As filed with the Securities and Exchange Commission on November 17, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BioLife Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 94-3076866 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

3303 Monte Villa Parkway, Suite 310, Bothell, Washington, 98021

(425) 402-1400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Roderick de Greef

Chief Executive Officer

BioLife Solutions, Inc.

3303 Monte Villa Parkway, Suite 310

Bothell, Washington, 98021

(425) 402-1400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael A. Hedge

Jason C. Dreibelbis

K&L Gates LLP

1 Park Plaza

Twelfth Floor

Irvine, California 92614

(949) 253-0900

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | þ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 17, 2023

PROSPECTUS

BioLife Solutions, Inc.

927,165 Shares of Common Stock

This prospectus relates to the resale from time to time of up to 927,165 shares, or the Shares of our common stock, par value $0.001 per share, which are held by the selling stockholder identified in the section entitled “Selling Stockholder” on page 12. The Shares were issued and sold to the selling stockholder in a private placement, or the Private Placement, pursuant to a securities purchase agreement between us and such selling stockholder dated October 19, 2023, or the Purchase Agreement. In connection with the Private Placement, we entered into a registration rights agreement, or the Registration Rights Agreement, with the selling stockholder, and we are registering the Shares being offered hereunder pursuant to the Registration Rights Agreement on behalf of the selling stockholder, to be offered and sold by them from time to time. We will not receive any proceeds from the sale of any Shares offered by this prospectus. We have agreed, pursuant to the Registration Rights Agreement, to bear all of the expenses incurred in connection with the registration of the Shares. The selling stockholder will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the Shares.

The selling stockholder identified in this prospectus may offer the Shares pursuant to this prospectus from time to time through public or private transactions at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholder may sell Shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholder, the purchasers of the Shares, or both. For additional information on the methods of sale that may be used by the selling stockholder, see the section entitled “Plan of Distribution” on page 13. We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should carefully read this prospectus and any amendments or supplements accompanying this prospectus, together with any documents incorporated by reference herein or therein, before you make your investment decision.

The selling stockholder may sell any, all or none of the Shares offered by this prospectus and we do not know when or in what amount the selling stockholder may sell the Shares hereunder following the effective date of the registration statement of which this prospectus forms a part.

Our common stock is listed on the Nasdaq Capital Market, or Nasdaq, under the trading symbol “BLFS.” On November 16, 2023, the last reported sale price of our common stock on Nasdaq was $11.96 per share.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” on page 5 of this prospectus and in any applicable prospectus supplement and in the documents filed with the U.S. Securities and Exchange commission, or the SEC, and incorporated by reference herein and therein to read about certain factors you should consider before investing in our common stock. Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 17, 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholder may, from time to time, sell the securities offered by them described in this prospectus in one or more offerings. We will not receive any proceeds from the sale by the selling stockholder of the securities offered by them described in this prospectus.

This prospectus provides you with a general description of the shares of our common stock that the selling stockholder may offer. When the selling stockholder sells shares of common stock under this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will contain specific information about the terms of that offering and may also provide you with a free writing prospectus. The prospectus supplement or free writing prospectus may also add, update, change or clarify information contained in or incorporated by reference into this prospectus. Before purchasing any shares of our common stock, you should carefully read this prospectus, any applicable accompanying prospectus supplement and any free writing prospectus prepared by or on behalf of us, together with the additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference into this prospectus, in any accompanying prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we, nor the selling stockholder, have authorized any person to give any information or to make any representations other than those contained or incorporated by reference in this prospectus, any accompanying prospectus supplement, or any free writing prospectuses prepared by or on behalf of us or to which we have referred you, and, if given or made, you must not rely upon the information or representations as having been authorized. This prospectus, any accompanying prospectus supplement and any free writing prospectuses prepared by or on behalf of us or to which we have referred you, do not constitute an offer to sell or the solicitation of an offer to buy securities, nor do this prospectus or any accompanying supplement to this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation. The information contained in this prospectus, any accompanying prospectus supplement, and any free writing prospectuses prepared by or on behalf of us or to which we have referred you, speaks only as of the date set forth on the cover page and may not reflect subsequent changes in our business, financial condition, results of operations and prospects even though this prospectus, any accompanying prospectus supplement, and any free writing prospectuses prepared by or on behalf of us or to which we have referred you, is delivered or securities are sold on a later date.

PROSPECTUS SUMMARY

This summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in shares of our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section contained in this prospectus and the other documents incorporated by reference into this prospectus.

Unless otherwise indicated herein, references in this prospectus to “BioLife,” “our company,” “we,” “us” and “our” refer to BioLife Solutions, Inc. and our consolidated subsidiaries.

Overview

We are a life sciences company that develops, manufactures, and markets bioproduction tools and services which are designed to improve quality and de-risk biologic manufacturing, storage, distribution, and transportation in the cell and gene therapy industry and broader biopharma markets. Our products are used in basic and applied research and commercial manufacturing of biologic-based therapies. Customers use our products to maintain the health and function of biologic material during sourcing, manufacturing, storage, and distribution.

Our current portfolio of bioproduction tools and services are comprised of three revenue lines that contain seven main offerings: (i) cell processing (including biopreservation media for the preservation of cells and tissues, human platelet lysate media for the supplementation of cell expansion, cryogenic vials and automated fill machines that provide high-quality, efficient, and precise mixes of solutions), (ii) freezers and thaw systems (including a full line of mechanical ultra-low temperature, isothermal, and liquid nitrogen freezers and accessories, automated thaw devices which provide controlled, consistent thawing of frozen biologics in vials and cryobags), and (iii) storage and storage services (including biological and pharmaceutical storage services, and “smart”, cloud connected devices for transporting biologic payloads).

We currently operate as one bioproduction tools and services business which supports several steps in the biologic material manufacturing and delivery process. We have a diversified portfolio of tools and services that focuses on biopreservation, cell processing, frozen biologic storage products and services, cold-chain transportation, and thawing of biologic materials. We have in-house expertise in cryobiology and continue to capitalize on opportunities to maximize the value of our product platform for our extensive customer base through both organic growth innovations and acquisitions.

For additional information about our company, please refer to other documents we have filed with the SEC and that are incorporated by reference into this prospectus, as listed under the heading “Incorporation of Certain Information by Reference.”

Company Information

We were incorporated in Delaware in 1987 under the name Trans Time Medical Products, Inc. In 2002, we, then known as Cryomedical Sciences, Inc., were engaged in manufacturing and marketing cryosurgical products. We merged with our wholly owned subsidiary, BioLife Solutions, Inc., which was engaged as a developer and marketer of biopreservation media products for cells and tissues. Following the merger, we changed our name to BioLife Solutions, Inc. Our principal executive offices are located at 3303 Monte Villa Parkway, Suite 310, Bothell, Washington, 98021, and our telephone number is (425) 402-1400. Our website is www.biolifesolutions.com. The information contained on or that can be accessed through our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

Private Placement of Shares of Common Stock

On October 19, 2023, we entered into a securities purchase agreement, or the Purchase Agreement, with the selling stockholder named in this prospectus, pursuant to which we sold and issued to the selling stockholder 927,165 shares, or the Shares, of our common stock at a purchase price of $11.19 per share. The Shares were issued

and sold to the selling stockholder in a private placement, or the Private Placement. The total purchase price paid by the selling stockholder was $10,374,976.35. In connection with the Private Placement, we entered into a registration rights agreement, or the Registration Rights Agreement, with the selling stockholder. Under the terms of the Registration Rights Agreement, we agreed to prepare and file, within 30 calendar days after the closing of the Private Placement, one or more registration statements with the SEC to register the Shares for resale, and to use commercially reasonable efforts to cause such registration statement to become effective as promptly as practicable.

The offer and sale of the securities in the Private Placement were not registered under the Securities Act of 1933, as amended, or the Securities Act, or any state securities laws. We relied on an exemption from the registration requirements of the Securities Act provided by Section 4(a)(2) thereof and Rule 506(b) of Regulation D promulgated thereunder. The selling stockholder has represented to us that such selling stockholder is an “accredited investor,” as defined in Regulation D of the Securities Act, and that the securities purchased by such selling stockholder were being acquired solely for such selling stockholder’s own account and for investment purposes, and not with a view to future sale or distribution.

The description of the Purchase Agreement and the Registration Rights Agreement are not complete and are qualified in their entirety by reference to the Purchase Agreement and the Registration Rights Agreement, which were filed as exhibits to our Current Report on Form 8-K, filed on October 19, 2023. See “Where You Can Find More Information” and “Incorporation by Reference.” The representations, warranties and covenants made by us in such agreements were made solely for the benefit of the parties to such agreements, including, in some cases, for the purpose of allocating risk among the parties thereto, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were made as of an earlier date. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

THE OFFERING

| | | | | |

Shares of Common Stock Offered by Selling Stockholder(1) | 927,165 |

| |

Use of Proceeds | We will not receive any proceeds from the sale of our common stock offered by the selling stockholder under this prospectus. See “Use of Proceeds” beginning on page 7 of this prospectus. |

| |

Offering Price | The selling stockholder may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. See “Plan of Distribution” beginning on page 13 of this prospectus. |

| |

Risk Factors | See “Risk Factors” beginning on page 5 of this prospectus and in the documents incorporated by reference herein for a discussion of factors you should consider carefully before investing in our common stock. |

| |

Nasdaq Symbol | “BLFS” |

__________________

(1)The number of shares of common stock being registered hereunder is comprised of 927,165 shares of our outstanding common stock issued to the selling stockholder on October 19, 2023 pursuant to the terms of the Purchase Agreement in connection with the closing of the Private Placement.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference into this prospectus from our most recent Annual Report on Form 10-K, our subsequent Quarterly Reports on Form 10-Q, and any Quarterly Reports on Form 10-Q we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that involve risks and uncertainties, including statements based on our current expectations, assumptions, estimates and projections about future events, our business, financial condition, results of operations and prospects, our industry and the regulatory environment in which we operate. Any statements contained or incorporated by reference herein that are not statements of historical facts may be deemed to be forward-looking statements. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, or other comparable terms intended to identify statements about the future. These forward-looking statements speak only as of the date made and are subject to a number of known and unknown risks, uncertainties and assumptions, including the important factors incorporated by reference into this prospectus from our most recent Annual Report on Form 10-K, our subsequent Quarterly Reports on Form 10-Q, and any Quarterly Reports on Form 10-Q we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act and in our other filings with the SEC, that may cause our actual results, performance or achievements to differ materially and adversely from those expressed or implied by the forward-looking statements.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements, whether as a result of any new information, future events, changed circumstances or otherwise.

Statistical Data

We obtained the industry, statistical and market data, including our general expectations, market position and market opportunity, included and incorporated by reference in this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. All of the market data included or incorporated by reference in this prospectus involves a number of assumptions and limitations. While we believe that the information from these industry publications, surveys and studies is reliable, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of important factors, including those described in the section entitled “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus is a part to permit the holder of the shares of our common stock described in the section entitled “Selling Stockholder” to resell such shares. We are not selling any securities under this prospectus and we will not receive any proceeds from the sale or other disposition of shares of our common stock held by the selling stockholder. The selling stockholder will receive all of the proceeds from this offering.

DESCRIPTION OF SECURITIES TO BE REGISTERED

The following is a summary of the rights of our common stock and preferred stock, certain provisions of our amended and restated certificate of incorporation, as amended, or our Certificate of Incorporation, our amended and restated bylaws, or our Bylaws, and applicable law. This summary does not purport to be complete and is qualified in its entirety by the provisions of our Certificate of Incorporation and Bylaws, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part.

General

As of the date of this prospectus, our authorized capital stock consists of:

•150,000,000 shares of common stock, par value $0.001 per share; and

•1,000,000 shares of preferred stock, par value $0.001 per share, of which 4,250 shares are designated as Series A preferred stock.

Our board of directors may establish the rights and preferences of the preferred stock from time to time. As of November 14, 2023, there were outstanding 45,047,488 shares of our common stock held of record by approximately 300 stockholders, 221,250 shares of our common stock issuable upon the exercise of outstanding stock options, no shares of our common stock issuable upon the vesting and settlement of restricted stock units, 1,117,904 shares of our common stock issuable upon the vesting and settlement of restricted stock awards, and there were no shares of our preferred stock outstanding.

Common Stock

The following summarizes the rights of holders of our common stock:

Voting

The holders of our common stock are entitled to one vote per share. The number of authorized shares of common stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of our outstanding capital stock entitled to vote, irrespective of the provisions of Section 242(b)(2) of the Delaware General Corporation Law, or the DGCL.

Dividends

Subject to preferences that may be applicable to the holders of outstanding shares of preferred stock and subject to applicable law, dividends may be declared and paid on the holders of our common stock when and as determined by our board of directors out of assets legally available for dividends.

As a Delaware corporation, we are subject to certain restrictions on dividends under the DGCL. Generally, a Delaware corporation may only pay dividends either out of “surplus” or out of the current or the immediately preceding year’s net profits. Surplus is defined as the excess, if any, at any given time, of the total assets of a corporation over its total liabilities and statutory capital. The value of a corporation’s assets can be measured in a number of ways and may not necessarily equal their book value.

Liquidation Rights

Upon our liquidation, dissolution or winding up, after satisfaction of all our liabilities and the payment of any liquidation preference of any outstanding preferred stock, the holders of shares of common stock will be entitled to share in all of our assets legally remaining for distribution after payment of all debt and other liabilities, subject to preferences that may be applicable to the holders of outstanding shares of preferred stock.

Redemption Rights

There are no redemption or sinking fund provisions applicable to our common stock.

Preemptive Rights and Conversion Rights

There are no preemptive or other subscription or conversion rights applicable to our common stock.

Anti-Takeover Effects of Provisions of our Certificate of Incorporation, Bylaws, and Delaware Law

Delaware Anti-Takeover Law

We are subject to Section 203 of the DGCL, or Section 203. Section 203 generally prohibits a public Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years following the time that such stockholder became an interested stockholder, unless:

•prior to such time the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•at or subsequent to such time the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder.

In general, Section 203 defines a business combination to include:

•any merger or consolidation involving the corporation and the interested stockholder;

•any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation;

•subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

•subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

•the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an interested stockholder as any entity (other than the corporation and any direct or indirect majority-owned subsidiary of the corporation) or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with, associated with or controlling or controlled by such entity or person.

Certificate of Incorporation and Bylaws

The following provisions of our Certificate of Incorporation and Bylaws may make a change in control of our company more difficult and could delay, defer or prevent a tender offer or other takeover attempt that a stockholder might consider to be in its best interest, including takeover attempts that might result in the payment of a premium to stockholders over the market price for their shares. These provisions also may promote the continuity of our management by making it more difficult for a person to remove or change the incumbent members of our board of directors.

Authorized but Unissued Shares; Undesignated Preferred Stock. The authorized but unissued shares of our common stock will be available for future issuance without stockholder approval, subject to applicable law and the rules of Nasdaq. These additional shares may be used for a variety of corporate purposes, including future public offerings to raise additional capital, acquisitions, and employee benefit plans. In addition, our board of directors may authorize, without stockholder approval, the issuance of undesignated preferred stock with voting rights or other rights or preferences designated from time to time by our board of directors (including the right to approve an acquisition or other change in our control). The existence of authorized but unissued shares of common stock or preferred stock may enable our board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

Election and Removal of Directors. The exact number of directors will be fixed from time to time by a resolution adopted by a majority of directors and shall not be less than three members. Our board of directors currently consists of seven members.

Director Vacancies. Our Bylaws authorize our board of directors to fill vacant directorships.

No Cumulative Voting. Our Certificate of Incorporation provides that stockholders do not have the right to cumulate votes in the election of directors (therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose).

Special Meetings of Stockholders. Our Bylaws provide that special meetings of our stockholders may be called at any time by the chairman of our board of directors, our president or our board of directors, or by our president or secretary upon written request of the holders of thirty five percent (35%) of the outstanding shares entitled to vote thereat, or as otherwise required by law.

Advance Notice Procedures for Director Nominations. Our Bylaws establish advance notice procedures for stockholders seeking to nominate candidates for election as directors at an annual or special meeting of stockholders, including certain requirements regarding the form and content of a stockholder’s notice. Although our Bylaws do not give the board of directors the power to approve or disapprove stockholder nominations of candidates to be elected at a meeting, our Bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of us.

Amendments to Bylaws. Our Bylaws may be amended by vote of a majority of the directors then in office or by vote of a majority of our stock outstanding and entitled to vote.

Limitations on Liability and Indemnification Matters

Our Certificate of Incorporation contains provisions that limit the personal liability of our directors for monetary damages to the fullest extent permitted by the DGCL. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for any of the following: (i) breach of the director’s duty of loyalty to us or our stockholders; (ii) an act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; (iii) unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the DGCL; or (iv) a transaction from which the director derives an improper personal benefit.

Our bylaws provide that we must indemnify our directors and officers, and may indemnify our employees or agents, to the maximum extent permitted by Section 145 of the DGCL.

The limitation of liability and indemnification provisions set forth in our Certificate of Incorporation and Bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against directors and officers, even though an action, if successful, might benefit us and our stockholders. To the extent we pay the costs of settlement or a damage award against any director or officer pursuant to these indemnification provisions, our stockholders’ investment may be harmed.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Nasdaq Capital Market Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol “BLFS.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Broadridge Financial Solutions, Inc. The transfer agent and registrar’s address is 51 Mercedes Way, Edgewood, New York 11711.

SELLING STOCKHOLDER

The shares of common stock being offered by the selling stockholder are those previously issued to the selling stockholder in the Private Placement. For additional information regarding the issuance of those shares of common stock, see “Prospectus Summary – Private Placement of Shares of Common Stock” above. We are registering the shares of common stock in order to permit the selling stockholder to offer the shares for resale from time to time. Except for the ownership of the shares of common stock, the selling stockholder has not had any material relationship with us within the past three years.

The table below lists the selling stockholder and other information regarding the beneficial ownership of shares of common stock by the selling stockholder. The second column lists the number of shares of common stock beneficially owned by the selling stockholder, based on its ownership of the shares of common stock, as of November 17, 2023.

The third column lists the shares of common stock being offered by this prospectus by the selling stockholder.

In accordance with the terms of the Registration Rights Agreement, this prospectus generally covers the resale of the number of shares of common stock issued to the selling stockholder in the Private Placement described above, as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the Registration Rights Agreement. The fourth column assumes the sale of all of the shares offered by the selling stockholder pursuant to this prospectus.

The selling stockholder may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| | | | | | | | | | | | | | | | | | | | |

| Name of Selling Stockholder | | Number of shares of Common Stock Owned Prior to Offering | | Maximum Number of shares of Common Stock to be Sold Pursuant to this Prospectus | | Number of shares of Common Stock Owned After Offering(1) |

Casdin Partners Master Fund, L.P.(2) | | 8,707,165 | | | 927,165 | | | 7,780,000 | |

__________________

(1)Represents the number of shares that will be held by the selling stockholder after completion of this offering based on the assumption that (a) all shares of common stock registered for sale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common stock currently owned or hereafter acquired are sold by the selling stockholder prior to completion of this offering. The selling stockholder may sell all, some or none of such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration provisions of the Securities Act, including under Rule 144.

(2)The shares reported under “Number of shares of Common Stock Owned Prior to Offering” consist of (i) 8,557,165 shares owned directly by Casdin Partners Master Fund, L.P. and may be deemed to be indirectly beneficially owned by (A) Casdin Capital, LLC, the investment adviser to Casdin Partners Master Fund, L.P., (B) Casdin Partners GP, LLC, the general partner of Casdin Partners Master Fund L.P., and (C) Eli Casdin, the managing member of Casdin Capital, LLC and Casdin Partners GP, LLC and (ii) 150,000 shares owned directly by Casdin Partners FO1-MSV, LP (“Casdin FO1”) and may be deemed to be indirectly beneficially owned by (A) Casdin Capital, LLC, the investment adviser to Casdin FO1; (B) Casdin Partners GP, LLC, the general partner of Casdin FO1, and (C) Eli Casdin, the managing member of Casdin Capital, LLC and Casdin Partners GP, LLC. Each of Casdin Capital, LLC, Casdin Partners GP, LLC and Eli Casdin disclaims beneficial ownership of such securities except to the extent of their respective pecuniary interest therein.

PLAN OF DISTRIBUTION

The selling stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on Nasdaq or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling securities:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution or other exchange transaction effected in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such securities at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•the pledge of securities for any loan or obligation, including pledges to brokers or dealers who may from time to time effect distributions of shares of our common stock or other of our securities and, in the case of any collateral call or default on such loan or obligation, pledges or sales of shares of our common stock or other of our securities by such pledgees or secured parties;

•through distribution by the selling stockholder or any of their successors in interest to its members, general or limited partners or shareholders (or their respective members, general or limited partners or shareholders) or any creditor of any of the foregoing;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option, forward sale or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities

such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

We are required to pay certain fees and expenses incurred by us and the selling stockholder incident to the registration of the securities. The Company has agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to use commercially reasonable efforts to keep this prospectus effective until the earlier of the date on which all of the securities offered under this prospectus (i) have been sold by the selling stockholder pursuant to this prospectus or Rule 144 under the Securities Act or (ii) may be sold by the selling stockholder without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement under Rule 144, as reasonably determined by the Company, upon the advice of counsel to the Company. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

The selling stockholder will be subject to any applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to comply with the prospectus delivery requirements of the Securities Act (including by compliance with Rule 172 under the Securities Act).

In connection with an offering of securities under this prospectus, any underwriters may purchase and sell securities in the open market. These transactions may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters of a greater number of securities than they are required to purchase in an offering. Stabilizing transactions consist of certain bids or purchases made for the purpose of preventing or retarding a decline in the market price of the securities while an offering is in progress.

Underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the underwriters have repurchased securities sold by or for the account of that underwriter in stabilizing or short-covering transactions.

These activities by underwriters may stabilize, maintain or otherwise affect the market price of the securities offered under this prospectus. As a result, the price of the securities may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time. These transactions may be effected on Nasdaq or another securities exchange or automated quotation system, or in the over-the-counter market or otherwise.

LEGAL MATTERS

The validity of the securities offered by this prospectus and any applicable prospectus supplement thereto will be passed upon for us by K&L Gates LLP, Irvine, California. Additional legal matters may be passed upon for the selling stockholder or any underwriters, dealers or agents, by counsel that we will name in any applicable prospectus supplement.

EXPERTS

The consolidated financial statements as of and for the year ended December 31, 2022 and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2022 incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in auditing and accounting.

The consolidated financial statements as of December 31, 2021 and for each of the two years in the period ended December 31, 2021 incorporated by reference in this prospectus and in the registration statement have been so incorporated in reliance on the report of BDO USA, LLP (n/k/a BDO USA, P.C.), an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus and any accompanying prospectus supplement do not contain all of the information set forth in the registration statement and its exhibits and schedules in accordance with SEC rules and regulations. For further information with respect to us and the securities being offered hereby, you should read the registration statement, including its exhibits and schedules. Statements contained in this prospectus and any accompanying prospectus supplement, including documents that we have incorporated by reference, as to the contents of any contract or other document referred to are not necessarily complete, and, with respect to any contract or other document filed as an exhibit to the registration statement or any other such document, each such statement is qualified in all respects by reference to the corresponding exhibit. You should review the complete document to evaluate these statements. You may obtain copies of the registration statement and its exhibits via the SEC’s EDGAR database or our website.

We file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Exchange Act. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers, including our company, that file electronically with the SEC. You may obtain documents that we file with the SEC at http://www.sec.gov.

We also make these documents available on our website at www.biolifesolutions.com. Our website and the information contained or connected to our website is not incorporated by reference in this prospectus or any accompanying prospectus supplement, and you should not consider it part of this prospectus or any accompanying prospectus supplement. You may also request a copy of these filings, at no cost, by writing us at 3303 Monte Villa Parkway, Suite 310, Bothell, Washington, 98021, Attention: Corporate Secretary or telephoning us at (425) 402-1400.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” in this prospectus certain of the information we file with the SEC. This means we can disclose important information to you by referring you to another document that has been filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying prospectus supplement. We incorporate by reference the documents listed below that we have previously filed with the SEC other than portions of these documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on Form 8–K:

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 31, 2023; •the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 from our Definitive Proxy Statement on Schedule 14A (other than information furnished rather than filed), filed with the SEC on June 6, 2023; •our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, filed with the SEC on May 11, 2023, June 30, 2023, filed with the SEC on August 9, 2023 and September 30, 2023, filed with the SEC on November 9, 2023; •our Current Reports on Form 8-K, filed with the SEC on May 19, 2023, June 6, 2023, July 27, 2023, August 16, 2023, October 19, 2023 and October 23, 2023; and •the description of our common stock contained in our Registration Statement on Form 8-A, filed with SEC on March 19, 2014, as updated by Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and We also incorporate by reference into this prospectus additional documents that we may file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the completion or termination of the offering of the securities described in this prospectus, but excluding any information deemed furnished and not filed with the SEC. Any statements contained in a previously filed document incorporated by reference into this prospectus is deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, or in a subsequently filed document also incorporated by reference herein, modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Notwithstanding the statements in the preceding paragraphs, no document, report or exhibit (or portion of any of the foregoing) or any other information that we have “furnished” to the SEC pursuant to the Exchange Act shall be incorporated by reference into this prospectus.

We will furnish without charge to each person, including any beneficial owner, to whom a prospectus is delivered, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits to these documents. You should direct any requests for documents to BioLife Solutions, Inc., 3303 Monte Villa Parkway, Suite 310, Bothell, Washington, 98021, Attention: Corporate Secretary or telephoning us at (425) 402-1400. You may also access the documents incorporated by reference in this prospectus through our website at www.biolifesolutions.com. Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms a part.

BioLife Solutions, Inc.

927,165 Shares of Common Stock

PROSPECTUS

November 17, 2023

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

Set forth below are estimates of the fees and expenses payable by the registrant in connection with the registration of the offered securities. All the amounts shown are estimates, except for the SEC registration fee.

| | | | | |

| SEC Registration Fee | $ | 1,425 | |

| Printing Fees and Expenses | 5,000 | |

| Accounting Fees and Expenses | 67,500 | |

| Legal Fees and Expenses | 12,500 | |

| Total | $ | 86,425 | |

Item 15. Indemnification of Directors and Officers

We are incorporated under the laws of the State of Delaware. Section 145 of the Delaware General Corporation Law, or the DGCL, provides that a Delaware corporation may indemnify any persons who were, are, or are threatened to be made, parties to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that such person is or was an officer, director, employee or agent of such corporation, or is or was serving at the request of such corporation as an officer, director, employee or agent of another corporation or enterprise. Except in the case of an action by or in the right of the corporation (i.e., a derivative action), the indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided that such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal. With respect to an action by or in the right of the corporation, the indemnity may only include expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit provided such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests except that no indemnification is permitted without judicial approval if such person is adjudged to be liable, unless the Delaware Court of Chancery, or the court in which such action or suit was brought, determines that despite the adjudication of liability, such person is fairly and reasonably entitled to indemnity for such expenses. Where a present or former officer or director is successful on the merits or otherwise in the defense of any action, suit or proceeding referred to above, the corporation must indemnify him or her against the expenses (including attorneys’ fees) by him or her in connection therewith.

Our Certificate of Incorporation and Bylaws provide for the indemnification of our directors and officers to the fullest extent permitted under the DGCL.

Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duties as a director, except for liability for any:

•transaction from which the director derives an improper personal benefit;

•act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

•willful or negligent violations of Delaware law governing the authorizations of dividends, stock repurchases, and redemptions, as provided in Section 174 of the DGCL; or

•breach of a director’s duty of loyalty to the corporation or its stockholders.

Our Certificate of Incorporation includes such a provision. Expenses incurred by any of our officers or directors in defending any such action, suit or proceeding in advance of its final disposition shall be paid by us upon delivery

to us of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to be indemnified by us.

Section 174 of DGCL provides, among other things, that a director who willfully or negligently approves of an unlawful payment of dividends or an unlawful stock purchase or redemption, may be held liable for such actions. A director who was either absent when the unlawful actions were approved or dissented at the time may avoid liability by causing his or her dissent to such actions to be entered in the books containing minutes of the meetings of the board of directors at the time such action occurred or immediately after such absent director receives notice of such action.

At present, there is no pending or proceeding involving any of our directors or officers as to which indemnification is required or permitted, and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

We maintain a general liability insurance policy that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their capacities as directors or officers and we intend to maintain such insurance coverage.

In any underwriting agreement we enter into in connection with the sale of common stock being registered hereby, the underwriters will agree to indemnify, under certain conditions, us, our directors, our officers and persons who control us within the meaning of the Securities Act against certain liabilities.

Item 16. Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 3.1 | | |

| 3.2 | | |

| 3.3 | | |

| 3.4 | | |

| 4.1 | | |

| 4.2 | | |

| 5.1 | | |

| 23.1 | | |

| 23.2 | | |

| 23.3 | | |

| 24.1 | | |

| 107 | | |

Item 17. Undertakings

(a)The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference

into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(b)The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bothell, State of Washington, on November 17, 2023.

| | | | | | | | |

| BIOLIFE SOLUTIONS, INC. |

| By: | /s/ Roderick de Greef |

| | Roderick de Greef |

| | President and Chief Executive Officer (Principal Executive Officer) |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below hereby constitutes and appoints Roderick de Greef and Troy Wichterman and each of them, as his or her true and lawful attorney-in-fact and agent with full power of substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this registration statement, and to sign any registration statement for the same offering covered by this registration statement that is to be effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act of 1933, as amended, increasing the number of securities for which registration is sought, and all post-effective amendments thereto, and to file the same, with all exhibits thereto and all documents in connection therewith, making such changes in this registration statement as such attorney-in-fact and agent so acting deem appropriate, with the SEC, granting unto said attorney-in-fact and agent, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done with respect to the offering of securities contemplated by this registration statement, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agent or any of them, or his, her or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-3 has been signed below by the following persons in the capacities and on the dates indicated:

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

/s/ Roderick de Greef | | Chief Executive Officer and Chairman of the Board of Directors (Principal Executive Officer) | | November 17, 2023 |

| Roderick de Greef | | |

| | | | |

/s/ Troy Wichterman | | Chief Financial Officer (Principal Financial and Accounting Officer) | | November 17, 2023 |

| Troy Wichterman | | |

| | | | |

/s/ Joseph Schick | | Director | | November 17, 2023 |

| Joseph Schick | | |

| | | | |

/s/ Amy DuRoss | | Director | | November 17, 2023 |

| Amy DuRoss | | |

| | | | |

/s/ Rachel Ellingson | | Director | | November 17, 2023 |

| Rachel Ellingson | | |

| | | | |

/s/ Joydeep Goswami | | Director | | November 17, 2023 |

| Joydeep Goswami | | |

| | | | |

/s/ Tim Moore | | Director | | November 17, 2023 |

| Tim Moore | | |

Calculation of Filing Fee Table

Form S-3

(Form Type)

BioLife Solutions, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security

Type | Security

Class

Title | Fee

Calculation

or Carry

Forward

Rule | Amount

Registered

(1) | Proposed

Maximum

Offering

Price Per

Unit (2) | Maximum

Aggregate

Offering

Price | Fee

Rate | Amount

of

Registration

Fee | Carry

Forward

Form

Type | Carry

Forward

File

Number | Carry

Forward

Initial

effective

date | Filing Fee

Previously

Paid In

Connection

with

Unsold

Securities

to be

Carried

Forward |

| Newly Registered Securities |

Fees to Be

Paid | Equity | Common Stock, par value $0.001 per share | Rule 457(c) | 927,165 | $10.42 | $9,656,423.48 | 0.00014760 | $1,425.29 | | | | |

| Fees Previously Paid | — | — | — | — | — | — | | — | | | | |

| Carry Forward Securities |

| Carry Forward Securities | — | — | — | — | | — | | | — | — | — | — |

| Total Offering Amounts | | $9,656,423.48 | | $1,425.29 | | | | |

| Total Fees Previously Paid | | | | — | | | | |

| Total Fee Offsets | | | | — | | | | |

| Net Fees Due | | | | $1,425.29 | | | | |

(1)Pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, the shares being registered hereunder include an indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

(2)Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based upon the average of the high and low prices per share of the registrant’s common stock as reported on the Nasdaq Capital Market on November 13, 2023.

K&L Gates LLP

1 Park Plaza

Twelfth Floor

Irvine, CA 92614

T +1 949 253 0900 F +1 949 253 0902 klgates.com

November 17, 2023

BioLife Solutions, Inc.

3303 Monte Villa Parkway, Suite 310

Bothell, Washington, 98021

Ladies and Gentlemen:

We have acted as counsel to BioLife Solutions, Inc., a Delaware corporation (the “Company”), in connection with the Registration Statement on Form S-3 (the “Registration Statement”) filed by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), on November 17, 2023, relating to the resale from time to time by the selling stockholder identified in the Registration Statement of an aggregate of 927,165 shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”) issued to the selling stockholder as provided in the Securities Purchase Agreement, dated as of October 19, 2023, between the Company and the selling stockholder (the “Agreement”). This opinion letter is being furnished to you in accordance with the requirements of Item 601(b)(5) of Regulation S-K.

You have requested our opinion as to the matters set forth below in connection with the Registration Statement. For purposes of rendering the opinions expressed below, we have examined (i) the Registration Statement; (ii) the Amended and Restated Certificate of Incorporation of the Company, as amended to date; (iii) the Amended and Restated Bylaws of the Company; (iv) the Agreement; and (v) the records of corporate actions of the Company relating to the Agreement, the Registration Statement and matters in connection therewith. We have also made such investigation as we have deemed appropriate. We have examined and relied upon certificates of public officials and, as to certain matters of fact that are material to our opinions, we have also relied on a certificate of an officer of the Company. In rendering our opinions, we have also made assumptions that are customary in opinion letters of this kind. We have not verified any of these assumptions.

Our opinions set forth below are limited to the Delaware General Corporation Law. We are not opining on, and we assume no responsibility for, the applicability to or effect on any of the matters covered herein of (a) any other laws; (b) the laws of any other jurisdiction; or (c) the laws of any county, municipality or other political subdivision or local governmental agency or authority.

Based upon and subject to the foregoing and in reliance thereon, is it our opinion that the Shares have been validly issued and are fully paid and non-assessable.

We assume no obligation to update or supplement any of our opinions to reflect any changes of law or fact that may occur after the date hereof.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement and to the reference to this firm in the Registration Statement under the caption “Legal Matters.” In giving our consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

| | |

| Yours truly, |

|

| /s/ K&L Gates LLP |

|

| K&L Gates LLP |

Consent of Independent Registered Public Accounting Firm

We have issued our reports dated March 31, 2023, with respect to the consolidated financial statements and internal control over financial reporting of BioLife Solutions, Inc. included in the Annual Report on Form 10-K for the year ended December 31, 2022, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement and to the use of our name as it appears under the caption “Experts.”

/s/ GRANT THORNTON LLP

Bellevue, Washington

November 17, 2023

Consent of Independent Registered Public Accounting Firm

BioLife Solutions, Inc.

Bothell, Washington

We hereby consent to the incorporation by reference in the Prospectus constituting a part of this Registration Statement of our report dated March 31, 2022, relating to the consolidated financial statements of BioLife Solutions, Inc. as of December 31, 2021 and for the years ended December 31, 2021 and 2020, appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

We also consent to the reference to us under the caption “Experts” in the Prospectus.

/s/ BDO USA, P.C.

Seattle, Washington

November 17, 2023

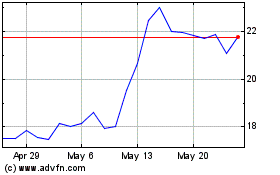

BioLife Solutions (NASDAQ:BLFS)

Historical Stock Chart

From Apr 2024 to May 2024

BioLife Solutions (NASDAQ:BLFS)

Historical Stock Chart

From May 2023 to May 2024