The FTSE 100 closed up as mining and energy shares rallied on

the back of higher commodity prices. Oil companies Shell and BP

closed up 3.72% and 3.69% respectively, on the back of a recovery

in crude prices driven by supply concerns and expectations that

China would increase its economic stimulus after an easing of its

factory-gate inflation. The day's biggest riser was catering group

Compass, up 7.4%, after reporting a 1H ahead of expectations and

upgrading its full-year outlook. This was followed by Prudential,

up 6.7%, and Pershing Square Holdings, up 4.7%. Solid gains were

seen in the travel and leisure sector after TUI reported a large

increase in 2Q revenue and helped to narrow losses to EUR708

million from a loss of EUR1.5 billion in the year-prior period.

Companies News:

Capricorn Energy Says 2022 Exploration Focused on UK, Egypt,

Mexico

Capricorn Energy PLC said Wednesday that its 2022 exploration is

focused on Egypt, Mexico and the U.S., and that it is targeting

wells that can be rapidly commercialized if successful.

---

Airtel Africa FY 2022 Pretax Profit, Revenue Rose on Strong

Growth

Airtel Africa PLC said Wednesday that its fiscal 2022 pretax

profit and revenue rose due to an 8.7% growth in its customer base,

and double-digit underlying revenue growth in all its regions.

---

Spirax-Sarco Backs 2022 Guidance Despite Weaker Macro

Outlook

Spirax-Sarco Engineering PLC on Wednesday reiterated its

guidance for 2022 despite the weakening of the macroeconomic

outlook and lower global industrial production growth

forecasts.

---

ITV 1Q Advertising Revenue Rose; Coming Quarters Face Tough

Comparatives

ITV PLC said Wednesday that first-quarter total external revenue

rose on year, but warned that comparatives in the second and third

quarters get much tougher amid macroeconomic and geopolitical

uncertainty.

---

Compass Group Upgrades Guidance After 1H Pretax Profit Rose,

Plans GBP500 Mln Buyback

Compass Group PLC said Wednesday that it is upgrading its

guidance for fiscal 2022 after first-half pretax profit rose, and

that it plans a share buyback program.

---

Vertu Motors Posts Jump in Pretax Profit for FY 2022

Vertu Motors PLC on Wednesday reported a rise in pretax profit

for fiscal 2022, with the group performing at record profitability

levels in the period, and said its outlook will depend on the

available supply of new vehicles.

---

Harbour Energy Reiterates 2022 Guidance After Strong Start to

Year

Harbour Energy PLC on Wednesday reiterated production, cost and

capital expenditure guidance for 2022 following a strong start to

the year.

---

Marshalls Early 2022 Revenue Rose; Backs Full-Year

Expectations

Marshalls PLC said Wednesday that revenue in early 2022 rose on

increased public sector and commercial sales, and backed its

expectations for 2022.

---

Brewin Dolphin's 1H Pretax Profit Fell Ahead of Sale

Completion

Brewin Dolphin Holdings PLC reported Wednesday a decline in

pretax profit for the first half of fiscal 2022 ahead of being

officially acquired by RBC Wealth Management.

---

Global Ports Swung to Adjusted Earnings Profit in FY 2022 Amid

Cruise Activity Rebound

Global Ports Holding PLC said Wednesday that it swung to an

adjusted profit for fiscal 2022 as the strong rebound in cruise

activity in the third quarter continued in the fourth quarter.

---

Cenkos Securities Says 2022 Pipeline Is Encouraging

Cenkos Securities PLC said Wednesday that it has had a good

start to 2022, and that it remains confident in its business model

despite the macroenvironment challenges.

---

Ten Lifestyle 1H Adjusted Earnings Fell on Higher Cost Base,

Omicron

Ten Lifestyle Group PLC said Wednesday that first-half adjusted

earnings fell on year due to higher costs and the impact of the

Omicron variant of the coronavirus in the second quarter.

---

Dignity 1Q Underlying Operating Profit Fell on Increased

Competition

Funeral-services provider Dignity PLC said Wednesday that

first-quarter underlying operating profit and revenue fell on

increased industry competition amid a drop in deaths.

---

Secure Income REIT Agrees to GBP1.5 Bln Takeover by LXI REIT

Secure Income REIT PLC said Wednesday that it has agreed to a

takeover by LXI REIT PLC in a deal that values the company at 1.5

billion pounds ($1.85 billion).

---

Hostelworld Says Early 2022 Recovery Carried Over Into April,

May

Hostelworld Group PLC said Wednesday that strong first-quarter

bookings carried over into April and early May as its recovers from

the coronavirus pandemic, with its performance exceeding

expectations.

---

Duke Royalty Raises GBP20 Mln via Share Placing, PrimaryBid

Offer

Duke Royalty Ltd. said Wednesday that it has now raised 20

million pounds ($24.6 million) via the share placing and PrimaryBid

offer outlined late Tuesday.

---

TP ICAP 1Q Revenue Rose, Market Share Grew

TP ICAP Group PLC said Wednesday that its performance for the

first quarter of 2022 was marked by revenue growth across all

business divisions and a gain in its overall market share.

---

Best of the Best Sees Slight FY 2022 Pretax Profit

Outperformance; Shares Rise

Best of the Best PLC shares rose Wednesday after it said that

its pretax profit for fiscal 2022 was slightly ahead of its prior

market guidance, with revenue in-line with its expectations.

---

Carbon Transition Swung to 1Q Net Profit

Carbon Transition ASA said Wednesday that it swung to a net

profit for the first quarter, and that it is now debt free

following the latest multiclient sale.

---

TClarke Says Confident in Meeting 2022 Market Expectations;

Order Levels Are High

TClarke PLC said Wednesday that it is confident in meeting

market expectations for 2022 after a strong start to the year, and

said that it is maintaining a historically high level of

orders.

---

Spire Healthcare Backs 2022 Outlook

Spire Healthcare Group PLC on Wednesday reiterated its outlook

for the full year after it said it booked a satisfying performance

in the first four months of 2022.

---

Ilika Expects Lower FY 2022 Revenue, Widened Ebitda Loss; Shares

Drop

Shares in Ilika PLC on Wednesday fell after the company said it

expects a fiscal 2022 decline in revenue and a widened loss before

interest, taxes, depreciation and amortization.

Market Talk:

CLS Holdings Shares Look Attractive

0925 GMT - CLS Holdings' shares are priced too cheaply given its

strong track record and business outlook, Liberum says. The

real-estate investor's new dividend policy implies an attractive

prospective dividend yield of 4.8%, up from the 3.5% average for

the wider U.K. real estate investment trust sector, the brokerage's

analysts say in a research note. Meanwhile shares are currently

trading at a discount to net tangible asset value--a discount

significantly larger than peers, they add. "Given CLS' long-term

track record of value creation and continued resilient operational

performance, we view this [share price] as attractive," Liberum

says, retaining its buy rating and 290.0 pence price target. Shares

are up 9.4% at 210.5 pence. (joseph.hoppe@wsj.com)

Hostelworld's 'Eye-Catching' Recovery Leads to Upgrades

0918 GMT - Hostelworld's pace of recovery in bookings is

eye-catching, providing further evidence that the strategic work it

undertook throughout the pandemic significantly enhanced

competitiveness, Davy Research says. The London-listed online

hotel-booking platform's strong start to 2022 and continued

momentum prompts Davy analysts Ross Harvey and David Reynolds to

upgrade full-year adjusted Ebitda forecasts to be closer to

break-even. "We are particularly encouraged by the recovery of

revenue, which reached 97% of 2019 levels in week 18--for context,

this was 33% in [1H of 2021] and climbed to around 75% by the end

of March, suggesting a 20 percentage point improvement in just six

weeks," the Irish research firm says in a research note. Davy

reiterates its outperform rating. Shares are up 4.2% at 84.4 pence.

(joseph.hoppe@wsj.com)

Reckitt Benckiser Seen as Potential Buyer of Mondelez's

Halls

0844 GMT - Reckitt Benckiser is a potential buyer of Mondelez

International's cough-drop brand Halls, RBC Capital Markets analyst

James Edwardes Jones says after the U.S. food conglomerate said it

plans to refocus its portfolio on chocolates and snacks. Halls has

3.4% of the cough, cold and allergy global market, while Reckitt's

Mucinex and Strepsils brands have 1.9% and 1.5%, respectively, he

says. Halls' annual turnover is $470 million, while Strepsils' is

estimated to be around $308 million, Jones notes. "This wouldn't be

a major acquisition if it were to happen but seems to tick the

consumer-health box," he says. (michael.susin@wsj.com)

ITV's Streaming Revenue Growth Looks Significant

0839 GMT - ITV's continuing growth in revenues from streaming

platforms is significant, Shore Capital's Roddy Davidson says in a

research note after the company's first-quarter trading update.

Strong first-quarter performance and reassuring outlook comments

are pleasing, Davidson says, adding that the U.K. investment group

is confident that public sector broadcasters will remain a very

influential and effective platform for brand advertising for some

time to come. The potential for its advertising-funded ITVX

streaming service to gain significant traction is also noteworthy,

he says. Shore Capital has a buy rating on the British broadcaster.

(kyle.morris@dowjones.com)

Compass Group Prospects Look Uncertain Given Longer-Term Impact

of Hybrid Working

0831 GMT - Compass Group remains a well-managed business and has

done a good job in the face of unprecedented disruption through

Covid-19 restrictions, RBC Capital Markets says after the catering

company beat first-half earnings views. However, the lack of

visibility around the longer-term impact of structural shifts to

hybrid working and learning, and risks of future restrictions are

concerning, Karl Green and Andrew Brooke, analysts at the Canadian

bank, say in a research note. The combination of optimistic

medium-term revenue estimates, concerns over persistent

inflationary headwinds across key input cost categories and an

elevated valuation are key risks, they say. RBC has an underperform

recommendation on the U.K. company's stock and a price target of

1,340 pence. (michael.susin@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

May 11, 2022 13:12 ET (17:12 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

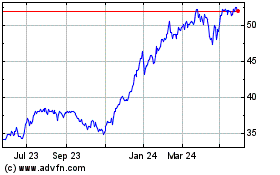

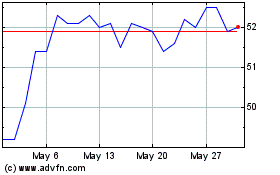

Pershing Square (EU:PSH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pershing Square (EU:PSH)

Historical Stock Chart

From Feb 2024 to Feb 2025