HBO Chief Richard Plepler Makes Case for Big Providers to Offer Its Streaming Product

21 October 2015 - 3:07PM

Dow Jones News

By Amol Sharma

LAGUNA BEACH, Calif.--HBO Chief Executive Richard Plepler made a

case for big broadband providers to market the company's new

standalone streaming service, saying it would help both sides grow

without compromising the traditional pay-television business.

Speaking at The Wall Street Journal's WSJD Live event here, Mr.

Plepler noted that companies like Comcast Corp., Charter

Communications Inc. and AT&T Inc. have millions of

broadband-only households, and suggested it would be in their

interest to offer HBO Now, the new streaming product, to target

those audiences.

"Why wouldn't you want to take a product like HBO...and make it

a part of your package, and share the revenue with us?" Mr. Plepler

said. "We're having better conversations with some than

others."

HBO Now offers the Time Warner Inc. premium cable channel's

programming--from "Game of Thrones" to "Veep"--to customers who

don't have pay-TV connections. The $15 a month streaming service is

available through outlets like Apple Inc. and Roku Inc., but the

biggest broadband companies so far haven't signed on as

distributors.

Mr. Plepler downplayed the notion that cable companies should be

concerned about HBO Now cannibalizing the hugely profitable pay TV

business. He said less than 1% of customers who signed up for HBO

Now were pay-TV customers.

"This is going to be a tremendous expansion of their reach as

well," he said, referring to the broadband companies.

Mr. Plepler declined to comment on the number of subscribers HBO

has signed up, but said the company is pleased so far.

Amid growing industry concerns about cord-cutting, Mr. Plepler

said he believes the pay-TV industry is moving toward offering

"skinny" bundles, smaller packages of channels. He said that

outcome would benefit HBO, putting it in reach for more households.

"What people really want are bundles that don't have 500 channels,"

he said.

Big TV channels will survive in the skinny bundle world, he

said, while smaller networks that have been "riding on the backs"

of larger sibling networks will struggle, he said.

Despite constant talk of a rivalry between Netflix Inc. and HBO,

Mr. Plepler said the companies' services complement each other. "We

overindex in their homes. They overindex in our homes," he said,

adding that the households that tend to like both services are

"entertainment junkies."

Mr. Plepler said the company has been trying to invest in

content strategically, citing the company's deals to carry Sesame

Street programming and the signing of sports commentator Bill

Simmons away from ESPN.

He said Vice Media's new daily newscast will have "a little more

HBO production patina to it" than the Vice documentaries HBO has

carried thus far.

"I like the grit of that organization," he said of Vice. "I like

their bravery. I like their storytelling."

Write to Amol Sharma at amol.sharma@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 23:52 ET (03:52 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

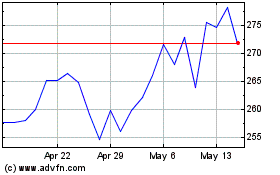

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

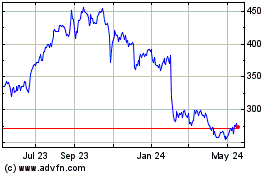

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024