UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C.

SCHEDULE

14A

(RULE

14a-101)

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to Rule 14a-12 |

Digital

Ally, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of filing fee: (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

14001

Marshall Drive

Lenexa,

Kansas 66215

Important

Notice Regarding the Availability of Proxy Materials

for

the Special Meeting of Stockholders to Be Held on August 23, 2024

The

Notice of Special Meeting and the Proxy Statement

are

available at:

https://www.digitalallyinc.com/investor-relations/

DIGITAL

ALLY, INC.

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON AUGUST 23, 2024

July

10, 2024

To

our Stockholders:

NOTICE

IS HEREBY GIVEN that a special meeting of stockholders (“Special Meeting”) of Digital Ally, Inc., a Nevada corporation (the

“Company,” “we,” “us,” or “our”), will be held on August 23, 2024 at 1:00 p.m.,

Eastern Time, at the Company’s offices at 14001 Marshall Drive, Lenexa, Kansas 66215 for the following purpose:

| 1. | To

approve the transactions contemplated by the securities purchase agreement, entered into

as of June 24, 2024, by and between the Company and investors, including, the issuance of

20% or more of our outstanding shares of common stock, par value $0.001 per share (the “Common

Stock”) upon (i) exercise of Series A Common Stock Purchase Warrant; and (ii) exercise

of Series B Common Stock Purchase Warrant, each dated June 25, 2024. |

The

foregoing proposal is more fully described in the proxy statement that is attached and made a part of this notice of Special Meeting

(the “Proxy Statement”). Only stockholders of record of shares of Common Stock at the close of business on July 17,

2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting or any adjournment thereof.

All

stockholders who are record or beneficial owners of shares of Common Stock as of the Record Date are cordially invited to attend the

Special Meeting in person. Your vote is important regardless of the number of shares of Common Stock that you own. When you arrive at

the Special Meeting, you must present photo identification, such as a driver’s license. Beneficial owners of shares of Common Stock

also must provide evidence of their holdings of such shares as of the Record Date, such as a recent brokerage account or bank statement.

Whether

or not you expect to attend the Special Meeting, it is important that your shares of Common Stock be represented and voted during the

Special Meeting. We urge you to promptly complete, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope

in order to ensure representation of your shares of Common Stock. It will help in our preparations for the Special Meeting if you would

check the box on the form of proxy if you plan on attending the Special Meeting. You may also vote by proxy (i) via the Internet or (ii)

by telephone using the instructions provided in the enclosed proxy card. Your proxy is revocable in accordance with the procedures set

forth in the Proxy Statement. Please be advised that if you are not a record or beneficial owner of shares of Common Stock on the Record

Date, you are not entitled to vote and any proxies received from persons who are not record or beneficial owners of shares of Common

Stock on the Record Date will be disregarded.

Thank

you for your ongoing support of, and continued interest in, Digital Ally.

| Sincerely,

|

|

| |

|

| |

|

| Stanton

E. Ross |

|

| Chief

Executive Officer and |

|

| Chairman

of the Board |

|

If

your shares are held in street name, you must request an admission ticket in advance by mailing a request, along with proof of your ownership

of shares of our common stock, par value $0.001 per share (“Common Stock”), as of the record date of July 17, 2024,

to Digital Ally, Inc., 14001 Marshall Drive, Lenexa, Kansas 66215, telephone (913) 814-7774 , Attention: Corporate Secretary. Proof

of ownership would be a copy of a brokerage statement or other documentation reflecting your stock ownership as of the record date. An

individual arriving without an admission ticket will not be admitted unless it can be verified that the individual was a Digital Ally

stockholder as of the record date.

Backpacks,

cameras, recording equipment and other electronic recording devices will not be permitted at the Special Meeting. Cell phones will be

permitted in the meeting venue but may not be used for any purpose at any time while in the meeting venue. Digital Ally reserves the

right to inspect any persons or items prior to their admission to the Special Meeting. Failure to follow the meeting rules or permit

inspection will be grounds for exclusion from the Special Meeting.

WHETHER

OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE PROMPTLY VOTE VIA INTERNET OR BY TELEPHONE, OR BY COMPLETING, SIGNING, DATING AND

RETURNING THE ENCLOSED PROXY CARD IN THE ACCOMPANYING ENVELOPE. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED

STATES.

Table

of Contents

Cautionary

Note Regarding Forward Looking Statements

Certain

statements in this Proxy Statement may be considered to be “forward-looking statements” as that term is defined in the U.S.

Private Securities Litigation Reform Act of 1995. In particular, these forward-looking statements include, among others, statements about,

opportunities for and growth of our business, our plans regarding product development and enhancements, and our expectations regarding

profitability. The words “believe,” “may,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “could,” “target,” “potential,” “is

likely,” “expect,” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking

statements speak only as of the date of this Proxy Statement. We assume no obligation to, and do not necessarily intend to, update these

forward-looking statements.

DIGITAL

ALLY, INC.

PROXY

STATEMENT

FOR

A SPECIAL MEETING OF STOCKHOLDERS

INFORMATION

CONCERNING SOLICITATION AND VOTING

General

The

enclosed proxy is solicited on behalf of the Board of Directors of Digital Ally, Inc., a Nevada corporation, (referred to in this Proxy

Statement as “Digital Ally,” “we,” “our,” “us,” or the “Company”) in connection

with the solicitation of proxies by our Board of Directors (the “Board” or “Board of Directors”) for use at a

Special Meeting of Stockholders (the “Special Meeting”) to be held on Friday, August 23, 2024 at 1:00 p.m.,

ET, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying notice of Special Meeting

of Stockholders. The Special Meeting will be held at our corporate facility, located at 14001 Marshall Drive, Lenexa, Kansas, 66215.

The telephone number at that location is (913) 814-7774.

Voting

materials, which include this Proxy Statement and the enclosed proxy card, will be first mailed to stockholders on or about July,

2024.

Stanton

E. Ross is named as attorney-in-fact in the proxy. Mr. Ross is our Chairman of the Board, and Chief Executive Officer. Mr. Ross will

vote all shares represented by properly executed proxies returned in time to be counted at the Special Meeting, as described below. Where

a vote has been specified in the proxy with respect to the matters identified in the Notice of the Special Meeting, the shares represented

by the proxy will be voted in accordance with those voting specifications. If no voting instructions are indicated, your shares will

be voted as recommended by the Board of Directors on all matters, and as the proxy holder may determine in his discretion with respect

to any other matters properly presented for a vote before the Special Meeting.

The

stockholders will consider and vote upon a proposal to approve the transactions contemplated by the securities purchase agreement, entered

into as of June 24, 2024, by and between the Company and investors, including, the issuance of 20% or more of our outstanding shares

of common stock, par value $0.001 per share (the “Common Stock”) upon (i) exercise of Series A Common Stock Purchase Warrant;

and (ii) exercise of Series B Common Stock Purchase Warrant, each dated June 25, 2024.

Who

is Entitled to Vote?

Our

Board of Directors has fixed the close of business on July 17, 2024 as the record date (the “Record Date”) for a determination

of stockholders entitled to notice of, and to vote at, the Special Meeting. On the Record Date, [●] shares of our common stock,

par value $0.001 per share (the “Common Stock”) were issued and outstanding, all of which are voting stock.

Voting

Holders

of Common Stock are entitled to one vote for each share of Common Stock held by them. There are no cumulative voting rights.

What

is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner?

If

your shares are registered in your name with our transfer agent, Securities Transfer Corporation, you are the “record holder”

of those shares. If you are a record holder, we will provide these proxy materials directly to you.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares held in “street name.” If your shares are held in street name, these proxy materials will be forwarded to

you by that organization. As the beneficial owner, you have the right to instruct such organization on how to vote your shares.

Who

May Attend the Meeting?

Record

holders and beneficial owners may attend the Special Meeting. If your shares are held in street name, you will need to bring a copy of

a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

How

Do I Vote?

Whether

you hold shares as a stockholder of record or as a beneficial owner, you may vote before the Special Meeting by granting a proxy or,

for shares held in street name, by submitting voting instructions to your bank, broker or nominee. Please refer to the instructions below.

Record

Holder

If

you are a stockholder of record who owns shares directly in your name, you may vote your shares in one of the following ways:

|

|

By

telephone. You may vote your shares by calling 1-800-690-6903. |

| |

|

|

|

|

Over

the Internet. Go to www.proxyvote.com. You will need to have your Control Number available when you access the website. Your Control

Number is on the Notice or proxy card that you received in the mail. |

| |

|

|

|

|

By

mail. If you received printed proxy materials, you may submit your vote by completing, signing and dating each proxy card received

and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Be sure to return your proxy card

in time to be received and counted before the Special Meeting. |

| |

|

|

|

|

During

the Special Meeting. You may vote your shares in person at the Special Meeting. Even if you plan to attend the Special Meeting in

person, we recommend that you also submit your proxy card or voting instructions, vote by telephone or via the Internet by the applicable

deadline so that your vote will be counted if you later decide not to virtually attend the meeting. |

If

you vote by telephone or via the Internet at www.proxyvote.com, you must vote no later than 11:59 p.m. ET on August 22, 2024.

You do not need to return a proxy card by mail. Voting electronically or by telephone is convenient, reduces the use of natural resources

and saves significant postage and processing costs. Your vote is also recorded immediately and there is no risk that postal delays could

cause your vote to arrive late and therefore not be counted.

Beneficial

Owner (Holding Shares in Street Name)

If

you are a beneficial owner who owns shares indirectly through a bank, broker or other nominee, you should follow the instructions in

the Notice or voting instructions that you receive from the broker or other nominee holding your shares. The availability of telephone

and Internet voting will depend on the voting process of your broker or nominee. Shares held beneficially may be voted at the Special

Meeting only if you provide a legal proxy from your broker or nominee giving you the right to vote the shares.

Is

My Vote Confidential?

Yes,

your vote is confidential. Only the following persons have access to your vote: election inspectors, individuals who help with processing

and counting your votes and persons who need access for legal reasons. If you write comments on your proxy card, your comments will be

provided to the Company, but how you vote will remain confidential.

What

Constitutes a Quorum?

We

must have a quorum to carry on the business of the Special Meeting. Our Bylaws (the “Bylaws”) provide that the presence,

in person or by proxy duly authorized, of the holders of a majority of the outstanding shares of stock entitled to vote shall constitute

a quorum for the transaction of business at the Special Meeting or any adjournment thereof. Broker non-votes (see definition below) and

abstentions are not counted as present to determine the existence of a quorum. The broker non-votes are not counted because there are

no routine matters presented at the Special Meeting.

The

stockholders present at a duly called or convened meeting at which a quorum is present may continue to transact business until adjournment,

notwithstanding the withdrawal of enough stockholders to leave less than a quorum. In the absence of a quorum at the Special Meeting

or any adjournment thereof, a majority in voting interest of those present in person or by proxy and entitled to vote, or any officer

entitled to preside at, or to act as secretary of, the Special Meeting may adjourn the Special Meeting until stockholders holding the

amount of stock requisite for a quorum are present in person or by proxy.

What

is a Broker Non-Vote?

If

your shares are held in “street name,” you must instruct your bank, broker or other nominee as to how to vote your shares

by following the instructions that the broker or other nominee provides to you. Brokers usually offer the ability for stockholders to

submit voting instructions by mail by completing a vote instruction form, by telephone or over the Internet. If you do not provide voting

instructions to your bank, broker or other nominee, your shares will not be voted on any proposal on which your broker or other nominee

does not have discretionary authority to vote, namely, “non-routine” matters. This is called a “broker non-vote.”

On the other hand, if you do not provide voting instructions to your bank, broker or other nominee, such party has the discretion to

vote your shares on “routine” matters.

Which

Proposals are Considered “Routine” or “Non-Routine” for Brokers or Other Nominees?

The

following Proposal is “non-routine” and thus a broker discretionary vote is not allowed:

Proposal

1, “To approve the transactions contemplated by the securities purchase agreement, entered into as of June 24, 2024, by and between

the Company and investors, including, the issuance of 20% or more of our outstanding shares of Common Stock upon (i) exercise of Series

A Common Stock Purchase Warrant; and (ii) exercise of Series B Common Stock Purchase Warrant, each dated June 25, 2024.”

How

Many Votes are Needed for Each Proposal to Pass and is Broker Discretionary Voting Allowed?

For

matters at the Special Meeting, if a quorum is present, the following votes will be required for the Proposal to pass:

| |

Proposal |

|

Vote Required |

|

Broker

Discretionary Vote

Allowed |

| 1. |

Approve the Issuance of 20% or more of the Company’s Outstanding Shares of Common Stock |

|

The affirmative vote of the holders of a majority of the votes cast. |

|

No |

How

are Abstentions Treated?

An

abstention occurs when a stockholder attends a meeting, either in person or by proxy, but specifically indicates an abstention from voting

on one or more of the proposals. If you vote by Internet or telephone, or submit a proxy card or provide proxy instructions to your broker

or other nominee, and affirmatively elect to abstain from voting, your proxy will be counted as present for the purpose of determining

the presence of a quorum for the meeting, but will not be voted at the Special Meeting. Abstentions only have an effect on the outcome

of any matter being voted on that requires a certain level of approval based on our total voting stock outstanding. Thus, abstentions

by holders of Common Stock will have no effect on any of the proposals.

What

Are the Voting Procedures?

In

voting by proxy on the proposal, you may vote for the proposal or against the proposal, or you may abstain from voting on the proposal.

You should specify your respective choices as discussed in the section “How Do I Vote?” on page 1.

Is

My Proxy Revocable?

You

may revoke your proxy and reclaim your right to vote up to and including on the day of the Special Meeting by giving written notice to

the Corporate Secretary of Digital Ally or by voting in person at the Special Meeting. If you provide more than one proxy, the proxy

having the latest date will revoke any earlier proxy. All written notices of revocation and other communications with respect to revocations

of proxies should be addressed to: Digital Ally, Inc., 14001 Marshall Drive, Lenexa, Kansas 66215, telephone (913) 814-7774, Attention:

Corporate Secretary.

Who

is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

We

will pay all the expenses involved in preparing, assembling, and mailing these proxy materials and all costs of soliciting proxies. In

addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons

will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses

and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record

by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing.

What

is “Householding” and How Does It Affect Me?

Record

holders who have the same address and last name will receive only one copy of the Special Meeting materials, unless we are notified that

one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and

postage fees.

If

you are eligible for householding, but you and other record holders with whom you share an address receive multiple copies of the Special

Meeting materials, or if you hold Digital Ally stock in more than one account, and in either case you wish to receive only a single copy

of each of these documents for your household, please contact our transfer agent, Securities Transfer Corporation, in writing: [Mr. Matthew

Smith, Securities Transfer Corporation, 2901 N. Dallas Parkway, Suite 380, Plano, TX 75093; or by telephone: (469) 633-0101; or by facsimile:

(469) 633-0088 ].

If

you participate in householding and wish to receive a separate copy of the Special Meeting materials, or if you do not wish to continue

to participate in householding and prefer to receive separate copies in the future, please contact Securities Transfer Corporation as

indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do

I Have Dissenters’ (Appraisal) Rights?

Appraisal

rights are not available to Digital Ally stockholders with any of the proposals described above to be brought before the Special Meeting.

Stockholder

List

The

stockholder list as of the Record Date will be available for examination by any stockholder at our corporate office, 14001 Marshall Drive,

Lenexa, Kansas 66215, beginning August 12, 2024, which is at least ten (10) business days prior to the date of the Special Meeting

and the stockholder list will be available at the Special Meeting.

Our

Voting Recommendations

Our

Board of Directors recommends that you vote:

| |

● |

FOR

the approval of the transactions contemplated by the securities purchase agreement, entered into as of June 24, 2024, by and

between the Company and investors, including, the issuance of 20% or more of our outstanding shares of Common Stock upon (i) exercise

of Series A Common Stock Purchase Warrant; and (ii) exercise of Series B Common Stock Purchase Warrant, each dated June 25, 2024.

|

Voting

Results

The

preliminary voting results will be announced at the Special Meeting. The final voting results will be calculated by our Inspector of

Elections and published in our Current Report on Form 8-K, which will be filed with the SEC within four (4) business days of the Special

Meeting.

Other

Matters

Other

than the proposals listed above, our Board of Directors does not intend to present any other matters to be voted on at the Special Meeting.

Our Board of Directors is not currently aware of any other matters that will be presented by others for action at the Special Meeting.

However, if other matters are properly presented at the Special Meeting and you have signed and returned your proxy card, the proxy holders

will have discretion to vote your shares on these matters to the extent authorized under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”).

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 23, 2024:

Copies

of our notice of Special Meeting and Proxy Statement are available online at www.digitalallyinc.com.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of July 9, 2024, information regarding beneficial ownership of our Common Stock for:

| ● | each

person, or group of affiliated persons, known by us to beneficially own more than 5% of our

Common Stock; |

| ● | each

of our executive officers; |

| ● | each

of our directors; and |

| ● | all

of our current executive officers and directors as a group. |

Beneficial

ownership is determined according to the rules of the United States Securities and Exchange Commission (the “SEC”) and generally

means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that

security, including securities that are currently exercisable or exercisable within sixty (60) days of July 9, 2024. Except as indicated

by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting

and investment power with respect to all shares of Common Stock shown that they beneficially own, subject to community property laws

where applicable.

Common

Stock subject to securities currently exercisable or exercisable within sixty (60) days of July 9, 2024 are deemed to be outstanding

for computing the percentage ownership of the person holding such securities and the percentage ownership of any group of which the holder

is a member but are not deemed outstanding for computing the percentage of any other person.

Unless

otherwise indicated, the address of each beneficial owner listed in the table below is c/o Digital Ally, Inc., 14001 Marshall Drive.,

Lenexa, KS 66215.

| | |

Number of Shares of Common Stock Beneficially Owned (1)

| | |

% of Total | |

| | |

Shares | | |

% | | |

Voting Power | |

| 5% or Greater Stockholders: | |

| | | |

| | | |

| | |

| None | |

| — | | |

| — | | |

| — | |

| Executive Officers and Directors: | |

| | | |

| | | |

| | |

| Stanton E.

Ross(2) | |

| 136,065 | | |

| 3.3 | % | |

| 3.3 | % |

| Leroy C. Richie(3) | |

| 18,211 | | |

| * | | |

| * | |

| D. Duke Daughtery | |

| 1,405 | | |

| * | | |

| * | |

| Thomas J. Heckman(4) | |

| 120,513 | | |

| 3.0 | % | |

| 3.0 | % |

| Peng Han(5) | |

| 28,781 | | |

| * | | |

| * | |

| | |

| | | |

| | | |

| | |

| All executive officers and directors as a group (five individuals) | |

| 337,848 | | |

| 8.3 | % | |

| 8.3 | % |

*

Represents less than 1%.

| (1) | Based

on 4,075,045 shares of Common Stock issued and outstanding as of July 9, 2024 and, with respect

only to the ownership by all executive officers and directors as a group. |

| (2) | Mr.

Ross’s total shares of Common Stock include 28,750 restricted shares that are subject

to forfeiture to us. |

| (3) | Mr.

Richie’s total shares of Common Stock include 16,250 shares of Common Stock to be received

upon the exercise of vested options. |

| (4) | Mr.

Heckman’s total shares of Common Stock include 66,946 shares of Common Stock held in

the Company’s 401(k) Plan (on December 31, 2023) as to which Mr. Heckman has voting

power as trustee of the 401(k) Plan. |

| | (5) | Mr.

Han’s total shares of Common Stock include (i) 22,000 restricted shares that are subject

to forfeiture to us and (ii) 331 shares of Common Stock to be received upon the exercise

of vested options. |

PROPOSAL

ONE

APPROVAL

OF THE NASDAQ PROPOSAL

Summary

The

purpose of this Proposal is to approve, pursuant to The Nasdaq Stock Market LLC Rule 5635(d), the issuance of 20% or more of the Company’s

outstanding shares of Common Stock in connection with the transactions contemplated by the Securities Purchase Agreement (as defined

below), including, without limitation, the issuance of shares of exercise of Series A Warrants (as defined below) and Series B Warrants

(as defined below) issued to the Purchasers (as defined below).

Background

Private

Placement

On

June 24, 2024, the “Company entered into a private placement transaction (the “Private Placement”), pursuant to a Securities

Purchase Agreement (the “Securities Purchase Agreement”) with certain institutional investors (the “Purchasers”)

for aggregate gross proceeds of approximately $2.9 million, before deducting fees to the placement agent and other expenses payable by

the Company in connection with the Private Placement. The Company intends to use the net proceeds from the Private Placement for inventory

purchases, artist costs for upcoming festivals, transaction cost, expanded sales, marketing, partial prepayment of an outstanding note

and general working capital.

As

part of the Private Placement, the Company issued an aggregate of 1,195,219 units and pre-funded units (collectively, the “Units”)

at a purchase price of $2.51 per unit (less $0.0001 per pre-funded unit). Each Unit consists of (i) one share of Common Stock (or one

pre-funded warrant to purchase one share of Common Stock (the “Pre-Funded Warrants”)), (ii) one Series A warrant to purchase

one share of Common Stock (the “Series A Warrant”) and (iii) one Series B warrant to purchase such number of shares of Common

Stock as will be determined on the Reset Date (as defined below) and in accordance with the terms therein (the “Series B Warrant”,

and together with the Series A Warrant, the “Warrants”).

The

Pre-Funded Warrants are immediately exercisable at an exercise price of $0.0001 per share of Common Stock and will not expire until exercised

in full. The Series A Warrants will be exercisable at any time or times on or after the date Stockholder Approval (as defined below)

is obtained, have an initial exercise price of $2.51 per share of Common Stock and a term of 5 years after the later of (a) the date

that the Company obtains the Stockholder Approval and (b) the earlier of (i) the Resale Effective Date (as defined below) registering

all of the Registerable Securities or (ii) the date that the Registrable Securities (as defined below) can be sold, assigned or transferred

without restriction or limitation pursuant to Rule 144 or Rule 144A promulgated under the Securities Act of 1933 (the “Securities

Act”), as amended, (or a successor rule thereto). The Series B Warrants will be exercisable at any time or times on or after the

date Stockholder Approval is obtained, have an initial exercise price of $0.001 per share of Common Stock and will not expire until exercised

in full. The number of shares of Common Stock issuable under the Series B Warrants will be determined following the earliest to occur

of: (i) the date on which a resale registration statement covering the resale of all Registrable Securities has been declared effective

for 20 consecutive trading days, (ii) the date on which the Purchasers may sell the Registrable Securities pursuant to Rule 144 under

the Securities Act for a period of 20 consecutive trading days, and (iii) twelve months and 20 days following the issuance date of the

Series B Warrants (the “Reset Date”), in each case, pursuant to the lowest daily weighted average trading price of the shares

of Common Stock during a period of 20 trading days, subject to a pricing floor of $0.502 per share of Common Stock (the “Floor

Price”), such that, assuming the Floor Price, the maximum number of shares of Common Stock underlying the Series A Warrants and

Series B Warrants would be an aggregate of approximately 5,976,095 shares and 4,780,877 shares, respectively. The Company has undertaken

to file a resale registration statement covering all of the Registrable Securities on behalf the Purchasers pursuant to a registration

rights agreement, also entered into with the Purchasers in connection with the Private Placement. Pursuant to the Registration Rights

Agreement, the Company shall file the resale registration statement within twenty (20) trading days after the closing of the Private

Placement, and the resale registration statement shall be effective within thirty (30) calendar days following the filing date (or, in

the event of a full review by the SEC, fifty (50) calendar days

following the filing date).

The

exercise price and number of shares of Common Stock issuable upon exercise of the Series A Warrants are subject to adjustment upon future

dilutive issuances and stock combination events. Whenever on or after the subscription date, as long as the Series A Warrant is outstanding,

the Company issues or sells any Common Stock for a consideration per share (the “New Issuance Price”) less than a price equal

to the exercise price in effect immediately prior to such issue or sale or deemed issuance or sale (the foregoing a “Dilutive Issuance”),

then immediately after such Dilutive Issuance, the exercise price then in effect shall be reduced to an amount equal to the lower of

(a) the New Issuance Price or (b) the lowest weighted average price during the 5 consecutive trading day period commencing on the date

of the Dilutive Issuance (such lower price, the “Base Share Price”), and the number of shares of Common Stock issuable upon

exercise of the Series A Warrant shall be proportionately adjusted such that the aggregate exercise price of the Series A Warrant on

the issuance date for the warrant shares then outstanding shall remain unchanged; provided that the Base Share Price shall not be less

than the Floor Price. In addition to the adjustments set forth above, if at any time on or after the issuance date there occurs any share

split, reverse share split, share dividend, share combination recapitalization or other similar transaction involving the Common Stock

(each, a “Share Combination Event”, and such date on which the Share Combination Event is effected, the “Share Combination

Event Date”) and the lowest weighted average price of the Common Stock during the period commencing on the trading day immediately

following the applicable Share Combination Event Date and ending on the fifth (5th) trading day immediately following the applicable

Share Combination Event Date (the “Event Market Price”) (provided if the Share Combination Event is effective prior to the

opening of trading on the principal market, then, commencing on the Share Combination Event Date and ending on the fourth (4th) trading

day immediately following the applicable Share Combination Event Date (such period, the “Share Combination Adjustment Period”))

is less than the exercise price then in effect, then, at the close of trading on the principal market on the last day of the Share Combination

Adjustment Period, the exercise price then in effect on such 5th trading day shall be reduced (but in no event increased) to the Event

Market Price and the number of warrant shares issuable upon exercise of the Series A Warrant shall be increased such that the aggregate

exercise price payable thereunder, after taking into account the decrease in the exercise price, shall be equal to the aggregate exercise

price on the issuance date for the warrant shares then outstanding; provided, however, that in no event shall the event market price

be lower than the Floor Price.

The

Series A Warrant also includes a reset feature, where, on the Reset Date, the exercise price shall be adjusted to equal the lower of

(i) the exercise price then in effect and (ii) the Reset Price (as defined below) determined as of the date of determination. Upon such

reset of the exercise price pursuant to the Series A Warrant, the number of warrant shares issuable upon exercise of the Series A Warrant

shall be increased such that the aggregate exercise price payable thereunder, after taking into account the decrease in the exercise

price, shall be equal to the aggregate exercise price on the issuance date for the warrant shares then outstanding.

Pursuant

to the Securities Purchase Agreement, the Company shall hold a special meeting of stockholders at the earliest practicable date after

the date of the Securities Purchase Agreement, but in no event later than sixty (60) days after the closing date of the Private Placement

for the purpose of obtaining Stockholder Approval (the “Stockholder Approval”), and the Company shall solicit proxies from

its stockholders in connection therewith in the same manner as all other management proposals in such proxy statement and all management-appointed

proxyholders shall vote their proxies in favor of such proposal. Within ten (10) business days following the closing date of the Private

Placement, the Company shall file with the SEC this Proxy Statement to request for the purpose of obtaining Stockholder Approval. From

the date of the Securities Purchase Agreement until six (6) months from the Release Date (as defined below), the Company and its subsidiaries

shall be prohibited from effecting or entering into an agreement to effect any issuance by the Company or any of its subsidiaries of

shares of Common Stock or Common Stock Equivalents (as defined below) (or a combination of units thereof) involving a Variable Rate Transaction

(as defined below).

As

defined in the Series A Warrants, each of the terms have the following meaning:

“Resale

Effective Date” means the earliest of the date that (a) the initial registration statement registering for resale the Registerable

Securities has been declared effective by the SEC, (b) all of the Registerable Securities have been sold pursuant to Rule 144 or may

be sold pursuant to Rule 144 without the requirement for the Company to be in compliance with the current public information required

under Rule 144 and without volume or manner-of-sale restrictions, (c) following the one year anniversary of the closing of the Private

Placement provided that a holder of Registerable Securities is not an affiliate of the Company, or (d) all of the Registerable Securities

may be sold pursuant to an exemption from registration under Section 4(a)(1) of the Securities Act without volume or manner-of-sale restrictions

and Company counsel has delivered to such holders a standing written unqualified opinion that resales may then be made by such holders

of the Registerable Securities pursuant to such exemption which opinion shall be in form and substance reasonably acceptable to such

holders.

“Reset

Period” means the period commencing on the twentieth (20th) Trading Day immediately preceding the Reset Date and ending on

the Reset Date.

“Reset

Price” means the greater of (i) the lowest single day weighted average price of the Common Stock during the Reset Period and

(ii) the Floor Price (as adjusted for stock splits, stock dividends, recapitalizations, reorganizations, reclassification, combinations,

reverse stock splits or other similar events occurring after the subscription date).

As

defined in the Securities Purchase Agreement, each of the terms have the following meaning:

“Common

Stock Equivalents” means any securities of the Company which would entitle the holder thereof to acquire at any time Common

Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Release

Date” means the later of (x) the earlier of (i) the Resale Effective Date registering all of the securities or (ii) the date

that the securities can be sold, assigned or transferred without restriction or limitation pursuant to Rule 144 or Rule 144A promulgated

under the Securities Act and (y) the date that the Company obtains the Stockholder Approval or a board approval in lieu of Stockholder

Approval to effect the purposes of the Stockholder Approval.

“Variable

Rate Transaction” means a transaction in which the Company (i) issues or sells any shares of Common Stock or Common Stock Equivalents

either (A) at a conversion price, exercise price or exchange rate or other price that is based upon, and/or varies with, the trading

prices of or quotations for the shares of Common Stock at any time after the initial issuance of such debt or equity securities or (B)

with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such debt

or equity security or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company

or the market for the Common Stock, other than in connection with customary anti-dilution adjustments resulting from future stock splits,

stock dividends or similar transactions, or (ii) issues or sells any amortizing convertible security that amortizes prior to its maturity

date, whereby it is required to or has the option to (or the investor in such security has the option to require the Company to) make

such amortization payments in Common Stock (whether or not such payments in stock are subject to certain equity conditions) or (iii)

enters into, or effects a transaction under, any agreement, including, but not limited to, an equity line of credit or “at-the-market”

offering, whereby it may sell securities at a future determined price, regardless of whether Shares pursuant to such agreement have actually

been issued and regardless of whether such agreement is subsequently canceled, provided that any issuance of shares upon the exercise

of the Common Warrants issuable hereunder will not be deemed a Variable Rate Transaction.

As

defined in the Registration Rights Agreement, the following term has the following meaning:

“Registrable

Securities” means, as of any date of determination, (a) all Common Stock, (b) all warrant shares then issued and issuable upon

exercise of the Warrants and Pre-Funded Warrants (assuming on such date the Warrants and Pre-Funded Warrants are exercised in full without

regard to any exercise limitations therein), and (c) any securities issued or then issuable upon any stock split, dividend or other distribution,

recapitalization or similar event with respect to the foregoing; provided, however, that any such Registrable Securities shall cease

to be Registrable Securities (and the Company shall not be required to maintain the effectiveness of any, or file another, registration

statement with respect thereto) for so long as (a) a registration statement with respect to the sale of such Registrable Securities is

declared effective by the SEC under the Securities Act and such Registrable Securities have been disposed of by the Purchaser in accordance

with such effective registration statement, (b) such Registrable Securities have been previously sold in accordance with Rule 144, or

(c) such securities become eligible for resale and without the requirement for the Company to be in compliance with the current public

information requirement under Rule 144 (if such requirement is applicable) as set forth in a written opinion letter to such effect, addressed,

delivered and acceptable to the transfer agent of the Company and the affected Purchasers (assuming that such securities and any securities

issuable upon exercise, conversion or exchange of which, or as a dividend upon which, such securities were issued or are issuable, were

at no time held by any affiliate of the Company, as reasonably determined by the Company, upon the advice of counsel to the Company.

Effect

of Issuance of Additional Securities

The

issuance of the securities described in this Proposal would result in the issuance of over 20% of the Company’s outstanding shares

of Common Stock on a pre-transaction basis. As such, for so long as the Purchasers beneficially own a significant amount of shares of

our Common Stock, they could significantly influence future Company decisions. Our stockholders will incur dilution of their percentage

ownership to the extent that the Purchasers fully exercise the Warrants. Further, because of the possibility that the exercise price

of the Warrants may be further adjusted to a lower amount, stockholders may experience an even greater dilutive effect. Stockholder approval

of Proposal No. 1 will apply to all issuances of Common Stock pursuant to the Warrants, including such potential issuance of additional

shares.

Nasdaq

Marketplace Requirements and the Necessity of Stockholder Approval

The

Common Stock is currently listed on The Nasdaq Capital Market and, as such, the Company is subject to the Nasdaq rules. Nasdaq Marketplace

Rule 5635(d) requires the Company to obtain stockholder approval prior to the issuance of shares of Common Stock in connection with certain

non-public offerings involving the sale, issuance or potential issuance by the Company of shares of Common Stock (and/or securities convertible

into or exercisable for shares of Common Stock) equal to 20% or more of the shares of Common Stock outstanding prior to such issuance

where the price of the Common Stock to be issued is below the “Minimum Price.” “Minimum Price” means a price

that is the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding

agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days

immediately preceding the signing of the binding agreement. Shares of Common Stock issuable upon the exercise or conversion of warrants,

options, debt instruments, preferred stock or other equity securities issued or granted in such non-public offerings will be considered

shares issued in such a transaction in determining whether the 20% limit has been reached, except in certain circumstances such as issuing

warrants that are not exercisable for a minimum of six months and have an exercise price that exceeds market value. The Company believes

that the transactions contemplated by the transaction documents in connection with the Securities Purchase Agreement, including full

issuance of shares of Common Stock upon the exercise of the Warrants into shares of Common Stock, may require stockholder approval.

If

our stockholders do not approve this Proposal, (i) the Warrants will not be fully exercisable in a manner that complies with Nasdaq Marketplace

Rule 5635(d).

Additional

Information

This

summary is intended to provide you with basic information concerning the Securities Purchase Agreement and the Warrants. The full text

of the Securities Purchase Agreement and the form of Warrants were filed as exhibits to our Current Report on Form 8-K filed with the

SEC on June 28, 2024.

Vote

Required and Recommendation

The

affirmative vote of the holders of a majority of the votes cast will be required to approve the Nasdaq Proposal.

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE TO APPROVE THE NASDAQ PROPOSAL.

FUTURE

STOCKHOLDER PROPOSALS

The

Board has not yet determined the date on which the next Annual Meeting of Stockholders will be held. Stockholders may submit proposals

on matters appropriate for stockholder action at annual meetings in accordance with the rules and regulations adopted by the SEC.

Any proposal which an eligible stockholder desires to have included in our proxy statement and presented at the next Annual Meeting of

Stockholders will be included in our proxy statement and related proxy card if it is received by us a reasonable time before we begin

to print and send our proxy materials and if it complies with SEC rules regarding inclusion of proposals in proxy statements. In

order to avoid controversy as to the date on which we receive a proposal, it is suggested that any stockholder who wishes to submit a

proposal submit such proposal by certified mail, return receipt requested.

Other

deadlines apply to the submission of stockholder proposals for the next Annual Meeting of Stockholders that are not required to be included

in our proxy statement under SEC rules. With respect to these stockholder proposals for the next Annual Meeting of Stockholders, a stockholder’s

notice must be received by us a reasonable time before we begin to print and send our proxy materials. The form of proxy distributed

by the Board for such meeting will confer discretionary authority to vote on any such proposal not received by such date. If any such

proposal is received by such date, the proxy statement for the meeting will provide advice on the nature of the matter and how we intend

to exercise our discretion to vote on each such matter if it is presented at that meeting.

OTHER

MATTERS

The

Board of Directors knows of no other items that are likely to be brought before the Special Meeting except those that are set forth in

the foregoing notice of Special Meeting. However, if any other matter is properly presented at the Special Meeting, it is the intention

of the persons named in the enclosed proxy to vote the shares they represent as the Board of Directors may recommend.

| |

BY

ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

| _________________,

2024 |

Stanton E. Ross

Chairman

of the Board and Chief Executive |

| Lenexa,

Kansas |

Officer |

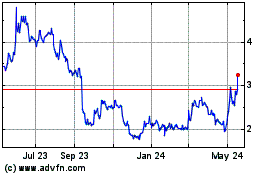

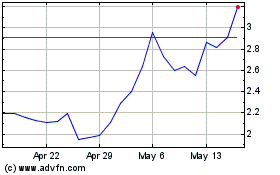

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Jul 2023 to Jul 2024