Management Changes at Body Central - Analyst Blog

23 August 2012 - 3:30AM

Zacks

Body Central Corp.

(BODY) recently promoted Tom Stoltz to the position of the chief

operating officer (COO) as well as the interim chief executive

officer (CEO). Stoltz had been serving as the company’s executive

vice president, chief financial officer (CFO) and treasurer since

September 26, 2011. However, he will continue to operate as the CFO

of the company.

The shuffle in management follows

the retirement of Allen Weinstein from the position of president

and CEO, effective August 16, 2012. The company will now be

on the lookout for a permanent CEO.

In his new role, Tom Stoltz will be in charge of the company’s

regular operations as well as all financial issues including

corporate finance, financial planning and analysis, tax, treasury,

corporate facilities and information technology.

Stoltz has donned many important roles in his illustrious career.

He was the CFO at Fanatics, LLC from 2008 to 2011. Prior to that,

he held the same post at Cato Corp. (CATO),

Citi Trends Inc. (CTRN), and Factory Card Outlet.

Cato and Citi Trends are well-known retailers of urban fashion

apparel and accessories in the United States.

With his rich financial experience, Stoltz can easily be tagged as

an industry veteran in both specialty store and e-commerce

channels. A number of senior finance positions held at

Dollar General Corporation (DG), a discount

retailer of general merchandise in the southern, southwestern,

mid-western, and eastern United States, and Food Lion Inc. also

vouch for his expertise.

Management is hopeful that Stoltz’s vast know-how and expertise

regarding retail will add value to Body Central’s growth during his

tenure as the interim CEO. The Florida-based multi-channel

specialty retailer, selling quality apparel and accessories also

incorporated other managerial changes. It has appointed an industry

veteran, Robert Glass, as a member of the Board of Directors. The

company is also hiring a general merchandise manager to support its

merchandise division.

In the second quarter of 2012, Body Central’s net revenue grew

6.3%, while its net income dipped 35.8% year over year. The company

also slashed its guidance for the second half of 2012 reflecting a

tough retail environment.

In such a scenario, the role of an interim CEO will be crucial as

the company needs proper brand re-invigoration and sales strategies

to drive revenue and earnings. Also, the transition is still at its

early stage, keeping us cautious until there is further evidence of

successful execution.

Body Central currently retains a Zacks #5 Rank, which translates

into a short-term Strong Sell rating. We are maintaining our

long-term Underperform recommendation on the stock.

BODY CENTRAL CP (BODY): Free Stock Analysis Report

CATO CORP A (CATO): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

DOLLAR GENERAL (DG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

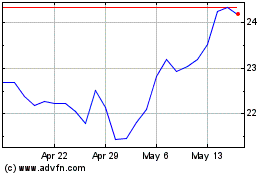

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

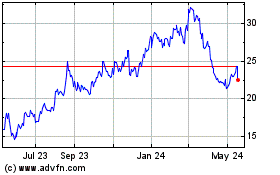

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024