Bitcoin Option Traders Seem Doubtful At Entering Directional Trades

17 February 2022 - 5:37PM

NEWSBTC

Data from Bitcoin options shows that crypto traders are currently

selling out and uncertain about entering directional bets on the

coin’s future transactions. This is the highest occurrence of this

kind of investors’ sentiments on the coin since last year May, when

more than 50% of Bitcoin’s value declined. Arcane Research’s Report

On Bitcoin Crypto market analysis company Arcane Research had

recently published a report on the performance of Bitcoin. Their

research highlighted that the coin experienced low volatility of

over 70%, bolstering that this is the first time options traders

have gone on a long-term bearish direction since last year May.

Meanwhile, Bitcoin options enable traders to trade on BTC price

movements; as the coin appreciates, the price of the options

increases. Consequently, the analyzed low volatility shows that

investors aren’t ready to bet on the direction of the leading

cryptocurrency. Also, this is the first time that the coin’s

options have been this cheap since May 2021. Related Reading

| Bitcoin Dominance Will Continue To Decline In Favor Of

Ethereum, Altcoins, FTX US President In addition, Arcane Research

stated that the coin’s volatility skew has peaked since last May.

The volatility skew evaluates the difference between market price

and call price. Generally, the call option has been more costly

than the pull options, creating a downward option skew. Moreover,

the recent depreciation in BTC price, the current BTC option skew,

has now surmounted to its highest since the overall crypto crash in

May 2021. This suggests more sellers than buyers in the coin,

resulting in a bearish market. Presently, Bitcoin option investors

are the most bearish in a long while. Also, they’re hesitant about

choosing a direction they feel that the BTC coin is moving in.

Furthermore, the report shows that this signals traders to purchase

cheap calls. A Brief On Crypto Options Options enable traders to

place trades on an assets’ price directions. For a transaction to

be completed, the traders buy the possibilities if the digital

asset reaches a predicted price. Also, it’s worthy to note that

volatile assets’ options have a greater demand, as they offer

better possibilities for leveraging. Consequently, crypto assets

with high volatility have more expensive options. Despite Chaos,

Bitcoin Price Faces a Turnaround Regardless of traders’ lack of

confidence and hesitations in betting on the directions of Bitcoin

options, the coin seems to be gaining. From the 4-hour chart,

Bitcoin has created an upward triangle pattern and shown a 15%

increase from its previous upper boundary. Related Reading

| TA: Bitcoin Fails to Test $45K, Why Dips Could Be Attractive

For the world’s largest crypto asset to surmount its bullish

milestone, it must surpass the upper boundary of the existing chart

pattern, which is above $44k. Featured image from Pixabay, chart

from TradingView.com

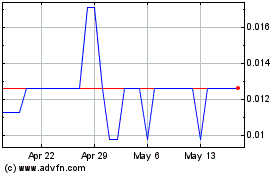

Rally (COIN:RLYUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

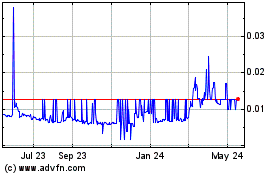

Rally (COIN:RLYUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Rally (Cryptocurrency): 0 recent articles

More Rally News Articles