Erickson Inc. opens DIP purchase option to Second Priority Note Holders

09 December 2016 - 9:49AM

Erickson Incorporated (NASDAQ:EAC) (the “Company”), a leading

global provider of aviation services, today announced the

commencement of a process to syndicate participation in a

debtor-in-possession term loan facility (the “DIP Term Facility”)

by eligible beneficial holders of Erickson’s 8.25% Second Priority

Senior Secured Promissory Notes due 2020 (“Second Priority Notes”)

as of December 2, 2016. Such eligible beneficial holders of

Second Priority Notes shall have the opportunity to purchase a

portion of $62,500,000 in aggregate principal amount of the DIP

Term Facility pursuant to certain syndication procedures (the

“Syndication Procedures”) established by Erickson, certain holders

of the Second Priority Notes that entered into a creditor support

agreement with the Debtors and certain other creditors of the

Debtors, and the agent under the DIP Term Facility. The

Syndication Procedures were filed on the docket of the United

States Bankruptcy Court for the Northern District of Texas (the

“Bankruptcy Court”) on November 29, 2016 at docket number

110. On December 2, 2016, the Bankruptcy Court entered into a

final order granting final approval of the DIP Term Facility (the

“Final DIP Order”), and pursuant to the Final DIP Order, Erickson

has been authorized to assist in the syndication of the DIP Term

Facility in accordance with the Syndication Procedures.

Participation in the opportunity is limited to an eligible

holder of the Second Priority Notes (including each Backstop Party

(as defined in the Final DIP Order)) that is an entity that is (i)

either (A) a Qualified Institutional Buyer, as such term is defined

in Rule 144A under the Securities Act or (B) an Institutional

Accredited Investor within the meaning of Rule 501(A)(1), (2), (3)

or (7) under the Securities or an entity in which all of the equity

investors are such institutional “Accredited Investors” under the

Securities Act, (ii) a beneficial holder of Second Priority Notes

on December 2, 2016, and (iii) not the Company or an affiliate of

the Company and (iv) a Backstop Party (as defined in the Final DIP

Order).

Pursuant to the Syndication Procedures, the syndication process

shall begin on December 8, 2016 and expire at 5:00 P.M. New York

City time on December 19, 2016, unless extended or earlier

terminated by mutual agreement of the Backstop Parties, the Company

and the agent under the DIP Term Facility. Detailed information

concerning eligibility for participation in the DIP Term Facility

syndication, the requirements and process for participation, and

various relevant deadlines in connection with the syndication are

set forth in the Syndication Procedures.

Holders of Second Priority Notes may obtain copies of the

Syndication Procedures and related documents upon request to

Erickson’s Information Agent, Kurtzman Carson Consultants, 1290

Avenue of the Americas, 9th Floor, New York, NY 10104, Attn:

Erickson Incorporated, Telephone: (917) 281-4800, Email:

ericksondip@kccllc.com.

About Erickson

Erickson is a leading global provider of aviation services and

operates, maintains and manufactures utility aircraft to safely

transport and place people and cargo around the world. The

Company is self-reliant, multifaceted and operates in remote

locations under challenging conditions specializing in Global

Defense and Security, Manufacturing and MRO, and Commercial

Services (comprised of firefighting, HVAC, power line,

construction, timber harvesting, oil and gas and specialty lift).

With roots dating back to 1960, Erickson operates a fleet of

approximately 69 aircraft, is headquartered in Portland, Oregon,

USA, and operates in North America, South America, Europe, the

Middle East, Africa, Asia Pacific, and Australia. For more

information, please visit our website at www.ericksoninc.com.

This press release contains certain statements

relating to future results (including, without limitation,

“believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“plan,” “expect,” “predict”), which are forward-looking statements

as that term is defined in the Private Securities Litigation Reform

Act of 1995. These forward-looking statements are based on beliefs

of Company management, as well as assumptions and estimates based

on information currently available to the Company, and are subject

to certain risks and uncertainties that could cause actual results

to differ materially from historical results or those anticipated,

including certain other risks or uncertainties more fully described

under the heading “Risk Factors” in our most recently filed Annual

Report on Form 10-K as well as in the other reports we file with

the SEC from time to time, which are available at the SEC’s web

site located at http://www.sec.gov. You should not place undue

reliance on any forward-looking statements. The Company assumes no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

Contact

Susan Bladholm—Media

(971) 255-5023, sbladholm@ericksoninc.com

Zachary Cotner—Investor Relations

(503) 505-5804, zcotner@ericksoninc.com

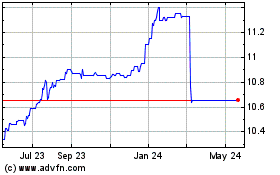

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Feb 2025 to Mar 2025

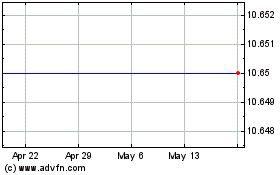

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Mar 2024 to Mar 2025