Current Report Filing (8-k)

29 April 2021 - 5:46AM

Edgar (US Regulatory)

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April 25, 2021

Date of Report (Date of earliest event reported)

Edify Acquisition Corp.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-251775

|

|

85-3274503

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

888 7th Avenue, Floor 29

New York, NY

|

|

10106

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (212) 603-2800

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Units, each consisting of one share of Common Stock and one-half of one Redeemable Warrant

|

|

EACPU

|

|

The Nasdaq Capital Market LLC

|

|

Common Stock, par value $0.0001 per share

|

|

EAC

|

|

The Nasdaq Capital Market LLC

|

|

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

|

EACPW

|

|

The Nasdaq Capital Market LLC

|

|

x

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On April 26th and April 25th, 2021, Edify Acquisition Corp. (the “Company”)

received the resignation of Ronald H. Schlosser from his position as a member of the board of directors of the Company (the “Board”)

and Peter Ma as Chief Executive Officer of the Company, respectively. Neither Mr. Schlosser’s nor Mr. Ma’s resignation was the result of

any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. On the same date, Mr.

Schlosser was appointed as the Company’s Chief Executive Officer.

Effective April 26th, 2021, the Board appointed Ari.

Horowitz to fill the vacancy resulting from the resignation of Mr. Schlosser. In addition, to fill the vacancy on both the Audit Committee

and the Compensation Committee of the Board (the “Committees”) created by Mr. Schlosser’s resignation, the Board appointed

Mr. Horowitz to serve as a member of both Committees.

The Board determined that Mr. Horowitz qualifies

as independent under the director independence standards set forth in the rules and regulations of the Securities and Exchange Commission

and applicable NASDAQ listing standards.

There is no arrangement or understanding between

Mr. Horowitz and any other persons pursuant to which he was selected as a director, and there are no related party transactions

involving Mr. Horowitz that are reportable under Item 404(a) of Regulation S-K.

Mr. Horowiz is currently the Chief Executive Officer of Yardline Capital

– a leading provider of non-dilutive growth capital solutions for business operating within the marketplace commerce economies.

He has more than 20 years of experience in operational and transactional senior leadership, marketing, and corporate development roles.

Prior to Yardline, Mr. Horowitz was the SVP, Strategic Partnerships & Corp Development at Thrasio, the fastest growing acquirer of

Amazon third-party seller businesses, where he co-led the team which has acquired over 100 Amazon sellers. He continues to serve as an

Advisor to Thrasio and has been the CEO of multiple companies, including Opus360 which he co-founded and took public. During his career,

he has also been a senior member of teams which completed financings and M&A transactions with a total value in excess of $1.5B. Mr.

Horowitz holds a Bachelor of Arts degree in economics from the University of Pennsylvania.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EDIFY ACQUISITION CORP.

|

|

|

|

|

Dated: April 28, 2021

|

|

|

|

|

|

|

|

By:

|

/s/ Morris Beyda

|

|

|

|

Name: Morris Beyda

|

|

|

|

Title: Chief Financial Officer

|

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Mar 2025 to Apr 2025

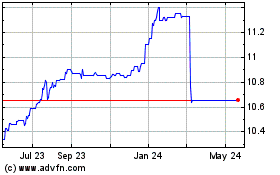

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Apr 2024 to Apr 2025

Real-Time news about Edify Acquisition Corporation (NASDAQ): 0 recent articles

More Edify Acquisition Corp. News Articles