Why Trapped Longs At Bitcoin ATH Could Lead To More Downside

28 October 2021 - 4:00AM

NEWSBTC

Bitcoin’s new all-time high this month has led to a number of

interesting developments in the crypto space. The success of the

first Bitcoin ETF contributed greatly to the price of BTC finally

bursting through the $67K price point and with it has come to a

spike in funding rates in the market. The ProShares ETF saw over $1

billion in trading volume in its first day, signaling increased

inflows into the market. The spike in funding rates moved along

with the price movements of BTC in the month of October. This spike

maintained momentum along with BTC movements. However, as the price

of bitcoin has begun a downward trend, funding rates have also

evened out to mid-October levels. Bitcoin Open Interest Spikes Open

interest in bitcoin had recorded a significant spike when the price

of the digital asset had moved past $67K. BTC-denominated open

interest in perpetuals had since a sharp increase to the tune of

15,000 when the asset reached its new all-time high in October. The

spike in BTC-dominated perpetuals had risen past levels recorded

during the April all-time high. Related Reading | Brace For

Impact: Wall Street Is Headed Straight For Bitcoin, Says Analyst

The increased interest from big money is credited for the spike in

the funding rates recorded last week. More specifically short-term

traders expected the value of the digital asset to continue to grow

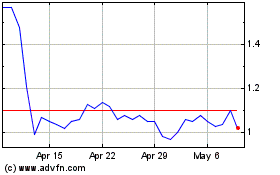

and break past $70K. Funding rates have shown similar movements to

the futures market in recent times. Funding rates for BTC spikes in

October | Source: Arcane Research Arcane Research put forward that

this increase in open interest and increased funding rates could

point to leveraged long-trades currently in the all-time high

range. If this is so, then this is something to keep an eye on if

the price of the digital asset continues to decline in the coming

days. Big Money Moving Into The Market Institutional inflows also

saw record volumes following the all-time high breakout last week.

A CoinShares report showed that bitcoin saw inflows of up to $1.45

billion in the past week alone. Most of this volume came from

trading in the ProShares ETF that debuted on Tuesday last week. An

additional $138 million flowed into BTC products in other regions.

BTC price falls below $59,000 | Source: BTCUSD on TradingView.com

Sentiment on Wall Street is beginning to turn in favor of the top

cryptocurrency in the market. Data showed that the number of Wall

Street brokers interested in the BTC and the market had spiked from

5% at the beginning of the year to 15% presently who say that they

are starting to make investments in BTC more seriously. Related

Reading | Analyst Puts Bitcoin Bottom At $50,000, Here’s Why

Market sentiment overall remains positive with the all-time high

run of the previous week. However, declining prices have led

investors down a more cautious path when trading in the

cryptocurrency. Bitcoin’s price touched $58K in the early hours of

Wednesday ahead of market opening for midweek trading. Featured

image from iStock, charts from Arcane Research and TradingView.com

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles