Fourth quarter 2015 pretax income increased

15%

Fourth quarter 2015 net income per diluted

share of $0.24 compared with $0.31 last year

Full year net income per diluted share of

$1.03 compared with $0.60 last year

Citi Trends, Inc. (NASDAQ: CTRN) today reported results for the

fourth quarter and fiscal year ended January 30, 2016.

Financial Highlights – 13-week fourth

quarter ended January 30, 2016

Total sales in the 13 weeks ended January 30, 2016 decreased

2.8% to $176.1 million compared with $181.1 million in the 13 weeks

ended January 31, 2015. Comparable store sales decreased 5.0% in

the fourth quarter.

Net income was $3.5 million, or $0.24 per diluted share, in the

fourth quarter of 2015 compared with $4.7 million, or $0.31 per

diluted share, in last year’s fourth quarter. While net income

declined in the fourth quarter of 2015, pretax income increased 15%

to $6.0 million from $5.2 million in the fourth quarter of 2014.

The significant difference between the improvement in pretax income

and the decline in net income was attributable to an unusually low

effective income tax rate in 2014’s fourth quarter due to a benefit

from income tax credits.

Financial Highlights – 52-week fiscal

year ended January 30, 2016

Total sales in the 52 weeks ended January 30, 2016 increased

1.9% to $683.8 million compared with $670.8 million in the 52 weeks

ended January 31, 2015. Comparable store sales decreased 0.1% for

the full year.

Net income was $15.5 million, or $1.03 per diluted share, in

fiscal 2015 compared with $9.0 million, or $0.60 per diluted share,

in fiscal 2014.

The Company opened 13 stores, relocated or expanded 13 others,

and closed three stores in fiscal 2015.

As previously announced, the Board of Directors has declared a

quarterly dividend payment of $0.06 per share, which will be paid

on March 15, 2016 to stockholders of record as of March 1,

2016.

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is

(212) 231-2912. A replay of the conference call will be

available until March 18, 2016, by dialing (402) 977-9140 and

entering the passcode, 21803639.

The live broadcast of Citi Trends’ conference call will be

available online at the Company’s website, www.cititrends.com,

under the Investor Relations section, beginning today at 9:00 a.m.

ET. The online replay will follow shortly after the call and will

be available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company operates

526 stores located in 31 states. Citi Trends’ website address is

www.cititrends.com. CTRN-G

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding our future financial

results and position, business policy and plans and objectives of

management for future operations, are forward-looking statements

that are subject to material risks and uncertainties. The words

“believe,” “may,” “could,” “plans,” “estimate,” “continue,”

“anticipate,” “intend,” “expect” and similar expressions, as they

relate to Citi Trends, are intended to identify forward-looking

statements. Statements with respect to earnings guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s year-end financial and accounting procedures, are not

guarantees of future performance or results and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in Citi Trends,

Inc. filings with the Securities and Exchange Commission. These

risks and uncertainties include, but are not limited to,

uncertainties relating to economic conditions, growth risks,

consumer spending patterns, competition within the industry,

competition in our markets and the ability to anticipate and

respond to fashion trends. Any forward-looking statements by the

Company, with respect to earnings guidance, the declaration and

payment of dividends, the Company’s share repurchase program, or

otherwise, are intended to speak only as of the date such

statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, Citi

Trends does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise.

CITI TRENDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(in thousands, except per share data) Thirteen

Weeks Ended Thirteen Weeks Ended January 30, 2016

January 31, 2015 (unaudited) (unaudited) Net sales $ 176,063

$ 181,143 Cost of sales (exclusive of depreciation shown

separately below) (108,526 ) (113,567 ) Selling, general and

administrative expenses (57,087 ) (57,515 ) Depreciation

(4,555 ) (4,871 ) Income from operations 5,895 5,190

Interest income 117 52 Interest expense (41 ) (48 )

Income before income taxes 5,971 5,194 Income tax expense

(2,499 ) (521 ) Net income $ 3,472 $ 4,673

Basic net income per common share $ 0.24 $ 0.31

Diluted net income per common share $ 0.24 $ 0.31

Weighted average shares used to compute basic

net income per share 14,651 14,989

Weighted average shares used to compute diluted net income per

share 14,723 15,128

Fifty-Two Weeks Ended Fifty-Two Weeks

Ended January 30, 2016 January 31, 2015

(unaudited) (unaudited) Net sales $ 683,791 $ 670,840 Cost

of sales (exclusive of depreciation shown separately below)

(416,779 ) (418,416 ) Selling, general and administrative expenses

(224,218 ) (221,041 ) Depreciation (18,577 ) (20,177 ) Asset

impairment - (83 ) Income (loss) from

operations 24,217 11,123 Interest income 339 187 Interest expense

(242 ) (200 ) Income (loss) before income taxes

24,314 11,110 Income tax (expense) benefit (8,787 )

(2,144 ) Net income $ 15,527 $ 8,966 Basic net

income per common share $ 1.04 $ 0.60 Diluted net

income per common share $ 1.03 $ 0.60

Weighted average shares used to compute basic net income per share

14,996 14,961 Weighted average shares

used to compute diluted net income per share 15,056

15,020

CITI TRENDS,

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands) January 30, 2016 January 31,

2015 (unaudited) (unaudited) Assets: Cash and cash equivalents

$ 39,116 $ 74,514 Short-term investment securities 32,671 15,850

Inventory 137,020 131,057 Other current assets 18,321 19,936

Property and equipment, net 50,632 47,603 Long-term investment

securities 30,890 22,447 Other noncurrent assets 5,858

6,966 Total assets $ 314,508 $ 318,373

Liabilities and Stockholders’ Equity:

Accounts payable $ 67,419 $ 72,245 Accrued liabilities 27,742

29,172 Other current liabilities 497 585 Noncurrent liabilities

6,616 5,749 Total liabilities 102,274

107,751

Total stockholders’ equity

212,234 210,622

Total liabilities and stockholders’

equity

$ 314,508 $ 318,373

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160311005055/en/

Citi Trends, Inc.Bruce Smith, 912-443-2075Chief Operating

Officer and Chief Financial OfficerorJason Mazzola,

912-443-3990President and Chief Executive Officer

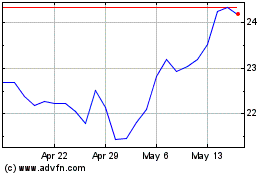

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

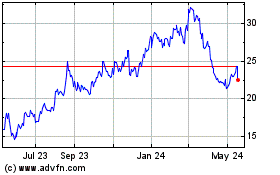

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024