Atlanta Braves Holdings, Inc. (“ABH”) (Nasdaq: BATRA, BATRK)

today reported fourth quarter and year end 2023 results.

Headlines include(1):

- Total revenue grew 9% to $641 million in 2023

- Baseball revenue up 9% to $582 million

- Mixed-use development revenue up 10% to $59 million

- Mixed-use development generated $39 million of Adjusted

OIBDA(2) in 2023

- Extended Alex Anthopoulos as President of Baseball Operations

and General Manager through 2031 season

“The Braves are a unique and valuable sports property with

leading on-field and off-field business performance. Congrats to

the team on capping off the 2023 season with their sixth

consecutive NL East title and unprecedented player accolades,” said

Greg Maffei, Chairman and CEO of ABH. “Strong on-field performance

yielded robust revenue growth for the full year, and early

indicators for the 2024 season show increased demand.”

“We are thrilled with both the team and financial performance at

the Braves in 2023,” said Terry McGuirk, Chairman and CEO of Braves

Holdings, LLC. “Our management continues to focus on optimizing the

ballpark, with upgrades planned for 2024 to drive more commercial

opportunities and an improved fan experience. Season tickets,

including premium seats, are already sold out in anticipation of

another exciting season. The Battery benefitted from increased foot

traffic and strong sales across the development and we expect

another strong year ahead.”

Corporate Updates

On July 18, 2023, Liberty Media Corporation (“Liberty Media”)

completed the split-off of the Braves and its associated mixed-use

development (the “Split-Off”) into the separate public company ABH.

The businesses and assets at ABH consist of Braves Holdings, LLC,

the owner and operator of the Atlanta Braves Major League Baseball

Club, and certain assets and liabilities associated with the

Braves’ ballpark and mixed-use development, called The Battery

Atlanta, which were previously attributed to the Braves Group

tracking stock of Liberty Media. For purposes of this presentation,

ABH standalone results, assets and liabilities represent the

combination of the historical financial information of the Braves

Group until the date of the Split-Off. Although ABH was reported as

a combined company until the date of the Split-Off, it is now a

consolidated company and all periods reported in this presentation

are referred to as consolidated.

Discussion of Results

Three months ended

Twelve months ended

December 31,

December 31,

2022

2023

% Change

2022

2023

% Change

amounts in thousands

amounts in thousands

Baseball revenue

$

56,947

$

52,909

(7

)%

$

534,984

$

581,671

9

%

Mixed-use development revenue

14,312

14,839

4

%

53,577

58,996

10

%

Total revenue

71,259

67,748

(5

)%

588,561

640,667

9

%

Operating costs and expenses:

Baseball operating costs

(37,805

)

(51,967

)

(37

)%

(427,832

)

(482,391

)

(13

)%

Mixed-use development costs

(2,275

)

(2,383

)

(5

)%

(8,674

)

(8,834

)

(2

)%

Selling, general and administrative,

excluding stock-based compensation

(19,760

)

(26,431

)

(34

)%

(93,279

)

(111,117

)

(19

)%

Adjusted OIBDA

$

11,419

$

(13,033

)

NM

$

58,776

$

38,325

(35

)%

Operating income (loss)

$

(7,210

)

$

(32,366

)

(349

)%

$

(30,581

)

$

(46,440

)

(52

)%

Regular season home games in period

2

1

81

81

Postseason home games in period

2

2

2

2

Baseball revenue per home game

$

14,237

$

17,636

24

%

$

6,446

$

7,008

9

%

Baseball revenue is derived from two primary sources on an

annual basis: (i) baseball event revenue (ticket sales,

concessions, advertising sponsorships, suites and premium seat

fees) and (ii) broadcasting revenue (national and local broadcast

rights). Mixed-use development revenue is derived from the Battery

Atlanta mixed-use facilities and primarily includes rental

income.

The following table disaggregates revenue by segment and by

source:

Three months ended

Twelve months ended

December 31,

December 31,

2022

2023

% Change

2022

2023

% Change

amounts in thousands

amounts in thousands

Baseball:

Baseball event

$

17,220

$

15,205

(12

)%

$

298,364

$

339,485

14

%

Broadcasting

23,539

22,158

(6

)%

154,185

160,944

4

%

Retail and licensing

8,592

6,507

(24

)%

47,792

51,533

8

%

Other

7,596

9,039

19

%

34,643

29,709

(14

)%

Baseball revenue

56,947

52,909

(7

)%

534,984

581,671

9

%

Mixed-use development

14,312

14,839

4

%

53,577

58,996

10

%

Total revenue

$

71,259

$

67,748

(5

)%

$

588,561

$

640,667

9

%

There were 83 and 3 home games (including postseason) played in

the full year and fourth quarter of 2023, respectively, compared to

83 and 4 home games played in the comparable prior year

periods.

Baseball revenue increased 9% for the full year. Baseball event

and retail and licensing revenue grew primarily due to increased

ticket demand and attendance at regular season home games. Baseball

event revenue also increased due to new advertising sponsorships

and contractual rate increases from existing sponsors. Broadcasting

revenue increased due to contractual rate increases. Retail and

licensing revenue also benefited from demand for City Connect

apparel, partially offset by a reduction in demand for World Series

Champions apparel compared to the prior season. Other revenue

declined due to fewer concerts at the ballpark compared to the

prior year period and a reduction in World Series trophy tour

revenue, partially offset by higher spring training revenue with

six additional spring training games compared to the prior year

period and revenue from special events held at the ballpark.

Baseball revenue decreased 7% in the fourth quarter primarily

driven by fewer home games played, partially offset by stronger

postseason revenue and more concerts held at the ballpark compared

to the prior year period.

Mixed-use development revenue increased 10% for the full year

and 4% in the fourth quarter due to increases in rental income

related to tenant recoveries and various new lease agreements, as

well as higher sponsorship revenue.

Operating income and Adjusted OIBDA decreased in the full year

and fourth quarter. Baseball operating costs increased primarily

due to higher player salaries, including offseason trade activity

in the fourth quarter, as well as increases under MLB’s revenue

sharing plan. These costs also increased for the full year due to

higher minor league team and player expenses, variable concession

and retail operating costs attributable to increased attendance and

spring training related expenses. Selling, general and

administrative expense increased in the full year primarily driven

by costs related to the Split-Off and increased in the fourth

quarter primarily driven by higher personnel costs.

FOOTNOTES

1)

ABH will be available to answer

questions related to these headlines and other matters on Liberty

Media’s earnings conference call that will begin at 10:00 a.m.

(E.T.) on February 28, 2024. For information regarding how to

access the call, please see “Important Notice” later in this

document.

2)

For a definition of Adjusted

OIBDA (as defined by ABH) and the applicable reconciliation, see

the accompanying schedule.

Important Notice: Atlanta Braves Holdings, Inc. (Nasdaq:

BATRA, BATRK) will be available to answer questions on Liberty

Media’s earnings conference call which will begin at 10:00 a.m.

(E.T.) on February 28, 2024. The call can be accessed by dialing

(877) 704-2829 or (215) 268-9864, passcode 13742815 at least 10

minutes prior to the start time. The call will also be broadcast

live across the Internet and archived on our website. To access the

webcast go to

https://www.bravesholdings.com/investors/news-events/ir-calendar.

Links to this press release will also be available on the ABH

website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, product

and marketing strategies, future financial performance and

prospects, expectations regarding the 2024 season and mixed-use

development upgrades, and other matters that are not historical

facts. These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, ABH’s historical financial information not

being representative of its future financial position, results of

operations, or cash flows, ABH’s ability to recognize anticipated

benefits from the Split-Off, possible changes in the regulatory and

competitive environment in which ABH operates (including an

expansion of MLB), the unfavorable outcome of pending or future

litigation, operational risks of ABH and its business affiliates,

including operations outside of the U.S., ABH’s indebtedness and

its ability to obtain additional financing on acceptable terms and

cash in amounts sufficient to service debt and other financial

obligations, tax matters, ABH’s ability to use net operating loss

and disallowed business interest carryforwards, compliance with

government regulations and potential adverse outcomes of regulatory

proceedings, changes in the nature of key strategic relationships

with broadcasters, partners, vendors and joint venturers, the

impact of organized labor, the performance and management of the

mixed-use development, disruptions in ABH’s information systems and

information system security, ABH’s use and protection of personal

data and the impact of inflation and weak economic conditions on

consumer demand. These forward-looking statements speak only as of

the date of this press release, and ABH expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in ABH’s expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based. Please refer to the publicly filed documents of ABH,

including the most recently filed Form 10-K, for additional

information about ABH and about the risks and uncertainties related

to ABH’s business which may affect the statements made in this

press release.

NON-GAAP FINANCIAL MEASURES AND SUPPLEMENTAL

DISCLOSURES

SCHEDULE 1: Reconciliation of Adjusted OIBDA to Operating Income

(Loss)

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for ABH

together with reconciliations to operating income, as determined

under GAAP. ABH defines Adjusted OIBDA as operating income (loss)

plus depreciation and amortization, stock-based compensation,

separately reported litigation settlements, restructuring,

acquisition and impairment charges.

ABH believes Adjusted OIBDA is an important indicator of the

operational strength and performance of its businesses by

identifying those items that are not directly a reflection of each

business’ performance or indicative of ongoing business trends. In

addition, this measure allows management to view operating results

and perform analytical comparisons and benchmarking between

businesses and identify strategies to improve performance. Because

Adjusted OIBDA is used as a measure of operating performance, ABH

views operating income as the most directly comparable GAAP

measure. Adjusted OIBDA is not meant to replace or supersede

operating income or any other GAAP measure, but rather to

supplement such GAAP measures in order to present investors with

the same information that ABH management considers in assessing the

results of operations and performance of its assets.

The following table provides a reconciliation of Adjusted OIBDA

for ABH to operating income (loss) calculated in accordance with

GAAP for the three and twelve months ended December 31, 2022 and

December 31, 2023.

Three months ended

Twelve months ended

December 31,

December 31,

(amounts in thousands)

2022

2023

2022

2023

Operating income (loss)

$

(7,210

)

$

(32,366

)

$

(30,581

)

$

(46,440

)

Impairment of long-lived assets and other

related costs

616

—

5,427

564

Stock-based compensation

3,045

3,568

12,233

13,221

Depreciation and amortization

14,968

15,765

71,697

70,980

Adjusted OIBDA

$

11,419

$

(13,033

)

$

58,776

$

38,325

Baseball

$

4,606

$

(17,571

)

$

33,259

$

21,225

Mixed-use development

9,340

9,519

35,433

39,499

Corporate and other

(2,527

)

(4,981

)

(9,916

)

(22,399

)

SCHEDULE 2: Cash and Debt

The following presentation is provided to separately identify

cash and debt information. ABH cash increased $18 million during

the fourth quarter as net borrowing and cash from operations

primarily due to working capital changes more than offset capital

expenditures. ABH debt increased $14 million in the fourth quarter

primarily due to borrowing on the mixed-use development term debt

to support current capital projects.

(amounts in thousands)

September 30, 2023

December 31, 2023

ABH Cash (GAAP)(a)

$

106,715

$

125,148

Debt:

Baseball

League wide credit facility

$

—

$

—

MLB facility fund - term

30,000

30,000

MLB facility fund - revolver

41,400

41,400

TeamCo revolver

10,000

—

Term debt

165,370

165,370

Mixed-use development

312,399

336,177

Total ABH Debt

$

559,169

$

572,947

Deferred financing costs

(3,898

)

(3,678

)

Total ABH Debt (GAAP)

$

555,271

$

569,269

_________________________

a)

Excludes restricted cash held in

reserves pursuant to the terms of various financial obligations of

$20 million and $13 million as of September 30, 2023 and December

31, 2023, respectively.

ATLANTA BRAVES

HOLDINGS

CONSOLIDATED BALANCE SHEET

INFORMATION

December 31, 2023

(unaudited)

December 31,

December 31,

2023

2022

amounts in thousands

except share amounts

Assets

Current assets:

Cash and cash equivalents

$

125,148

150,664

Restricted cash

12,569

22,149

Accounts receivable and contract assets,

net of allowance for credit losses

62,922

70,234

Other current assets

17,380

24,331

Total current assets

218,019

267,378

Property and equipment, at cost

1,091,943

1,007,776

Accumulated depreciation

(325,196

)

(277,979

)

766,747

729,797

Investments in affiliates, accounted for

using the equity method

99,213

94,564

Intangible assets not subject to

amortization:

Goodwill

175,764

175,764

Franchise rights

123,703

123,703

299,467

299,467

Other assets, net

120,884

99,455

Total assets

$

1,504,330

1,490,661

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

73,096

54,748

Deferred revenue and refundable

tickets

111,985

104,996

Current portion of debt

42,153

74,806

Other current liabilities

6,439

6,361

Total current liabilities

233,673

240,911

Long-term debt

527,116

467,160

Redeemable intergroup interests

—

278,103

Finance lease liabilities

103,586

107,220

Deferred income tax liabilities

50,415

54,099

Pension liability

15,222

15,405

Other noncurrent liabilities

33,676

28,253

Total liabilities

963,688

1,191,151

Equity:

Preferred stock, $.01 par value.

Authorized 50,000,000 shares; zero shares issued at December 31,

2023 and December 31, 2022

—

—

Series A common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 10,318,197

and zero at December 31, 2023 and December 31, 2022,

respectively

103

—

Series B common stock, $.01 par value.

Authorized 7,500,000 shares; issued and outstanding 977,776 and

zero at December 31, 2023 and December 31, 2022, respectively

10

—

Series C common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 50,577,776

and zero at December 31, 2023 and December 31, 2022,

respectively

506

—

Additional paid-in capital

1,089,625

—

Former parent’s investment

—

732,350

Accumulated other comprehensive earnings

(loss), net of taxes

(7,271

)

(3,758

)

Retained earnings (deficit)

(554,376

)

(429,082

)

Total stockholders' equity/former parent's

investment

528,597

299,510

Noncontrolling interests in equity of

subsidiaries

12,045

—

Total equity

540,642

299,510

Commitments and contingencies

Total liabilities and equity

$

1,504,330

1,490,661

ATLANTA BRAVES

HOLDINGS

CONSOLIDATED STATEMENT OF

OPERATIONS INFORMATION

December 31, 2023

(unaudited)

Three months ended

Year ended

December 31,

December 31,

2023

2022

2023

2022

amounts in thousands, except

per share amounts

Revenue:

Baseball revenue

$

52,909

56,947

$

581,671

534,984

Mixed-use development revenue

14,839

14,312

58,996

53,577

Total revenue

67,748

71,259

640,667

588,561

Operating costs and expenses:

Baseball operating costs

51,967

37,805

482,391

427,832

Mixed-use development costs

2,383

2,275

8,834

8,674

Selling, general and administrative,

including stock-based compensation

29,999

22,805

124,338

105,512

Impairment of long-lived assets and other

related costs

—

616

564

5,427

Depreciation and amortization

15,765

14,968

70,980

71,697

100,114

78,469

687,107

619,142

Operating income (loss)

(32,366

)

(7,210

)

(46,440

)

(30,581

)

Other income (expense):

Interest expense

(9,656

)

(9,054

)

(37,673

)

(29,582

)

Share of earnings (losses) of affiliates,

net

3,601

6,809

26,985

28,927

Realized and unrealized gains (losses) on

intergroup interests, net

—

(40,317

)

(83,178

)

(35,154

)

Realized and unrealized gains (losses) on

financial instruments, net

(3,329

)

829

2,343

13,067

Gains (losses) on dispositions, net

(209

)

(151

)

2,309

20,132

Other, net

3,633

1,345

6,496

1,674

Earnings (loss) before income taxes

(38,326

)

(47,749

)

(129,158

)

(31,517

)

Income tax benefit (expense)

5,968

2,810

3,864

(2,655

)

Net earnings (loss)

$

(32,358

)

(44,939

)

$

(125,294

)

(34,172

)

Basic net earnings (loss) attributable to

Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

(0.52

)

(0.73

)

$

(2.03

)

(0.55

)

Diluted net earnings (loss) attributable

to Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

(0.52

)

(0.73

)

$

(2.03

)

(0.55

)

ATLANTA BRAVES

HOLDINGS

CONSOLIDATED STATEMENT OF CASH

FLOWS INFORMATION

December 31, 2023

(unaudited)

Years ended

December 31,

2023

2022

amounts in thousands

Cash flows from operating activities:

Net earnings (loss)

$

(125,294

)

(34,172

)

Adjustments to reconcile net earnings

(loss) to net cash provided by (used in) operating activities:

Depreciation and amortization

70,980

71,697

Stock-based compensation

13,221

12,233

Impairment of long-lived assets

—

4,811

Share of (earnings) losses of affiliates,

net

(26,985

)

(28,927

)

Realized and unrealized (gains) losses on

intergroup interests, net

83,178

35,154

Realized and unrealized (gains) losses on

financial instruments, net

(2,343

)

(13,067

)

(Gains) losses on dispositions, net

(2,309

)

(20,132

)

Deferred income tax expense (benefit)

(7,872

)

(10,413

)

Cash receipts from returns on equity

method investments

22,450

21,700

Net cash received (paid) for interest rate

swaps

5,104

(1,194

)

Other charges (credits), net

1,218

2,329

Net change in operating assets and

liabilities:

Current and other assets

(42,802

)

9,912

Payables and other liabilities

13,080

3,418

Net cash provided by (used in) operating

activities

1,626

53,349

Cash flows from investing activities:

Capital expended for property and

equipment

(69,036

)

(17,669

)

Cash proceeds from dispositions

—

48,008

Investments in equity method affiliates

and equity securities

(125

)

(5,273

)

Other investing activities, net

110

27,500

Net cash provided by (used in) investing

activities

(69,051

)

52,566

Cash flows from financing activities:

Borrowings of debt

83,033

154,753

Repayments of debt

(56,187

)

(309,612

)

Payments to settle intergroup

interests

—

(13,828

)

Contribution from noncontrolling

interest

12,045

—

Other financing activities, net

(6,562

)

(8,528

)

Net cash provided by (used in) financing

activities

32,329

(177,215

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(35,096

)

(71,300

)

Cash, cash equivalents and restricted cash

at beginning of period

172,813

244,113

Cash, cash equivalents and restricted cash

at end of period

$

137,717

172,813

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240227265576/en/

Shane Kleinstein (720) 875-5432

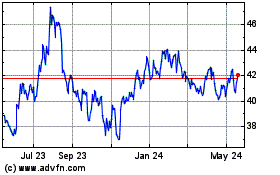

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

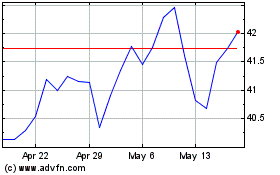

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Feb 2024 to Feb 2025