Bridger Aerospace Announces $70 Million Proposed Public Follow-On Offering to Fund Growth Initiatives

18 October 2023 - 7:20AM

Bridger Aerospace Group Holdings, Inc. (“Bridger” or “Bridger

Aerospace”) (NASDAQ: BAER) today announced the commencement of a

proposed underwritten public offering by Bridger of $70 million of

shares of its common stock, par value $0.0001 per share (“Common

Stock”). Bridger intends to grant the underwriters a 30-day option

to purchase up to an additional $10.5 million of shares of its

Common Stock at the public offering price less the underwriting

discounts and commissions. The offering is subject to market and

other conditions, and there can be no assurance as to whether or

when the offering may be completed, or as to the actual size or

terms of the offering.

Bridger intends to use the net proceeds of the

offering to finance the cash purchase price for four additional

Super Scooper aircraft from the Spanish government and for the

previously announced acquisition of Bighorn Airways, Inc., and the

remainder for general corporate purposes, including funding

the upgrade costs for the acquired Super Scoopers and other

working capital needs.

Stifel, Nicolaus & Company, Incorporated is

acting as the lead book-running manager for the offering and BTIG

LLC and Canaccord Genuity LLC are also acting as joint book-runners

for the offering.

The offering will be made only by means of a

prospectus forming part of a registration statement on Form S-1 on

file with the Securities and Exchange Commission (the “SEC”). A

registration statement relating to these securities has been filed

with the SEC but has not yet become effective. These securities may

not be sold, nor may offers to buy be accepted, prior to the time

the registration statement becomes effective. A copy of the

preliminary prospectus relating to the offering may be obtained by

sending a request to Stifel, Nicolaus & Company, Incorporated,

Attn: Syndicate Department, 1 South Street, 15th Floor, Baltimore,

MD 21202, or by telephone at (855) 300-7136, or by email at

syndprospectus@stifel.com. The preliminary prospectus and the final

prospectus, when available, may also be obtained on the SEC’s

website at http://www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Bridger AerospaceBased in

Belgrade, Montana, Bridger Aerospace Group Holdings, Inc. is one of

the nation’s largest aerial firefighting companies. Bridger

provides aerial firefighting and wildfire management services to

federal and state government agencies, including the United States

Forest Service, across the nation, as well as internationally.

Forward-Looking Statements

Certain statements included in this press

release are not historical facts but are forward-looking

statements, including for purposes of the safe harbor provisions

under the United States Private Securities Litigation Reform Act of

1995. Forward-looking statements generally are accompanied by words

such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,”

“project,” “forecast,” “predict,” “poised,” “positioned,”

“potential,” “seem,” “seek,” “future,” “outlook,” “target,” and

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters, but the

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements include, but are

not limited to, (1) market conditions and the satisfaction of

closing conditions related to the proposed public offering; (2) the

intended use of proceeds from the offering; (3) references to the

anticipated acquisition of Super Scoopers from the Spanish

government and of Bighorn Airways, Inc., including the ultimate

outcome and benefits of such acquisitions; and (4)

planned upgrades for the new Super Scoopers to be acquired.

These statements are based on various assumptions and estimates,

whether or not identified in this press release, and on the current

expectations of Bridger’s management and are not predictions of

actual performance. These forward-looking statements are provided

for illustrative purposes only and are not intended to serve as,

and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Bridger. These

forward-looking statements are subject to a number of risks and

uncertainties, including: changes in domestic and foreign business,

market, financial, political and legal conditions; Bridger’s

failure to realize the anticipated benefits of any acquisitions;

Bridger’s successful integration of the aircraft (including

achievement of synergies and cost reductions); Bridger’s ability to

successfully and timely develop, sell and expand its services, and

otherwise implement its growth strategy; risks relating to

Bridger’s ongoing operations and businesses, including information

technology and cybersecurity risks, loss of requisite licenses,

flight safety risks, and loss of key customers; the risk of a

deterioration in relationships between Bridger and its employees,

including as a result of any acquisition; risks related to

increased competition; risks relating to potential disruption of

current plans, operations and infrastructure of Bridger as a

result of the consummation of any acquisition; risks that Bridger

experiences difficulties managing its growth and expanding

operations; Bridger’s ability to compete with existing or new

companies that could cause downward pressure on prices, fewer

customer orders, reduced margins, the inability to take advantage

of new business opportunities, and the loss of market share; and

the ability to successfully select, execute or integrate future

acquisitions into Bridger’s business, which could result in

material adverse effects to operations and financial conditions.

Forward-looking statements are also subject to the risk factors and

cautionary language described from time to time in the reports

Bridger files with the SEC, including those in Bridger’s most

recent Annual Report on Form 10-K and any updates thereto

in Bridger’s Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K. If any of these risks materialize

or our assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. The risks and uncertainties above are not exhaustive,

and there may be additional risks that Bridger presently does not

know or that Bridger currently believes are immaterial that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect Bridger’s expectations, plans or forecasts of future events

and views as of the date of this press release. Bridger anticipates

that subsequent events and developments will cause Bridger’s

assessments to change. However, while Bridger may elect to update

these forward-looking statements at some point in the future,

Bridger specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing Bridger’s assessments as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements contained in this

press release.

Investor ContactsAlison ZieglerDarrow

Associates201-220-2678aziegler@darrowir.com

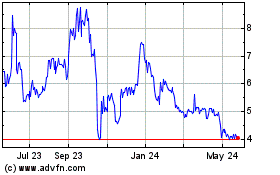

Bridger Aerospace (NASDAQ:BAER)

Historical Stock Chart

From Oct 2024 to Nov 2024

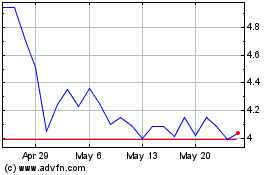

Bridger Aerospace (NASDAQ:BAER)

Historical Stock Chart

From Nov 2023 to Nov 2024