Citi Trends, Inc. (CTRN) - Bull of the Day

06 July 2012 - 10:00AM

Zacks

We are upgrading our long-term recommendation on

Citi Trends,

Inc. (CTRN) to Outperform on the back of the company's

better-than-expected first-quarter 2012 results. After reporting a

loss in three consecutive quarters, Citi Trends posted positive

earnings of $0.69 per share.

Despite a 5% decline in comparable store sales, Citi Trends net

sales increased 4.5% from the prior-year quarter, beating the Zacks

Consensus Estimate. We believe Citi Trends effective cost-control

initiatives and inventory management has helped it to drive

growth.

Moreover, Citi Trends' extensive focus on store expansion

strategy will drive top-line growth in the future. Looking ahead,

the company has taken prudent steps to reduce inventory shrinkages,

which we believe will facilitate its operational performance.

CITI TRENDS INC (CTRN): Free Stock Analysis Report

To read this article on Zacks.com click here.

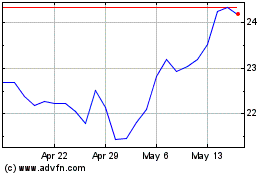

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

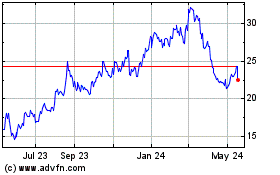

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024