00009091082024FYfalse368,996,6757,000,0007,000,0002,670,4692,823,0762,670,4692,823,076173,120211,5751,000,0001,000,000006.006.0010.000011,000,0000000http://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNetiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesdhil:paymentxbrli:pureutr:sqft00009091082024-01-012024-12-3100009091082024-06-3000009091082025-02-2600009091082024-12-3100009091082023-12-310000909108dhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:MutualFundAdministrativeServicesMember2022-01-012022-12-3100009091082023-01-012023-12-3100009091082022-01-012022-12-310000909108us-gaap:CommonStockMember2021-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2021-12-310000909108us-gaap:RetainedEarningsMember2021-12-3100009091082021-12-310000909108us-gaap:CommonStockMember2022-01-012022-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2022-01-012022-12-310000909108us-gaap:RetainedEarningsMember2022-01-012022-12-310000909108us-gaap:CommonStockMember2022-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2022-12-310000909108us-gaap:RetainedEarningsMember2022-12-3100009091082022-12-310000909108us-gaap:CommonStockMember2023-01-012023-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2023-01-012023-12-310000909108us-gaap:RetainedEarningsMember2023-01-012023-12-310000909108us-gaap:CommonStockMember2023-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2023-12-310000909108us-gaap:RetainedEarningsMember2023-12-310000909108us-gaap:CommonStockMember2024-01-012024-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2024-01-012024-12-310000909108us-gaap:RetainedEarningsMember2024-01-012024-12-310000909108us-gaap:CommonStockMember2024-12-310000909108us-gaap:DeferredCompensationShareBasedPaymentsMember2024-12-310000909108us-gaap:RetainedEarningsMember2024-12-310000909108us-gaap:DemandDepositsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000909108us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000909108us-gaap:DemandDepositsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000909108us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000909108us-gaap:RelatedPartyMember2024-12-310000909108us-gaap:RelatedPartyMember2023-12-310000909108us-gaap:FurnitureAndFixturesMember2024-12-310000909108us-gaap:FurnitureAndFixturesMember2023-12-310000909108us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000909108us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310000909108us-gaap:ConstructionInProgressMember2024-12-310000909108us-gaap:ConstructionInProgressMember2023-12-310000909108srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000909108srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000909108dhil:ProprietaryFundsMemberdhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:ProprietaryFundsMemberdhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:ProprietaryFundsMember2024-01-012024-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMember2024-01-012024-12-310000909108dhil:OtherPooledVehiclesMemberdhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:OtherPooledVehiclesMemberdhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:OtherPooledVehiclesMember2024-01-012024-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:CollectiveInvestmentTrustsMember2024-01-012024-12-310000909108dhil:ModelDeliveryMemberdhil:InvestmentAdvisoryServicesMember2024-01-012024-12-310000909108dhil:ModelDeliveryMemberdhil:MutualFundAdministrativeServicesMember2024-01-012024-12-310000909108dhil:ModelDeliveryMember2024-01-012024-12-310000909108dhil:ProprietaryFundsMemberdhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:ProprietaryFundsMemberdhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:ProprietaryFundsMember2023-01-012023-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMember2023-01-012023-12-310000909108dhil:OtherPooledVehiclesMemberdhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:OtherPooledVehiclesMemberdhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:OtherPooledVehiclesMember2023-01-012023-12-310000909108dhil:ModelDeliveryMemberdhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:ModelDeliveryMemberdhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:ModelDeliveryMember2023-01-012023-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:InvestmentAdvisoryServicesMember2023-01-012023-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:MutualFundAdministrativeServicesMember2023-01-012023-12-310000909108dhil:CollectiveInvestmentTrustsMember2023-01-012023-12-310000909108dhil:ProprietaryFundsMemberdhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:ProprietaryFundsMemberdhil:MutualFundAdministrativeServicesMember2022-01-012022-12-310000909108dhil:ProprietaryFundsMember2022-01-012022-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMemberdhil:MutualFundAdministrativeServicesMember2022-01-012022-12-310000909108dhil:SeparatelyManagedAccountsExcludingPerformanceBasedFeesMember2022-01-012022-12-310000909108dhil:OtherPooledVehiclesMemberdhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:OtherPooledVehiclesMemberdhil:MutualFundAdministrativeServicesMember2022-01-012022-12-310000909108dhil:OtherPooledVehiclesMember2022-01-012022-12-310000909108dhil:ModelDeliveryMemberdhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:ModelDeliveryMemberdhil:MutualFundAdministrativeServicesMember2022-01-012022-12-310000909108dhil:ModelDeliveryMember2022-01-012022-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:InvestmentAdvisoryServicesMember2022-01-012022-12-310000909108dhil:CollectiveInvestmentTrustsMemberdhil:MutualFundAdministrativeServicesMember2022-01-012022-12-310000909108dhil:CollectiveInvestmentTrustsMember2022-01-012022-12-310000909108dhil:AdministrationRevenueGrossMember2024-01-012024-12-310000909108dhil:AdministrationRevenueGrossMember2023-01-012023-12-310000909108dhil:AdministrationRevenueGrossMember2022-01-012022-12-310000909108dhil:FundRelatedExpenseMember2024-01-012024-12-310000909108dhil:FundRelatedExpenseMember2023-01-012023-12-310000909108dhil:FundRelatedExpenseMember2022-01-012022-12-310000909108dhil:AdministrationRevenuenetofrelatedexpenseMember2024-01-012024-12-310000909108dhil:AdministrationRevenuenetofrelatedexpenseMember2023-01-012023-12-310000909108dhil:AdministrationRevenuenetofrelatedexpenseMember2022-01-012022-12-310000909108dhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108dhil:SecuritiesheldinConsolidatedFundsMember2023-12-310000909108dhil:CompanySponsoredInvestmentsMember2024-12-310000909108dhil:CompanySponsoredInvestmentsMember2023-12-310000909108us-gaap:ParentMemberdhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108us-gaap:NoncontrollingInterestMemberdhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108dhil:DMHFMember2024-12-310000909108dhil:DiamondHillInternationalFundMember2024-12-310000909108dhil:LargeCapConcentratedFundMember2024-12-310000909108dhil:DMHFMember2023-12-310000909108dhil:DiamondHillInternationalFundMember2023-12-310000909108dhil:LargeCapConcentratedFundMember2023-12-310000909108dhil:DMHFMember2022-12-310000909108dhil:LargeCapConcentratedFundMember2022-12-310000909108us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-12-310000909108us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-12-310000909108us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-01-012024-12-310000909108us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-12-310000909108us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-12-310000909108us-gaap:FairValueInputsLevel1Member2024-12-310000909108us-gaap:FairValueInputsLevel2Member2024-12-310000909108us-gaap:FairValueInputsLevel3Member2024-12-310000909108us-gaap:FairValueInputsLevel1Memberdhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108us-gaap:FairValueInputsLevel2Memberdhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108us-gaap:FairValueInputsLevel3Memberdhil:SecuritiesheldinConsolidatedFundsMember2024-12-310000909108us-gaap:FairValueInputsLevel1Memberdhil:CompanySponsoredInvestmentsMember2024-12-310000909108us-gaap:FairValueInputsLevel2Memberdhil:CompanySponsoredInvestmentsMember2024-12-310000909108us-gaap:FairValueInputsLevel3Memberdhil:CompanySponsoredInvestmentsMember2024-12-310000909108us-gaap:FairValueInputsLevel1Member2023-12-310000909108us-gaap:FairValueInputsLevel2Member2023-12-310000909108us-gaap:FairValueInputsLevel3Member2023-12-310000909108us-gaap:FairValueInputsLevel1Memberdhil:CompanySponsoredInvestmentsMember2023-12-310000909108us-gaap:FairValueInputsLevel2Memberdhil:CompanySponsoredInvestmentsMember2023-12-310000909108us-gaap:FairValueInputsLevel3Memberdhil:CompanySponsoredInvestmentsMember2023-12-310000909108dhil:TheCreditAgreementMemberus-gaap:LineOfCreditMember2024-12-310000909108dhil:TheCreditAgreementMemberus-gaap:LineOfCreditMember2024-01-012024-12-310000909108dhil:A2022EquityAndCashIncentivePlanMember2024-12-310000909108dhil:EquityAndCashIncentivePlanMember2024-12-310000909108us-gaap:RestrictedStockUnitsRSUMember2023-12-310000909108us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310000909108us-gaap:RestrictedStockUnitsRSUMember2024-12-310000909108us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000909108us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000909108us-gaap:EmployeeStockMember2024-01-012024-12-310000909108us-gaap:EmployeeStockMember2023-01-012023-12-310000909108us-gaap:EmployeeStockMember2024-12-310000909108us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310000909108us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000909108us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-3100009091082024-07-3100009091082024-07-312024-07-310000909108us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberdhil:AcquiredFundsMember2021-02-020000909108us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberdhil:AcquiredFundsMember2022-07-300000909108us-gaap:SubsequentEventMember2025-02-2600009091082024-10-012024-12-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-24498

DIAMOND HILL INVESTMENT GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ohio | | 65-0190407 |

(State of

incorporation) | | (I.R.S. Employer

Identification No.) |

325 John H. McConnell Blvd, Suite 200, Columbus, Ohio 43215

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (614) 255-3333

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common shares, no par value | | DHIL | | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common shares (the only common equity of the registrant) held by non-affiliates on The Nasdaq Global Select Market was $368,996,675, based on the closing price of $140.75 on June 30, 2024. For these purposes only, calculation of holdings by non-affiliates is based upon the assumption that the registrant’s executive officers and directors are affiliates.

As of February 26, 2025, the registrant had 2,787,492 outstanding common shares.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for its 2025 Annual Meeting of Shareholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Diamond Hill Investment Group, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2024

Index

PART I

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Form 10-K”), the documents incorporated herein by reference and statements, whether oral or written, made from time to time by representatives of Diamond Hill Investment Group, Inc., an Ohio corporation organized in 1990 (“DHIL”, and collectively with its subsidiaries, the “Company”), may contain or incorporate “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended (the “PSLR Act”), Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements are provided under the “safe harbor” protection of the PSLR Act. Forward-looking statements include, but are not limited to, statements regarding anticipated operating results, prospects and levels of assets under management, technological developments, economic trends (including interest rates and market volatility), expected transactions and similar matters. The words “may,” “believe,” “expect,” “anticipate,” “target,” “goal,” “project,” “estimate,” “guidance,” “forecast,” “outlook,” “would,” “will,” “continue,” “likely,” “should,” “hope,” “seek,” “plan,” “intend,” and variations of such words and similar expressions identify such forward-looking statements. Similarly, descriptions of the Company’s objectives, strategies, plans, goals, or targets are also forward-looking statements. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. While the Company believes that the assumptions underlying its forward-looking statements are reasonable, investors are cautioned that any of the assumptions could prove to be inaccurate and, accordingly, the Company's actual results and experiences may differ materially from the anticipated results or other expectations expressed in its forward-looking statements.

Factors that may cause such actual results or experiences to differ materially from results discussed in the forward-looking statements include, but are not limited to: (i) any reduction in the Company’s assets under management (“AUM”) or assets under advisement (“AUA”); (ii) withdrawal, renegotiation, or termination of investment advisory agreements; (iii) damage to the Company’s reputation; (iv) failure to comply with investment guidelines or other contractual requirements; (v) challenges from the competition the Company faces in its business; (vi) challenges from industry trends towards lower fee strategies and model portfolio arrangements; (vii) adverse regulatory and legal developments; (viii) unfavorable changes in tax laws or limitations; (ix) interruptions in or failure to provide critical technological service by the Company or third parties; (x) adverse civil litigation and government investigations or proceedings; (xi) failure to adapt to or successfully incorporate technological changes, such as artificial intelligence (“AI”), into the Company’s business; (xii) risk of loss on the Company’s investments; (xiii) lack of sufficient capital on satisfactory terms; (xiv) losses or costs not covered by insurance; (xv) a decline in the performance of the Company’s products; (xvi) changes in interest rates and inflation; (xvii) changes in national and local economic and political conditions; (xix) the continuing economic uncertainty in various parts of the world; (xviii) the effects of pandemics and the actions taken in connection therewith; (xx) political uncertainty caused by, among other things, political parties, economic nationalist sentiments, tensions surrounding the current socioeconomic landscape; and (xix), other risks identified from time-to-time in the Company’s public documents on file with the U.S. Securities and Exchange Commission (“SEC”), including those discussed in Item 1A of this Form 10-K.

Forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above, in Item 1A of this Form 10-K, and in the Company’s other public documents on file with the SEC. New risks and uncertainties arise from time to time, and factors that the Company currently deems immaterial may become material, and it is impossible for the Company to predict these events or how they may affect it. The Company undertakes no obligation to update any forward-looking statements after the date they are made, whether as a result of new information, future events or developments, except as required by federal securities laws, although it may do so from time to time. Readers are advised to consult any further disclosures the Company makes on related subjects in its public announcements and SEC filings. The Company does not endorse any projections regarding future performance that may be made by third parties.

Overview

DHIL derives its consolidated revenue and net income from investment advisory and fund administration services provided by its wholly owned subsidiary, Diamond Hill Capital Management, Inc., an Ohio corporation (“DHCM”). DHCM is a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and is the investment adviser and administrator for the Diamond Hill Funds, a series of open-end mutual funds (each, a “Diamond Hill Fund”, and collectively, the “Diamond Hill Funds”) and the Diamond Hill Securitized Credit Fund, a closed-end registered investment company (“DHSC”, and collectively with the Diamond Hill Funds, the “Proprietary Funds”). DHCM also provides investment advisory and related services to the Diamond Hill Micro Cap Fund, LP (“DHMF”), a private fund, as well as separately managed accounts (“SMAs”), collective investment trusts (“CITs”), other pooled vehicles including sub-advised funds, and model delivery programs.

The Company believes focusing on generating excellent, long-term investment outcomes and building enduring client partnerships will enable it to grow its intrinsic value to achieve a compelling, long-term return for its shareholders.

The Company accomplishes this through its shared investment principles, including: (i) valuation-disciplined active portfolio management, (ii) fundamental bottom-up research, (iii) a long-term, business-owner mindset, and (iv) a client alignment philosophy that ensures clients’ interests come first. Client alignment is emphasized through: (i) a strategic capacity discipline that protects portfolio managers’ abilities to generate excess returns, (ii) personal investment by portfolio managers in the strategies they manage, (iii) portfolio manager compensation being driven by long-term investment results in client portfolios, and (iv) a fee philosophy focused on a fair sharing of the economics among clients, employees, and shareholders. The Company’s core cultural values of curiosity, ownership, trust, and respect create an environment where investment professionals focus on investment results and all teammates focus on the overall client experience.

The Company offers a variety of investment strategies designed for long-term strategic allocations from institutionally oriented investors in key asset classes, aligning its investment team’s competitive advantages with its clients’ needs.

Assets Under Management

DHCM’s principal source of revenue is investment advisory fee income earned from managing client accounts under investment advisory and sub-advisory agreements. The fees earned depend on the type of investment strategy, account size, and servicing requirements. DHCM’s revenues depend largely on the total value and composition of its AUM. Accordingly, net cash flows from clients, market fluctuations, and the composition of AUM impact the Company’s revenues and results of operations.

Model Delivery Programs - Assets Under Advisement

DHCM provides strategy-specific model portfolios to sponsors of model delivery programs. DHCM is paid for its services by the program sponsors at a pre-determined rate based on AUA in the model delivery programs. DHCM does not have discretionary investment authority over individual client accounts in the model delivery programs, and therefore, the AUA is not included in the Company’s AUM.

The Company’s revenues are highly dependent on both the value and composition of AUM and AUA. The following is a summary of the Company’s AUM by product and investment strategy, a roll-forward of the change in AUM, and a summary of AUA for each of the past three years ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | |

| Assets Under Management and Assets Under Advisement

As of December 31, |

| (in millions) | 2024 | | 2023 | | 2022 | | | | |

| Proprietary Funds | $ | 18,097 | | | $ | 15,879 | | | $ | 14,745 | | | | | |

| Separately managed accounts | 6,108 | | | 6,617 | | | 6,220 | | | | | |

| Collective investment trusts | 1,947 | | | 1,359 | | | 1,040 | | | | | |

| Other pooled vehicles | 3,860 | | | 3,563 | | | 2,758 | | | | | |

| Total AUM | 30,012 | | | 27,418 | | | 24,763 | | | | | |

| Total AUA | 1,913 | | | 1,746 | | | 1,802 | | | | | |

| Total AUM and AUA | $ | 31,925 | | | $ | 29,164 | | | $ | 26,565 | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Assets Under Management

by Investment Strategy

As of December 31, |

| (in millions) | 2024 | | 2023 | | 2022 | | | | |

| U.S. Equity | | | | | | | | | |

| Large Cap | $ | 17,702 | | | $ | 17,307 | | | $ | 16,478 | | | | | |

| Small-Mid Cap | 2,009 | | | 2,588 | | | 2,646 | | | | | |

| Mid Cap | 1,082 | | | 1,023 | | | 899 | | | | | |

| Select | 755 | | | 593 | | | 392 | | | | | |

| Small Cap | 253 | | | 255 | | | 306 | | | | | |

| Large Cap Concentrated | 129 | | | 98 | | | 99 | | | | | |

| Micro Cap | 33 | | | 21 | | | 15 | | | | | |

| Total U.S. Equity | 21,963 | | | 21,885 | | | 20,835 | | | | | |

| | | | | | | | | |

| Alternatives | | | | | | | | | |

| Long-Short | 1,684 | | | 1,725 | | | 1,752 | | | | | |

| Total Alternatives | 1,684 | | | 1,725 | | | 1,752 | | | | | |

| | | | | | | | | |

| International Equity | | | | | | | | | |

| International | 141 | | | 109 | | | 52 | | | | | |

| | | | | | | | | |

| Total International Equity | 141 | | | 109 | | | 52 | | | | | |

| | | | | | | | | |

| Fixed Income | | | | | | | | | |

| Short Duration Securitized Bond | 3,732 | | | 1,948 | | | 1,308 | | | | | |

| Core Fixed Income | 2,416 | | | 1,735 | | | 792 | | | | | |

| Securitized Credit | 52 | | | — | | | — | | | | | |

| Long Duration Treasury | 24 | | | 26 | | | 33 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total Fixed Income | 6,224 | | | 3,709 | | | 2,133 | | | | | |

| | | | | | | | | |

| Total-All Strategies | 30,012 | | | 27,428 | | | 24,772 | | | | | |

(Less: Investments in affiliated funds)(a) | — | | | (10) | | | (9) | | | | | |

| Total AUM | 30,012 | | | 27,418 | | | 24,763 | | | | | |

Total AUA(b) | 1,913 | | | 1,746 | | | 1,802 | | | | | |

| Total AUM and AUA | $ | 31,925 | | | $ | 29,164 | | | $ | 26,565 | | | | | |

(a) Certain of the Proprietary Funds own shares of the Diamond Hill Short Duration Securitized Bond Fund. The Company reduces the total AUM of each Proprietary Fund that holds such shares by the AUM of the investments held in this affiliated fund.

(b) AUA is primarily comprised of model portfolio assets related to the Large Cap and Select strategies.

| | | | | | | | | | | | | | | | | | | | | |

| Change in Assets Under Management

For the Year Ended December 31, |

| (in millions) | 2024 | | 2023 | | 2022 | | | | |

| AUM at beginning of the year | $ | 27,418 | | | $ | 24,763 | | | $ | 31,028 | | | | | |

Net cash inflows (outflows) | | | | | | | | | |

| Proprietary Funds | 726 | | | (599) | | | (2,433) | | | | | |

| Separately managed accounts | (1,269) | | | (416) | | | (73) | | | | | |

| Collective investment trusts | 403 | | | 153 | | | 486 | | | | | |

| Other pooled vehicles | (149) | | | 368 | | | (221) | | | | | |

| (289) | | | (494) | | | (2,241) | | | | | |

| Net market appreciation/(depreciation) and income | 2,883 | | | 3,149 | | | (4,024) | | | | | |

| Increase (decrease) during the year | 2,594 | | | 2,655 | | | (6,265) | | | | | |

| AUM at end of the year | 30,012 | | | 27,418 | | | 24,763 | | | | | |

| AUA at end of year | 1,913 | | | 1,746 | | | 1,802 | | | | | |

| Total AUM and AUA at end of year | $ | 31,925 | | | $ | 29,164 | | | $ | 26,565 | | | | | |

Capacity

The Company’s ability to retain and grow its AUM has been, and will continue to be, primarily driven by delivering attractive long-term investment results. If the Company determines the size of a strategy could impede its ability to meet its investment objectives, the Company, where possible, may close that strategy to new clients. The Company’s commitment to capacity discipline inherently impacts its ability to grow its AUM as investment results are prioritized over asset accumulation.

The Company’s capacity as of December 31, 2024 was estimated to be $45 billion to $55 billion in domestic equities, $20 billion to $30 billion in international equities, and $50 billion to $70 billion in fixed income. The Company’s capacity increases with the development of new products or strategies.

Growth and Distribution Strategy

The Company’s growth centers first and foremost on delivering an investment and client experience that enables investors to experience better outcomes over the long-term. The Company’s client alignment philosophy guides it to develop strategies and offer vehicles that meet clients’ objectives, capitalize on its investment team’s research capabilities, and align with its investment principles.

The Company looks to attract like-minded, long-term focused clients across all of its offerings. To ensure efficient business development and relationship management, the Company has dedicated resources toward content-led marketing and sales enablement efforts. The Company believes that the combination of these efforts will lead to a deeper understanding of its investment strategies, and ultimately, longer holding periods for investors.

As an active investment boutique, the Company brings long-term oriented investment strategies to clients. Each strategy is designed to deliver excellent, long-term investment outcomes. It is imperative that the Company attracts and retains a diversified client base that philosophically aligns with the Company’s investment principles, long-term orientation, and understands the outcomes the Company can provide.

The Company’s distribution team focuses primarily on asset allocators with centralized research teams, allowing it to efficiently deliver services to a large and diversified client base. These asset allocators tend to be highly sophisticated buyers, who conduct deep research and pair the Company’s strategies with complementary strategies to meet holistic client objectives. These asset allocators include centralized research teams at institutional consulting firms, wirehouses, banks, independent broker dealers (“IBD”), and independent registered investment advisory firms (“RIAs”). The Company also believes having a focus on plan sponsors with their own investment research teams is important.

The Company’s distribution team members possess a deep understanding of the Company’s clients’ business models and needs. The team takes a consultative, customized approach to developing and maintaining relationships.

Creating a customized approach requires integrating marketing throughout the sales process and client lifecycle. A proactive, investment content-led marketing effort with a compelling digital ecosystem allows the Company to deliver the right content to the right clients/prospects in the right format at all stages of the client lifecycle.

Distribution technology and business intelligence, including the use of third-party data sets and advanced analytics, provide a solid and scalable foundation for all client interactions. Compiling, centralizing, and analyzing data regarding trends, prospects, purchasing patterns, and engagement informs resource allocation and segmentation of clients, enhancing the effectiveness of the Company’s distribution efforts. The Company’s intention is to deliver investment strategies to clients in the investment vehicle that best meets their unique needs.

Fund Administration Activities

DHCM provides fund administration services to the Proprietary Funds. Fund administration services are broadly defined to include the following services: portfolio and regulatory compliance; treasury and financial oversight; oversight of back-office service providers, such as the custodian, fund accountant, and transfer agent; and general business management and governance of the Proprietary Funds.

Competition

Competition in the investment management industry is intense, and DHCM’s competitors include investment management firms, broker-dealers, banks, and insurance companies, some of whom offer various investment alternatives, including passive index strategies, and strategies that invest in private equity and credit. Many of DHCM’s competitors are better known, offer a broader range of investment products, and have more dedicated resources for business development and marketing.

Regulation

The Company is subject to various federal, state, and non-U.S. laws and regulations. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets, and with protecting the interests of participants in those markets, including investment advisory clients and shareholders of investment funds. If an adviser fails to comply with these laws and regulations, these regulatory bodies have broad administrative powers, including the power to limit, restrict, or prohibit an investment adviser from carrying on its business. Possible sanctions that regulatory bodies may impose include civil and criminal liability, the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser, broker-dealer, and other registrations, censures, and fines.

DHCM is registered with the SEC under the Advisers Act and operates in a highly regulated environment. The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, recordkeeping requirements, operational requirements, and disclosure obligations. All of the Proprietary Funds are registered with the SEC under the Investment Company Act of 1940, as amended (“Company Act”), and are required to make notice filings with all states where the Proprietary Funds are offered for sale. Virtually all aspects of DHCM’s investment advisory and fund administration business are subject to various federal and state laws and regulations.

DHCM is a “fiduciary” under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), with respect to benefit plan clients, and therefore, is subject to ERISA regulations. ERISA and applicable provisions of the Internal Revenue Code of 1986, as amended, impose certain duties on persons who are fiduciaries, prohibit certain transactions involving ERISA plan clients, and provide monetary penalties for violations of these prohibitions. In recent years, the Department of Labor, which administers ERISA, has been active in proposing and adopting regulations affecting the asset management industry.

DHCM’s trading activities for client accounts are regulated by the SEC under the Exchange Act, which includes regulations governing trading on inside information, market manipulation, and a broad number of trading and market regulation requirements in the United States.

The preceding descriptions of the regulatory and statutory provisions applicable to DHCM are not exhaustive or complete and are qualified in their entirety by reference to the respective statutory or regulatory provisions. Failure to comply with these requirements could have a material adverse effect on DHCM’s business.

Contractual Relationships with the Diamond Hill Funds

DHCM is highly dependent on its contractual relationships with the Diamond Hill Funds. If any of DHCM’s advisory or administration agreements with the Diamond Hill Funds were terminated or not renewed, or were amended or modified to reduce fees, DHCM would be materially and adversely affected. DHCM generated approximately 66%, 68%, and 71% of its 2024, 2023, and 2022 revenues, respectively, from its advisory and administration agreements with the Diamond Hill Funds. DHCM believes that it has strong relationships with the Diamond Hill Funds and their board of trustees, and DHCM has no reason to believe that these advisory or administration contracts will not be renewed in the future. However, there is no assurance that the Diamond Hill Funds will choose to continue their relationships with DHCM. Please see Item 1A for risk factors regarding this relationship.

Human Capital

The Company believes its people are its greatest asset, and each role within the firm contributes to its goals of generating excellent, long-term investment outcomes and building enduring client partnerships.

Workforce Data

Attracting, developing, and retaining talented employees is integral to the Company’s human capital strategy and critical to its success. The Company depends on highly skilled personnel, with specialized expertise and extensive experience in the investment management industry. The Company’s overall headcount has remained relatively consistent over the last five years, and was 127 as of December 31, 2024, two employees fewer than as of December 31, 2023.

The average employee tenure is 8.3 years, and more than one-third of its employees have been with the Company more than 10 years. The Company’s five-year average employee turnover rate is 7.4%. The Company’s employees are based in 12 states, and approximately 80% of its employees reside in Ohio.

As of December 31, 2024, females represented 43% of DHIL’s board of directors (“Board”), 67% of the Company’s management team, and approximately 33% of its employees. As of December 31, 2024, racial or ethnic minorities represented approximately 14% of the Company’s workforce and 14% of the Board. Please see additional demographic details on the Company’s website.

Competitive Pay and Benefits

The Company’s competitive compensation and benefits are designed to help attract, retain, and motivate employees who embody its values. The Company aligns its employees’ compensation with client outcomes, individual and team results, and company performance.

Culture

The Company’s culture emphasizes four key values: curiosity, ownership, trust and respect. The way its employees embody these core values creates the Company’s culture. The culture allows the Company to attract and retain employees who share its commitment to client alignment, are motivated by investment excellence, and are committed to delivering excellent outcomes. Diversity, equity, and inclusion is embedded in the policies, practices, and strategic initiatives of the Company, ensuring we have teams that encourage varied points of view. The Company believes clients are best served by decision making that engages diverse perspectives.

Our culture manifests itself in a variety of ways. Employees who are curious focus on continuous self-improvement and have a passion for learning. They are open-minded, seek differing perspectives, and go beyond surface-level assumptions. Employees who think and act like business owners naturally embrace a long-term mindset. They lead by example and accept accountability for ensuring strong client outcomes. Employees who embrace trust act with integrity, are authentic and honest in interactions with others, and put client interests ahead of all others. Employees who are motivated by giving and receiving respect communicate and provide feedback candidly, transparently, and with positive intent. They are humble in their assumptions and listen to better understand others. They embrace, value, and celebrate diversity, inclusion, and differences in all forms, and recognize that transparency and accountability are critical to driving real change within the firm, in the industry, and within their community.

The Company’s culture revolves around the fact that DHCM is a fiduciary first and foremost. The primary focus is serving its clients. The Company’s long-term, valuation-disciplined investment principles are foundational to its culture and have been consistently implemented since the firm’s inception. All members of the investment team believe in, and adhere to, the same investment principles. The Company’s employees invest alongside its clients, and portfolio managers have significant personal investments in the strategy or strategies they manage.

SEC Filings

The Company maintains a website at www.diamond-hill.com. The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports that it files or furnishes from time-to-time pursuant to Section 13(a) or 15(d) of the Exchange Act, are made available free of charge, on or through the Investor Relations section of the Company’s website, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Information contained on the Company’s website is not part of this Form 10-K or any other report or document that it files with, or furnishes to, the SEC. These reports are also available free of charge on the SEC’s website at http://www.sec.gov.

The Company’s future results of operations, financial condition, liquidity, and capital resources as well as the market price of its common shares, are subject to various risks, including those risks mentioned below and elsewhere in this Form 10-K as well as those risks that are discussed from time-to-time in the Company’s other filings with the SEC. Investors should carefully consider these risks before making an investment decision regarding the Company’s securities. There may be additional risks of which the Company is currently unaware, or of which the Company currently considers to be immaterial. The occurrence of any of these risks could have a material adverse effect on the Company’s financial condition, results of operations, liquidity, capital resources and the value of its securities. Please see “Forward Looking Statements” within Part I, Item 1, of this Form 10-K.

Business Risks

Poor investment results or adverse ratings of the Company’s products could affect its ability to attract new clients or could reduce its AUM, potentially negatively impacting revenue and net income.

If the Company fails to deliver acceptable investment results for its clients, both in the short and long-term, the Company could experience diminished investor interest and a decrease in its AUM.

Investment strategies are assessed and rated by independent third parties, including rating agencies, industry analysts, and publications. Investors can be influenced by such ratings. If a Company strategy receives an adverse report, it could negatively impact the Company’s AUM and revenues.

The Company’s success depends on its key personnel, and its financial performance could be negatively affected by the loss of their services.

The Company’s success depends on highly skilled personnel, including portfolio managers, research analysts, and management, many of whom have specialized expertise and extensive experience in the investment management industry. Financial services professionals are in high demand, and the Company faces significant competition for qualified employees. Other than the Company’s Chief Executive Officer, its employees do not have employment contracts and generally can terminate their employment at any time. The Company may not be able to retain or replace key personnel. To retain or replace its key personnel, the Company may be required to increase compensation, which would decrease its net income. The loss of key personnel could damage the Company’s reputation and make it more difficult to retain and attract new employees and clients. A loss of client assets resulting from the departure of key personnel may materially decrease the Company’s revenues and net income.

The Company’s investment results and/or growth in its AUM may be constrained if appropriate investment opportunities are not available or if the Company closes certain of its investment strategies to new investors.

The Company’s ability to deliver excellent investment results depends in large part on its ability to identify appropriate investment opportunities in which to invest client assets. If the Company is unable to identify sufficient investment opportunities for existing and new client assets on a timely basis, its investment results could be adversely affected. The risk that appropriate investment opportunities may be unavailable is influenced by a number of factors, including general market conditions, and is likely to increase if the Company’s AUM increases rapidly. The Company’s efforts to establish and develop new strategies may face challenges or ultimately be unsuccessful, which could impact its results of operations, reputation, and/or culture. In addition, if the Company determines that sufficient investment opportunities are not available for an investment strategy, or it believes that it is necessary to continue to produce attractive returns from an investment strategy, the Company will consider closing the investment strategy to new investors. If the Company misjudged the point at which it would be

optimal to close an investment strategy, the investment results of the strategy could be negatively impacted. The Company has closed investment strategies in the past and may do so again in the future. As of December 31, 2024, the Company does not have any closed investment strategies.

The Company is subject to substantial competition in all aspects of its business.

The Company’s investment products compete against investment products and services from:

•Asset management firms;

•Mutual fund companies;

•Commercial banks and thrift institutions;

•Insurance companies;

•Interval and other closed-end funds;

•Exchange-traded funds;

•Private funds, including hedge funds and private equity and credit funds; and

•Brokerage and investment banking firms.

Many of the Company’s competitors have substantially greater resources and may operate in more markets or offer a broader range of products, including passively managed or “index” products. Some of these institutions operate in a different regulatory environment, which may give them certain competitive advantages in the investment products and portfolio structures that they offer. The Company competes with other providers of investment services primarily based upon its philosophy, performance, and quality of client service. Some institutions have a broader array of products and distribution channels, which makes it more difficult for the Company to compete. If current or potential clients decide to use one of the Company’s competitors, it could face a significant decline in AUM, AUA, revenues, and net income. If the Company is required to lower its fees to remain competitive, its net income could be significantly reduced because some of the Company’s expenses are fixed, especially over shorter periods of time, and its expenses may not decrease in proportion to the decrease in revenues. Additionally, over the past several years, investors have generally shown a preference for passive investment products over actively managed strategies. If this trend continues, the Company’s AUM, revenues, and net income may be negatively impacted.

Industry trends towards lower fee strategies and model portfolio arrangements could adversely impact the Company’s revenues.

Market and competitive pressures in recent years have created a trend towards lower management fees in the asset management industry and there can be no assurance that the Company will be able to maintain its current fee structure. As a result, a shift in the Company’s AUM from higher to lower fee generating clients and strategies could result in a decrease in revenues even if its AUM increases or remains unchanged. Similarly, in recent years, there has been a trend in clients shifting their assets from higher fee mutual funds and SMAs to lower fee model portfolio arrangements. As a result, a shift in the Company’s client assets from AUM to AUA could result in a decrease in Company revenues.

The loss of access to, or increased fees required by, third-party distribution sources to market the Company’s portfolios and access its client base could adversely affect the Company’s results of operations.

The Company’s ability to attract additional AUM is dependent on its relationship with third-party financial intermediaries. The Company compensates some of these intermediaries for access to investors and for various marketing services provided. These distribution sources and client bases may not continue to be accessible to the Company under reasonable terms, or at all. If such investor access is restricted or eliminated, it could have an adverse effect on the Company’s results of operations. Fees paid to financial intermediaries for investor access and marketing services have generally increased in recent years. If such fee increases continue, refusal to pay them could restrict the Company’s access to those client bases while paying them could adversely affect its profitability.

A significant portion of DHCM's revenues are based on advisory and administration agreements with the Diamond Hill Funds that are subject to termination without cause and on short notice.

DHCM is highly dependent on its contractual relationships with the Diamond Hill Funds. If DHCM’s advisory or administration agreements with the Diamond Hill Funds were terminated or not renewed, or were amended or modified to reduce fees, DHCM would be materially and adversely affected. Generally, these agreements are terminable by either party upon 60 days’ prior written notice without penalty. The Diamond Hill Funds’ agreements are subject to annual approval by either: (i) their board of trustees, or (ii) a vote of the majority of the outstanding voting securities of each Diamond Hill Fund.

These agreements automatically terminate in the event of their assignment by either DHCM or the Diamond Hill Funds. DHCM generated approximately 66%, 68%, and 71% of its 2024, 2023, and 2022 revenues, respectively, from its advisory and administration agreements with the Diamond Hill Funds, including 29% and 11% from the advisory contracts with the Diamond Hill Large Cap Fund and the Diamond Hill Long-Short Fund during 2024. The loss of either the Diamond Hill Large Cap Fund or Diamond Hill Long-Short Fund contracts would have a material adverse effect on DHCM. DHCM believes that it has strong relationships with the Diamond Hill Funds and their board of trustees, and it has no reason to believe that these advisory or administration contracts will not be renewed in the future. However, there can be no assurance that the Diamond Hill Funds will choose to continue their relationships with DHCM.

Negative public opinion of the Company could cause it to lose clients and adversely affect its share price.

Negative public opinion can result from the Company’s actual or alleged conduct in any number of activities, including trading practices, corporate governance and acquisitions, DEI issues, social media and other marketing activities, and actions taken by governmental regulators and community organizations in response to any of the foregoing. Negative public opinion could adversely affect the Company’s ability to attract and maintain clients, could expose the Company to potential litigation or regulatory action, and could have a material adverse effect on its share price or result in heightened volatility.

Operational Risks

Cybersecurity attacks could prevent the Company from managing client portfolios, cause the unauthorized disclosure of sensitive or confidential client or employee information or result in misappropriation of information or funds, each of which could severely harm its business.

As part of its business, the Company collects, processes, and transmits sensitive and confidential information about its clients and employees, as well as proprietary information about its business. The Company has policies and procedures pursuant to which it takes numerous security measures to prevent cyberattacks of various kinds as well as fraudulent and inadvertent activity by persons who have been granted access to such sensitive or confidential information. Nevertheless, the Company’s systems, like all technology systems, remain vulnerable to unauthorized access, which can result in theft or corruption of information. In addition, the Company shares information with third-party vendors upon whom it relies for various functions. The systems of such third parties also are vulnerable to cyber threats. Unauthorized access can come from unrelated third parties through the internet, from access to hardware removed from the Company’s or those third parties’ premises, or from employees acting intentionally or inadvertently.

Cybersecurity incidents can involve, among other things: (i) deliberate attacks designed to corrupt the Company’s information systems and make them unusable by the Company to operate its business; (ii) theft of information used by the perpetrators for financial and other gain; or (iii) inadvertent releases of information by employees or third parties with whom the Company does business.

Cyberattacks that corrupt the Company’s information systems and make them unusable could impair its ability to trade securities in its clients’ accounts. Corruption of the systems of the Company’s third-party vendors could impact the Company to the same extent as corruption of its own systems. If information about the Company’s employees or clients is intentionally stolen or inadvertently made public, that information could be used to commit identity theft, obtain credit in an employee’s or client’s name, or steal from an employee or client. If information about the Company’s business is obtained by unauthorized persons, whether through intentional attacks or inadvertent releases of information, it could be used to harm its competitive position.

Whether information is corrupted, stolen, or inadvertently disclosed, and regardless of the type and nature of the information (e.g., proprietary information about the Company’s business or personal information about clients or employees), it could have various adverse impacts on, and be materially harmful to, the Company, including the following:

•The Company’s reputation could be harmed, resulting in the loss of clients, vendors, and employees or making payments or concessions to such persons to maintain its relationships with them;

•The Company’s inability to operate its business fully, even if temporarily, and thus, fulfill contracts with clients or vendors, could result in termination of contracts and loss of revenue;

•Harm suffered by clients or vendors whose contracts have been breached, or by clients, vendors, or employees whose information is compromised, could result in costly litigation against the Company;

•The Company’s need to focus attention on remediation of a cybersecurity issue could take its attention away from the operation of its business, resulting in lost revenue;

•The Company could incur costs to repair systems made inoperable by a cyberattack and to make changes to its systems to reduce future cyber threats. Those changes could include, among other things, obtaining additional technologies as well as employing additional personnel and training employees;

•The interruption of the Company’s business or theft of proprietary information could harm its ability to compete; and

•Any losses that the Company may be responsible to bear may not be covered by insurance.

Any of the above potential impacts of a cybersecurity incident, individually or collectively, could have a material adverse effect on the Company’s business, financial condition, and results of operations.

The Company may not be able to adapt to technological change.

The financial services industry is continually undergoing rapid technological change with frequent introductions of new technology-driven products and services. The effective use of technology increases efficiency and enables financial institutions to better serve clients while reducing costs. The Company’s future success depends, in part, upon its ability to address client needs by using technology to provide products and services that will satisfy client demands, as well as to create additional efficiencies in its operations. The Company may not be able to implement effectively new technology-driven products and services or be successful in marketing these products and services to its clients. Failure to successfully keep pace with technological changes affecting the financial services industry could negatively affect the Company’s growth, revenue, and profit.

The Company operates in an intensely competitive business environment. It may not be as successful as its competitors incorporating AI into its business or adapting to a rapidly changing marketplace.

The Company’s competitors may be larger, more diversified, better funded, and have access to more advanced technology, including generative AI. These competitive advantages may enable its competition to innovate better and more quickly, or to compete more effectively on quality and price, which could cause the Company to lose business and profitability. Burgeoning interest in AI may increase competition and disrupt the Company’s business model. AI may lower barriers to entry in the industry and the Company may be unable to effectively compete with the products or services offered by new competitors. AI-related changes to the products and services on offer may affect customer expectations, requirements, or tastes in ways that the Company cannot adequately anticipate or adapt to, causing its business to lose revenues, market share, or the ability to operate profitably and sustainably.

Operational risks may disrupt the Company’s business, result in losses, or limit its growth.

The Company is dependent on the capacity and reliability of the communications, information, and technology systems supporting its operations, whether developed, owned, or operated internally by the Company or by third parties. Operational risks, such as trading or operational errors, interruption of the Company’s financial, accounting, trading, compliance, and other data processing systems, the loss of data contained in such systems, or compromised systems due to cyberattack, could result in a disruption of the Company’s business, liability to clients, regulatory intervention, or reputational damage, and thus, adversely affect its business.

Employee misconduct could harm the Company by impairing its ability to attract and retain clients and subjecting the Company to significant legal liability, regulatory scrutiny and reputational harm.

The Company’s controls and procedures may fail or be circumvented, its risk management policies and procedures may be inadequate,and operational risks could adversely affect its reputation and financial condition.

The Company has developed and continues to update strategies and procedures specific to its business for managing risks, which include market risk, liquidity risk, operational risk and reputational risk. Management of these risks can be very complex. These strategies and procedures may fail under some circumstances, particularly if the Company is confronted with risks that it has underestimated or not identified. Some of the Company’s risk evaluation methods depend upon information provided by others and public information regarding markets, clients, or other matters that are otherwise accessible by the Company. If the Company’s policies and procedures are not fully effective or it is not successful in capturing all risks to which it is or may be exposed,the Company may suffer harm to its reputation or be subject to litigation or regulatory actions that could have a material adverse effect on its business, results of operations,or financial condition.

Industry, Market, and Economic Risks

The Company’s AUM, which impacts revenue, is subject to significant fluctuations.

The majority of the Company’s revenue is calculated as a percentage of AUM or is related to the general performance of the equity securities markets. A decline in securities prices or in the sale of investment products, or an increase in client redemptions, generally will reduce revenue and net income. Financial market declines will generally negatively impact the level of the Company’s AUM, and consequently, its revenue and net income. A recession or other economic or political events, whether in the United States or globally could also adversely impact the Company’s revenue, if such events led to a decreased demand for products, a higher redemption rate, or a decline in securities prices. Investor interest in the Company’s fixed income strategies is affected by changes in interest rates and the overall credit environment. In addition, the majority of the Company’s existing AUM is managed in primarily long-only, equity investment strategies, which exposes it to greater risk than certain of its competitors who may manage assets in more diverse strategies.

The Company’s investment approach may underperform other investment approaches during certain market conditions.

The Company’s investment strategies are best suited for investors with long-term investment time horizons. The Company’s investment strategies may not perform well during certain periods of time. Additionally, the Company has, and is expected to continue to have, common positions and industry concentrations across its strategies at the same time. As such, factors leading to underperformance may impact multiple strategies simultaneously.

The Company’s investment income and asset levels may be negatively impacted by fluctuations in its investment portfolio.

The Company currently has a substantial portion of its assets invested in investment strategies that it manages. All of these investments are subject to market risk and the Company’s non-operating investment income could be adversely affected by market performance. Fluctuations in investment income are expected to occur in the future.

Trading in DHIL common shares is limited, which may adversely affect the time and the price at which shareholders can sell their shares.

Although DHIL common shares are listed on The Nasdaq Global Select Market, the shares are held by a relatively small number of shareholders, and trading in its common shares is relatively inactive. Certain shareholders, including certain of the Company’s directors and officers, own a significant number of shares. The spread between the bid and the ask prices is often wide. As a result, shareholders may not be able to sell their shares on short notice, and the sale of a large number of shares at one time could temporarily depress the market price.

Regulatory Risks

Changes in tax laws and unanticipated tax obligations could have an adverse impact on the Company’s financial condition, results of operations, and cash flow.

The Company is subject to federal, state, and local income taxes in the United States. We cannot predict future changes in the tax regulations to which we are subject, and any such changes could have a material impact on our tax liability or result in increased costs of our tax compliance efforts. Tax authorities may disagree with certain positions that the Company has taken or may implement changes in tax policy, which may result in the assessment of additional taxes on the Company. The Company regularly assesses the appropriateness of its tax positions and reporting. The Company cannot provide assurances, however, that tax authorities will agree with the positions it has taken, or that the Company will accurately predict the outcomes of audits, and the actual outcomes of these audits could be unfavorable.

The Company’s business is subject to substantial governmental regulation, which can change frequently and may increase costs of compliance, reduce revenue, result in fines, penalties, and lawsuits for noncompliance, and adversely affect its results of operations and financial condition.

The Company’s business is subject to a variety of federal securities laws, including the Advisers Act, the Company Act, the Securities Act, the Exchange Act, the Sarbanes-Oxley Act of 2002, the U.S. PATRIOT Act of 2001, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, each as amended. In addition, the Company is subject to significant regulation and oversight by the SEC. Changes in legal, regulatory, accounting, tax, and compliance requirements could have a significant effect on the Company’s operations and results, including, but not limited to, increased expenses and reduced investor interest in certain funds and other investment products that the Company offers. The Company continually monitors legislative, tax, regulatory, accounting, and compliance developments that could impact its business. The Company and its directors, officers, and employees could be subject to lawsuits or regulatory proceedings for violations of such laws and

regulations, which could result in the payment of fines or penalties and cause reputational harm to the Company, which could negatively affect its financial condition and results of operations, as well as divert management’s attention from its operations.

General Risk Factors

The Company’s insurance policies may not cover all losses and costs to which it may be exposed.

The Company carries insurance in amounts and under terms that it believes are appropriate. The Company’s insurance may not cover all liabilities and losses to which it may be exposed. Certain insurance coverage may not be available or may be prohibitively expensive in future periods. As the Company’s insurance policies come up for renewal, it may need to assume higher deductibles or pay higher premiums, which could have an adverse impact on its results of operations and financial condition.

Natural disasters, global pandemics, and other unpredictable events could adversely affect the Company’s operations.

Natural disasters, outbreaks of epidemics or pandemics, terrorist attacks, extreme weather events or other unpredictable events could adversely affect the Company’s revenues, expenses, and net income by:

•Decreasing investment valuations in, and returns on, the investment portfolios that the Company manages and its corporate investments, thus, causing reductions in AUM, AUA, and revenue;

•Causing disruptions in national or global economies that decrease investor confidence and make investment products generally less attractive;

•Reducing the availability of key personnel necessary to conduct the Company’s business activities;

•Interrupting the Company’s business operations or those of critical service providers;

•Triggering technology delays or failures; and/or

•Requiring substantial capital expenditures and operating expenses to restore the Company’s operations.

The Company has developed various backup systems and contingency plans but cannot be assured that those preparations will be adequate in all circumstances that could arise, or that material interruptions and disruptions will not occur. The Company also relies to varying degrees on outside vendors for service delivery in addition to technology and disaster contingency support. There is a risk that these vendors will not be able to perform in an adequate and timely manner. If the Company’s operations or its employees’ ability to perform their duties is temporarily disrupted, or if the Company is unable to respond adequately to such an event in a timely manner, revenues, expenses, and net income could be negatively impacted.

| | | | | |

| ITEM 1B. | Unresolved Staff Comments |

None.

The Company is subject to several material risks related to cybersecurity threats. A cybersecurity attack could prevent the Company from managing client portfolios, cause the unauthorized disclosure of sensitive or confidential client or employee information, and/or result in misappropriation of information or funds, which individually or collectively could severely harm its business. In 2024, the Company did not identify any cybersecurity risks that have materially affected or are reasonably likely to materially affect its business strategy, results of operations, or financial condition. However, despite its efforts, the Company cannot eliminate all risks from cybersecurity threats or incidents, or provide assurances that it has not experienced an undetected cybersecurity incident. For more information about these risks, please see Item 1A.

The Company has an Information Security Committee (the “Committee”) to identify, assess, and manage cybersecurity risks and to implement necessary policies and procedures to mitigate those risks. The Committee also coordinates employee education efforts throughout the year. The Technology Risk & Information Security Officer serves as the Committee chair and the day-to-day manager of the Company’s information security management systems. The Committee is comprised of members having expertise in information technology infrastructure, data security, risk management, compliance, legal, and business continuity and recovery efforts. The Committee identifies and assesses risks by understanding and evaluating the Company’s systems, processes, data, and controls. This information is then augmented through participation by certain

Committee members in industry threat intelligence groups designed to share best practices and emerging threats related to cybersecurity. The Committee also completes a full cybersecurity risk assessment annually, which drives the implementation of policies and procedures as well as the scope of third-party testing. The Committee has implemented an information security program that includes a comprehensive set of cybersecurity policies and procedures that follows standards established by the International Organization for Standardization (“ISO 27001”). The policies and procedures within the program, among other things, are to oversee, identify, and mitigate the Company’s cybersecurity risks as well as cybersecurity risks to the Company associated with its significant service providers and vendors. The Company’s cybersecurity policies and procedures have been independently certified by a third party as compliant with the ISO 27001 standard. The Committee engages third-party experts to perform penetration tests on a periodic basis and to assess whether these policies and procedures are designed appropriately and operating effectively.

Cybersecurity oversight forms part of the Board’s risk oversight of the Company. The Board oversees efforts by management to manage the cybersecurity risks to which the Company may be exposed. The Board receives quarterly reports and meets periodically with the Committee chair. From its review of these reports and discussions with management and the Committee chair, the Board ensures it has sufficient awareness of the material cybersecurity risks to which the Company is exposed, enabling a dialogue about how management manages and mitigates those risks. The Board currently has four members who have obtained certifications in cybersecurity oversight.

The Company leases office space and conducts its general operations at one location, the address of which is 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215. The Company does not own any real estate or interests in real estate.

The Company is not aware of any pending legal proceedings that the Company believes will have, individually or in the , a material adverse effect on its consolidated financial statements.

| | | | | |

| ITEM 4. | Mine Safety Disclosures |

Not applicable.

PART II

| | | | | |

| ITEM 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

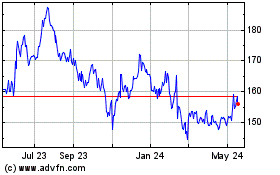

The following performance graph compares the cumulative total shareholder return of an investment in DHIL common shares to that of the Russell 2000 Index and the Russell 2000 Asset Managers & Custodians Index (the “R2000 A&C Index”) for the five-year period ended December 31, 2024. The graph assumes that the value of the investment in DHIL common shares and each index was $100 on December 31, 2019. Total return includes reinvestment of all dividends. The Russell 2000 Index measures the performance of approximately 2,000 small-cap U.S. equities, and was selected as a broad equity market index comprised of companies with comparable market capitalization to DHIL. The R2000 A&C Index is comprised of the Asset Managers & Custodians subsector of the Russell 2000 Index, and provides a comparison to companies with comparable market capitalization to DHIL that operate in the same industry as the Company. The historical information set forth below is not necessarily indicative of future performance. The Company does not make or endorse any predictions as to future share performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2019 | | 12/31/2020 | | 12/31/2021 | | 12/31/2022 | | 12/31/2023 | | 12/31/2024 | Cumulative 5 Year Total Return |

| Diamond Hill Investment Group, Inc. | $100 | | $115 | | $167 | | $168 | | $156 | | $151 | 51 | % |

| Russell 2000 Index | $100 | | $120 | | $138 | | $110 | | $128 | | $143 | 43 | % |

Russell 2000 Asset Managers & Custodians Index(a) | $100 | | $134 | | $170 | | $132 | | $182 | | $239 | 139 | % |

(a) The R2000 A&C Index used to calculate the returns includes the following companies by year:

| | | | | | | | | | | | | | |

| 2020 | 2021 | 2022 | 2023 | 2024 |

| Arlington Asset Investment Corp. | Arlington Asset Investment Corp. | Associated Capital Group, Inc. | Associated Capital Group, Inc. | AlTi Global, Inc. |

| Associated Capital Group, Inc. | Associated Capital Group, Inc. | AssetMark Financial Holdings, Inc. | AlTi Global, Inc. | AssetMark Financial Holdings, Inc. |

| AssetMark Financial Holdings, Inc. | AssetMark Financial Holdings, Inc. | Artisan Partners Asset Management, Inc. | AssetMark Financial Holdings, Inc. | Artisan Partners Asset Management, Inc. |

| Artisan Partners Asset Management, Inc. | Artisan Partners Asset Management, Inc. | Blucora, Inc. | Artisan Partners Asset Management, Inc. | BrightSphere Investment Group Inc |

| Ares Management Corporation | Blucora, Inc. | Brookfield Business Corp. | Avantax, Inc. | Brookfield Business Corp. |

| BrightSphere Investment Group, Inc. | BrightSphere Investment Group, Inc. | BrightSphere Investment Group, Inc. | Brookfield Business Corp. | Burford Capital Limited |

| Cohen & Steers, Inc. | Cohen & Steers, Inc. | Cohen & Steers, Inc. | BrightSphere Investment Group, Inc. | Cohen & Steers, Inc. |

| Cowen Inc | Cowen Inc | Diamond Hill Investment Group, Inc. | Cohen & Steers, Inc. | Diamond Hill Investment Group, Inc. |

| Diamond Hill Investment Group, Inc. | Diamond Hill Investment Group, Inc. | Federated Hermes, Inc. | Diamond Hill Investment Group, Inc. | GCM Grosvenor, Inc. |

| Federated Hermes, Inc. | Federated Hermes, Inc. | Focus Financial Partners, Inc. | Federated Hermes, Inc. | Hamilton Lane Incorporated |

| Focus Financial Partners, Inc. | Focus Financial Partners, Inc. | GAMCO Investors, Inc. | Focus Financial Partners, Inc. | Patria Investments Ltd. |

| GAMCO Investors, Inc. | GAMCO Investors, Inc. | GCM Grosvenor, Inc. | GCM Grosvenor, Inc. | PJT Partners, Inc. |

| Greenhill & Co., Inc. | GCM Grosvenor, Inc. | Greenhill & Co., Inc. | Hamilton Lane Incorporated | Perella Weinberg Partners |

| Hamilton Lane Incorporated | Greenhill & Co., Inc. | Hamilton Lane Incorporated | Oppenheimer Holdings Inc. | P10, Inc. |

| Morgan Group Holding Co. | Hamilton Lane Incorporated | Manning & Napier, Inc. | Patria Investments Ltd. | Silvercrest Asset Management Group Inc. |

| Oppenheimer Holdings Inc. | MMA Capital Holdings, Inc. | Oppenheimer Holdings Inc. | PJT Partners, Inc. | StepStone Group, Inc. |

| PJT Partners, Inc. | Oppenheimer Holdings Inc. | PJT Partners, Inc. | Perella Weinberg Partners | Victory Capital Holdings, Inc. |

| Pzena Investment Management, Inc. | PJT Partners, Inc. | Perella Weinberg Partners | P10, Inc. | Virtus Investment Partners, Inc. |

| Silvercrest Asset Management Group Inc. | Pzena Investment Management, Inc. | Pzena Investment Management, Inc. | Silvercrest Asset Management Group Inc. | WisdomTree, Inc. |

| Sculptor Capital Management, Inc. | Silvercrest Asset Management Group Inc. | Silvercrest Asset Management Group Inc. | Sculptor Capital Management, Inc. | |

| StepStone Group, Inc. | Sculptor Capital Management, Inc. | Sculptor Capital Management, Inc. | StepStone Group, Inc. | |

| Virtus Investment Partners, Inc. | StepStone Group, Inc. | StepStone Group, Inc. | Victory Capital Holdings, Inc. | |

| Waddell & Reed Financial, Inc. | Virtus Investment Partners, Inc. | Victory Capital Holdings, Inc. | Virtus Investment Partners, Inc. | |