sanctions.

Treasury and State Department officials have traveled to the

Middle East, Europe and Asia in recent weeks to meet with foreign

governments and private businesses to discuss ways to help Iranian

commerce, according to U.S. officials, who didn't address the

proposed dollar arrangement.

On Wednesday, Mr. Lew gave an address on sanctions policy at the

Carnegie Endowment for International Peace, a Washington think

tank, and argued the U.S. risked losing international credibility

if it didn't follow through and provide Iran with significant

relief.

"The risk that sanctions overreach will ultimately drive

business activity away from the U.S. financial system could become

more acute if alternatives to the United States as a center for

financial activity…assume a larger role," Mr. Lew said.

The Treasury chief refused during a March congressional hearing

to answer a lawmaker's questions about whether Iran would be

granted access to the dollar. The administration will "make sure

Iran gets relief," he responded.

Members of Congress from both parties have rapped reports that

the White House is preparing to provide Iran with access to the

U.S. dollar.

Lawmakers argued in letters to the administration this week that

such a step risked undermining U.S. sanctions campaigns around the

world, which are predicated on using the heft of the U.S. financial

system to punish America's adversaries. Iran, they stressed,

continues to support terrorism and is developing ballistic-missile

capabilities, despite moving to scale back its nuclear program.

"I believe this will set bad precedent, and it will not be the

last time the Iranians and/or their business partners receive

additional relief not contemplated" under the nuclear deal, Rep.

Brad Sherman (D., Calif.) wrote President Barack Obama on

Thursday.

In a statement released by his office on Thursday, House Speaker

Paul Ryan said the administration should abandon the dollar-access

idea. "As Iran continues to undermine the spirit of its nuclear

agreement with illicit ballistic missile tests, the Obama

administration is going out of its way to help Tehran reopen for

business," he said in the statement.

Republican Sens. Marco Rubio of Florida and Mark Kirk of

Illinois wrote Mr. Lew on Wednesday seeking assurances that Iran

wouldn't be granted dollar access. Their offices said they haven't

received responses.

"We believe the United States should instead increase pressure

on the Iranian regime in order to hold it fully accountable for its

threatening and destabilizing activities outside the nuclear

realm," the letter from the senators said.

Iran has conducted a string of ballistic-missile tests in recent

months that the Obama administration said were "inconsistent" with

a United Nations Security Council resolution, though it stopped

short of charging Tehran with a violation. U.S. officials also

believe Iran is a major supplier of arms and funding for the Bashar

al-Assad regime in Syria and the Houthi militia in Yemen.

Since the agreement went into force in January, Iran has scaled

back its nuclear activities. The U.S., however, has maintained

penalties on Iranian defense and missile firms and individuals

allegedly involved in human-rights abuses.

Iranian officials have increasingly complained that the ongoing

U.S. penalties are prohibiting Iran from conducting normal business

with a flood of European, Asian and Middle East companies that have

sought to enter the Iranian markets.

Iran's Supreme Leader Ayatollah Ali Khamenei sharply criticized

the Obama administration during a Persian New Year's speech for

allegedly misleading Tehran's nuclear negotiators during the

talks.

"Our banking trade, our efforts to return wealth from their

banks, various kinds of businesses that require financial services,

all of these are still facing problems," Mr. Khamenei said. "When

we investigate the issue, it becomes obvious that [the banks] are

afraid of the United States."

Mr. Lew and other U.S. officials said in the months after the

nuclear agreement that Iran would continue to be denied any access

to the U.S. financial system. This included blocking Iranians from

establishing accounts at American banks or conducting dollar trade

through European or Asian banks.

"Iranian banks will not be able to clear U.S. dollars through

New York, hold correspondent account relationships with U.S.

financial institutions, or enter into financial arrangements with

U.S. banks," Mr. Lew said last summer.

(END) Dow Jones Newswires

March 31, 2016 21:25 ET (01:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

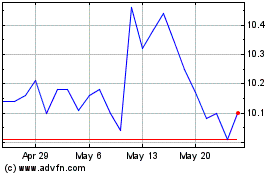

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

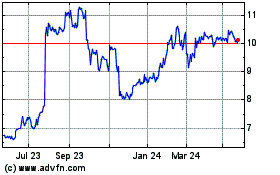

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024