UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Under Rule 14a-12 |

Alpha Star Acquisition Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ALPHA STAR ACQUISITION CORPORATION

80

Broad Street, 5th Floor

New York, NY 10004

(212) 837-7977

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 10, 2024

TO THE SHAREHOLDERS OF ALPHA STAR ACQUISITION CORPORATION:

You are cordially invited to attend the Extraordinary General Meeting of shareholders of Alpha Star Acquisition Corporation (“Alpha Star,” “Company,” “we,” “us” or “our”) to be held at 10:00 a.m. Eastern Time on January 10, 2024 (the “Extraordinary General Meeting”). The Extraordinary General Meeting will be held in the offices of the Company’s counsel, Becker & Poliakoff P.A., at 45 Broadway, 17th Floor, New York, NY 10006.

As an extraordinary general meeting of the Company’s shareholders, the Extraordinary General Meeting is being held for the purpose of considering and voting upon the following proposals:

| |

1. |

a proposal to amend Alpha Star’s amended and restated memorandum and articles of association (the “Amended and Restated Memorandum and Articles of Association”) to extend the date by which Alpha Star must consummate a business combination (the “Extension”) to September 15, 2024 (the “Extended Date”) and reduce the amount of the fee to extend such time period, by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Section 36.2 thereof and replacing it with the new Section 36.2 in the form provided in the first resolution set forth in Annex A of the accompanying proxy statement (the “Proposal 1” or “Extension Proposal”); |

| |

|

|

| |

2. |

a proposal to amend the Amended and Restated Memorandum and Articles of Association, as provided by the second resolution set forth in Annex A of the accompanying proxy statement, to allow the Company to undertake an initial business combination with an entity or business (“Target Business”), with a physical presence, operation, or other significant ties to China or which may subject the post-business combination business to the laws, regulations and policies of China (including Hong Kong and Macao), or entity or business that conducts operations in China through variable interest entities, or VIEs, pursuant to a series of contractual arrangements (the “VIE Agreements”) with the VIE and its shareholders on one side, and a China-based subsidiary of the China-based Target (the “WFOE”), on the other side (a “China-based Target”) (the “Proposal 2” or “Target Limitation Amendment Proposal”); |

| |

|

|

| |

3. |

a proposal to amend the Amended and Restated Memorandum and Articles of Association, as provided by the second resolution set forth in Annex A of the accompanying proxy statement, to eliminate (i) the limitation that the Company shall not redeem its public shares to the extent that such redemption would result in the ordinary shares, or the securities of any entity that succeeds the Company as a public company, becoming “penny stock” (as defined in accordance with Rule 3a51-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), or cause the Company to not meet any greater net tangible asset or cash requirement which may be contained in the agreement relating to a Business Combination (the “Redemption Limitation”) and (ii) the limitation that the Company shall not consummate a Business Combination if the Redemption Limitation is exceeded (the “Proposal 3” or “Redemption Limitation Amendment Proposal”); and |

| |

|

|

| |

4. |

a proposal to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Extraordinary General Meeting, there are not sufficient votes to approve any of the foregoing proposals (the “Proposal 4” or “Adjournment Proposal”). |

The purpose of the

Extension Proposal is to allow Alpha Star more time to complete an initial business combination. Currently, our Amended and Restated Memorandum

and Articles of Association provide that Alpha Star has 27 months from the consummation of the IPO to complete a business combination.

The Company’s charter was most recently amended and restated on July 13, 2023 to extend the time period within which the Company

must consummate its initial business combination to March 15, 2024. The purpose of the Extension Proposal is to allow the Company

the option to further extend the time to complete a business combination. Our board of directors has determined that it is in the best

interests of our shareholders to allow the Company to extend the time to complete a business combination for an additional six (6) one-month

periods, beginning on March 15, 2024 to September 15, 2024 (the “Extended Date”) and provide that the date for cessation

of operations of the Company if the Company has not completed a business combination would similarly be extended to the Extended Date.

If the shareholders approve

the Extension Proposal, the Company, without another shareholder vote, may elect to extend the time period within which the Company must

consummate its initial business combination for up to six (6) additional one-month periods (each a “Monthly Extension”), to

September 15, 2024, by depositing the Monthly Extension Fee (as defined below) into the Company’s trust account (the “Trust

Account”). In addition, if the shareholders approve the Extension Proposal, the Company will amend the Investment Management Trust

Account, dated December 9, 2021 entered into by the Company and Wilmington Trust, N.A., as trustee (the “Trust Agreement”)

to reduce the amount that the Sponsor or its designee must deposit into the Trust Account in connection with each monthly extension such

that it would be equal to the lesser of (i) $70,000 for all remaining public shares and (ii) $0.033 for each remaining public share for

each Monthly Extension (the “Monthly Extension Fee”).

To effectuate each Monthly

Extension, if the Extension Proposal is adopted, the Sponsor and/or its designee will deposit the lesser of (i) $70,000 for all remaining

public shares and (ii) $0.033 for each remaining public share into the Trust Account. The first Monthly Extension Fee after the approval

of the Extension Proposal must be made by January 15, 2024, while the subsequent Monthly Extension Fees must be deposited into the Trust

Account by the 15th of each succeeding month until September 15, 2024. In the event that the Company does not consummate

its initial business combination before March 15, 2024 (or up to September 15, 2024, if extended), such failure shall trigger

an automatic redemption of the public shares of the Company (an “Automatic Redemption Event”) and the directors of the Company

shall take all such action necessary to (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably

possible but no more than ten (10) business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to

the aggregate amount then on deposit in the Trust Account including interest earned on the funds held in the Trust Account and not previously

released to the Company (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then

issued and outstanding public shares, which redemption will completely extinguish public shareholders’ rights as shareholders (including

the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption,

subject to the approval of the Company’s remaining shareholders and the board of directors of the Company (the “Board”), liquidate

and dissolve, subject in each case to the Company’s obligations under Cayman Islands law to provide for claims of creditors and

other requirements of applicable law. In the event of an Automatic Redemption Event, only the holders of public shares shall be entitled

to receive pro rata redeeming distributions from the Trust Account with respect to their public shares. Further, the IPO Prospectus and

the Amended and Restated Memorandum and Articles of Association provide that the Company may amend the timeline that the Company must

complete its business combination (the “Prescribed Timeline”) by special resolution provided that the holders of the public

shares are provided with the opportunity to redeem their public shares upon the approval or effectiveness of any such amendment.

The purpose of the Target Limitation Amendment Proposal is to afford the Company with flexibility to enter into (a) businesses or entities with a physical presence, operation or other significant ties to China or which may subject the post-business combination entity or business to the laws, regulations and policies of China (including Hong Kong and Macao). If the Target Limitation Amendment Proposal is approved, the Company will be allowed to undertake an initial business combination with a China-based Target, which will allow the Company to access a larger pool of target candidates and provide additional flexibility for the Company to consummate an initial business combination before the final extension date permitted under the Company’s Amended and Restated Memorandum and Articles of Association (the “Combination Period”). The Board has determined that, given the Company’s expenditure of time, effort and money on identifying a suitable target business and completion of a business combination, and the market opportunity the Company has observed in China (including Hong Kong and Macau), it is in the best interests of its shareholders to approve the Target Limitation Amendment to allow the Company to undertake a business combination with a China-based Target.

The purpose of the Redemption Limitation Amendment Proposal is to eliminate the Redemption Limitation from the Amended and Restated Memorandum and Articles of Association. Unless the Redemption Limitation Amendment Proposal is approved, we will not proceed with the Amendment of the Amended and Restated Memorandum and Articles of Association if Redemptions made in connection with the Extraordinary General Meeting would cause the Ordinary shares to become “penny stock” as such term is defined in Rule 3a51-1 of the Exchange Act. Further, if the Redemption Limitation Amendment Proposal is not approved and there are significant requests for Redemptions such that the Redemption Limitation would be exceeded, the Redemption Limitation would prevent the Company from being able to consummate a Business Combination even if all other conditions to closing are met. The Company believes that the Redemption Limitation is not necessary. The purpose of such limitation was initially to ensure that the Company did not become subject to the U.S. Securities and Exchange Commission’s “penny stock” rules. The Company is presenting the Redemption Limitation Amendment Proposal to facilitate the consummation of a Business Combination.

Each of the Extension Proposals,

Target Limitation Amendment Proposal, Redemption Limitation Amendment Proposal and the Adjournment Proposal are more fully described in

the accompanying proxy statement. Please take the time to read carefully each of the proposals in the accompanying proxy statement before

you vote.

Holders (“public shareholders”)

of Alpha Star’s ordinary shares (“Public Shares”) sold in its initial public offering (“IPO”) may elect

to redeem their Public Shares for their pro rata portion of the funds available in the trust account in connection with the Extension

Proposal and the Redemption Limitation Proposal (the “Election”) regardless of how such public shareholders vote in regard

to those amendments, or whether they were holders of Alpha Star’s ordinary shares on the Record Date or acquired such shares after

such date. This right of redemption is provided for and is required by Alpha Star’s Amended and Restated Memorandum and Articles

of Association and Alpha Star also believes that such redemption right protects Alpha Star’s public shareholders from having to

sustain their investments for an unreasonably long period if Alpha Star fails to find a suitable acquisition in the timeframe initially

contemplated by its Amended and Restated Memorandum and Articles of Association. If the Extension Proposal and the Redemption Limitation

Proposal are approved by the requisite vote of shareholders (and not abandoned), the remaining holders of Public Shares will retain their

right to redeem their Public Shares for their pro rata portion of the funds available in the trust account upon consummation of a business

combination.

To exercise your redemption rights, you must tender your shares to the Company’s transfer agent at least two (2) business days prior to the Extraordinary General Meeting. You may tender your shares by either delivering your share certificates to the transfer agent or by delivering your shares electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) system. If you hold your shares in street name, you will need to instruct your bank, broker or other nominee to withdraw the shares from your account in order to exercise your redemption rights.

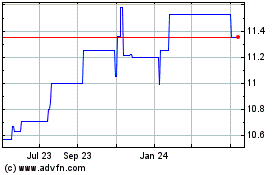

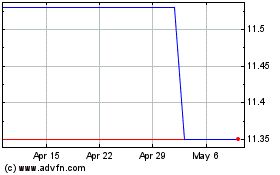

The per-share pro rata portion of the trust account was approximately $11.16 as of December 12, 2023. The closing price of Alpha Star’s shares on December 12, 2023 was $11.18. Alpha Star cannot assure shareholders that they will be able to sell their shares of Alpha Star in the open market, as there may not be sufficient liquidity in its securities when shareholders wish to sell their shares.

If the Extension Proposal is not approved and we do not consummate a business combination by March 15, 2024, in accordance with our Amended and Restated Memorandum and Articles of Association, or if the Extension Proposal is approved and we do not consummate a business combination by the Extended Date, we will cease all operations except for the purpose of winding up and as promptly as reasonably possible but not more than ten (10) business days thereafter, redeem 100% of the outstanding Public Shares with the aggregate amount then on deposit in the trust account.

The affirmative vote of the

holders of at least two-thirds (2/3) of the Company’s ordinary shares entitled to vote which are present (in person or by proxy)

at the Extraordinary General Meeting and which vote on the Extension Proposal, the Target Limitation Amendment Proposal, and the Redemption

Limitation Amendment Proposal will be required to approve the Extension Proposal, the Target Limitation Amendment Proposal and the Redemption

Limitation Amendment Proposal. The affirmative vote of a majority of the Company’s ordinary shares entitled to vote which are present

(in person or by proxy) at the Extraordinary General Meeting and which vote on the Adjournment Proposal will be required to approve such

proposal.

Our Board has fixed the close of business on December 12, 2023 (the “Record Date”) as the Record Date for determining Alpha Star shareholders entitled to receive notice of and vote at the Extraordinary General Meeting and any adjournment thereof. Only holders of record of Alpha Star’s ordinary shares on that date are entitled to notice of and to vote at the Extraordinary General Meeting or any adjournments thereof.

After careful consideration

of all relevant factors, our Board has determined that the Extension Proposal, the Target Limitation Amendment Proposal and the Redemption

Limitation Amendment Proposal and the Adjournment Proposal are fair to and in the best interests of Alpha Star and its shareholders, has

declared them advisable and recommends that you vote or give instruction to vote “FOR” all the foregoing proposals.

Enclosed is the proxy statement containing detailed information concerning the proposals and Extraordinary General Meeting. Whether or not you plan to attend the Extraordinary General Meeting, we urge you to read this material carefully and vote your shares.

We look forward to seeing you at the Extraordinary General Meeting.

Dated: December 21, 2023

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Zhe Zhang |

| |

Zhe Zhang |

| |

Chief Executive Officer |

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the Extraordinary General Meeting. If you are a shareholder of record, you may also cast your vote in person at the Extraordinary General Meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote online at the Extraordinary General Meeting by obtaining a proxy from your brokerage firm or bank.

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting of Shareholders to be held on January 10, 2024: This Notice of Extraordinary General Meeting and the accompanying proxy statement are available at the website of U.S. Securities and Exchange Commission at www.sec.gov.

ALPHA STAR ACQUISITION CORPORATION

80 Broad Street, 5th Floor

New York, NY 10004

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 10, 2024

PROXY STATEMENT

The Extraordinary General Meeting (the “Extraordinary General Meeting”) of shareholders of Alpha Star Acquisition Corporation (“Alpha Star,” “Company,” “we,” “us” or “our”), a Cayman Islands exempted company, will be held at 10:00 a.m. Eastern Time on January 10, 2024. The Extraordinary General Meeting will be held in the offices of the Company’s counsel, Becker & Poliakoff P.A., at 45 Broadway, 17th Floor, New York, NY 10006.

The Extraordinary General Meeting is being held for the sole purpose of considering and voting upon the following proposals:

| |

1. |

a proposal to amend Alpha Star’s amended and restated memorandum and articles of association (the “Amended and Restated Memorandum and Articles of Association”) to extend the date by which Alpha Star must consummate a business combination (the “Extension”) to September 15, 2024 (the “Extended Date”) and reduce the amount of the fee to extend such time period, by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Section 36.2 thereof and replacing it with the new Section 36.2 in the form provided in the first resolution set forth in Annex A of the accompanying proxy statement (the “Proposal 1” or “Extension Proposal”); |

| |

|

|

| |

2. |

a proposal to amend the Amended and Restated Memorandum and Articles of Association, as provided by the second resolution set forth in Annex A of the accompanying proxy statement, to allow the Company to undertake an initial business combination with an entity or business (“Target Business”), with a physical presence, operation, or other significant ties to China or which may subject the post-business combination business to the laws, regulations and policies of China (including Hong Kong and Macao), or entity or business that conducts operations in China through variable interest entities, or VIEs, pursuant to a series of contractual arrangements (the “VIE Agreements”) with the VIE and its shareholders on one side, and a China-based subsidiary of the China-based Target (the “WFOE”), on the other side (a “China-based Target”) (the “Proposal 2” or “Target Limitation Amendment Proposal”); |

| |

|

|

| |

3. |

a proposal to amend the Amended and Restated Memorandum and Articles of Association, as provided by the third resolution set forth in Annex A of the accompanying proxy statement, to eliminate (i) the limitation that the Company shall not redeem its public shares to the extent that such redemption would result in the ordinary shares, or the securities of any entity that succeeds the Company as a public company, becoming “penny stock” (as defined in accordance with Rule 3a51-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), or cause the Company to not meet any greater net tangible asset or cash requirement which may be contained in the agreement relating to a Business Combination (the “Redemption Limitation”) and (ii) the limitation that the Company shall not consummate a Business Combination if the Redemption Limitation is exceeded (the “Proposal 3” or “Redemption Limitation Amendment Proposal”); and |

| |

|

|

| |

4. |

a proposal to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Extraordinary General Meeting, there are not sufficient votes to approve any of the foregoing proposals (the “Proposal 4” or “Adjournment Proposal”). |

The Extension Proposal is

essential to the overall implementation of the Board’s plan to extend the date by which Alpha Star must complete an initial business

combination. The purpose of the Extension Proposal is to allow Alpha Star more time to complete an initial business combination and to

enable the Company to reduce the amount of the Monthly Extension Fee (as described below).

A quorum of shareholders

is necessary to hold a valid meeting. A quorum will be present for the Extraordinary General Meeting if there is present in person or

by proxy not less than a majority of the Company’s ordinary shares present at the Meeting in person or by proxy. The affirmative

vote of the holders of at least two-thirds (2/3) of the Company’s ordinary shares entitled to vote which are present (in person

or by proxy) at the Extraordinary General Meeting and which vote on the Extension Proposal, the Target Limitation Amendment Proposal and

the Redemption Limitation Amendment Proposal will be required to approve such proposals. The affirmative vote of a majority of the Company’s

ordinary shares entitled to vote which are present (in person or by proxy) at the Extraordinary General Meeting and which vote on the

Adjournment Proposal will be required to approve such proposals.

If the shareholders approve

the Extension Proposal, the Company, without another shareholder vote, may elect to extend the time period within which the Company must

consummate its initial business combination for up to six (6) additional one-month periods (each a “Monthly Extension”), to

September 15, 2024, by depositing the Monthly Extension Fee (as defined below) into the Company’s trust account (the “Trust

Account”). In addition, if the shareholders approve the Extension Proposal, the Company will amend the Investment Management Trust

Account, dated December 9, 2021 entered into by the Company and Wilmington Trust, N.A., as trustee (the “Trust Agreement”)

to reduce the amount that the Sponsor or its designee must deposit into the Trust Account in connection with each monthly extension such

that it would be equal to the lesser of (i) $70,000 for all remaining public shares and (ii) $0.033 for each remaining public share for

each Monthly Extension (the “Monthly Extension Fee”).

If the Extension Proposal

is approved, to effectuate each Monthly Extension (as defined herein), the Sponsor and/or its designee will deposit the lesser of (i)

$70,000 for all remaining public shares and (ii) $0.033 for each remaining public share into the Trust Account. The first Monthly Extension

Fee after the approval of the Extension Proposal must be made by January 15, 2024, while the subsequent Monthly Extension Fee must be deposited

into the Trust Account by the 15th of each succeeding month until September 15, 2024 (the “Contributions”).

The Contributions are conditioned upon the implementation of the Extension Proposal. The Contributions will not occur if the Extension

Proposal is not approved or the Extension is abandoned. The amount of the Contributions will not bear interest and will be repayable by

us to our sponsor or its designees upon consummation of an initial business combination. If our sponsor or its designee advises us that

it does not intend to make the Contributions, then the Extension Proposal, will not be put before the shareholders at the Extraordinary

General Meeting and, unless we can complete an initial business combination by March 15, 2024, we will dissolve and liquidate in

accordance with the Amended and Restated Memorandum and Articles of Association. Our sponsor or its designees will have the sole discretion

whether to continue extending for additional calendar months until the Extended Date and if our sponsor determines not to continue extending

for additional calendar months, its obligation to make additional Contributions will terminate.

Holders (“public shareholders”)

of Alpha Star’s ordinary shares sold in its IPO (“Public Shares”) may elect to redeem their Public Shares for their

pro rata portion of the funds available in the trust account in connection with the Extension Proposal and the Redemption Limitation

Proposal (the “Election”) regardless of how such public shareholder votes in regard to the Extension Proposal, Redemption

Limitation Amendment Proposal or Target Limitation Amendment Proposal or whether they were holders of Alpha Star ordinary shares on the

Record Date or acquired such shares after such date. Alpha Star believes that such redemption right protects Alpha Star’s public

shareholders from having to sustain their investments for an unreasonably long period if Alpha Star fails to find a suitable acquisition

in the timeframe initially contemplated by its Amended and Restated Memorandum and Articles of Association. If the proposed proposals

are approved and implemented, the remaining public shareholders will retain their right to redeem their Public Shares for their pro

rata portion of the funds available in the trust account upon consummation of a business combination.

However, unless the Redemption

Limitation Amendment Proposal is approved, the Company will not proceed with the Extension Proposal if the redemption of public shares

in connection therewith would cause the Company to have net tangible assets of less than $5,000,001. In the event that the Extension Proposal

is not implemented, the Company will be required to dissolve and liquidate its Trust Account by returning the then remaining funds in

such Trust Account to the public stockholders. If the Extension Proposal and the Redemption Limitation Proposal are approved by the requisite

vote of shareholders (and not abandoned), the remaining holders of public shares will retain their right to redeem their public shares

for their pro rata portion of the funds available in the Trust Account upon consummation of an initial business combination when it is

submitted to the shareholders, subject to any limitations set forth in the amended and restated memorandum and articles of association

and the limitations contained in related agreements.

If the Extension Proposal

is approved, such approval will constitute consent for the Company to (i) remove from the trust account an amount (the “Withdrawal

Amount”) equal to the number of Public Shares properly redeemed in connection with the shareholder vote on the Extension Proposal

multiplied by the per-share price equal to the aggregate amount then on deposit in the trust account as of two (2) business days prior

to the Extraordinary General Meeting, including interest earned on the trust account deposits (which interest shall be net of taxes payable),

divided by the number of then outstanding Public Shares; and (ii) deliver to the holders of such redeemed Public Shares their portion

of the Withdrawal Amount. The remainder of such funds shall remain in the trust account and be available for use by the Company to complete

a business combination on or before the Extended Date. Holders of Public Shares who do not redeem their Public Shares now will retain

their redemption rights and their ability to vote on a business combination through the Extended Date if the Extension Proposal is approved.

To exercise your redemption rights, you must tender your shares to the Company’s transfer agent at least two (2) business days prior to the Extraordinary General Meeting. You may tender your shares by either delivering your share certificates to the transfer agent or by delivering your shares electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) system. If you hold your shares in street name, you will need to instruct your bank, broker or other nominee to withdraw the shares from your account in order to exercise your redemption rights.

The removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account following the redemption, and the amount remaining in the trust account may be significantly reduced. In such event, the Company may need to obtain additional funds to complete a business combination and there can be no assurance that such funds will be available on terms acceptable to the parties or at all.

If the Extension Proposal

is not approved and we are unable to consummate our initial business combination by March 15, 2024, we will distribute the aggregate

amount then on deposit in the trust account (less up to $100,000 of the net interest earned thereon to pay dissolution expenses), pro

rata to our public shareholders by way of redemption and cease all operations except for the purposes of winding up of our affairs. Any

redemption of public shareholders from the trust account shall be effected automatically by function of our amended and restated memorandum

and articles of association prior to any voluntary winding up. If we are required to windup, liquidate the trust account and distribute

such amount therein, pro rata, to our public shareholders, as part of any liquidation process, such winding up, liquidation and distribution

must comply with the applicable provisions of the Companies Law of the Cayman Islands. In that case, investors may be forced to wait beyond

March 15, 2024 before the redemption proceeds of our trust account become available to them and they receive the return of their

pro rata portion of the proceeds from our trust account. We have no obligation to return funds to investors prior to the date of our redemption

or liquidation unless we consummate our initial business combination prior thereto and only then in cases where investors have sought

to redeem their ordinary shares. Only upon our redemption or any liquidation will public shareholders be entitled to distributions if

we are unable to complete our initial business combination.

Our sponsor, officers and

directors have entered into a letter agreement with us, pursuant to which they have waived their rights to liquidating distributions from

the trust account with respect to their founder shares and private placement shares if we fail to complete our initial business combination

prior to March 15, 2024 or the Extended Date if our shareholders approve the Extension Proposal. There will be no redemption rights

or liquidating distributions with respect to our rights and warrants, which will expire worthless if we fail to complete our initial business

combination prior to March 15, 2024 or the Extended Date if our shareholders approve the Extension Proposal.

You are also being asked to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Extraordinary General Meeting, there are not sufficient votes to approve the proposals.

The Record Date for the Extraordinary General Meeting is December 12, 2023. Record holders of Alpha Star ordinary shares at the close of business on the Record Date are entitled to vote or have their votes cast at the Extraordinary General Meeting. On the Record Date, there were 12,268,503 outstanding ordinary shares of Alpha Star, including 9,063,503 outstanding Public Shares. Alpha Star’s rights and warrants do not have voting rights.

This proxy statement contains important information about the Extraordinary General Meeting and the proposals. Please read it carefully and vote your shares.

This proxy statement is dated December 21, 2023 and is first being mailed to shareholders on or about that date.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE MEETING

These questions and answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully this entire proxy statement.

| Q. Why am I receiving this proxy statement? |

|

A. |

This proxy statement and the accompanying materials are being sent to you in connection with the solicitation of proxies by the Board, for use at the Extraordinary General Meeting to be held on January 10, 2024 at 10:00 a.m., Eastern Time, or at any adjournments or postponements thereof, in the office of the Company’s counsel, Becker & Poliakoff P.A., at 45 Broadway, 17th Floor, New York, NY 10006. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the Extraordinary General Meeting. |

| |

|

|

|

| Q. What is being voted on? |

|

A. |

You are being asked to consider and vote on the following proposals: |

| |

|

|

|

| |

|

|

|

● |

a proposal to amend Alpha Star’s Amended and Restated Memorandum and Articles of Association to extend the date by which Alpha Star must consummate a business combination (the “Extension”) to September 15, 2024 (the “Extended Date”) and reduce the amount of the fee to extend such time period, by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Section 36.2 thereof and replacing it with the new Section 36.2 in the form set forth in Annex A of the accompanying proxy statement (the “Proposal 1” or the “Extension Proposal”); |

| |

|

|

|

|

|

| |

|

|

|

● |

a proposal to amend the Amended and Restated

Memorandum and Articles of Association to allow the Company to undertake an initial business combination with an entity or business

(“Target Business”), with a physical presence, operation, or other significant ties to China or which may subject the

post-business combination business to the laws, regulations and policies of China (including Hong Kong and Macao), or entity or

business that conducts operations in China through variable interest entities, or VIEs, pursuant to a series of contractual

arrangements (the “VIE Agreements”) with the VIE and its shareholders on one side, and a China-based subsidiary of the

China-based Target (the “WFOE”), on the other side (a “China-based Target”) (the “Proposal 2” or

“Target Limitation Amendment Proposal”); |

| |

|

|

|

|

|

| |

|

|

|

● |

a proposal to amend the Amended and Restated Memorandum and Articles of Association to eliminate (i) the limitation that the Company shall not redeem its public shares to the extent that such redemption would result in the ordinary shares, or the securities of any entity that succeeds the Company as a public company, becoming “penny stock” (as defined in accordance with Rule 3a51-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), or cause the Company to not meet any greater net tangible asset or cash requirement which may be contained in the agreement relating to a Business Combination (the “Redemption Limitation”) and (ii) the limitation that the Company shall not consummate a Business Combination if the Redemption Limitation is exceeded (the “Proposal 3” or “Redemption Limitation Amendment Proposal”); and |

| |

|

|

|

|

|

| |

|

|

|

● |

a proposal to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Extraordinary General Meeting, there are not sufficient votes to approve the Extension Proposal (the “Proposal 4” or the “Adjournment Proposal”). |

| |

|

|

Unless the Redemption Limitation Amendment Proposal is approved, in no event will the Company proceed with the Amendment of the Amended and Restated Memorandum and Articles of Association if the Redemptions (as defined below) would cause the public shares to become “penny stock” as such term is defined in Rule 3a51-1 of the Exchange Act. |

| |

|

|

|

| Q. How does the Board of Directors recommend I vote? |

|

A. |

After careful consideration of all relevant factors, the Board recommends that you vote or give instruction to vote “FOR” the Extension Proposal, “FOR” the Target Limitation Amendment Proposal, “FOR” the Redemption Limitation Amendment Proposal, and “FOR” the Adjournment Proposal. |

| Q. Why is the Company proposing the Extension Proposal? |

|

A. |

Alpha Star’s Amended and Restated Memorandum and Articles of Association currently provides for the return of the IPO proceeds held in trust to public shareholders if there is no qualifying business combination consummated on or before March 15, 2024. |

| |

|

|

|

| |

|

|

Without the Extension Amendment, the Company believes that it will not be able to complete the Business Combination within the permitted time period. If that were to occur, the Company would be forced to liquidate. |

| |

|

|

If the Extension Proposal is approved, the removal of the Withdrawal Amount from the Trust Account in connection with the redemption will reduce the amount held in the Trust Account thereafter. We cannot predict the amount that will remain in the Trust Account if the Extension is approved and the amount remaining in the Trust Account may be substantially less than that was in the Trust Account as of December 12, 2023, which could impact our ability to consummate a business combination.

You are not being asked to vote on any proposed business combination at this time. If the Extension Proposal is approved and you do not elect to redeem your public shares in connection with such votes, you will retain the right to vote on any proposed business combination when and if one is submitted to shareholders and the right to redeem your public shares for a pro rata portion from the Trust Account in the event a proposed business combination is approved and completed or the Company has not consummated a business combination by the Extended Date. |

| Q. Why should I vote for the Extension Proposal? |

|

A. |

The Board believes that given Alpha Star’s expenditure of time, effort and money on finding an initial business combination, circumstances warrant providing public shareholders an opportunity to consider an initial business combination. Accordingly, our Board is proposing the Extension Proposal to extend the date by which Alpha Star must complete an initial business combination until the Extended Date and to allow for the Election. |

| |

|

|

|

| |

|

|

Alpha Star’s Amended and Restated Memorandum and Articles of Association require the affirmative vote of the holders of at least two-thirds (2/3) of the Company’s ordinary shares which are present (in person or by proxy) and which vote at the Extraordinary General Meeting in order to effect an amendment to certain of its provisions, including any amendment that would extend its corporate existence beyond March 15, 2024, except in connection with, and effective upon consummation of, an initial business combination. We believe that these Amended and Restated Memorandum and Articles of Association provisions were included to protect Alpha Star shareholders from having to sustain their investments for an unreasonably long period if Alpha Star failed to find a suitable initial business combination in the timeframe contemplated by the Amended and Restated Memorandum and Articles of Association. We also believe, however, that given Alpha Star’s expenditure of time, effort and money on the potential business combinations with the targets it has identified, circumstances warrant providing those who would like to consider whether a potential business combination with one or more of such targets is an attractive investment with an opportunity to consider such transaction, inasmuch as Alpha Star is also affording shareholders who wish to redeem their Public Shares the opportunity to do so, as required under its Amended and Restated Memorandum and Articles of Association. Accordingly, we believe the Extension is consistent with Alpha Star’s Amended and Restated Memorandum and Articles of Association and IPO prospectus. |

| Q. How do the Alpha Star insiders intend to vote their shares? |

|

A. |

All of Alpha Star’s directors, executive officers, initial shareholders and their respective affiliates are expected to vote any ordinary shares over which they have voting control (including any Public Shares owned by them) in favor of the Extension Proposal, the Target Limitation Amendment Proposal, the Redemption Limitation Amendment Proposal and the Adjournment Proposal. |

| |

|

|

|

| |

|

|

Alpha Star’s directors, executive officers, initial shareholders and their respective affiliates are not entitled to redeem the founder shares which include 2,875,000 ordinary shares initially issued to the Sponsor for an aggregate purchase price of $25,000. Public Shares purchased on the open market by Alpha Star’s directors, executive officers and their respective affiliates may be redeemed. On the Record Date, Alpha Star’s directors, executive officers, initial shareholders and their affiliates beneficially owned and were entitled to vote 2,875,000 founder shares and 330,000 private placement units, representing approximately 26.12% of Alpha Star’s issued and outstanding ordinary shares. |

| |

|

|

|

| |

|

|

Alpha Star’s directors, executive officers, initial shareholders and their affiliates may choose to buy Public Shares in the open market and/or through negotiated private purchases. In the event that purchases do occur, the purchasers may seek to purchase shares from shareholders who would otherwise have voted against the Extension Proposal, the Target Limitation Amendment Proposal or the Redemption Limitation Amendment Proposal. Any Public Shares held by or subsequently purchased by affiliates of Alpha Star may be voted in favor of all of these proposals. |

| Q. What amount will holders receive upon consummation of a subsequent business combination or liquidation if the Extension Proposal is approved? |

|

A. |

If the Extension Proposal is approved, then in accordance with the amendment to the Trust Agreement, our sponsor, or its designee, has agreed to contribute to us as a loan of the lesser of (i) $70,000 for all remaining public shares and (ii) $0.033 for each remaining public shares into the Trust Account (the “Monthly Extension Fee”). The Monthly Extension Fees must be deposited into the Trust Account by the 15th of each succeeding month until the Extended Date (the “Contributions”). Assuming the Extension Proposal is approved, the initial and any subsequent Contribution will be deposited in the trust account promptly following the Extraordinary General Meeting. Each additional Contribution will be deposited in the trust account established in connection with the IPO within thirty calendar days from the beginning of such calendar month (or portion thereof). The Contributions are conditioned upon the implementation of the Extension Proposal. The Contributions will not occur if the Extension Proposal is not approved or the Extension is abandoned. The amount of the Contributions will not bear interest and will be repayable by us to our sponsor or its designees upon consummation of an initial business combination. |

| |

|

|

|

| |

|

|

If our sponsor or its designee advises us that it does not intend to make the Contributions, then the Extension Proposal will not be put before the shareholders at the Extraordinary General Meeting and we will dissolve and liquidate in accordance with our Amended and Restated Memorandum and Articles of Association. Our sponsor or its designees will have the sole discretion whether to continue extending for additional calendar months until the Extended Date and if our sponsor determines not to continue extending for additional calendar months, its obligation to make additional Contributions will terminate. |

| Q. Will you seek any further extensions to liquidate the trust account? |

|

A. |

Other than the extension until the Extended Date as described in this proxy statement, Alpha Star does not anticipate, but is not prohibited from, seeking the requisite shareholder consent to any further extension to consummate a business combination. Alpha Star has provided that all holders of Public Shares, whether they vote for or against the Extension Proposal, or whether they were holders of Alpha Star ordinary shares on the Record Date or acquired such shares after such date, may elect to redeem their Public Shares into their pro rata portion of the trust account and should receive the funds shortly after the Extraordinary General Meeting. Those holders of Public Shares who elect not to redeem their shares now shall retain redemption rights with respect to the initial business combinations, or, if no future business combination is brought to a vote of the shareholders or if a business combination is not completed for any reason, such holders shall be entitled to the pro rata portion of the trust account on the Extended Date upon a liquidation of the Company. |

| Q. What happens if the Extension Proposal is not approved? |

|

A. |

If the Extension Proposal is not approved and we have not consummated an initial business combination by March 15, 2024, or if the Extension Proposal is approved and we have not consummated an initial business combination by the Extended Date, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten (10) business days thereafter, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of taxes payable, and less up to $100,000 of interest to pay dissolution expenses) divided by the number of then issued and outstanding Public Shares, which redemption will completely extinguish public shareholders’ rights as shareholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our Board of Directors, liquidate and dissolve, subject in each case to our obligations under Cayman Islands law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our rights and warrants, which will expire worthless if we fail to complete our initial business combination by March 15, 2024. |

| |

|

|

|

| |

|

|

Our sponsor, officers and directors have entered into a letter agreement with us, pursuant to which they have waived their rights to liquidating distributions from the trust account with respect to their founder shares and private placement shares if we fail to complete our initial business combination by March 15, 2024. |

| |

|

|

|

| Q. If the Extension Proposal is approved, what happens next? |

|

A. |

If the Extension Proposal is approved, the Company has until the Extended Date to complete its initial business combination. If the shareholders approve the Extension Proposal, the Company, without another shareholder vote, may elect to extend the time period within which the Company must consummate its initial business combination for up to six (6) additional one-month periods to the Extended Date, by depositing the Monthly Extension Fee into the Trust Account. The Company will also amend the Trust Agreement to reduce the amount of the fee that the sponsor (or its designee must deposit) to the Monthly Extension Fee as defined above. |

| |

|

|

| |

|

If the Extension Proposal is approved, we will remove the Withdrawal Amount from the trust account, deliver to the holders of redeemed Public Shares their portion of the Withdrawal Amount and retain the remainder of the funds in the trust account for our use in connection with consummating a business combination on or before the Extended Date. |

| |

|

|

| |

|

|

If the Extension Proposal is approved and the Extension is implemented, the removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account following the Election. We cannot predict the amount that will remain in the trust account if the Extension Proposal is approved and the amount remaining in the trust account may be only a small fraction of the current amount that was in the trust account as of the Record Date. In such event, we may need to obtain additional funds to complete an initial business combination, and there can be no assurance that such funds will be available on terms acceptable to the parties or at all. |

| |

|

|

However, the Company will not proceed with the Extension Proposal if the redemption of public shares in connection therewith would cause the Company to have net tangible assets of less than $5,000,001 unless the Redemption Limitation Amendment Proposal is approved. In the event that the Redemption Limitation Amendment Proposal is not approved and the redemption of public shares causes the net tangible assets to be less than $5,000,001 and the Extension Proposal is not implemented, the Company will be required to dissolve and liquidate its Trust Account by returning the then remaining funds in such Trust Account to the public shareholders. If the Extension Proposal is approved by the requisite vote of shareholders (and not abandoned), the remaining holders of public shares will retain their right to redeem their public shares for their pro rata portion of the funds available in the Trust Account upon consummation of an initial business combination when it is submitted to the shareholders, subject to any limitations set forth in the amended and restated memorandum and articles of association and the limitations contained in related agreements.

The Company will remain a reporting company under the Securities Exchange Act of 1934 (the “Exchange Act”) and its units, ordinary shares, rights and warrants will remain publicly traded.

If the Extension Proposal is approved and public shareholders elect to redeem their Public Shares, the removal of the Withdrawal Amount from the trust account will reduce the amount remaining in the trust account and increase the percentage interest of Alpha Star’s ordinary shares held by Alpha Star’s officers, directors, initial shareholders and their affiliates. |

| Q. Why is the Company proposing the Redemption Limitation Amendment Proposal? |

|

A. |

The purpose of the Redemption Limitation Amendment Proposal is to eliminate the Redemption Limitation from the Amended and Restated Memorandum and Articles of Association. Unless the Redemption Limitation Amendment Proposal is approved, we will not proceed with the Extension Proposal if Redemptions made in connection with the Extraordinary General Meeting would cause the Ordinary shares to become “penny stock” as such term is defined in Rule 3a51-1 of the Exchange Act. Further, if the Redemption Limitation Amendment Proposal is not approved and there are significant requests for Redemptions such that the Redemption Limitation would be exceeded, the Redemption Limitation would prevent the Company from being able to consummate a Business Combination even if all other conditions to closing are met. The Company believes that the Redemption Limitation is not necessary. The purpose of such limitation was initially to ensure that the Company did not become subject to the U.S. Securities and Exchange Commission’s “penny stock” rules. The Company is presenting the Redemption Limitation Amendment Proposal to facilitate the Charter Amendment and the consummation of a Business Combination. |

| |

|

|

|

| Q. Why should I vote “FOR” the Redemption Limitation Amendment Proposal? |

|

A. |

The Company believes that by eliminating the Redemption Limitation from the Amended and Restated Memorandum and Article of Association, the Company would be permitted to redeem Public Shares, irrespective of whether such redemption would exceed the Redemption Limitation. |

| |

|

|

|

| |

|

|

The purpose of such limitation was initially to ensure that the Company did not become subject to the SEC’s “penny stock” rules. The Company is presenting the Redemption Limitation Amendment Proposal to facilitate the implementation of the Charter Amendment and the consummation of a Business Combination. |

| Q. What happens if the Redemption Limitation Amendment Proposal is not approved? |

|

A. |

If the Redemption Limitation Amendment Proposal is not approved at the Shareholder Meeting or at any adjournment thereof and there are significant requests for Redemption such that the Redemption Limitation would be exceeded, the Redemption Limitation would prevent the Company from being able to consummate a Business Combination. If the Redemption Limitation Amendment Proposal is not approved, we will not redeem Public Shares to the extent that accepting all properly submitted redemption requests would exceed the Redemption Limitation. In the event that the Redemption Limitation Amendment Proposal is not approved and we receive notice of Redemptions approaching or in excess of the Redemption Limitation, we and/or the Sponsor may take action to increase the Company’s net tangible assets to avoid exceeding the Redemption Limitation. |

| |

|

|

|

| Q. Why is the Company proposing the Target Limitation Amendment Proposal? |

|

A. |

The purpose of the Target Limitation Amendment Proposal is to afford the Company with flexibility to enter into an initial business combination with a China-based Target that conducts its operations through the use of the VIE structure to manage and control its operations in China. The Company’s IPO prospectus provides that the Company will not conduct an initial business combination with any target company that conducts its operations through variable interest entities, or VIEs (the “Target Limitation”). If the Target Limitation Amendment Proposal is approved, the Company will be allowed to undertake an initial business combination with a China-based Target that operates through a VIE, which will allow the Company to access a larger pool of target candidates and provide additional flexibility for the Company to consummate an initial business combination before the final extension date permitted under the Company’s charter. The Board has determined that, given the Company’s expenditure of time, effort and money on identifying a suitable target business and completion of a business combination, and the market opportunity the Company has observed in China (including Hong Kong and Macau), it is in the best interests of its shareholders to approve the Target Limitation Amendment to allow the Company to undertake a business combination with a China-based Target that conducts its operations through a VIE. |

| |

|

|

|

| Q. Why should I vote “FOR” the Target Limitation Amendment Proposal? |

|

A. |

The Company believes shareholders will benefit from the Company consummating a Business Combination and is proposing the Target Limitation Amendment Proposal to afford the Company with flexibility in its search for a target with which to consummate a Business Combination. The approval of the Target Limitation Amendment Proposal is essential to the implementation of the Board’s plan to consummate a Business Combination within the Combination Period. The Board believes that the Company may need more flexibility in its search for a potential target in order to complete a Business Combination on or before the end date of the Combination Period. If the Target Limitation Amendment Proposal is not approved, and we are unable to consummate a Business Combination by the Original Deadline Date, the Company would be forced to liquidate. |

| |

|

|

|

| Q. What happens if the Target Limitation Amendment Proposal is not approved? |

|

A. |

If the Target Limitation Amendment Proposal is not approved, the Company will not conduct an initial business combination with an entity or business with it principal or a majority of its business operations (either directly or through any subsidiaries) in the People’s Republic of China (including Hong Kong and Macau). |

| |

|

|

|

| Q. Why is the Company proposing the Adjournment Proposal? |

|

A. |

To allow the Company more time to solicit additional proxies in favor of the Election of Directors Proposal, the Ratification of Appointment of Independent Auditor Proposal, the Redemption Limitation Amendment Proposal, the Target Limitation Amendment Proposal, in the event the Company does not receive the requisite shareholder vote to approve the aforesaid Proposals. |

| Q. Why should I vote “FOR” the Adjournment Proposal? |

|

A. |

If the Adjournment Proposal is not approved by the Company’s shareholders, the Board may not be able to adjourn the Shareholder Meeting to a later date or dates to approve the Election of Directors Proposal, the Ratification of Appointment of Independent Auditor Proposal, the Redemption Limitation Amendment Proposal, the Target Limitation Amendment Proposal or to allow public shareholders time to reverse their redemption requests. |

| |

|

|

|

|

Q. What if I do not want to vote “FOR” the Extension

Proposal, the Redemption Limitation Amendment Proposal, the Target Limitation Amendment Proposal or the Adjournment Proposal?

|

|

A. |

If you do not want the Extension Proposal, the Redemption Limitation Amendment Proposal, the Target Limitation Amendment Proposal or the Adjournment Proposal to be approved, you may “ABSTAIN,” not vote, or vote “AGAINST” such proposal. |

| |

|

|

| |

|

If you attend the Extraordinary General Meeting in person or by proxy, you may vote “AGAINST” any of the Proposals, and your ordinary shares will be counted for the purposes of determining whether the Proposals are approved. |

| |

|

|

| |

|

However, if you fail to attend the Extraordinary General Meeting in person or by proxy, or if you do attend the Extraordinary General Meeting in person or by proxy but you “ABSTAIN” or otherwise fail to vote at the Extraordinary General Meeting, your ordinary shares will not be counted for the purposes of determining whether the Adjournment Proposal is approved, and your ordinary shares which are not voted at the Extraordinary General Meeting will have no effect on the outcome of such vote. If you “ABSTAIN” or otherwise fail to vote at the Extraordinary General Meeting, this will have the same effect as a vote “AGAINST” the Proposals. |

| |

|

|

|

| Q. Who bears the cost of soliciting proxies? |

|

A. |

The Company will bear the cost of soliciting proxies and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, the Company, through their respective directors and officers, may solicit proxies in person, by telephone or by electronic means. Such directors and officers will not receive any Extraordinary General remuneration for these efforts. We have retained Advantage Proxy, Inc. (“Advantage Proxy”) to assist us in soliciting proxies. If you have questions about how to vote or direct a vote in respect of your shares, you may contact Advantage Proxy at (877) 870-8565 (toll free) or by email at ksmith@advantageproxy.com. The Company has agreed to pay Advantage Proxy a fee and expenses, for its services in connection with the Extraordinary General Meeting. |

| |

|

|

|

| Q. How do I change my vote? |

|

A. |

If you have submitted a proxy to vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy card to Alpha Star’s Secretary prior to the date of the Extraordinary General Meeting or by voting online at the Extraordinary General Meeting. Attendance at the Extraordinary General Meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to 80 Broad Street, 5th Floor, New York, NY 10004, Attention - Secretary. |

| Q. If my shares are held in “street name,” will my broker automatically vote them for me? |

|

A. |

No. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. We believe that Proposals 1, 2, 3 and 4 are “non-discretionary” items. |

| |

|

|

Your broker can vote your shares with respect to “non-discretionary items” only if you provide instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. If you do not give your broker instructions, your shares will be treated as broker non-votes and will have no effect on the proposals. |

| Q. What is a quorum requirement? |

|

A. |

A quorum of shareholders is necessary to hold a valid Meeting. A quorum will be present for the Extraordinary General Meeting if there is present in person or by proxy not less than a majority of the Company’s ordinary shares present at the Meeting in person or by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee), vote online, or if you attend the Extraordinary General Meeting. Abstentions will be counted towards the quorum requirement. If there is no quorum, the chairman of the Extraordinary General Meeting may adjourn the Extraordinary General Meeting to another date. |

| |

|

|

|

| Q. How are votes counted? |

|

|

The affirmative vote of the holders of at least two-thirds (2/3) of the Company’s ordinary shares entitled to vote which are present (in person or by proxy) at the Extraordinary General Meeting and which vote on the Extension Proposal, Target Limitation Amendment Proposal and the Redemption Limitation Amendment Proposal will be required to approve such Proposals.

The affirmative vote of a majority of the Company’s ordinary shares entitled to vote which are present (in person or by proxy) at the Extraordinary General Meeting and which vote on the Adjournment Proposal will be required to approve such proposal. The Adjournment Proposal will only be put forth for a vote if there are not sufficient votes for, or otherwise in connection with, the approval of the other proposals at the special meeting.

For purposes of the Extension Proposal, the Target Limitation Amendment Proposal, the Redemption Limitation Amendment Proposal and Adjournment Proposal, abstentions (but not broker non-votes), while considered present for the purposes of establishing a quorum, will not count as a vote cast at the Extraordinary General Meeting and will have no effect on the outcome of any vote on such proposals. |

| |

|

|

|

| Q. Who can vote at the Extraordinary General Meeting? |

|

A. |

Only holders of record of Alpha Star’s ordinary shares at the close of business on December 12, 2023 (the “Record Date”) are entitled to have their vote counted at the Extraordinary General Meeting and any adjournments or postponements thereof. On the Record Date, 12,268,503 ordinary shares were issued and outstanding and entitled to vote.

Shareholder of Record: Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with Alpha Star’s transfer agent, Vstock Transfer LLC, then you are a shareholder of record. As a shareholder of record, you may vote in person or online at the Extraordinary General Meeting or vote by proxy. Whether or not you plan to attend the Extraordinary General Meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. |

| |

|

|

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Extraordinary General Meeting. However, since you are not the shareholder of record, you may not vote your shares online at the Extraordinary General Meeting unless you request and obtain a valid proxy from your broker or other agent. |

| Q. Does the Board recommend voting for the approval of the Extension Proposal, the Target Limitation Amendment Proposal, the Redemption Limitation Amendment Proposal and the Adjournment Proposal? |

|

A. |

Yes. After careful consideration of the terms and conditions of these proposals, the Board has determined that the Proposals 1, 2, 3 and 4 are fair to and in the best interests of Alpha Star and its shareholders. The Board recommends that Alpha Star’s shareholders vote “FOR” for the Proposals 1, 2, 3 and 4. |

| |

|

|

|

| Q. What interests do the Company’s sponsor, directors and officers have in the approval of the proposals? |

|

A. |

Alpha Star’s directors, officers, initial shareholders and their affiliates have interests in the proposals that may be different from, or in addition to, your interests as a shareholder. These interests include ownership of certain securities of the Company. See the section entitled “The Extension Proposal — Interests of Alpha Star’s Sponsor, Directors and Officers.” |

| |

|

|

|

| Q. What happens to the Alpha Star rights and warrants if the Extension Proposal is not approved? |

|

A. |

If the Extension Proposal is not approved, we will automatically wind up, liquidate and dissolve effective starting on March 15, 2024. In such event, your rights and warrants will become worthless. |

| |

|

|

|

| Q. What happens to the Alpha Star right and warrants if the Extension Proposal is approved? |

|

A. |

If the Extension Proposal is approved, Alpha Star will continue to attempt to consummate an initial business combination with potential targets until the Extended Date, and will retain the blank check company restrictions previously applicable to it. The rights and warrants will remain outstanding in accordance with their terms. |

| |

|

|

|

| Q. What do I need to do now? |

|

A. |

Alpha Star urges you to read carefully and consider the information contained in this proxy statement, including Annex A, and to consider how the proposals will affect you as an Alpha Star shareholder. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card. |

| Q. How do I vote? |

|

A. |

If you are a holder of record of Alpha Star Public Shares, you may vote online at the Extraordinary General Meeting or by submitting a proxy for the Extraordinary General Meeting. Whether or not you plan to attend the Extraordinary General Meeting, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may still attend the Extraordinary General Meeting and vote online if you have already voted by proxy.

Voting by Mail. By signing the proxy card and returning it in the enclosed prepaid and addressed envelope, you are authorizing the individuals named on the proxy card to vote your shares at the Extraordinary General Meeting in the manner you indicate. You are encouraged to sign and return the proxy card even if you plan to attend the Extraordinary General Meeting so that your shares will be voted if you are unable to attend. |

| |

|

|

|

| |

|

|

Voting by Internet. Shareholders who have received a copy of the proxy card by mail may be able to vote over the Internet by visiting the web address on the proxy card and entering the voter control number included on your proxy card. |

| |

|

|

Voting by email or fax. If available, you may vote by email or fax by following the instructions provided on the proxy card.

If your shares of Alpha Star are held in “street name” by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Extraordinary General Meeting. However, since you are not the shareholder of record, you may not vote your shares online at the Extraordinary General Meeting unless you request and obtain a valid proxy from your broker or other agent. |

| Q. How do I exercise my redemption rights? |

|

A. |

If the Extension is implemented, each public shareholder may seek to redeem such shareholder’s Public Shares for its pro rata portion of the funds available in the trust account, less any income taxes owed on such funds but not yet paid. You will also be able to redeem your Public Shares in connection with any shareholder vote to approve a proposed business combination, or if the Company has not consummated an initial business combination by the Extended Date.

To demand redemption of your Public Shares, you must ensure your bank or broker complies with the requirements identified elsewhere herein.

In connection with tendering your shares for

redemption, you must elect either to physically tender your share certificates to Vstock Transfer LLC, the Company’s transfer

agent, at 18 Lafayette Place, Woodmere, New York 11598, at least two (2) business days prior to the Extraordinary General Meeting or

to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At

Custodian) System, which election would likely be determined based on the manner in which you hold your shares. |

| |

|

|

|

| |

|

|

Certificates that have not been tendered in accordance with these procedures at least two (2) business days prior to the Extraordinary General Meeting will not be redeemed for cash. In the event that a public shareholder tenders its shares and decides prior to the Extraordinary General Meeting that it does not want to redeem its shares, the shareholder may withdraw the tender. If you delivered your shares for redemption to our transfer agent and decide prior to the Extraordinary General Meeting not to redeem your shares, you may request that our transfer agent return the shares (physically or electronically). You may make such request by contacting our transfer agent at the address listed above. |

| |

|

|

|

| Q. What should I do if I receive more than one set of voting materials? |

|

A. |

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your Alpha Star shares. |

| Q. Who can help answer my questions? |

|

A. |

If you have questions about the proposals or if you need additional copies of the proxy statement or the enclosed proxy card, you should contact:

Alpha Star Acquisition Corporation

80 Broad Street, 5th Floor

New York, NY 10004

(212) 837-7977

Or

Advantage Proxy, Inc.

P.O. Box 13581

Des Moines, WA 98198

Toll Free: (877) 870-8565

Collect: (206) 870-8565

You may also obtain additional information about the Company from documents filed with the SEC by following the instructions in the section entitled “Where You Can Find More Information.” |

FORWARD-LOOKING STATEMENTS

We believe that some of the information in this proxy statement constitutes forward-looking statements. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they:

| |

● |

discuss future expectations; |

| |

|

|

| |

● |

contain projections of future results of operations or financial condition; or |

| |

|

|

| |

● |

state other “forward-looking” information. |

We believe it is important to communicate our expectations to our shareholders. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The cautionary language discussed in this proxy statement provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including, among other things, claims by third parties against the trust account, unanticipated delays in the distribution of the funds from the trust account and Alpha Star’s ability to finance and consummate any proposed business combination. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement.

All forward-looking statements included herein attributable to Alpha Star or any person acting on Alpha Star’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, Alpha Star undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this proxy statement or to reflect the occurrence of unanticipated events.

BACKGROUND

We are a blank check company incorporated as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.