Amended Current Report Filing (8-k/a)

17 November 2022 - 9:30AM

Edgar (US Regulatory)

0001845149

false

0001845149

2022-10-13

2022-10-13

0001845149

CBRGU:UnitseachconsistingofoneClassAordinaryshareandonehalfofoneredeemableWarranttoacquireoneClassAordinaryshareMember

2022-10-13

2022-10-13

0001845149

us-gaap:CommonClassAMember

2022-10-13

2022-10-13

0001845149

CBRGU:RedeemableWarrantseachwholewarrantexercisableforoneClassAordinaryshareatanexercisepriceofDollar11.50Member

2022-10-13

2022-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): October 13, 2022

Chain Bridge I

(Exact name of registrant

as specified in its charter)

| Cayman Islands |

|

001-41047 |

|

98-1578955 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

100 El Camino Real, Ground Suite

Burlingame, California |

|

94010 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (202) 656-4257

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which

registered |

| Units,

each consisting of one Class A ordinary share and one-half of one redeemable Warrant to acquire one Class A ordinary

share |

|

CBRGU |

|

The Nasdaq Global Market |

| |

|

|

|

|

| Class

A ordinary shares, par value $0.0001 per share |

|

CBRG |

|

The Nasdaq Global Market |

| |

|

|

|

|

| Redeemable

Warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

CBRGW |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

Chain Bridge I (the “Company”) is filing

this Amendment No. 1 (this “Amendment”) to its Current Report on Form 8-K, as originally filed with the U.S. Securities

and Exchange Commission (the “SEC”) on October 19, 2022 (the “Original Form 8-K”), related to the appointment

of David G. Brown as a director of the Company and a member of the Company’s Audit Committee, Compensation Committee and Nominating

Committee, as further described below. The Original Form 8-K omitted Mr. Brown’s appointment as a member of the Company’s

Compensation Committee.

The information in this Amendment is presented

as of the filing date of the Original Form 8-K and does not reflect events occurring after that filing date or modify or update disclosures

in any way other than as required to reflect the restatement as described below. Accordingly, this Amendment should be read in conjunction

with the Company’s other filings with the SEC subsequent to the date on which it filed the Original Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On

October 13, 2022, the Company announced that David G. Brown has been appointed as a director of the Company and a member of the Company’s

Audit Committee, Compensation Committee and Nominating Committee. Mr. Brown will serve in the class of directors whose term expires

at the Company’s second general annual meeting of shareholders. The Board of Directors of the Company has determined that Mr. Brown

is an independent director under applicable Securities and Exchange Commission and the Nasdaq Stock Market LLC rules.

In

connection with the appointment of Mr. Brown, the Company and Mr. Brown entered into the following agreements:

| · |

A Letter Agreement, dated October 13, 2022, between the Company and Mr. Brown, pursuant to which, among other things, the Company agreed to grant Mr. Brown 30,000 restricted stock units of the Company subject to the terms and conditions set forth therein; Mr. Brown has agreed to vote any Class B ordinary shares and Class A ordinary shares held by him in favor of the Company’s initial business combination; facilitate the liquidation and winding up of the Company if an initial business combination is not consummated within the time period required by its Amended and Restated Memorandum and Articles of Association; and certain transfer restrictions with respect to the Company’s securities. |

| · |

An Indemnification Agreement, dated October 13, 2022, between the Company and Mr. Brown, providing Mr. Brown contractual rights to indemnification in addition to the indemnification provided for in the Company’s Amended and Restated Memorandum and Articles of Association. |

| · |

A Joinder Agreement, dated October 13, 2022, pursuant to which Mr. Brown became a party to that certain Registration and Shareholder Rights Agreement, dated November 9, 2021, among the Company, Chain Bridge Group (the “Sponsor”), CB Co-Investment LLC (“CB Co-Investment”) and certain equityholders of the Company, which provides for, among other things, customary demand and piggy-back registration rights. |

The

foregoing descriptions of the Letter Agreement, the Indemnification Agreement and the Joinder Agreement do not purport to be complete

and are qualified in their entireties by reference to the Letter Agreement, the Indemnification Agreement and the Joinder Agreement, copies

of which are attached as Exhibits 10.1, 10.2, and 10.3, respectively, and are incorporated herein by reference.

Other

than the foregoing, Mr. Brown is not party to any arrangement or understanding with any person pursuant to which he was appointed

as a director, nor is he party to any transactions required to be disclosed under Item 404(a) of Regulation S-K involving the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this Form 8-K:

| Exhibit No. |

|

| |

|

| 10.1 |

Letter Agreement, dated October 13, 2022, between the Company and Mr. Brown. |

| |

|

| 10.2 |

Indemnification Agreement, dated October 13, 2022, between the Company and Mr. Brown. |

| |

|

| 10.3 |

Joinder Agreement, dated October 13, 2022, among the Company, the Sponsor, CB Co-Investment

and Mr. Brown. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: November 16, 2022

| |

CHAIN BRIDGE I |

| |

|

| |

By: |

/s/

Michael Rolnick |

| |

Name: |

Michael Rolnick |

| |

Title: |

Chief Executive Officer |

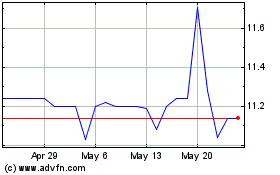

Chain Bridge I (NASDAQ:CBRG)

Historical Stock Chart

From Apr 2024 to May 2024

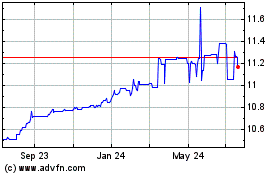

Chain Bridge I (NASDAQ:CBRG)

Historical Stock Chart

From May 2023 to May 2024