Company News for August 18, 2011 - Corporate Summary

18 August 2011 - 7:10PM

Zacks

• Deere (NYSE:DE) reported

Q3 EPS of $1.69, ahead of the Zacks Consensus Estimates of $1.68

per share. Revenues for the quarter rose 24.1% year-over-year to

$7.72 billion

• Dell Inc. (NASDAQ:DELL) posted second quarter

2012 EPS of 54 cents, easily beating the Zacks Consensus Estimate

of 49 cents. Revenues for the second quarter were $15.7 billion, up

1.0% from $15.5 billion reported in the year-ago quarter

• Target (NYSE:TGT) reported Q2 EPS of $1.03,

above the Zacks Consensus Estimate of $0.97. Revenues for the

quarter rose to 11.5% year-over-year to $16.24 billion

• Staples (NASDAQ:SPLS) posted Q2 EPS of $0.22,

surpassing the Zacks Consensus Estimate of $0.19 per share.

Revenues for the quarter rose 5.2% year-over-year to $5.82

billion

• BJ's Wholesale (NYSE:BJ) reported Q2 EPS of

$0.84, ahead of analysts expectations of $0.77 per share. Revenues

for the quarter rose 10.8% year-over-year to $2.98 billion

• Citi Trends (NASDAQ:CTRN) reported a Q2 loss of

$0.69 per share, wider than analysts expectations for a loss of

$0.64 per share. Revenues for the quarter rose 0.9% year-over-year

to $130.2 million

• Analysts at Wells Fargo initiated coverage on

shares of managed care organization Healthspring (NYSE:HS) with an

"Outperform" rating

• Analysts at CRT Capital initiated coverage on

shares of Cliffs Natural Resources (NYSE:CLF) with a “Buy”

rating

BJ'S WHOLESALE (BJ): Free Stock Analysis Report

CLIFFS NATURAL (CLF): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

DELL INC (DELL): Free Stock Analysis Report

HEALTHSPRING IN (HS): Free Stock Analysis Report

STAPLES INC (SPLS): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

Zacks Investment Research

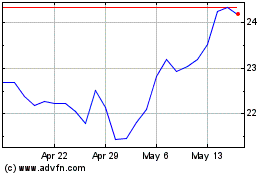

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

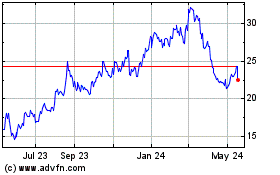

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024