Barclays to Sell Italian Retail Banking Business to CheBanca! -- Update

03 December 2015 - 10:16PM

Dow Jones News

By Giovanni Legorano in Milan and Max Colchester in London

Barclays PLC on Thursday said it agreed to sell its Italian

retail business to CheBanca!, part of the banking group Mediobanca

Banca di Credito Finanziario SpA, in the British bank's latest move

to focus on its core operations.

The Italian group said it would pay EUR237 million ($251.6

million) for the business, which consists of 89 branches, although

Barclays said it would book a loss of GBP200 million ($299 million)

on the sale because the price was below the unit's its book

value.

For Barclays, the deal represents its latest move to exit retail

banking in continental Europe to focus on the U.K., U.S. and

Africa, following a similar move in Spain last year and Portugal in

September. The bank is also trying to sell its retail business in

France, which is made up of around 70 branches.

For Mediobanca, the deal is part of its strategy to focus more

on growing its CheBanca! retail network, along with its investment

banking business and asset management arm. The emphasis on such

areas comes after it decided two years ago to move away from a

model of owning large stakes in prominent Italian companies, which

had allowed it to play an outsize role in Italian industry.

Mediobanca said the purchase would grow CheBanca!'s client base

by 40% to 770,000 clients and that its direct funding would rise

30% to EUR13.5 billion. It expects the acquisition to boost

earnings after a year, as cost and revenue synergies start to bear

fruit.

Barclays said the financial impact of the transaction depends on

the balance sheet of the business at the time the deal closes and

on foreign-exchange movements. Barclays estimates the sale will

reduce its risk-weighted assets by about GBP800 million.

"This transaction is further evidence of the reshaping of

Barclays Group to focus on our core businesses," new Chief

Executive Jes Staley said. As well as the sale of retail operations

in Europe, Mr. Staley, who started as CEO on Tuesday, is also

pushing along plans for Barclays to shrink in investment

banking.

Barclays will continue to operate investment banking and

corporate banking in Italy. It is exploring further loan portfolio

sales in Italy, according to a person familiar with the matter.

Margot Patrick and Rory Gallivan contributed to this

article.

Write to Giovanni Legorano at giovanni.legorano@wsj.com and Max

Colchester at max.colchester@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 03, 2015 06:01 ET (11:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

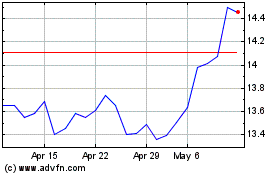

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Jan 2025 to Feb 2025

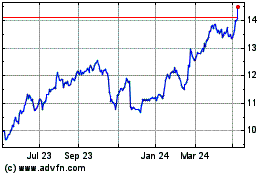

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Feb 2024 to Feb 2025