false

0001282224

0001282224

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 14, 2024

DOLPHIN

ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| Florida |

001-38331 |

86-0787790 |

| (State

or other jurisdiction |

(Commission

|

(IRS

Employer |

| of

incorporation) |

File

Number) |

Identification

No.) |

150

Alhambra Circle, Suite 1200,

Coral Gables, Florida

33134

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area

code (305) 774

-0407

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.015 par value per share |

|

DLPN |

|

The Nasdaq

Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On August 14, 2024, Dolphin Entertainment, Inc.,

a Florida corporation (the “Company”), issued a press release announcing its financial results for the three and six

months ended June 30, 2024. A copy of the Company’s earnings press release is furnished as Exhibit 99.1 to this Current Report on

Form 8-K and incorporated herein by reference.

The information contained in this Current Report

on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor incorporated by reference

in any registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

DOLPHIN ENTERTAINMENT, INC. |

| |

|

|

|

| Date: August 14, 2024 |

|

|

|

By: |

|

/s/ Mirta A. Negrini |

| |

|

|

|

|

|

Mirta A. Negrini |

| |

|

|

|

|

|

Chief Financial and Operating Officer |

Exhibit 99.1

Dolphin Reports Record Q2 Revenue

of $11.4 Million; H1 2024 Delivers $26.7 Million Revenue and $0.9 Million Adjusted Operating Income

MIAMI, FL / Dolphin (NASDAQ:DLPN),

a leading entertainment marketing and premium content production company, announces its financial results for the second quarter ended

June 30, 2024.

Bill O'Dowd, CEO of Dolphin Entertainment

commented:

“Dolphin achieved record Q2 revenues

this year, setting a solid foundation to exceed $50 million in annual revenues and deliver full year positive Adjusted Operating Income—the

key financial metric by which we measure ourselves, and the one that we believe truly reflects our value creation. We are lining up for

a strong second half of the year, with the acquisition of Elle Communications to concentrate our work in the Impact PR space, and our

anticipated launch of a sports company to complement our market-leading position in entertainment. Furthermore, we expect to close on

our next Ventures opportunity, continuing our strategy of generating immediate service revenues while amassing equity stakes typically

without capital deployment, positioning us for potentially significant returns as our portfolio grows and matures.

In summary, we believe that our record

results provide solid progress towards our Revenue and Adjusted Operating Income goals which, along with new vertical expansion, and our

Ventures strategy providing optionality, all together position us well for sustained growth, profitability and success.”

Q2 2024 and Recent Highlights

| • | | Total revenue for the quarter ended June 30 2024 was $11.4 million, an increase of 4% over

the same period in 2023. |

| • | | Operating loss of $1.1 million for the quarter ended June 30, 2024 as compared to an operating

loss of $7.5 million for the quarter ended June 30, 2023. Operating loss of $0.9 million for the six months ended June 30, 2024 as compared

to an operating loss of $10.0 million for the six months ended June 30, 2023. |

| • | | Adjusted operating loss(1) of $0.1 million for the three months ended June 30, 2024

and $0.05 million for the three months ended June 30, 2023. Adjusted operating income of $0.9 million for the six months ended June 30,

2024 as compared to adjusted operating loss of $1.9 million for the six months ended June 30, 2023. |

| • | | Operating expenses for the second quarter of 2024 were $12.6 million, including depreciation

and amortization of $0.6 million and goodwill impairment of $0.2 million. Operating expense for the second quarter of 2023 were $18.5

million, including depreciation and amortization of $0.5 million and goodwill impairment of $6.5 million. |

| • | | Net loss for the quarter was $1.6 million including depreciation and amortization of $0.5

million, goodwill impairment of $0.2 million and interest expense of $0.5 million. Net loss for the same period in prior year was $8.0

million including depreciation and amortization of $0.5 million, goodwill impairment of $6.5 million, interest expense of $0.5 million

and equity losses in unconsolidated affiliates of $0.1 million. |

| • | | Loss per share was $0.08 per share based on 19.4 million weighted average shares for basic

loss per share and 19.6 million weighted average shares for diluted loss per share for the three months ended June 30, 2024. Loss per

share was $0.60 per share based on 13.2 million weighted average shares outstanding for both basic loss per share and fully diluted loss

per share for the three months ended June 30, 2023. |

| • | | Cash and cash equivalents of $9.8 million as of June 30, 2024, as compared to $7.6 million

as of December 31, 2023. |

(1)The Company has provided

adjusted operating income information that has not been prepared in accordance with GAAP. This measure is defined below in the section

“Use of non-GAAP measures.”

| o | | Dolphin’s

film, "Blue Angels" crossed a box office milestone and debuted at #1 on Prime Video over the Memorial Day holiday frame. The

film's one week IMAX run grossed $2,082,327 at the box office, including a Top 10 debut with $1,404,820 on its opening weekend. |

| o | | Launched the first

product developed by Dolphin in partnership with one of the A-list celebrities on its talent rosters: Staple Gin, a recipe-driven spirit

created by Rachael Ray and crafted in New York's Catskills region. Staple Gin, which won Double Gold and a 96 point rating at the 15th

Annual New York International Spirits Competition, is now available nationally via e-commerce at www.staplegin.com and in New York State

at bars, restaurants and retail destinations via Southern Glazer’s Wine & Spirits, with additional markets to follow. Southern

Glazer’s Wine & Spirits is the world’s preeminent distributor of beverage alcohol. |

| o | | Announced the selection

of Oak View Group (OVG), a global leader in venue development, management, premium hospitality services and 360-degree solutions, for

the management of operations at Mastercard Midnight Theater. |

| o | | Later in the year,

we expect to make the announcement of the first of Dolphin's owned or co-owned live events, to occur in late 2024 or in 2025. |

| o | | Elle Communications, a leading PR agency specializing in social and environmental impact

has been added as a new division following its acquisition by Dolphin Entertainment. |

| o | | Led multiple award-winning campaigns at the 2024 Tribeca Festival. |

| • | | Client wins included Best Performance in a U.S. Narrative Feature and Best Screenplay in

an International Narrative Feature. |

| • | | Premiered HBO's new documentary feature "Wise Guy: David Chase and The Sopranos"

directed by Alex Gibney. |

| o | | Fandoms & Franchises spearheaded campaigns for three triple AAA video games-- Funko Fusion,

Alien: Rogue Incursion and MultiVersus. |

| o | | Supported world premiere of “Megalopolis,” the new feature from longtime client

Francis Ford Coppola, and GKIDS' "Ghost • Cat Anzu," at the 77th Cannes Film Festival. |

| o | | Championed clients at the 2024 Television Upfronts. Clients receiving renewals including:

“The Boys,” “Conan O'Brien Must Go,” “The Conners,” and “Lopez vs. Lopez.” Additionally, Discovery's

“Shark Week” revealed that John Cena will host this year's iteration of the programming event. |

| o | | Dave Matthews Band was successfully nominated for induction into the Rock & Roll Hall

of Fame |

| o | | Kylie Minogue made Time Magazine’s esteemed TIME 100 list of the 100 most influential

people in the world for 2024 |

| o | | Warren Zeiders won Breakthrough Male Video of the Year at the 2024 CMT Awards for his chart-topping

hit "Pretty Little Poison," and Brittney Spencer brought the house down performing with Parker Mccollum. |

| o | | Announced the promotion of five of its staff to key leadership positions - reflecting the

company's growth and expanding roster of artists, brands, businesses, talent, creators, events and more since its acquisition by Dolphin

Entertainment. |

| o | | Promoted the launch of Newman's Own “Pay What You Want” pizza truck, with all

proceeds benefiting the Newman’s Own Foundation. |

| o | | Four Twenty Five, a Jean-Georges Restaurant, became one of the newest additions to Michelin

Guide. |

| o | | Supported Carbone Fine Food’s Launch of 'The Sales Rep' Jacket, the first piece of

an exclusive capsule collection, available for a limited time. |

| o | | Dolphin Entertainment partnered with Rachael Ray, long-time client of The Door, as creative

marketing partner for her new Staple Gin. Staple Gin launched in May 2024 with Do Good Spirits, leveraging The Door's expertise in marketing

wines, spirits, and culinary brands. |

| o | | Staple Gin landed a spot on Vine Pair's “30 Best Gins in the World,” receiving

a rating of 94 – the highest score received. |

| o | | Executed a comprehensive influencer strategy for Crocs' latest product line, the Getaway

Sandals, garnering more than 5 million impressions, a reach of 3.9 million, 248,000 engagements, and over 13,000 link clicks. |

| o | | Selected to join Ulta Beauty’s 2024 Beauty Collective, to enhance brand visibility

and drive business growth. |

| o | | TDD talents Mariyah and Peter Gerber launched their new clothing collection The Match Me

Boutique on Amazon. |

| o | | Made its mark on the CHANELTribeca Festival Arts Dinner, featuring Robert De Niro, Blake

Lively, Jude Law, Trevor Noah and Katie Holmes. |

| o | | Supported Infatuation’s EatsCon L.A., presented by Chase Sapphire, with Sofia Vergara,

Nicole Byer, and Chrissy Teigen. |

| o | | Led an incredible night at the Peabody Awards with an star-studded lineup that included Billy

Crystal, JJ Abrams, Kumail Nanjiani, Lilly Singh, Mel Brooks, Regina King, and Rose Byrne. |

Conference Call Information

To participate in this event, dial in approximately 5 to 10 minutes before the beginning of the call.

Date: August 14, 2024

Time: 4:30pm ET.

Toll Free: 877-545-0320 International: 973-528-0002 Participant Access Code: 630741

Webcast: https://www.webcaster4.com/Webcast/Page/2225/51040

Replay

Toll Free: 877-481-4010 International: 919-882-2331 Replay Passcode: 51040

Webcast Replay: https://www.webcaster4.com/Webcast/Page/2225/51040

About

Dolphin

Dolphin (Nasdaq: DLPN), founded in

1996 by Bill O'Dowd, has evolved from its origins as an Emmy-nominated television, digital, and feature film content producer to a company

with three dynamic divisions: Dolphin Entertainment, Dolphin Marketing, and Dolphin Ventures.

Dolphin Entertainment:

This legacy division, where it all began, has a rich history of producing acclaimed television shows, digital content, and feature films.

With high-profile partnerships like IMAX and notable projects including "The Blue Angels," Dolphin Entertainment continues to

set the standard in quality storytelling and innovative content creation.

Dolphin Marketing: Established

in 2017, this division has become a powerhouse in public relations, influencer marketing, branding strategy, talent booking, and special

events. Comprising top-tier companies such as 42West, The Door, Shore Fire, Special Projects, and The Digital Dept., Dolphin Marketing

serves a wide range of industries, from entertainment, music and sports to hospitality, fashion and consumer products.

Dolphin Ventures: This

division leverages Dolphin's best-in-class cross-marketing acumen and business development relationships to create, launch and/or accelerate

innovative ideas and promising products, events and content in our areas of expertise. Key ventures include collaborations with Rachael

Ray for Staple Gin and Mastercard Midnight Theatre. The company is actively exploring new projects in AI, beauty, and sports.

This press release contains 'forward-looking

statements' within the meaning of the Private Securities Litigation Reform Act. These forward-looking statements may address, among other

things, Dolphin Entertainment Inc.'s offering of common stock as well as expected financial and operational results and the related assumptions

underlying its expected results. These forward-looking statements are distinguished by the use of words such as "will," "would,"

"anticipate," "expect," "believe," "designed," "plan," or "intend," the negative

of these terms, and similar references to future periods. These views involve risks and uncertainties that are difficult to predict, and

accordingly, Dolphin Entertainment's actual results may differ materially from the results discussed in its forward-looking statements.

Dolphin Entertainment's forward-looking statements contained herein speak only as of the date of this press release. Factors or events

Dolphin Entertainment cannot predict, including those described in the risk factors contained in its filings with the Securities and Exchange

Commission, may cause its actual results to differ from those expressed in forward-looking statements. Although Dolphin Entertainment

believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that

its expectations will be achieved. Dolphin Entertainment undertakes no obligation to update publicly any forward-looking statements as

a result of new information, future events, or otherwise, except as required by applicable law.

Contact:

James Carbonara/Hayden IR

(646)-755-7412

james@haydenir.com

DOLPHIN ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

| | |

| |

| | |

June 30, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 8,718,975 | | |

$ | 6,432,731 | |

| Restricted cash | |

| 1,127,960 | | |

| 1,127,960 | |

| Accounts receivable: | |

| | | |

| | |

| Trade, net of allowance of $1,499,842 and $1,456,752, respectively | |

| 7,707,126 | | |

| 5,817,615 | |

| Other receivables | |

| 4,469,209 | | |

| 6,643,960 | |

| Notes receivable | |

| 1,135,000 | | |

| — | |

| Other current assets | |

| 606,964 | | |

| 701,335 | |

| Total current assets | |

| 23,765,234 | | |

| 20,723,601 | |

| | |

| | | |

| | |

| Capitalized production costs, net | |

| 538,231 | | |

| 2,295,275 | |

| Employee receivable | |

| 908,085 | | |

| 796,085 | |

| Right-of-use asset | |

| 4,638,274 | | |

| 5,599,736 | |

| Goodwill | |

| 25,211,206 | | |

| 25,220,085 | |

| Intangible assets, net | |

| 10,147,970 | | |

| 11,209,664 | |

| Property, equipment and leasehold improvements, net | |

| 148,630 | | |

| 194,223 | |

| Other long-term assets | |

| 216,305 | | |

| 216,305 | |

| Total Assets | |

$ | 65,573,935 | | |

$ | 66,254,974 | |

| LIABILITIES | |

| | |

| |

| Current | |

| | |

| |

| Accounts payable | |

$ | 3,196,441 | | |

$ | 6,892,349 | |

| Term loan, current portion | |

| 1,023,468 | | |

| 980,651 | |

| Notes payable, current portion | |

| 3,900,000 | | |

| 3,500,000 | |

| Revolving line of credit | |

| 400,000 | | |

| 400,000 | |

| Accrued interest – related party | |

| 1,763,779 | | |

| 1,718,009 | |

| Accrued compensation – related party | |

| 2,625,000 | | |

| 2,625,000 | |

| Lease liability, current portion | |

| 1,959,835 | | |

| 2,192,213 | |

| Deferred revenue | |

| 851,402 | | |

| 1,451,709 | |

| Other current liabilities | |

| 10,290,241 | | |

| 7,694,114 | |

| Total current liabilities | |

| 26,010,166 | | |

| 27,454,045 | |

| | |

| | | |

| | |

| Term loan, noncurrent portion | |

| 3,979,052 | | |

| 4,501,963 | |

| Notes payable | |

| 2,980,000 | | |

| 3,380,000 | |

| Convertible notes payable | |

| 5,100,000 | | |

| 5,100,000 | |

| Convertible note payable at fair value | |

| 290,000 | | |

| 355,000 | |

| Loan from related party | |

| 3,217,873 | | |

| 1,107,873 | |

| Lease liability | |

| 3,220,449 | | |

| 4,068,642 | |

| Deferred tax liability | |

| 329,510 | | |

| 306,691 | |

| Warrant liability | |

| — | | |

| 5,000 | |

| Other noncurrent liabilities | |

| 18,915 | | |

| 18,915 | |

| Total Liabilities | |

| 45,145,965 | | |

| 46,298,129 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred Stock, Series C, $0.001 par value, 50,000 shares authorized, 50,000 shares issued and outstanding at June 30, 2024 and December 31, 2024 | |

| 1,000 | | |

| 1,000 | |

| Common stock, $0.015 par value, 200,000,000 shares authorized, 20,196,416 and 18,219,531 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| 302,947 | | |

| 273,293 | |

| Additional paid-in capital | |

| 155,686,452 | | |

| 153,293,756 | |

| Accumulated deficit | |

| (135,562,429 | ) | |

| (133,611,204 | |

| Total Stockholders’ Equity | |

| 20,427,970 | | |

| 19,956,845 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 65,573,935 | | |

$ | 66,254,974 | |

DOLPHIN ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 11,449,089 | | |

$ | 11,024,935 | | |

$ | 26,684,981 | | |

$ | 20,916,356 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 216,247 | | |

| 217,245 | | |

| 2,535,474 | | |

| 436,141 | |

| Payroll and benefits | |

| 9,195,018 | | |

| 8,677,493 | | |

| 18,769,269 | | |

| 17,732,223 | |

| Selling, general and administrative | |

| 1,864,852 | | |

| 2,005,286 | | |

| 3,841,843 | | |

| 3,877,223 | |

| Depreciation and amortization | |

| 555,694 | | |

| 543,939 | | |

| 1,108,797 | | |

| 1,077,035 | |

| Impairment of goodwill | |

| 190,565 | | |

| 6,517,400 | | |

| 190,565 | | |

| 6,517,400 | |

| Change in fair value of contingent consideration | |

| — | | |

| 17,741 | | |

| — | | |

| 33,226 | |

| Legal and professional | |

| 546,178 | | |

| 496,570 | | |

| 1,193,959 | | |

| 1,259,847 | |

| Total expenses | |

| 12,568,554 | | |

| 18,475,674 | | |

| 27,639,907 | | |

| 30,933,095 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,119,465 | ) | |

| (7,450,739 | ) | |

| (954,926 | ) | |

| (10,016,739 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of convertible note | |

| 40,000 | | |

| 4,000 | | |

| 65,000 | | |

| (6,444 | ) |

| Change in fair value of warrants | |

| — | | |

| 5,000 | | |

| 5,000 | | |

| 5,000 | |

| Interest income | |

| 731 | | |

| 103,104 | | |

| 6,600 | | |

| 205,121 | |

| Interest expense | |

| (522,184 | ) | |

| (452,637 | ) | |

| (1,025,821 | ) | |

| (808,507 | ) |

| Total other (expenses) income, net | |

| (481,453 | ) | |

| (340,533 | ) | |

| (949,221 | ) | |

| (604,830 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes and equity in losses of unconsolidated affiliates | |

| (1,600,918 | ) | |

| (7,791,272 | ) | |

| (1,904,147 | ) | |

| (10,621,569 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| (23,540 | ) | |

| (33,086 | ) | |

| (47,079 | ) | |

| (60,184 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before equity in losses of unconsolidated affiliates | |

| (1,624,458 | ) | |

| (7,824,358 | ) | |

| (1,951,226 | ) | |

| (10,681,753 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Equity in losses of unconsolidated affiliates | |

| — | | |

| (134,886 | ) | |

| — | | |

| (246,811 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,624,458 | ) | |

$ | (7,959,244 | ) | |

$ | (1,951,226 | ) | |

$ | (10,928,564 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.08 | ) | |

$ | (0.60 | ) | |

$ | (0.10 | ) | |

$ | (0.85 | ) |

| Diluted | |

$ | (0.08 | ) | |

$ | (0.60 | ) | |

$ | (0.10 | ) | |

$ | (0.85 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 19,446,310 | | |

| 13,212,311 | | |

| 18,962,067 | | |

| 12,926,273 | |

| Diluted | |

| 19,574,187 | | |

| 13,212,311 | | |

| 19,089,944 | | |

| 12,926,273 | |

Use of Non-GAAP Financial Measures

In order to provide

greater transparency regarding our operating performance, the financial results in this press release refer to a non-GAAP financial measure

that involves adjustments to GAAP results. Non-GAAP financial measures exclude certain income and/or expense items that management deems

are not directly attributable to the Company’s core operating results and/or certain items that are inconsistent in amounts and

frequency, making it difficult to perform a meaningful evaluation of our current or past operating performance.

Adjusted operating

income or loss is defined by Dolphin as (loss) income from operations before: (i) depreciation and amortization, (ii) write-off of assets,

(iii) impairment of goodwill or intangible assets, (iv) acquisition costs, (v) employee stock compensation, (vi) change in fair value

of contingent consideration, (vii) bad debt expense and (viii) and impairment of capitalized production costs.

Management believes

that the presentation of operating results using this non-GAAP financial measure provides useful supplemental information for investors

by providing them with the non-GAAP financial measure used by management for financial and operational decision making, planning and

forecasting and in managing the business. This non-GAAP financial measure does not replace the presentation of financial information

in accordance with U.S. GAAP financial results, should not be considered a measure of liquidity and is unlikely to be comparable to non-GAAP

financial measures provided by other companies.

Reconciliation of GAAP loss from operations to non-GAAP income from operations

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues (GAAP) | |

$ | 11,449,089 | | |

$ | 11,024,935 | | |

$ | 26,684,981 | | |

$ | 20,916,356 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 216,247 | | |

| 217,245 | | |

| 2,535,474 | | |

| 436,141 | |

| Payroll and benefits | |

| 9,195,018 | | |

| 8,677,493 | | |

| 18,769,269 | | |

| 17,732,223 | |

| Selling, general and administrative | |

| 1,864,852 | | |

| 2,005,286 | | |

| 3,841,843 | | |

| 3,877,223 | |

| Depreciation and amortization | |

| 555,694 | | |

| 543,939 | | |

| 1,108,797 | | |

| 1,077,035 | |

| Impairment of goodwill | |

| 190,565 | | |

| 6,517,400 | | |

| 190,565 | | |

| 6,517,400 | |

| Change in fair value of contingent consideration | |

| — | | |

| 17,741 | | |

| — | | |

| 33,226 | |

| Legal and professional | |

| 546,178 | | |

| 496,570 | | |

| 1,193,959 | | |

| 1,259,847 | |

| Total expenses (GAAP) | |

| 12,568,554 | | |

| 18,475,674 | | |

| 27,639,907 | | |

| 30,933,095 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations (GAAP) | |

| (1,119,465 | ) | |

| (7,450,739 | ) | |

| (954,926 | ) | |

| (10,016,739 | ) |

| Adjustments to GAAP measure: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 555,694 | | |

| 543,939 | | |

| 1,108,797 | | |

| 1,077,035 | |

| Bad debt expense | |

| 82,959 | | |

| 179,253 | | |

| 286,980 | | |

| 255,032 | |

| Impairment of goodwill | |

| 190,565 | | |

| 6,517,400 | | |

| 190,565 | | |

| 6,517,400 | |

| Change in fair value of contingent consideration | |

| — | | |

| 17,741 | | |

| — | | |

| 33,226 | |

| Stock compensation | |

| 153,291 | | |

| 139,648 | | |

| 259,052 | | |

| 214,289 | |

| Adjusted (Loss) income from operations

(non-GAAP) | |

| (136,956 | ) | |

| (52,758 | ) | |

| 890,468 | | |

| (1,919,757 | ) |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

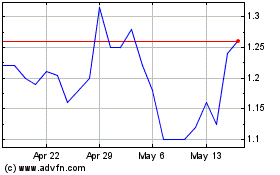

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Sep 2024 to Oct 2024

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Oct 2023 to Oct 2024