By Shalini Ramachandran and Lisa Beilfuss

Cable operators have shown significant improvements in video

subscriber results so far in the third quarter, a development that

could moderate investors' concerns about the pace of pay-TV

cord-cutting.

On Thursday, Charter Communications Inc. said it added 12,000

video customers in the period, up from a loss of 9,000 in the

year-ago quarter. Time Warner Cable Inc., which is being acquired

by Charter pending regulatory approval, lost just 7,000 residential

video subscribers compared with 184,000 in the same period last

year. Earlier this week, industry giant Comcast Corp. also reported

it had substantially reduced its video subscriber losses.

Taken together, the results point to cable's growing ability to

retain its customers. Some analysts say the earnings highlight

that, while the entire pay TV ecosystem is in decline, cable

companies may be faring better than their satellite TV rivals.

The results could temper media investors' fears that

cord-cutting is accelerating, which were stoked after a dreadful

second quarter, when the overall pay TV industry lost 606,000

subscribers, compared with 321,000 the year earlier, according to

MoffettNathanson estimates and company reports.

Other pay-TV providers, such as Dish Network Corp. and

Cablevision Systems Corp., have yet to report third-quarter

results.

Analysts and executives caution that pay-TV subscriptions are

still declining, and note there are still some significant

headwinds.

On Charter's earnings call, Chief Executive Tom Rutledge said

some consumers are being priced out of cable. "Cost of the product

relative to what people's incomes have done is creating a

mismatch," he said. "The population is poorer," even as cable bills

continue to rise.

Mr. Rutledge said college students are increasingly sharing

their parents' passwords for using so-called "TV Everywhere" apps,

through which TV networks offer live or on-demand programming for

cable TV subscribers. TV networks are "devaluing the product by not

managing" their apps to protect against password-sharing, he said.

That has "reduced the demand for video" in the college market

"because you don't have to pay for it," Mr. Rutledge said.

Nevertheless, the latest results have been a pleasant surprise

to some on Wall Street. In a research note Thursday,

MoffettNathanson analyst Craig Moffett said cable firms have

benefited from their strength in broadband services, ability to

deliver robust video-on-demand services compared with satellite

services, and new cloud-based TV guides that give customers more

Weblike experiences may be helping.

Cable video "may not be such a dinosaur after all," he said.

Including AT&T Inc.'s and Verizon's results from last week,

the data points to an estimated annual decline in pay-TV

subscriptions of about one to two million, Sanford C. Bernstein

analyst Todd Juenger wrote in a research note Thursday.

That is "about the range most media investors *say* they're

comfortable with," he said. The number doesn't account for people

who are "cord-shaving," or downgrading to skinnier pay-TV packages,

which translates into lower revenue for cable operators and

networks left out of those bundles.

On Time Warner Cable's investor call, Chief Executive Rob Marcus

said 82% of new customers in the quarter signed up for the full TV

bundle. "For all the talk about skinny bundles, we are doing pretty

well offering a full video product," he said.

The operator this week began beta-testing a streaming TV service

for New York customers that offers the full bundle of channels but

without requiring a set-top box.

TWC's profit slipped 12% in its latest quarter as higher

expenses offset strong residential subscriber additions and higher

sales to businesses. The company reported net income of $437

million, or $1.53 a share, down from $499 million, or $1.76 a

share, a year earlier.

Overall, Charter swung to a profit of $54 million, or 48 cents a

share, compared with a year-earlier loss of $53 million, or 49

cents a share. The company enjoyed a $142 million tax benefit in

the latest quarter, versus a $59 million tax expense in the

year-earlier period.

Time Warner Cable in May agreed to be acquired by Charter

Communications Inc. for $55 billion. Mr. Marcus said it "feels

ambitious" for the deal to close by the end of this year, as the

companies had originally predicted.

Separately, Charter said it is "studying" participating in the

coming auction of airwaves by the Federal Communications

Commission, which could signal that it, like Comcast, has an

interest in entering the wireless business.

Anne Steele contributed to this article.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 14:08 ET (18:08 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

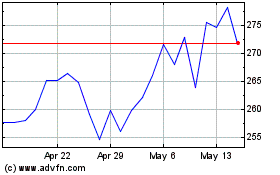

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

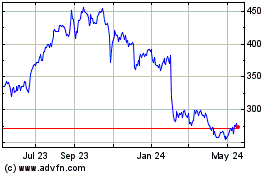

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024