Definitive Materials Filed by Investment Companies. (497)

20 March 2013 - 8:25AM

Edgar (US Regulatory)

BLACKROCK FUNDS II

BlackRock GNMA Portfolio

(the “Fund”)

Supplement dated March 19, 2013

to the Prospectus dated January 28, 2013

Effective immediately, the following changes

are made to the Fund’s Prospectus:

The second sentence of the first

paragraph in the section of the Prospectus entitled “Fund Overview

—

Key Facts about BlackRock GNMA Portfolio

—

Principal Investment Strategies of the Fund” is deleted in its entirety and replaced with the following:

The Fund invests primarily in securities

issued by the GNMA as well as other U.S. Government securities.

The third paragraph in the section

of the Prospectus entitled “Fund Overview

—

Key Facts about BlackRock GNMA Portfolio

—

Principal

Investment Strategies of the Fund” is deleted in its entirety and replaced with the following:

The Fund measures its performance

against the Barclays GNMA MBS Index (the benchmark). Under normal circumstances, the Fund seeks to maintain an average portfolio

duration that is within ±1 year of the duration of the benchmark.

The first sentence

of the first paragraph in the section of the Prospectus entitled “Details about the Funds — How Each Fund Invests —

GNMA Portfolio — Principal Investment Strategies” is deleted in its entirety and replaced with the following:

In pursuit of this objective,

the Fund invests primarily in securities issued by the Government National Mortgage Association (GNMA) as well as other U.S. Government

securities.

The fourth sentence

of the first paragraph in the section of the Prospectus entitled “Details about the Funds — How Each Fund Invests —

GNMA Portfolio — Principal Investment Strategies” is deleted in its entirety.

The fifth paragraph

in the section of the Prospectus entitled “Details about the Funds — How Each Fund Invests — GNMA Portfolio —

Principal Investment Strategies” is deleted in its entirety and replaced with the following:

The Fund will

normally seek to structure the Fund’s portfolio to have an average portfolio duration that is within ±1 year of the

duration of the benchmark. Duration is a mathematical calculation of the average life of a bond (or bonds in a bond fund) that

serves as a useful measure of its price risk. Each year of duration represents an expected 1% change in the net asset value of

a bond fund for every 1% immediate change in interest rates. For example, if a bond fund has an average duration of four years,

its net asset value will fall about 4% when interest rates rise by one percentage point. Conversely, the bond fund’s net

asset value will rise about 4% when interest rates fall by one percentage point. Duration, which measures price sensitivity to

interest rate changes, is not necessarily equal to average maturity. As of January 29, 2013, the duration of the benchmark was

2.63 years, as calculated by BlackRock.

Shareholders should retain

this Supplement for future reference.

PRO-BD7-0313SUP

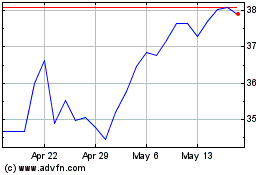

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jun 2024 to Jul 2024

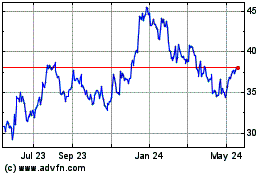

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jul 2023 to Jul 2024