Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

23 January 2024 - 10:15PM

Edgar (US Regulatory)

ISSUER FREE WRITING PROSPECTUS

Filed pursuant to Rule 433

Relating

to the Short Form Base Shelf Prospectus filed on February 23, 2023

Registration

Statement No. 333-269945

BRP Inc.

Secondary Offering of Subordinate Voting Shares

January 22, 2024

A base shelf prospectus and a preliminary

prospectus supplement containing important information relating to the securities described in this document have been filed with the securities regulatory authorities in each of the provinces and territories of Canada. There will not be any sale or

any acceptance of an offer to buy the securities until a final prospectus supplement to the base shelf prospectus is made available. A copy of the base shelf prospectus, any amendment to the base shelf prospectus and any applicable shelf prospectus

supplement that has been filed, is required to be delivered with this document. This document does not provide full disclosure of all material facts relating to the Subordinate Voting Shares. Investors should read the base shelf prospectus, any

amendment and any applicable prospectus supplement, for disclosure of those facts, especially risk factors relating to the Subordinate Voting Shares, before making an investment decision.

The Company has filed a registration statement (including a prospectus and prospectus supplement) with the United States Securities and Exchange Commission

(the “SEC”) for the offering to which this communication relates. Before you invest, you should read the short form base shelf prospectus and prospectus supplement in that registration statement and other documents the Company has filed

with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating

in the offering will arrange to send you the prospectus if you request it, or you may request a copy of the prospectus in the United States from: RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity

Syndicate, phone: 877-822-4089, Email: equityprospectus@rbccm.com or in Canada from: RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON M5J

0C2, Attention: Distribution Centre, or via telephone: 1-416-842-5349, or via email at Distribution.RBCDS@rbccm.com.

Terms and Conditions

|

|

|

| Issuer: |

|

BRP Inc. (the “Company”) |

|

|

| Selling Shareholder: |

|

Bain Capital Integral Investors II, L.P. (“Bain”). |

|

|

|

|

Bain currently holds 15,796,615 multiple voting shares of the Company (“Multiple Voting Shares”) representing approximately 20.8% of the issued and outstanding shares of the Company (the “Shares”) and

approximately 33.0% of the voting power attached to all of the Shares. Following the closing of the Offering, Bain will hold 13,796,615 Multiple Voting Shares, representing approximately 18.3% of the issued and outstanding Shares and approximately

29.9% of the voting power attached to all of the Shares. |

|

|

| Offering: |

|

Secondary offering of 2,000,000 subordinate voting shares of the Company (“Subordinate Voting Shares”), all of the Subordinate Voting Shares are being sold by Bain. |

|

|

| Offering Price: |

|

C$91.00 per Subordinate Voting Share. |

|

|

| Gross Proceeds: |

|

C$182,000,000 |

|

|

| Use of Proceeds: |

|

The net proceeds of the Offering will be paid directly to Bain. The Company will not receive any proceeds from the Offering. |

|

|

| Form of Offering: |

|

Bought deal offering by way of a prospectus supplement to be filed in each of the provinces and territories of Canada. Registered public offering in the United States via MJDS. |

|

|

| Standstill: |

|

The Company and Bain will each enter into a 45 day standstill agreement. |

|

|

|

| Listing: |

|

The Subordinate Voting Shares of the Company are listed on the Toronto Stock Exchange under the symbol “DOO” and on the NASDAQ under the symbol “DOOO”. |

|

|

| Eligibility: |

|

Eligible for RRSPs, RRIFs, RESPs, TFSAs, FHSAs and RDSPs. |

|

|

| Sole Underwriter: |

|

RBC Capital Markets |

|

|

| Commission: |

|

4% |

|

|

| Closing: |

|

On or about January 26, 2024 |

The issuer has filed a registration statement (including a prospectus) with the United States Securities and Exchange

Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information

about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the

prospectus if you request it, or you may request a copy of the prospectus in the United States from: RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, phone:

877-822-4089, Email: equityprospectus@rbccm.com or in Canada from: RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON M5J 0C2, Attention:

Distribution Centre, or via telephone: 1-416-842-5349, or via email at Distribution.RBCDS@rbccm.com.

- 2 -

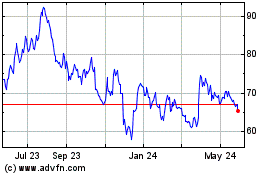

BRP (NASDAQ:DOOO)

Historical Stock Chart

From Apr 2024 to May 2024

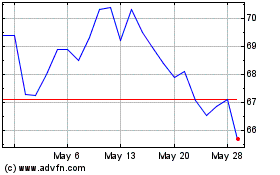

BRP (NASDAQ:DOOO)

Historical Stock Chart

From May 2023 to May 2024