Vinco Ventures, Inc. (Nasdaq Capital Market: BBIG), a technology

company specializing in converting content to digital and social

platforms, today announced that the Board of Directors (the

“Board”) issued a letter to shareholders outlining the Company’s

strategy in advance of the 2023 Annual Meeting of Stockholders (the

“Annual Meeting”). The full text of the letter is below.

***

April 25, 2023

Dear Fellow Shareholders,

The Board of Directors (the “Board”) thanks you

for your investment in Vinco Ventures, Inc. (Nasdaq Capital Market:

BBIG) (“Vinco,” “we,” “our,” or the “Company”). We are writing to

you about the upcoming Annual Meeting of Stockholders (the “Annual

Meeting”), scheduled for April 27, 2023. At the Annual Meeting, we

are asking you to vote on proposals that will pave the way for the

Company to execute upon our strategy to improve profitability and

enhance shareholder value.

We are on the cusp of an exciting new chapter

with our planned acquisition of the National Enquirer, the National

Examiner and Globe and digital publishing assets (the

“Acquisition”). While we recognize we have more work to do, we are

confident that this Acquisition will open up multiple ways to

create value.

NEW LEADERSHIP TEAM

As we embark on this next step, we are pleased

to announce the Board has unanimously approved two new leaders:

- James Robertson as

President and Chief Executive Officer. James joins us from Us

Weekly, the prestigious magazine and digital brand, where he served

as Editor-In-Chief. He brings unparalleled experience to Vinco and

will lead the Company into the next phase of our growth strategy to

provide digital content and advertising.

- Chris Polimeni as

Chief Financial Officer and Chief Operating Officer. Chris

previously served as Executive Vice President – CFO/COO of

Accelerate360 Holdings, LLC & Subsidiaries, the parent company

of a360 Media, LLC (formerly American Media, LLC.). He has been

involved in acquisitions, corporate finance, SEC reporting and

corporate management for more than 30 years.

This new executive leadership team brings years

of experience in piloting content-driven and digital businesses,

which will be instrumental in guiding our growth strategy as we

execute the integration of our robust new and existing assets into

our digital and advertising platforms.

These recent announcements and developments

underscore that Vinco is shifting its focus from addressing legacy

challenges to executing against future growth. We strongly urge you

to protect the value of your investment and vote for

ALL 12 proposals on the proxy materials –

including approving the Acquisition, approving the increase in

authorized shares of stock and reverse stock split, both of which

types of proposals are considered routine and thus usually subject

to discretionary broker voting, and reelecting the five highly

qualified directors that currently serve on your Board. Ahead of

the Annual Meeting, we encourage you to consider the following:

THE ACQUISITION LAYS THE GROUNDWORK FOR

FIVE KEY PILLARS OF VALUE CREATION

- Pillar 1:

Leveraging the Enquirer’s

famous library of highly valuable celebrity

content. Vinco plans to transform this library into new,

exciting and highly sought-after multimedia formats, including TV

shows, documentaries and true crime series, podcasts, online and

streaming productions, special issues and more.

- Pillar 2:

Growing revenue by leveraging the wealth of content and

strong subscription bases the Acquisition will bring.

Vinco intends to prioritize the growth of this base of revenue by

introducing new and innovative digital and premium subscription

products.

- Pillar 3:

Actively exploring intellectual property and licensing

opportunities. Vinco will leverage the brand's recognition

and reputation as “America’s most talked about magazine” to expand

into new markets and generate revenue.

- Pillar 4:

Leveraging content collaborations. Vinco intends

to integrate and promote the Company’s social media platform,

Lomotif, and the Company’s tech-education platform, Magnifi U,

across the online and print publishing group’s pages, as well as

harmoniously publishing original content with the MindTank and

AdRizer networks.

- Pillar 5:

Pursuing additional content outside the

Acquisition. Vinco is focused on exploring additional

media and publishing asset acquisitions to generate content and

deliver significant audience scale across the Company’s digital

first content ecosystem.

Your Board is highly engaged, extremely

qualified and is currently overseeing the effective execution of

the Company’s strategy to generate significant long-term value. The

Board collectively possesses the right marketing and technology

expertise, prior public board and C-suite experience and financial

acumen to oversee the successful execution of the Company’s

strategy to unlock value for shareholders.

The reverse stock split will automatically

increase the stock price to regain compliance with Nasdaq continued

listing requirements. The following table contains approximate

information relating to the Common Stock under the low end, high

end and midpoint of the proposed range of reverse stock split

ratios, without giving effect to any adjustments for fractional

shares of Common Stock, based upon a closing price of $0.26 (as of

April 18, 2023).

|

Status |

|

Stock Price (as

adjusted) |

|

|

Number of Shares of Common Stock

Authorized |

|

|

Number of Shares of Common Stock

Issued and Outstanding |

|

|

Number of Shares of Common Stock

Authorized but Unissued |

|

| Pre-Reverse Stock Split |

|

$ |

0.26 |

|

|

|

249,000,000 |

|

|

|

248,987,660 |

|

|

|

12,340 |

|

| Post-Reverse Stock Split 1:2 |

|

$ |

0.52 |

|

|

|

249,000,000 |

|

|

|

124,493,830 |

|

|

|

124,506,170 |

|

| Post-Reverse Stock Split 1:10 |

|

$ |

2.60 |

|

|

|

249,000,000 |

|

|

|

24,898,766 |

|

|

|

224,101,234 |

|

| Post-Reverse Stock Split 1:20 |

|

$ |

5.20 |

|

|

|

249,000,000 |

|

|

|

12,449,383 |

|

|

|

236,550,617 |

|

YOUR VOTE IS VERY IMPORTANT – HELP ENSURE

VINCO’S MOMENTUM CONTINUES

Protect the value of your investment and vote

for ALL 12 proposals on the proxy materials you

receive.

We believe that approving the Acquisition is an

essential first step in the Company’s growth strategy and that

approving the share issuances and reverse stock split will give

Vinco the necessary financial flexibility to operate successfully

by automatically increasing the stock price to regain compliance

with Nasdaq continued listing requirements.

Thank you for your continued support as we

capitalize on the opportunities ahead.

Sincerely,

The Vinco Board of Directors

James Robertson

BiographyMr. Robertson is the former

Editor-In-Chief of Us Weekly. Previously, he served as Senior

Executive Editor overseeing all newsgathering for a portfolio of

celebrity publications for American Media Inc., including Us

Weekly, The National Enquirer, RadarOnline, InTouch, Star and Life

& Style, and was previously the youngest Editor-In-Chief in

tabloid media for OK! Magazine. He’s an experienced producer for TV

specials and podcast productions. Mr. Robertson has been uniquely

instrumental in the current acquisition strategies to help elevate

Vinco into becoming the largest entertainment media and technology

company in the country. Mr. Robertson holds a BA Hons in Magazine

Journalism and Feature Writing from Southampton Solent University,

England, UK.

Chris Polimeni Biography

Mr. Polimeni previously served as Executive Vice

President - CFO/COO of Accelerate360 Holdings, LLC &

Subsidiaries, the parent company of a360 Media, LLC (formerly

American Media, LLC.). He also served in the same capacity at

American Media, LLC for 12 years prior to the consolidation of

American Media, LLC with Accelerate360 Holdings, LLC in 2020. He

has been involved in acquisitions, corporate finance, SEC reporting

and corporate management for more than thirty years. Mr. Polimeni

holds a B.B.A. from Hofstra University.

***

YOUR VOTE IS IMPORTANT!

THE BOARD RECOMMENDS THAT YOU VOTE “FOR”

ALL 12 PROPOSALS.

WE URGE YOU TO COMPLETE, DATE AND SIGN

THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE-PAID

ENVELOPE PROVIDED, OR VOTE BY TELEPHONE OR THE INTERNET AS

INSTRUCTED ON THE PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE

ANNUAL MEETING.

***

To vote by phone, please dial

1-800-690-6903 and have your control number ready, which is

available on the proxy card mailed or electronically delivered to

each shareholder of record.

To vote by mail, please mark, sign and

date your Proxy Card and return it in the postage-paid envelope

provided or return it to Vote Processing, c/o Broadridge, 51

Mercedes Way, Edgewood, NY 11717.

If you need assistance voting your shares

or obtaining your control number or have any other questions,

please contact Kingsdale Advisors by calling toll free at

1-855-682-2023 or via email at

contactus@kingsdaleadvisors.com.

***

Vinco Urges Shareholders to Vote FOR All

12 Proposals at the Annual Meeting.

If shareholders have any questions,

please contact Vinco’s proxy

solicitors, Kingsdale Advisors US, at 1-855-682-2023

About Vinco Ventures

Vinco Ventures (Nasdaq: BBIG) is focused on the

development of digital media and content technologies. Vinco

Ventures’ consolidated subsidiary, ZVV Media Partners, LLC, a joint

venture of Vinco Ventures and ZASH Global Media and Entertainment

Corporation, has an 80% ownership interest in Lomotif Private

Limited. Vinco Ventures owns a 100% ownership interest in AdRizer,

LLC.

For more information, please visit

https://investors.vincoventures.com.

Forward-Looking Statements and

Disclaimers

This press release contains “forward-looking

statements” as defined in the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995, which are based

upon beliefs of, and information currently available to, Vinco

Ventures’ management as well as estimates and assumptions made by

Vinco Ventures’ management. These statements can be identified by

the fact that they do not relate strictly to historic or current

facts. When used in this presentation the words “estimate,”

“expect,” “intend,” “believe,” “plan,” “anticipate,” “projected,”

and other words or the negative of these terms and similar

expressions as they relate to the applicable company or its

management identify forward-looking statements. Such statements

reflect the current view of Vinco Ventures with respect to future

events and are subject to risks, uncertainties, assumptions and

other factors relating to Vinco Ventures and its subsidiaries and

consolidated variable interest entities including Lomotif, their

industry, financial condition, operations and results of

operations. Such factors include, but are not limited to, the

expected risks and benefits from the proposed increase in Vinco

Ventures’ authorized shares as described in our proxy statement,

Vinco Ventures’ investments in ZVV Media Partners, LLC, Lomotif

Private Limited, PZAJ Holdings, LLC and related growth initiatives

and strategies such as the blended media, cross-platform

distribution strategy, the expected benefits of Lomotif’s

participation in and sponsorship of live entertainment events, the

expected benefits from acquisition of AdRizer and planned

integration of the AdRizer technology with Lomotif and Honey Badger

and synergies between AdRizer, Lomotif and Honey Badger, the

regulatory risks with the NFT and blockchain business lines and

such other risks and uncertainties described more fully in

documents filed by Vinco Ventures and Cryptyde with or furnished to

the Securities and Exchange Commission, including the risk factors

discussed in Vinco Ventures’ Annual Report on Form 10-K for the

period ended December 31, 2021 filed on April 15, 2022 which is

available at www.sec.gov. Should one or more of these risks or

uncertainties materialize, or the underlying assumptions prove

incorrect, actual results may differ significantly from those

anticipated, believed, estimated, expected, intended, or planned.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, performance, or achievements. Except as required by

applicable law, including the securities laws of the United States,

we do not intend to update any of the forward-looking statements to

conform these statements to actual results.

For further information, please

contact:

Investor

Contactinvestor@vincoventures.com

Media ContactLongacre Square

PartnersJoe Germani / Charlotte Kiaievinco@longacresquare.com

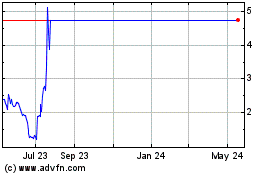

Vinco Ventures (NASDAQ:BBIG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vinco Ventures (NASDAQ:BBIG)

Historical Stock Chart

From Dec 2023 to Dec 2024