By William Watts and Mark DeCambre, MarketWatch

The U.S. generated 263,000 jobs in April, Labor Department data

showed

Stock benchmarks headed higher Friday morning after a key

reading of April employment came in hotter than expected, with

unemployment falling to a nearly 50-year low, underscoring the

health of the U.S. job market.

How are benchmarks performing?

The Dow Jones Industrial Average rose 108 points, or 0.4%, to

26,416, the S&P 500 index climbed 17 points, or 0.6%, at 2,934,

while the Nasdaq Composite Index advanced 75 points, or 0.9%, at

8,110.

For the week, all three main benchmarks were poised for weekly

skid of at least 0.2%, with the Nasdaq poised to halt a weekly win

streak at five with a 0.5% five-session drop.

What's driving the market?

The April jobs report underscored a healthy labor market that

produced a stronger-than-expected

(http://www.marketwatch.com/story/us-creates-263000-jobs-in-april-unemployment-falls-to-36-2019-05-03)

263,000 new jobs in April, helping to drive down the unemployment

rate to a 49-year low of 3.6%, topping economists' estimates polled

by MarketWatch for monthly job gains of 217,000.

The jobless rate slid from 3.8% in March to hit the lowest level

since December 1969. The average wage paid to American workers rose

6 cents, or 0.2%, to $27.77 an hour, while the 12-month rate of

hourly wage gains was unchanged at 3.2%. Hours worked each week

fell 0.1 hour in April to 34.4.

Read:The jobs report might be incredibly strong for an unusual

reason

(http://www.marketwatch.com/story/why-the-april-jobs-report-could-be-unusually-strong-and-not-reflecting-underlying-economy-2019-05-02)

The labor market data appeared to help stock-market bulls

momentarily shake off a two-day skid for the S&P 500 and Dow,

widely blamed on disappointment with remarks by Federal Reserve

Chairman Jerome Powell on Wednesday. Powell offered no indication

the central bank was eager to move rates either direction

(http://www.marketwatch.com/story/fed-sticks-with-patient-policy-notes-weaker-core-inflation-2019-05-01),

appearing to disappoint investors who had hoped the central bank

would indicate it was tilting toward a rate cut.

Read: 'Boom!' Economists hail strong jobs report as jobless rate

dips to Vietnam draft-era low

(http://www.marketwatch.com/story/boom-economists-hail-strong-jobs-report-as-jobless-rate-dips-to-vietnam-draft-era-low-2019-05-03)

A heavy week of earnings results is set to draw to a close.

What stocks are in focus?

Amazon.com Inc.(AMZN) stocks were rising in premarket activity

after billionaire investor Warren Buffett told CNBC late Thursday

that Berkshire Hathaway (BRKA) (BRKA) had bought shares of the

e-commerce giant. Shares of the e-commerce giant rose 2.1%.

Read:Berkshire buying Amazon is a wake-up call for individual

investors, says this portfolio manager

(Berkshire%20buying%20Amazon%20is%20a%20wake-up%20call%20for%20retail%20investors,%20says%20this%20portfolio%20manager)

Shares of Newell Brands(NWL) may be in focus after topping Wall

Street expectations for earnings and sales. The company's stock

surge more than 12%.

Shares of Beyond Meat Inc. , the alternative meat company,

extended its gains after its initial public offering on Thursday.

Shares were up about 6.8% on Friday.

What are analysts saying?

"This is another loud and clear signal that the economy is in

really good shape. Jobs--check, wages--check, earnings--check, and

tame inflation--check," wrote Mike Loewengart, v.p. investment

strategy at E-Trade Financial Corp., in a Friday note after the

jobs report.

"We're getting to a point where it's hard to find something to

be concerned about. But that's not an excuse for complacency. As we

enter the back nine of earnings season, traders will likely turn

their attention to potential trade resolutions coming out of

Washington next week. And despite the murmuring of positivity on

that front, there are more than a few questions marks in the air,"

he said.

What else is on the economic calendar?

A reading of advance trade deficit in goods rose 0.7% to $71.4

billion, according to the government report. Economists polled by

MarketWatch expected a $72 billion trade gap.

The Institute for Supply Management nonmanufacturing index

(http://www.marketwatch.com/story/ism-services-index-slows-in-april-to-lowest-level-in-nearly-two-years-2019-05-03),

or services, came in at 55.5, representing the lowest read since

August 2017. Economists polled by MarketWatch had expected a

reading of 56.1. A reading of 50 or better indicates improving

conditions.

Investors will also hear from a range of Fed speakers. Chicago

Fed President Charles Evans is set to speak at 10:15 a.m., while

Fed Vice Chairman Richard Clarida makes an appearance at 11:30 a.m.

New York Fed President John Williams is set to speak at 1:45

p.m.

How did other markets trade?

China's markets were closed for a holiday, and Japan's Nikkei

remained closed for a 10-day holiday commemorating the installation

of a new emperor earlier this week. Hong Kong's Hang Seng Index

advanced on the day.

European stocks were broadly higher

(http://www.marketwatch.com/story/strong-banks-and-weak-miners-tug-europe-markets-in-opposite-directions-2019-05-02)

as reflected by a 0.6% gain in the Stoxx Europe 600. .

Crude-oil prices traded mixed Friday, while gold prices edged

higher in early trade after settling at its lowest level in about

four months on Thursday. The U.S. dollar index , meanwhile, edged

slightly higher.

(END) Dow Jones Newswires

May 03, 2019 10:15 ET (14:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

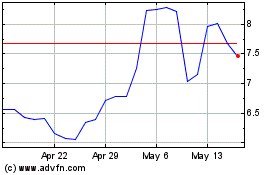

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Jul 2023 to Jul 2024