Citi Trends, Inc. (NASDAQ: CTRN) today reported results for the

first quarter of fiscal 2012.

Financial Highlights – First quarter

ended April 28, 2012

Total sales in the first quarter ended April 28, 2012 increased

4.5% to $197.7 million compared with $189.2 million in the first

quarter ended April 30, 2011. Comparable store sales decreased 5.0%

in the first quarter. Net income was $10.1 million, or $0.69 per

diluted share, in the first quarter of 2012, compared with $12.1

million, or $0.83 per diluted share, in last year’s first

quarter.

The Company opened two stores, relocated one store, and closed

two stores in the first quarter of 2012, resulting in a total store

count of 511 at the end of the quarter.

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is

(212) 231-2906. A replay of the conference call will be

available until May 23, 2012, by dialing (402) 977-9140 and

entering the passcode, 21575848. The live broadcast of Citi Trends'

quarterly conference call will be available online at the Company's

website, www.cititrends.com, as well as

http://ir.cititrends.com/events.cfm, beginning today at 9:00 a.m.

ET. The online replay will follow shortly after the call and

continue through May 23, 2012.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

after quarter-end. The Company’s responses to questions, as well as

other matters discussed during the conference call, may contain or

constitute information that has not been disclosed previously.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company operates

511 stores located in 29 states. Citi Trends’ website address is

www.cititrends.com. CTRN-E

Forward-Looking Statements

All statements other than historical facts contained in this

news release, including statements regarding our future financial

results and position, business policy and plans and objectives of

management for future operations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," "continue,"

"anticipate," "intend," "expect" and similar expressions, as they

relate to Citi Trends, are intended to identify forward-looking

statements. Statements with respect to earnings guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarterly financial and accounting procedures, are not

guarantees of future performance or results and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements,

as a result of various factors which are discussed in Citi Trends,

Inc. filings with the Securities and Exchange Commission. These

risks and uncertainties include, but are not limited to,

uncertainties relating to economic conditions, growth risks,

consumer spending patterns, competition within the industry,

competition in our markets and the ability to anticipate and

respond to fashion trends. Any forward-looking statements by the

Company, with respect to earnings guidance or otherwise, are

intended to speak only as of the date such statements are made.

Except as required by applicable law, including the securities laws

of the United States and the rules and regulations of the

Securities and Exchange Commission, Citi Trends does not undertake

to publicly update any forward-looking statements in this news

release or with respect to matters described herein, whether as a

result of any new information, future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (unaudited) (in thousands,

except per share data)

Thirteen Weeks Ended Thirteen Weeks Ended April

28, 2012 April 30, 2011 (unaudited) (unaudited) Net

sales $ 197,694 $ 189,168 Cost of sales 123,028

114,099 Gross profit 74,666 75,069 Selling, general

and administrative expenses 52,669 51,072 Depreciation and

amortization 6,145 5,584 Income from

operations 15,852 18,413 Interest income 62 54 Interest expense

(49 ) (4 ) Income before income taxes 15,865 18,463

Income tax expense 5,761 6,370 Net

income $ 10,104 $ 12,093 Basic net

income per common share $ 0.69 $ 0.83 Diluted net

income per common share $ 0.69 $ 0.83

Weighted average shares used to compute basic net income per share

14,636 14,554 Weighted average shares

used to compute diluted net income per share 14,637

14,567

CITI

TRENDS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited) (in thousands) April 28,

2012 April 30, 2011 (unaudited) (unaudited) Assets: Cash

and cash equivalents $ 63,964 $ 76,847 Short-term investment

securities 1,637 - Inventory 115,008 113,380 Prepaid and other

current assets 17,749 15,828 Property and equipment, net 85,622

91,175 Long-term investment securities 18,088 16,824 Other

noncurrent assets 3,022 3,132 Total

assets $ 305,090 $ 317,186 Liabilities and

Stockholders' Equity: Accounts payable $ 59,996 $ 58,988 Accrued

liabilities 24,628 23,370 Other current liabilities 1,975 6,223

Noncurrent liabilities 12,218 10,778

Total liabilities 98,817 99,359 Total stockholders' equity

206,273 217,827 Total liabilities and

stockholders' equity $ 305,090 $ 317,186

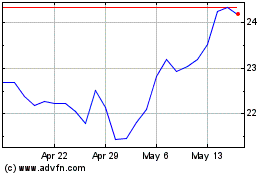

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

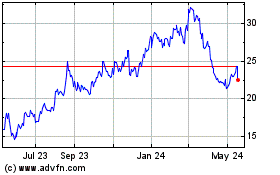

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024