Dollar Extends Decline After Weak U.S. Retail Sales Data

15 January 2016 - 8:34PM

RTTF2

The U.S. dollar extended its early decline against most major

currencies in European deals on Friday, as retail sales fell

modestly in December, while lingering worries about Chinese economy

and falling oil prices revived worries about global growth

outlook.

Data from the Commerce Department showed that retail sales edged

down by 0.1 percent in December following an upwardly revised 0.4

percent increase in November.

Economists had expected sales to come in unchanged compared to

the 0.2 percent uptick originally reported for the previous

month.

Excluding auto sales, retail sales still dipped by 0.1 percent

in December after climbing by 0.3 percent in November. Ex-auto

sales had been expected to rise by 0.2 percent.

Another report from the Labor Department showed that the U.S.

producer prices fell slightly more-than-expected in December,

reflected by steep drops in prices for food and energy.

The producer price index for final demand dipped by 0.2 in

December after rising 0.3 percent in November. Economists had

expected prices to edge down by 0.1 percent.

Excluding food and energy prices, core producer prices inched up

by 0.1 in December after climbing 0.3 percent in the previous

month. The modest uptick matched economist estimates.

The greenback showed mixed performance in Asian trading. While

the currency declined against the euro and the yen, it was steady

against the franc. Against the pound, it climbed.

Extending early decline, the greenback fell to near a 5-month

low of 116.60 against the Japanese yen, coming off from its prior

high of 118.27. The next downside target for the greenback-yen pair

is seen around the 115.00 mark.

The Japanese central bank is not planning to ease policy further

now, but policymakers stand ready to adjust stance if needed, Bank

of Japan Governor Haruhiko Kuroda said.

The central bank chief said the bank does not have plans for

further monetary easing "at the moment".

The greenback slid to 1.0984 against the European currency, its

lowest since December 29, 2015. On the downside, 1.11 is likely

seen as the next support level for the greenback.

Data from Eurostat showed that the euro area trade surplus hit a

nine-month high in November as exports increased amid fall in

imports.

The trade surplus rose to a seasonally adjusted EUR 22.7 billion

from EUR 19.8 billion in October. This was the highest since

February, when it totaled EUR 23.1 billion. Also, it stayed above

the expected level of EUR 21 billion.

Reversing from an early high of 1.0060 against the Swiss franc,

the greenback dropped to a 4-day low of 0.9958. Continuation of the

greenback's downtrend may take it to a support surrounding the 0.98

level.

The greenback eased back to 1.4457 against the loonie, from near

a 13-year low of 1.4547 hit at 4:20 am ET. The greenback is seen

finding support around the 1.43 area.

The greenback held firm around an early 5-1/2-year high of

1.4325 against the pound, compared to Thursday's closing value of

1.4410. If the greenback extends rise, 1.42 is possibly seen as its

next resistance level.

Figures from the Office for National Statistics showed that U.K.

construction output dropped unexpectedly in November.

Construction output fell 0.5 percent month-on-month in November,

reversing a 0.2 percent rise in October. Economists had forecast a

0.5 percent rise for November.

U.S. business inventories data for November, U.S. Baker Hughes

rig count data and the University of Michigan's preliminary U.S.

consumer sentiment index for January are slated for release

shortly.

At 1:00 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan is scheduled to participate in a moderated Q&A session

before the Dallas Assembly Luncheon hosted by the Federal Reserve

Bank of Dallas.

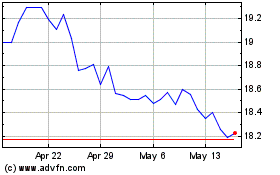

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jun 2024 to Jul 2024

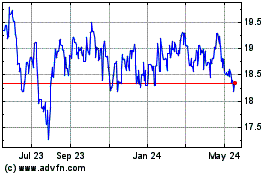

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jul 2023 to Jul 2024