0001068875

false

0001068875

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

November 6, 2023

AVANTAX, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-25131 |

|

91-1718107 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

3200 Olympus Blvd, Suite 100

Dallas, Texas 75019

(Address of principal executive offices, including

zip code)

(972) 870-6400

(Registrant’s telephone number, including area

code)

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

AVTA |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

As previously disclosed,

on September 9, 2023, Avantax, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan

of Merger (the “Merger Agreement”) with Aretec Group, Inc., a Delaware corporation (“Parent”),

and C2023 Sub Corp., a Delaware corporation and a wholly-owned subsidiary of Parent (“Acquisition Sub”). The

Merger Agreement provides that, on the terms and subject to the conditions of the Merger Agreement, Acquisition Sub will merge with and

into the Company (the “Merger”), with the Company continuing as the surviving corporation in the Merger and

becoming a wholly-owned subsidiary of Parent.

On November 6,

2023, Christopher Walters, the Chief Executive Officer of the Company, announced that, subject to the closing of the Merger, he

plans to step down from the role of Chief Executive Officer after the end of 2023, and Marc Mehlman, the Company’s Chief

Financial Officer and Treasurer, and Tabitha Bailey, the Company’s Chief Legal Officer and Corporate Secretary, announced

that, subject to the closing of the transactions contemplated by the Merger Agreement, they would not remain with the Company

long-term following such closing. None of Mr. Walters, Mr. Mehlman or Ms. Bailey entered into any agreements or understandings with

the Company in connection with such announcements.

Litigation Related to the Merger.

As of the date of this Current Report on Form 8-K,

three lawsuits relating to the Merger (together, the “Lawsuits”) have been filed: (1) Vincent Lavanga v.

Avantax, Inc., et al., No. 1:23-cv-09159, which was filed in the United States District Court for the Southern District of New York

on October 18, 2023; (2) Christopher Taylor v. Avantax, Inc., et al., 1:23-cv-01222-UNA, which was filed in the United States District

Court for the District of Delaware on October 26, 2023; and (3) Brian Jones v. Avantax, Inc., et al., No. 1:23-cv-01218-UNA, which

was filed in the United States District Court for the District of Delaware on October 26, 2023. Each of the Lawsuits was filed by a purported

stockholder of the Company and as an individual action and alleges that the Company’s definitive proxy statement filed on October

16, 2023 (the “Proxy Statement”) omitted material information in violation of Sections 14(a) and 20(a) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and certain rules promulgated thereunder,

rendering the Proxy Statement false and misleading. The Lawsuits name as defendants the Company and its directors and seek, among other

relief, an order enjoining the completion of the Merger. There can be no assurance regarding the ultimate outcome of the Lawsuits.

As of the date of this Current Report on Form 8-K,

multiple purported stockholders of the Company have also delivered demand letters to the Company (collectively, the “Demand

Letters”) alleging that the disclosures contained in the Proxy Statement are deficient and requesting that the Company supplement

such disclosures prior to the special meeting of the stockholders of the Company in connection with the Merger, which is scheduled to

be held on November 21, 2023, as disclosed in the Proxy Statement. The Demand Letters also threaten the Company with lawsuits in the event

that the purported deficiencies in the Proxy Statement are not addressed.

The Company believes that the claims asserted in the

Lawsuits and the Demand Letters are without merit. However, in order to moot the unmeritorious disclosure claims, alleviate the costs,

risks and uncertainties inherent in litigation and provide additional information to its stockholders, the Company has determined to voluntarily

supplement the Proxy Statement as described in this Current Report on Form 8-K. Nothing in this Current Report on Form 8-K shall be deemed

an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary,

the Company specifically denies all allegations set forth in the Lawsuits and the Demand Letters that any additional disclosure in the

Proxy Statement was or is required.

Supplemental Disclosures.

The following disclosures supplement the

disclosures contained in the Proxy Statement and should be read in conjunction with the disclosures contained in the Proxy

Statement, which should be read in its entirety. To the extent the information set forth herein differs from or updates information

contained in the Proxy Statement, the information set forth herein shall supersede or supplement the information in the Proxy

Statement. All page references are to pages in the Proxy Statement, and terms used below, unless otherwise defined, have the

meanings set forth in the Proxy Statement.

| (a) | In the section of the Proxy Statement entitled “The Merger—Background of the Merger,”

the disclosure in the penultimate paragraph of page 48 is amended by adding the following sentence at the end of such paragraph: |

Prior

to the entry into the merger agreement, there were no discussions or negotiations regarding any post-closing employment arrangement between

Avantax or any of its executive officers, on the one hand, and Parent or any of the other potential counterparties, on the other hand.

| (b) | The section of the Proxy Statement entitled “Opinion of Avantax’s Financial Advisor”

is amended and supplemented as follows: |

(i) The

table at the top of page 65 is amended by replacing it with the following (so as to add the columns captioned “2024E Low”

and “2024E High”):

| | |

2024E Low | |

2024E High | |

2024E Median |

| TEV / Adjusted EBITDA (Post-SBC) | |

| 5.8x | | |

| 9.5x | | |

| 7.7x | |

| Price / Non-GAAP EPS (Post-SBC) | |

| 7.7x | | |

| 13.8x | | |

| 10.5x | |

(ii)

The table at the bottom of page 65 is amended by replacing it with the following (so as to add the column captioned “Closing Date”):

|

Announcement Date |

|

Closing Date |

|

Acquiror |

|

Target |

| February 2, 2023 |

|

August 31, 2023 |

|

Clayton, Dubilier & Rice, LLC and Stone Point Capital, LLC |

|

Focus Financial Partners Inc. |

| December 2, 2020 |

|

April 30, 2021 |

|

LPL Financial Holdings, Inc and Macquarie Group Limited |

|

Waddell & Reed Financial, Inc. |

| January 7, 2020 |

|

July 1, 2020 |

|

Blucora, Inc. (n/k/a Avantax, Inc.) |

|

HK Financial Services, Inc. |

| November 12, 2019 |

|

February 14, 2020 |

|

Advisor Group Holdings, Inc. |

|

Ladenburg Thalmann Financial Services Inc. |

| March 19, 2019 |

|

May 6, 2019 |

|

Blucora, Inc. (n/k/a Avantax, Inc.) |

|

1st Global Advisors, Inc. |

| November 5, 2015 |

|

February 1, 2016 |

|

Financial Engines Advisors, LLC |

|

The Mutual Fund Store, LLC |

| October 14, 2015 |

|

December 31, 2015 |

|

Blucora, Inc. (n/k/a Avantax, Inc.) |

|

HD Vest Financial Services, Inc. |

(iii)

The table following the first paragraph on page 66 is amended by replacing it with the following (so as to add the columns captioned “Low”

and “High”):

| | |

Low | |

High | |

Average | |

Median |

| TEV / LTM Adjusted EBITDA (Pre-SBC) | |

| 7.7x | |

| 18.0x | |

| 12.1x | |

| 12.0x |

Additional Information Regarding the Merger and Where to Find It

This Current Report on Form 8-K relates to

the proposed transaction (the “proposed transaction”) involving the Company, Parent and Acquisition Sub,

whereby the Company would become a wholly-owned subsidiary of Parent. This Current Report on Form 8-K does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction

will be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection

therewith, the Company has filed with the U.S. Securities and Exchange Commission (the “SEC”) the Proxy

Statement, which was mailed beginning on October 16, 2023 to the stockholders of the Company as of the record date established for

voting on the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed

transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY

HOLDERS OF THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may

obtain free copies of the Proxy Statement, any amendments or supplements thereto and other documents containing important

information about the Company, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov.

In addition, stockholders of the Company may obtain free copies of the documents filed with the SEC by directing a request through

the Investor Relations portion of the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200

Olympus Boulevard, Suite 100, Dallas, Texas 75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation

The Company and its directors, its executive

officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed to be participants

in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of

the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of the stockholders

of the Company, filed with the SEC on April 3, 2023, the Proxy Statement and in subsequent documents filed with the SEC, each of which

is (or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in

the solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security

holdings or otherwise, is contained in the Proxy Statement and other relevant materials filed or to be filed with the SEC regarding the

proposed transaction when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Exchange Act. Forward-looking statements provide current expectations of future events based on certain assumptions and include any

statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by

words such as “anticipates,” “believes,” “plans,” “expects,” “future,”

“intends,” “may,” “will,” “would,” “could,” “should,”

“estimates,” “predicts,” “potential,” “continues,” “target,”

“outlook” and similar terms and expressions, but the absence of these words does not mean that the statement is not

forward-looking. Actual results may differ significantly from management’s expectations due to various risks and uncertainties

including, without limitation: (i) the risk that the proposed transaction may not be completed in a timely manner, or at all; (ii)

the failure to satisfy the conditions to the consummation of the proposed transaction, including, without limitation, the receipt of

stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to the proposed transaction; (iv)

the effect of the announcement or pendency of the proposed transaction on the plans, business relationships, operating results and

operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of the announcement and

pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the announcement of

the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing business

operations; (viii) legal proceedings, including the Lawsuits and those that may be instituted against the Company, its board of

directors, its executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the

failure to obtain the necessary financing to complete the proposed transaction. In addition, a description of certain other factors

that could affect the Company’s business, financial condition or results of operations is included in the Company’s most

recent Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q filed with the SEC. Forward-looking statements

reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance or events.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this

Current Report on Form 8-K. The Company undertakes no obligation to update any forward-looking statements to reflect events or

circumstances after the date hereof, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

AVANTAX, INC. |

| |

|

|

(Registrant) |

| |

|

|

|

| Date: November 13, 2023 |

|

By: |

/s/ Marc Mehlman |

| |

|

|

Name: Marc Mehlman

Title: Chief Financial Officer and Treasurer |

| |

|

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

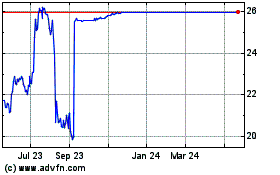

Avantax (NASDAQ:AVTA)

Historical Stock Chart

From Apr 2024 to May 2024

Avantax (NASDAQ:AVTA)

Historical Stock Chart

From May 2023 to May 2024