UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of report: November 21, 2023

Commission File Number: 001-38974

BIOPHYTIS S.A.

(Translation of registrant’s name into

English)

Stanislas Veillet

Biophytis S.A.

Sorbonne University—BC 9, Bâtiment

A 4ème étage

4 place Jussieu

75005 Paris, France

+33 1 44 27 23 00

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F

¨ Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On November 20, 2023, Biophytis S.A. issued a press release announcing

the success of its capital increase with preferential subscription rights for approximately € 1.96 million. A copy of the press

release is attached as Exhibit 99.1 to this Form 6-K.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BIOPHYTIS S.A. |

| |

|

|

| Date: November 20, 2023 |

By: |

/s/ Stanislas Veillet |

| |

|

Name: Stanislas Veillet |

| |

|

Title: Chairman and Chief Executive Officer |

Exhibit 99.1

Press

release

Biophytis announces

the success of its capital increase

with preferential

subscription rights for approximately €1.96 million

Paris (France) and Cambridge (Massachusetts,

United States), November 20, 2023 – 07:00am – Biophytis SA (Nasdaq CM: BPTS, Euronext Growth Paris: ALBPS),

(“Biophytis” or the “Company”), a clinical-stage biotechnology company focused on the development

of therapeutics that are aimed at slowing the degenerative processes associated with aging and improving functional outcomes for patients

suffering from age-related diseases, today announces the successful completion of its capital increase with shareholders' pre-emptive

subscription rights (DPS) through the issue of shares with redeemable share warrants (ABSAR), for an amount, including issue premium,

of approximately €1.96 million (the "Capital Increase").

Stanislas Veillet, Co-founder, and CEO of Biophytis,

said: "I would like to thank all the shareholders and investors who have contributed to the success of this capital increase and

expressed their confidence in our strategy. This operation will help to finance the next major steps in our development. As part of the

COVA programme, Biophytis is conducting discussions with the European and American regulatory agencies to define the conditions for market

access and to extend the scope of its indication to respiratory viral diseases other than COVID-19, such as influenza. As for the SARA

programme, the Company is actively seeking global or regional partners to start the SARA-31 clinical study, which will be the first phase

3 study ever launched in sarcopenia".

Considering the net proceeds of this operation,

as well as the bond financing facility in place with Atlas Capital, which may give rise to additional financing of €20 million, the

Company can ensure the continuity of its operations for at least the next 12 months.

Results of the Capital Increase

At the end of the subscription period, which ran

from 30 October 2023 to 13 November 2023 (inclusive), subscription requests totalled 45,247,404 ABSAR, broken down as follows:

| § | 39,283,182 ABSAR were subscribed on an irreducible

basis; |

| § | 5,964,222 ABSAR were subscribed for on a reducible

basis and were allocated in full. |

Considering the number of ABSAR subscribed for

at the end of the period on irreducible and reducible basis, the commitments to subscribe to the Capital Increase made by the Chairman

and CEO and by a group of investors were called up for free subscriptions amounting to €1,539,024.92, corresponding to 165,486,550

ABSAR, bringing the total amount subscribed to 75% of the issue.

The capital increase thus amounts to €1,959,825.77

and involves the issue of 210,733,954 ABSARs, subscribed at a price of €0.0093.

As a result, the Company's share capital following

the Capital Increase will amount to €1,947,047.49, divided into 973,523,747 shares with a par value of €0.002 each1.

Settlement and delivery of the new shares and

the attached redeemable equity warrants (BSAR), as well as their admission to trading on Euronext Growth Paris, are scheduled for 22 November 2023.

The new shares will carry dividend rights and will be listed on the same quotation line as the existing shares, under ISIN code FR0012816825,

and the BSARs will be listed on a separate quotation line under ISIN code FR001400LN79.

1 Note that on 4 October 2023 and 7 November 2023 respectively,

15,151,515 new shares and 13,513,513 new shares were issued following the conversion of ORNANE bonds previously issued by the Company.

The BSARs may be exercised at any time until 31

December 2026. One (1) BSAR will give the right to subscribe for one (1) new ordinary share (the "Exercise Parity"),

in return for payment of an exercise price of 0.012 euro.

The new shares resulting from the exercise of

the BSARs will be the subject of periodic applications for admission to trading on the Euronext Growth Paris market on the same quotation

line as the Company's existing shares under the same ISIN code FR0012816825.

Impact on the shareholder's situation

As an indication, the impact of the Capital Increase

on the interest in the Company's capital of a shareholder holding 1.00% of the share capital prior to the Capital Increase and not subscribing

to it (in %) is as follows:

| | |

Undiluted

base2 | | |

Diluted

basis3 | |

| Before

issue of ABSARs from the Capital Increase | |

| 1.00 | % | |

| 0.77 | % |

| After

issue of 210,733,954 ABSAR from the Capital Increase | |

| 0.70 | % | |

| 0.58 | % |

Impact on equity

For information purposes, the impact of the Capital

Increase on the share of consolidated equity per share (in euros) is as follows:

| | |

Undiluted base4 | | |

Diluted basis5 | |

| Before issue of ABSARs from the Capital Increase | |

| (0.0045 | ) | |

| (0.0034 | ) |

| After issue of 210,733,954 ABSAR from the Capital Increase | |

| (0.00033 | ) | |

| (0.00027 | ) |

***

About Biophytis

Biophytis SA is a clinical-stage

biotechnology company specializing in the development of drug candidates for age-related diseases. Sarconeos (BIO101), our lead drug

candidate, is a small molecule in development for age-related neuromuscular (sarcopenia and Duchenne muscular dystrophy) and

cardiorespiratory (Covid-19) diseases. Promising clinical results were obtained in the treatment of sarcopenia in an

international phase 2 study, enabling the launch of a phase 3 study in this indication (SARA project). The safety and efficacy

of Sarconeos (BIO101) in the treatment of severe COVID-19 were studied in a positive international phase 2-3 clinical trial

(COVA project). A pediatric formulation of Sarconeos (BIO101) is currently being developed for the treatment of Duchenne Muscular

Dystrophy (DMD, MYODA project). The company is based in Paris, France, and Cambridge, Massachusetts. The Company's ordinary shares

are listed on Euronext Growth (Ticker: ALBPS -ISIN: FR0012816825) and the ADSs (American Depositary Shares) are listed on Nasdaq

Capital Market (Ticker BPTS - ISIN: US09076G1040).

2 On the basis of negative consolidated shareholders'

equity of €3.354 million at 30 June 2023.

3 On 30 September 2023, there were 223,205,234 shares

to be issued on exercise of securities giving access to the Company's capital.

4 On the basis of negative consolidated equity of €3.354

million at 30 June 2023.

5 On 30 September 2023, there were 223,205,234 shares

to be issued on exercise of securities giving access to the Company's capital..

For more information, visit www.biophytis.com

Contacts

Investor Relations

Nicolas Fellmann, CFO

Investors@biophytis.com

Media

Antoine Denry: antoine.denry@taddeo.fr –

+33 6 18 07 83 27

Nizar Berrada: nizar.berrada@taddeo.fr

– +33 6 38 31 90 50

Disclaimer

This press release does not constitute an offer

to sell or buy shares, and there will be no selling of ordinary shares in a state or jurisdiction where such an offer, solicitation or

sale would be unlawful prior to qualification under the securities laws of such state or jurisdiction.

Distribution of this press release may be subject

to specific regulations in certain countries. Individuals in possession of this document are required to inform themselves of and comply

with any local restrictions.

This press release constitutes a promotional communication

and not a prospectus within the meaning of Directive 2003/71/EC of the European Parliament and of the Council of November 4, 2003,

as amended, in particular by Directive 2010/73/EU of the European Parliament and of the Council of November 24, 2010, as amended

and as implemented by each of the Member States of the European Economic Area (the “Prospectus Directive”).

As regards Member States of the European Economic

Area other than France (the “Member States”) that have implemented the Prospectus Directive, no action has been taken or shall

be taken to allow for an offer to the public of the securities referred to in this press release requiring the publication of a prospectus

in any Member State. As a result, the securities may be offered in Member States only: (a) to legal persons who are qualified investors

as defined in the Prospectus Directive; or (b) in other cases not requiring the Company to publish a prospectus pursuant to the Prospectus

Directive and/or applicable regulations in this Member State, provided that such an offer does not require the Company to publish a supplement

to the prospectus in accordance with the requirements of the Prospectus Directive.

This press release and the information it contains

do not constitute an offer to buy or sell securities or an invitation to buy or subscribe to securities or an invitation to sell securities

in the United States, the United Kingdom, Canada, Australia, Japan or any other jurisdiction in which the issue may be subject to restrictions.

This press release must not be published, released or distributed, directly or indirectly, in the United States, the United Kingdom, Canada,

Australia or Japan.

The securities concerned by this press release

have not been and shall not be registered within the meaning of the US Securities Act of 1933 as amended (the “US Securities Act”)

and may not be offered or sold in the United States without registration or exemption from the requirement to register in accordance with

the US Securities Act.

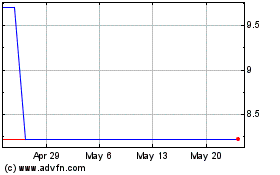

Biophytis (NASDAQ:BPTS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Biophytis (NASDAQ:BPTS)

Historical Stock Chart

From Mar 2024 to Mar 2025