Dow Extends Gains After Crossing Milestone

27 January 2017 - 7:42AM

Dow Jones News

By Akane Otani and Georgi Kantchev

The Dow Jones Industrial Average edged higher Thursday,

extending gains after it closed above 20000 for the first time

ever.

Moves in major indexes were muted, with the S&P 500 flipping

between slight gains and losses for much of the day after indexes

surged to a trifecta of records in the previous session. While

shares of financial companies ticked higher, putting the Dow

industrials on course to post a fresh closing high, declines in

shares of health-care and tech companies kept other broad indexes

under pressure.

The Dow industrials rose 38 points, or 0.2%, to 20106. The

S&P 500 fell less than 0.1%, and the Nasdaq Composite was near

unchanged.

Qualcomm shares fell 5.5% after the chip maker reported after

the bell Wednesday that its net income -- dented by fees for

alleged antitrust violations -- fell 54% in the latest quarter.

Meanwhile, Verizon shares lost 1.4% after The Wall Street

Journal reported that the company is exploring a combination with

Charter Communications. Shares of Charter jumped 6.7%.

Many investors say they remain optimistic but cautious about the

path forward for U.S. stocks, as they weigh the potential benefits

of regulatory rollbacks under President Donald Trump against the

possibility of protectionist policies, which some have said could

crimp corporate growth. Mr. Trump on Thursday sent Twitter messages

putting pressure on Mexico to pay for a wall he wants built on the

border.

The Mexican peso slid, with the dollar recently up 0.8% against

the currency. Mexican President Enrique Peña Nieto canceled a

planned meeting with Mr. Trump.

"This quarter is going to be bumpy," said Rick Anderson, chief

investment officer of Chicago-based Hull Investments, who said his

firm kept cash on the sidelines this week to guard against

potential stock swings.

The dollar and government bonds rose, and gold, a haven asset,

fell. The WSJ Dollar Index, which tracks the dollar against a

basket of 16 other currencies, was recently up 0.5%, coming off its

second lowest close of the year. The yield on the 10-year U.S.

Treasury note fell to 2.508% from 2.523% Wednesday, according to

Tradeweb. Bond yields fall as prices rise.

Gold fell 0.7% to $1,189.50 an ounce, notching its third

consecutive session of declines. Investor appetite for the metal --

which tends to rise when market uncertainty rises -- has diminished

in recent sessions as risk assets like stocks have gained.

Elsewhere, the Stoxx Europe 600 gained 0.2%, helped by the tech

and real-estate sectors. Japan's Nikkei Stock Average rose 1.8% and

Hong Kong's Hang Seng Index advanced 1.4% -- its biggest one-day

gain since Nov. 10.

Markets in China, South Korea, Taiwan and Vietnam will be closed

Friday, with China closed through next Thursday, due to the Lunar

New Year holiday.

Write to Akane Otani at akane.otani@wsj.com and Georgi Kantchev

at georgi.kantchev@wsj.com

(END) Dow Jones Newswires

January 26, 2017 15:27 ET (20:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

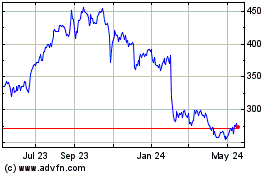

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

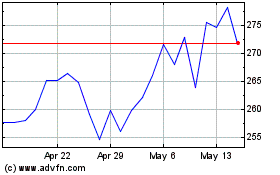

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024